So, you’ve been bitten by the DeFi bug. Maybe you saw GMX crushing it in the decentralized perpetuals scene, and you thought: “Why not us?” After all, GMX made leverage sexy again — on-chain, permissionless, and packed with juicy trading volumes. But let’s pump the brakes for a second.

Building a GMX clone isn’t just about slapping on a Uniswap-style UI and plugging into Arbitrum. It’s like trying to build a Ferrari with bicycle parts — if you miss the fine print. Plenty of eager startups dive in, only to hit the same five potholes over and over. Spoiler: they’re not always code-related.

If you’re thinking of launching your own decentralized trading app or a DeFi platform that mirrors GMX, this guide’s your crash helmet. We’ll unpack common blunders and show how Miracuves helps founders build smarter from day one.

Mistake #1: Underestimating the Complexity of Liquidity Pools

Liquidity ≠ Magic Wand

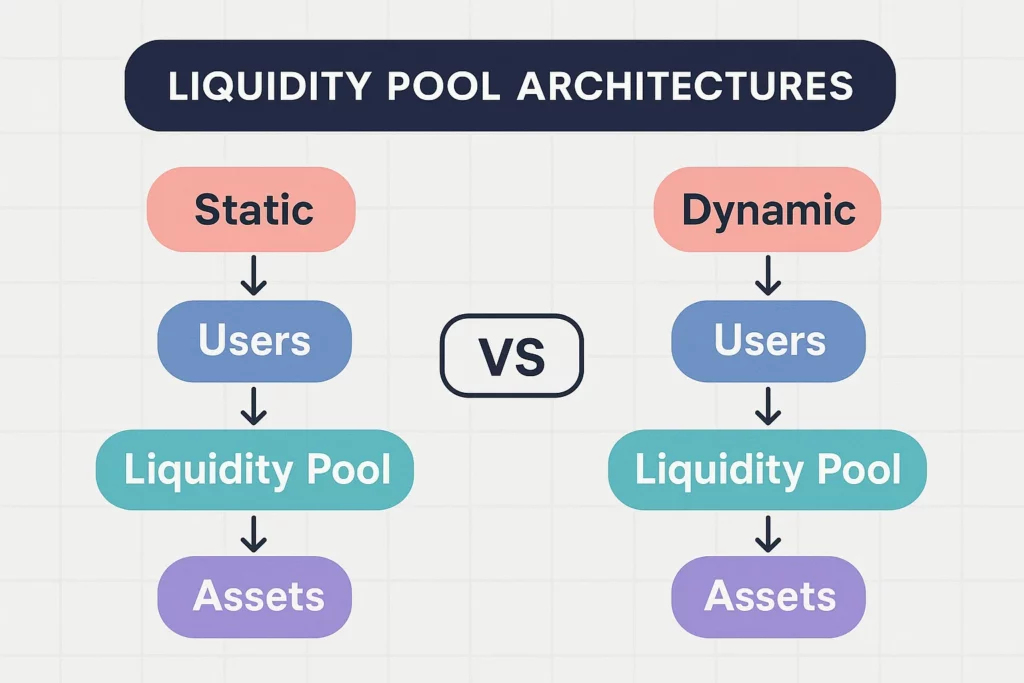

Most think liquidity just “shows up” when the app launches. Reality check? Without an incentive system, your pool will look more like a puddle. GMX uses a dual-token model (GLP + GMX) and relies on protocol-owned liquidity to keep spreads tight and slippage low.

Startups often oversimplify this with generic AMMs or forget impermanent loss even exists. They skip simulation modeling and real-world stress testing. Bad move.

How to Fix It

- Design dynamic fee models to attract providers

- Offer real yield or staking rewards

- Consider protocol-owned liquidity via bonding or buybacks

Read Also :-Best GMX Clone Scripts in 2025: Features & Pricing Compared

Mistake #2: Ignoring Smart Contract Risks

“We’ll audit later” — Famous Last Words

Every DeFi rug pull starts with good intentions. But skipping security layers until “after launch” is a death sentence — especially when users are tossing leverage into the mix.

GMX’s smart contracts have been battle-tested, yet they still undergo regular reviews. Meanwhile, clones often rely on GitHub snippets with zero auditing — or worse, use outdated code libraries with known vulnerabilities.

What Smart Startups Do

- Run bug bounties pre-launch

- Use formal verification tools like Certora

- Limit protocol permissions via timelocks and multi-sigs

Mistake #3: Copying Tokenomics Without Context

One Size Doesn’t Fit All

“Let’s just fork GMX’s tokenomics!” sounds cool — until your token price tanks and nobody sticks around. GMX’s ecosystem works because it’s tailored to its users, backed by real revenue, and anchored by Arbitrum’s community incentives.

You can’t just clone the GMX blueprint and expect it to magically work for a DAO-focused community or a new blockchain. You’ll need to think through emission schedules, lockups, utility, and value accrual loops.

