Netflix made an astonishing $38.2 billion in revenue in 2025, solidifying its position as the world’s largest streaming platform. From subscription plans to advertising and licensing deals, Netflix has built a data-driven model that consistently converts viewers into revenue.

For entrepreneurs, understanding Netflix’s monetization strategy is invaluable — it shows how recurring revenue, user retention, and global scalability can power digital success. With Miracuves’ Netflix Clone, entrepreneurs can replicate this proven framework andbuild profitable OTT platforms like Netflix with built-in monetization in just 3–9 days.

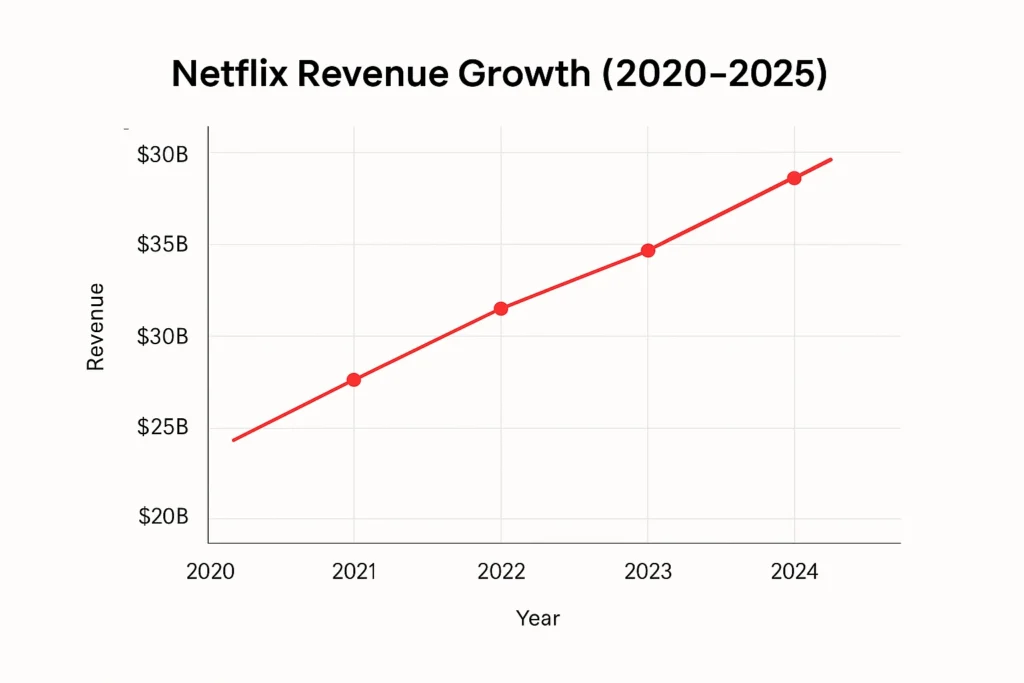

Netflix Revenue Overview – The Big Picture

Netflix’s 2025 annual revenue reached around $38.2 billion, marking 9% year-over-year growth compared to 2024. Its operating income exceeded $7 billion, while net profits rose to $6 billion.

- North America: ~43% of revenue

- Europe, Middle East & Africa: ~30%

- Latin America: ~13%

- Asia-Pacific: ~14%

The company added over 260 million global paid memberships by early 2025, reflecting its dominance in subscription-driven entertainment.

Netflix maintains operating margins between 18–22%, far above most streaming competitors like Disney+ or Prime Video. Its success lies in balancing subscription scalability with localized content investments.

Read More: What is Netflix App? How It Works & Why It’s a Streaming Giant

Primary Revenue Streams Deep Dive

| Revenue Stream | Description | Share of Total Revenue (2025) |

|---|---|---|

| Subscription Plans | Monthly or annual fees from users for streaming access (ad-free and ad-supported tiers). | ~78% |

| Advertising Revenue | Income from Netflix’s new ad-supported plans launched globally. | ~10% |

| Content Licensing | Selling or licensing Netflix Originals and regional content to other networks/platforms. | ~6% |

| Merchandising & Live Events | Revenue from physical merchandise, live experiences, and brand partnerships. | ~3% |

| Gaming & Interactive Media | Mobile and interactive game content under the Netflix Games division. | ~3% |

Subscription Plans:

Netflix’s core model charges monthly subscriptions — from $6.99 (ad-supported) to $22.99 (premium 4K) depending on region. The average revenue per user (ARPU) increased 8% YoY.

Advertising Revenue:

Netflix’s ad-tier model, launched in over 20 countries, allows brands to buy pre-roll and mid-roll ads. CPM rates average $55–65, generating strong incremental income.

