From a small Brazilian startup to becoming Latin America’s most valuable digital bank, Nubank disrupted finance with a frictionless, mobile-first experience. Today, the company serves 90+ million users and holds a valuation surpassing $60B, proving one thing: traditional banks aren’t built for the digital world anymore — but modern fintech is.

In 2026, global demand fordigital-first banking is projected to hit $1.5 trillion, with neobanks acquiring customers 4x faster than conventional banks. For entrepreneurs, this means a massive opportunity: launching a Nubank-style neo-banking platform that removes paperwork, eliminates high fees, and builds trust through simplicity.

A Nubank Clone Script by Miracuves gives founders this advantage — not months or years from now, but right now with full control, compliance-ready infrastructure, and revenue-focused features built for today’s competitive markets.

What Makes a Great Nubank Clone?

A great Nubank clone in 2026 is more than a mobile banking app — it is a complete digital banking ecosystem designed for user trust, operational efficiency, and regulatory readiness. Entrepreneurs are not just launching an app; they are launching a financial infrastructure that must scale, adapt, and meet compliance requirements from day one.

A successful Nubank-style platform balances three priorities: seamless onboarding, smart automation, and real-time financial control. This is what gives users the confidence to switch from traditional banks to a digital-first banking system. Without these pillars, growth stalls. With them, customer acquisition accelerates and churn rate drops drastically.

Modern fintech clones require smart engineering. That means lightning-fast response speed, multi-layered security, and banking-grade uptime reliability. For founders, this ensures the product doesn’t break under scale — even when onboarding thousands of users per day.

Key Defining Qualities of a Top Nubank Clone in 2026

• Performance engineered for growth with average response time under 300ms

• 99.9% uptime architecture for uninterrupted banking operations

• Military-grade encryption & compliance-ready infrastructure

• Scalable backend capable of handling 10K+ concurrent users

• Modular codebase for feature expansion and white-label transitions

• AI-assisted fraud detection and real-time risk analysis

• Seamless loan, credit card, and micro-lending workflows

• Personalized financial dashboards and customer support automations

Must-Have Functional Capabilities

• AI automation for fraud checks, scoring models, and support chat

• Blockchain logging for transaction transparency where required

• Cross-platform integration (mobile + web banking panel)

• Multi-currency support for global markets and remittance partners

Comparison Table: Classic Fintech Apps vs Nubank-Style Clones

| Criteria | Traditional Banking Apps | Nubank Clone by Miracuves |

|---|---|---|

| User Onboarding | Manual, branch verification | 100% digital onboarding with KYC |

| Performance | Slow, legacy systems | 300ms response with scalable API |

| Revenue Streams | Limited fees | Interchange fees, lending, subscriptions |

| Trust-Building | Paperwork + delays | Real-time alerts + transparency |

| Customization | Restricted | Full white-label + modular add-ons |

Essential Features Every Nubank Clone Must Have

A Nubank-inspired digital bank must operate like a financial engine—fast, transparent, secure, and designed for user trust. The product has to deliver a banking experience that feels effortless for users, intuitive for administrators, and profitable for founders. This is where most fintech failures happen: they underestimate the infrastructure behind real-time banking. A strong Nubank clone avoids this by combining UX simplicity with enterprise-grade architecture.

User Side — Experience That Builds Trust

The user module should remove friction entirely. Every action should feel instant.

• Instant account setup with digital KYC

• Real-time transaction history + spending insights

• In-app virtual cards + physical card management

• Credit score insights + credit line requests

• Push notifications for every debit/credit movement

• In-app support chat with AI + human escalation

This layer focuses heavily on retention, not just acquisition.

Admin Panel — Intelligence, Control, and Automation

The backend is where revenue protection happens. Admins must have full visibility at scale.

• Dashboard for financial control & risk supervision

• AI-based dispute, refund, and fraud management

• Automated compliance auditing + permissions

• Revenue reports, settlement batches, limits, KYC flags

• Loan approvals & credit risk scoring models

This is the command center that keeps operations profitable.

