Decentralized finance isn’t a trend anymore—it’s infrastructure. And at the core of this new financial frontier stands the MakerDAO model. Maker wasn’t just another protocol; it pioneered decentralized lending and gave the world DAI—a stablecoin that doesn’t rely on a central bank. That alone makes it one of the most copied, forked, and reimagined DeFi projects out there. In 2025, launching a MakerDAO clone Scripts is no longer reserved for blockchain purists. It’s a strategic play for anyone building localized stablecoins, DAO-run lending systems, or asset-backed crypto economies.

Whether you’re building a regional lending protocol, a token-backed stablecoin, or launching a DeFi product in an emerging market, MakerDAO clone scripts are a launchpad. The question is—what features do you need, and what are you really paying for? Let’s compare the best options and help you get started.

Why DeFi Projects Are Cloning MakerDAO in 2025

Stablecoins remain one of the most used, most trusted crypto utilities in a world still navigating regulatory gray zones. While USDT and USDC dominate with fiat reserves, MakerDAO stands apart with its collateralized debt position (CDP) model. Users lock in crypto assets to mint a decentralized stablecoin, typically pegged to USD, but customizable to any fiat or commodity.

MakerDAO clones let developers and organizations create similar frameworks—with their own tokenomics, governance rules, and branding. And as DeFi expands into real estate, agri-loans, gaming, and non-USD markets, the demand for customized Maker-like systems is skyrocketing.

Read More : How to Start a Decentralized Finance (DeFi) Platform Business

Core Features to Expect in a MakerDAO Clone Script

Building a DeFi lending platform with a stablecoin mechanic is no small feat. Here’s what your clone script must offer to be relevant and secure in 2025:

1. Collateralized Debt Positions (CDPs)

- Smart contracts to lock ETH, BTC, or custom tokens

- Automatic collateral valuation and liquidation ratios

- Vault creation, borrowing, and repayment functions

2. Stablecoin Minting Logic

- Issuance of stable tokens pegged to fiat or other assets

- Dynamic interest or stability fees

- Burn/mint models tied to vault behavior

3. Governance via DAO

- Token-based voting on protocol parameters

- Community proposals and upgrade flows

- Role-based permissions for multisig admins

4. Oracle Integrations

- Price feed oracles for real-time asset valuation

- Failover protections and price averaging logic

- Chainlink, Band Protocol, or custom oracles

5. Liquidation Engine

- Auction-style or fixed-penalty liquidations

- Collateral redistribution mechanisms

- Third-party liquidator support

6. Dashboard & UX Layer

- User-friendly frontend to open vaults and borrow

- Governance portal for proposals and voting

- Developer APIs for wallet, dApp, or Web3 integrations

Read More : The Future of Decentralized Finance (DeFi) Apps: Trends to Watch in 2025 and Beyond

Top MakerDAO Clone Scripts in 2025: Pricing & Breakdown

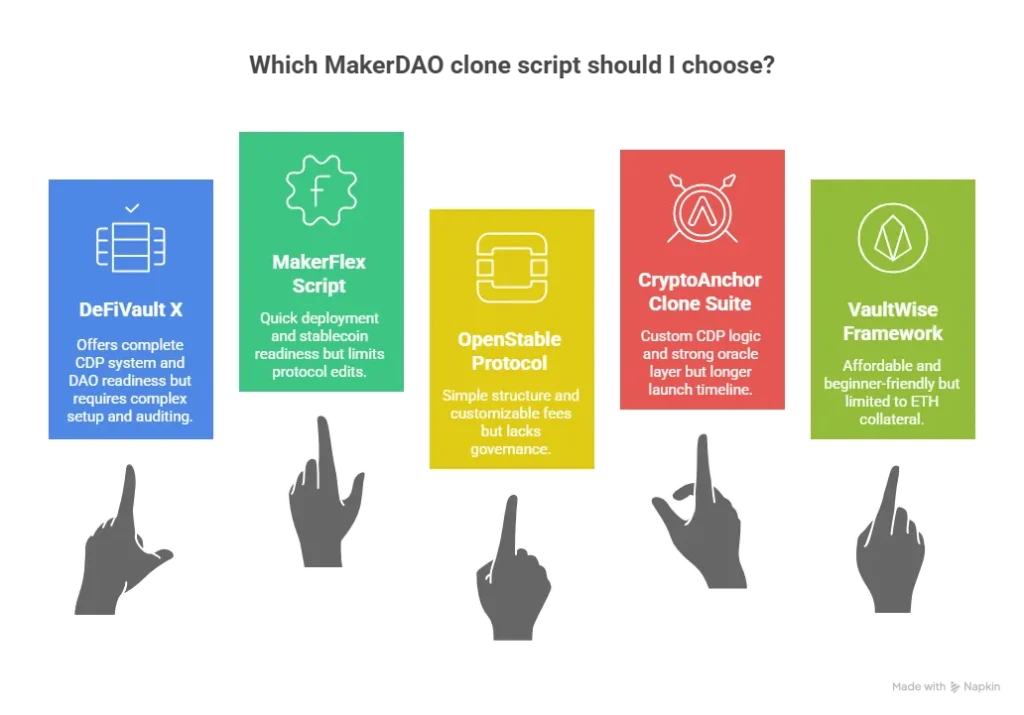

Choosing the right clone script depends on how deeply you want to customize tokenomics, how much control you want over governance, and whether you’re running this as a public good or a profit engine. Here’s a comparison of the top scripts:

1. DeFiVault X

- Pros: Complete CDP system, DAO-ready, supports multiple chains

- Cons: Setup complexity, requires smart contract auditing

2. MakerFlex Script

- Pros: Quick deployment, stablecoin ready, built-in frontend

- Cons: SaaS licensing, limits deep protocol edits

3. OpenStable Protocol

- Pros: Simple structure, customizable fees and oracles

- Cons: No governance layer, built for MVPs

4. CryptoAnchor Clone Suite

- Pros: Custom CDP logic, multiple collateral types, strong oracle layer

- Cons: Longer launch timeline, technical support required

5. VaultWise Framework

- Pros: Affordable, beginner-friendly, easy deployment

- Cons: Limited to ETH collateral, not ideal for multi-token ecosystems

Cost Factors & Pricing Breakdown

Miracuves’s MakerDAO Custom Development, Pricing, Timeline & Techstack

Developing a MakerDAO-style decentralized lending & stablecoin protocol requires enterprise-grade blockchain engineering, smart contract security, and scalable cloud/node infrastructure. Because it involves collateral vaults, liquidation automation, governance voting, and real-time price oracles, MakerDAO-type systems demand advanced DeFi architecture and rigorous stability engineering.

MakerDAO-Style DeFi Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. DeFi Lending MVP | Wallet connect (Metamask), deposit & collateral vaults, mint/redeem mechanism, dashboards, oracle feeds | $65,000 |

| 2. Full-Suite DeFi Lending Protocol | Multi-collateral vaults, liquidation engine, DAO participation, governance voting, analytics | $120,000 |

| 3. Advanced DeFi Ecosystem | Cross-chain support, institutional dashboards, AI-driven analytics, staking/reward pools | $250,000+ |

Miracuves Pricing for a MakerDAO-Like Platform

Miracuves Price: Starts at $15,999

Miracuves engineers a secure and scalable DeFi platform supporting collateralized lending, automated liquidations, stablecoin mechanics, wallet integration, and production-ready smart contracts—built for rapid launch & enterprise-level security.

Note: This includes full non-encrypted source code, deployment support, backend & smart-contract setup, admin panel configuration, and App Store / Play Store publishing assistance, ensuring a fully operational product ready for real-world scaling.

Build smarter, deploy faster, and save months of development time compared to custom agencies charging $120,000+ — Let’s launch your decentralized finance product today.

Delivery Timeline for MakerDAO

30–90 Days depending on smart-contract complexity, oracle integration, and governance workflows.

Tech Stack

We will be using JavaScript for the full platform architecture (Node/Next.js, PostgreSQL) & Flutter for mobile apps, optimized for security, scalability & multi-role operations.

Smart-contracts via Solidity / Rust with WalletConnect & EVM compatibility.

Custom variations available on request.

Use Case Breakdown: Who Should Use What?

Here’s how different user profiles match up with the available scripts:

- For local stablecoins backed by regional tokens: OpenStable or VaultWise are ideal

- For full-scale DAO-run DeFi products: DeFiVault X or CryptoAnchor are top picks

- For MVP testing or grant-funded pilots: OpenStable gives speed and affordability

- For startups with investor backing: MakerFlex saves time with managed support

Unique Use Cases Emerging in 2025

What started as a simple stablecoin concept is now being cloned for some very unique and regional use cases:

- Agricultural lending platforms offering crop-backed stablecoins

- Real estate-backed DeFi protocols offering home equity borrowing

- Creator DAOs minting stable tokens backed by NFT portfolios

- Community banks issuing stablecoins as local currency substitutes

- GameFi lending loops where players borrow against in-game assets

These innovations are only possible because of the MakerDAO framework’s flexibility. Clone scripts just make it easier to apply those mechanics to your specific industry or region.

Read More : Top UI/UX Mistakes in Decentralized Crypto Launchpads

Supported Monetization Models for MakerDAO Clones

While many DeFi protocols position themselves as neutral, open tools, clone scripts are often monetized in several ways:

- Stability fees on every borrow transaction

- DAO token sales and prelaunch staking pools

- Liquidation penalty fee collection

- Institutional partnership licenses

- Governance token appreciation

If you’re running this as a business, your clone can be tweaked to maximize fee capture, token utility, and treasury growth over time.

Final Thoughts

MakerDAO didn’t just build a decentralized bank—it sparked an entire playbook for stable, trustless finance. And in 2025, that playbook is being localized, forked, remixed, and reimagined across the world. MakerDAO clone scripts offer a real path for builders to launch collateral-backed lending protocols that serve unique markets—from rural India to metaverse economies. If your next big idea involves money without borders, this is the smartest place to start. At Miracuves, we help innovators launch powerful DeFi platforms that are secure, scalable, and governance-ready. Ready to bring your protocol to life? Let’s build together.

FAQs About MakerDAO Clone Scripts

What is a MakerDAO clone script?

A MakerDAO clone script is a ready-to-deploy DeFi protocol software that allows users to lock assets as collateral and mint stablecoins, replicating Maker’s decentralized lending model.

Can I change the stablecoin peg to something other than USD?

Yes. Most clone scripts allow you to peg the stable token to other fiat currencies, commodities, or even basket-backed indexes depending on your oracle setup.

Is it possible to integrate my own governance token?

Absolutely. Clone scripts often include modular DAO systems where you can plug in your own ERC-20 token and define voting rights and proposal logic.

How much technical knowledge do I need to launch?

If you choose a SaaS-style script, you won’t need deep technical skills. For on-chain deployments or custom tokenomics, smart contract experience or a technical team is essential.

What are the risks involved in running a MakerDAO clone?

Risks include oracle failure, smart contract bugs, liquidity crises, and regulatory scrutiny. Proper auditing, governance, and community transparency help mitigate these.

Can I use NFTs or real-world assets as collateral?

Some advanced scripts support non-standard collateral types, including NFTs or tokenized assets. You’ll need custom smart contract modules and reliable oracles for these assets.

Related Articles