Content Licensing:

Selective licensing of popular originals like “Stranger Things” and “Money Heist” to airlines and TV networks provides recurring third-party revenue.

Gaming & Interactive Media:

Netflix Games contributes a small but growing share of revenue as users engage with mobile titles tied to popular shows.

[Table: Revenue streams percentage breakdown]

The Fee Structure Explained

| User Type | Fee Components | Typical Rate / Range |

|---|---|---|

| Subscribers | Monthly/annual plan cost | $6.99 – $22.99 |

| Advertisers | Cost per 1,000 impressions (CPM) | $55 – $65 |

| Content Partners | Licensing and syndication fees | Negotiated per title |

| Gaming Users | Included in standard subscriptions | $0 incremental cost |

Netflix’s tiered subscription structure ensures flexibility across demographics. Its ad-tier plan appeals to price-sensitive audiences, while premium tiers boost ARPU through HD, 4K, and multi-device access. Regional pricing strategies keep adoption high in emerging markets.

[Table: Complete fee structure by user type]

How Netflix Maximizes Revenue per User

Netflix uses advanced algorithms to segment users, personalize content, and increase viewing hours — directly driving higher retention and cross-tier upgrades.

- Upselling: Promotes upgrades from standard to premium plans with AI-driven prompts.

- Cross-Selling: Bundles with mobile plans and smart TVs.

- Dynamic Pricing: Region-specific pricing tested through predictive analytics.

- Retention Monetization: Loyalty through content freshness and binge-friendly release formats.

- Psychological Pricing: Small regional price gaps ($1–$2) encourage users to choose higher plans.

In 2025, the average monthly revenue per member (ARM) rose by 9%, a result of deeper engagement and AI-led personalization.

Cost Structure & Profit Margins

Major cost categories:

- Content production and acquisition

- Technology infrastructure and cloud costs

- Marketing and brand partnerships

- Global operations and employee expenses

Unit Economics:

Netflix spends around $17 billion annually on content production but recoups it through subscriber retention and international expansion.

Profit margins remain at ~20%, boosted by growing ad revenue and reduced churn rates.

Read More: Top Netflix Clone Scripts | OTT Platform Features & Cost Guide

Future Revenue Opportunities & Innovations

- Ad-Supported Tier Expansion: Increasing global reach and CPM value.

- Cloud Gaming Integration: Expanding Netflix Games as a revenue engine.

- AI-Driven Personalization: Increasing user engagement through smarter recommendations.

- Merchandising and Brand Licensing: Turning franchises into lifestyle products.

- Global Original Content: Local-language hits in India, Korea, and LATAM driving regional growth.

Between 2025–2027, Netflix is projected to surpass $45 billion in annual revenue, leveraging hybrid monetization and stronger brand ecosystems.

Lessons for Entrepreneurs & Your Opportunity

Netflix proves that subscription-driven ecosystems with hybrid revenue models can scale fast and profitably.

Key takeaways:

- Focus on predictable monthly income.

- Use data to retain users.

- Diversify revenue beyond the main product.

- Leverage tech for engagement and personalization.

Want to build your own streaming platform with Netflix’s proven business model? Miracuves offers a ready-to-launch Netflix Clone — equipped with monetization systems, ad integrations, subscription modules, and content analytics. Many clients start earning within 30–45 days of deployment. Get your free consultation today and launch your OTT success story.

Final Thought

Netflix’s rise shows the power of recurring revenue and personalized entertainment. Entrepreneurs can adapt this model for niche markets — music, education, or regional OTT — using Miracuves’ scalable Netflix Clone.

FAQs

How much does Netflix make per subscriber?

Around $12 monthly ARPU globally in 2025.

What’s Netflix’s most profitable revenue stream?

Subscription plans remain the largest contributor, followed by advertising.

How does Netflix’s pricing compare to competitors?

It’s slightly higher than Disney+ but lower than Max or Apple TV+, offering strong value — and with Miracuves, you can build a similar streaming platform starting at just $2899.

What percentage does Netflix earn from ads?

Around 10% of total revenue in 2025.

How has Netflix’s model evolved?

From ad-free streaming to hybrid monetization — subscriptions, ads, and content licensing.

Can small OTT startups replicate this model?

Yes — with white-label Netflix Clone solutions like Miracuves.

What’s Netflix’s content spend vs revenue ratio?

Content costs make up around 45% of total revenue.

What are new opportunities for monetization?

AI-based upselling, regional pricing, and gamified content.

How quickly can a similar app monetize?

Using Miracuves’ Netflix Clone, you can start earning in just 3–9 days with guaranteed delivery, thanks to its fully ready and monetization-optimized setup.