Service Provider Layer (Credit, Cards, Lending, Partners)

If third-party lenders, card issuers, or microfinance operators are included, the system must track earnings, compliance, and onboarding.

• Real-time transaction alerts

• Partner-wise commission and settlement

• Earnings dashboard + compliance filters

• API connections to credit bureaus and payment processors

Advanced 2026 Features to Stay Competitive

• AI personalization for spending predictions and user behavior patterns

• AR-based onboarding walkthroughs for higher KYC completion

• Blockchain-backed ledger transparency for compliance regions

• Adaptive interest engine for loans and micro-lending

• Cross-border transfer routing with dynamic FX rates

Core Technical Architecture Requirements

• Microservices-based backend for modular scaling

• Auto-scaling servers with load balancing for peak hours

• Secure payments vault with tokenization & PCI-DSS alignment

• Third-party APIs: payment gateways, KYC, AML, credit bureaus

• Multi-layer security stack: WAF + anti-fraud + AML screening

• Cloud deployment with 99.9% uptime SLA

Feature Tiers Breakdown

| Feature Set | Basic | Professional | Enterprise |

|---|---|---|---|

| KYC, onboarding, cards | ✔ | ✔ | ✔ |

| Credit line engine | ✖ | ✔ | ✔ |

| AI fraud & AML automation | ✖ | ✔ | ✔ Advanced |

| Cross-border transfers | ✖ | Optional | ✔ |

| Blockchain transaction trail | ✖ | Optional | ✔ |

| White-label branding | Partial | Full | Full + Custom Modules |

| Delivery timeline | 30–45 days | 45–60 days | 60–90 days |

How Miracuves Delivers All of This

Miracuves integrates these layers into its Nubank Clone with clean engineering standards, modular code structure, and industry compliance alignment. The system is built for founders who need speed, credibility, and future-proof scalability—not experimental builds that break when users scale.

Cost Factors & Pricing Breakdown

Nubank-Like Digital Banking & Neobank Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Neobank MVP | User onboarding, KYC basics, digital wallet, balance management, transaction history, and a simple admin panel. | $70,000 |

| 2. Mid-Level Digital Banking Platform | Web dashboards, mobile-first UI, multi-currency wallets, virtual cards, notifications, spending insights, and analytics dashboards. | $180,000 |

| 3. Advanced Nubank-Level Platform | Physical & virtual cards, credit products, automated risk scoring, compliance workflows, fraud monitoring, subscriptions, and enterprise-grade scalability. | $350,000+ |

These figures represent the typical global investment required to build a modern neobank platform similar to Nubank, focused on mobile-first banking, financial inclusion, and scalable digital operations.

Miracuves Pricing for a Nubank-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete neobank foundation with user onboarding, wallet and account management, transaction processing, card-ready architecture, compliance-ready workflows, and a centralized admin dashboard — built for long-term scalability and digital banking use cases.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard and mobile integration, and deployment assistance — allowing you to launch a fully branded Nubank-style digital banking platform under your own ownership.

Launch Your Nubank-Style Digital Banking Platform — Contact Us Today

Delivery Timeline for a Nubank-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Banking features and account structures

- Card issuing and transaction logic

- Compliance, KYC, and regulatory requirements

- Risk scoring and fraud-prevention layers

- Branding and UI/UX customization

- Reporting and admin control depth

Tech Stack

Built using a JS-based architecture, ideal for modern neobank platforms that require secure financial transactions, scalable APIs, real-time processing, mobile-first performance, and enterprise-level reliability.

Customization & White-Label Option

Building a Nubank-style digital banking / neobank platform isn’t just about providing an app with account access — it’s about creating a modern financial ecosystem designed around user simplicity, regulatory alignment, and strong operational reliability. A platform inspired by Nubank must support onboarding, digital KYC, card and wallet management, analytics, compliance controls, and secure transaction handling while remaining intuitive for everyday users.