Build It Like You Mean It

- Use veToken mechanics for governance-based rewards

- Build actual utility (fee discounts, governance votes, staking)

- Avoid hyperinflation “fixes” like 1,000,000% APY farming

Mistake #4: UI/UX That Scares Off Non-Degens

If It Looks Like a Terminal, It’ll Die Like One

GMX gets a lot of love from pro traders, but even they appreciate a clean layout. Too many clones overcomplicate things with chart-heavy dashboards and buried features. Newsflash: your app isn’t Bloomberg Terminal 2.0.

Every click adds friction. Every buried feature loses trust. If you want mass adoption, your clone should feel as intuitive as placing an Uber order.

What Works?

- Reduce onboarding steps (wallet connect, deposit, trade)

- Use clear icons and tooltips for DeFi jargon

- Provide a demo/sandbox mode for new users

Learn More :- Reasons startup choose our gmx clone over custom development

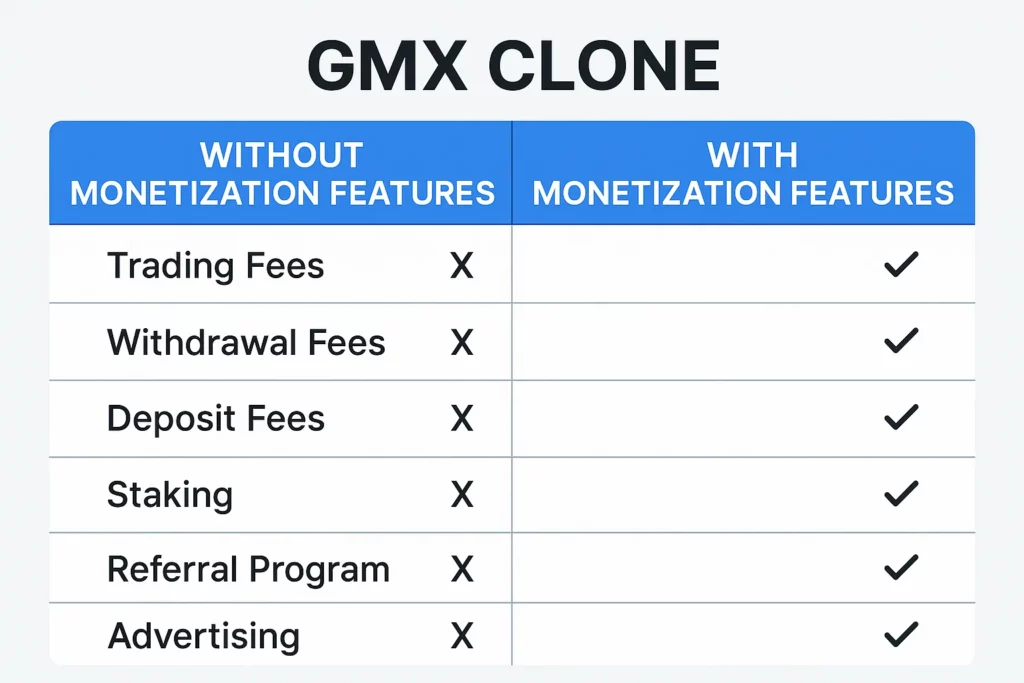

Mistake #5: No Real Monetization Model

Protocol Fees Are Not a Strategy

“Let’s earn from fees like GMX!” Sure — but that only works after you hit volume. Pre-volume, you need sustainability. Most clones die because they burn runway chasing liquidity or user growth, without revenue that supports operational costs.

Also, there’s a thin line between sustainable fee capture and making users feel exploited. Mispriced fees or greedy tokenomics can tank your project faster than a 20x short on a pump.

Think Bigger

- Offer premium analytics, alerts, or bot access

- Sell API access to quant traders or partners

- Run branded “copy trading” systems for influencers

Read More :-Pre-launch vs Post-launch Marketing for GMX Clone Startups

Conclusion

Building a GMX clone isn’t just a copy-paste job — it’s a balancing act of tech, trust, tokenomics, and UX. Avoiding these five mistakes doesn’t guarantee success, but it sure gives you a head start.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Can I legally clone GMX?

Yes, but with attribution where required. Most DeFi protocols are open source, but always check licenses and community norms.

What’s the biggest tech challenge in cloning GMX?

Building and securing the liquidity engine. It’s the beating heart of the platform and needs to be airtight.

How long does it take to launch a GMX-style platform?

Anywhere from 2–6 months depending on customizations, audits, and integrations. Miracuves can fast-track MVPs.

What chain should I launch on?

Arbitrum is battle-tested, but other chains like Optimism, zkSync, or even Solana offer unique benefits. Choose based on fees, tooling, and community.

How can I attract liquidity providers to my clone?

Offer real incentives — token rewards, LP staking bonuses, and low-risk simulations to test your protocol’s safety.

Do I need a native token to start?

Not always. Some founders launch without a token to build trust and add tokenomics later when there’s real traction.