Miracuves delivers a fully white-label Nubank-style solution that can be adapted for regional neobanks, fintech brands, challenger banks, card-centric financial products, or digital-first financial institutions. The platform is structured to let you control branding, workflows, risk layers, and product depth rather than operating within rigid, predefined rules.

Why Customization Matters

The neobank model changes across markets:

- Different KYC documentation rules

- Varying card issuance or BIN partnership models

- Transaction volume and settlement expectations

- Local policies on interest, overdrafts, and account tiers

Customization ensures your platform is designed for your regulatory jurisdiction, features, and customer segments — not a generic global template.

What You Can Customize

Complete UI/UX Personalization

- Mobile-first banking dashboard and navigation

- Card management screens (freeze/unfreeze, limits, PIN, controls)

- Personalization through themes, typography, and brand identity

- Localization through language and regional preferences

Digital Banking & Account Layer

- Wallet or account-like balance model (non-custodial/custodial flow depends on region)

- Balance, statements, transaction breakdown, dispute logic

- Account tiers, limits, and premium subscription layers

Cards, Payments & Transfers

- Virtual/physical card management (region-dependent)

- Contactless, QR, PIN-based, and online payments logic

- Transfer rules, internal routing, and settlement scheduling

- Automated categorization and spending analytics

Risk, Security & Compliance

- Custom KYC/KYB flows (ID, address, facial checks, etc.)

- AML screening, threshold rules, velocity checks, freeze logic

- Audit logging and reporting for operational/legal transparency

Support & Communication

- In-app helpdesk, ticketing, and chat

- Automated alerts for critical account activity

- Status tracking for disputes or identity review

Integrations & Extensions

- Third-party compliance APIs (KYC, AML, sanctions check)

- Payment rails and transaction processors (region-specific)

- ERP/CRM, customer support suites, analytics pipelines

- Optional link to payout, settlement, or reconciliation systems

Monetization & Business Models

- Subscription tiers for premium users

- Fee-on-service structure for transfers or add-on services

- Card or BIN-partner revenue share structures

- Cashback/rewards or loyalty-based value layers

How Miracuves Handles Customization

- Requirement Analysis

Define target market, expected compliance zone, feature scope, and product direction. - Architecture Layering

Core account model → transaction system → risk engine → UX layer → integration hooks. - Development & Branding

UI/UX personalizations, routing logic, compliance flows, and app structuring. - Testing & Verification

Transaction validation, data flow checks, permission systems, and load testing. - Deployment & Operational Setup

White-labeled rollout with branded environments, dashboards, and operational access.

Real Examples from Miracuves Portfolio

Miracuves has delivered 600+ fintech, banking, and wallet deployments, including:

- Digital wallets and card-first banking experiences

- Region-based compliance onboarding and identity verification flows

- Multi-tier neobank solutions with analytics and subscription models

- White-label financial apps with custom dashboard and UX identity

These implementations show how a Nubank-style concept becomes a controlled, scalable, and compliance-conform financial product under your brand architecture.

Launch Strategy & Market Entry

Launching a Nubank-style neobank is not just a development process; it’s a market entry operation. The first 90 days determine whether the product becomes a growth engine or struggles for traction. Success comes from structured onboarding, compliance readiness, and user acquisition momentum. This is where founders must think like operators, not just app owners.

Pre-Launch Checklist for a Successful Go-Live

• Technical testing: load testing, peak concurrency, transaction accuracy

• Compliance validation: KYC, AML, PCI-DSS alignment depending on region

• App store readiness: ASO titles, screenshots, onboarding flow polishing

• Server setup: auto-scaling cloud + encrypted data vaults

• Marketing prep: landing page, trust signals, waitlist, influencer pipeline

This ensures launch day is smooth, not chaotic.

Winning Regional Entry Strategies in 2026

• Asia: Launch with micro-lending + wallet-first adoption to gain early market trust

• MENA: Focus on compliance partnerships + co-branded card programs

• Europe: Strengthen licensing early + build credibility with financial audits

• U.S. & LATAM: Go for user incentives + referral rewards + merchant tie-ups

The goal here is simple: reduce CAC while increasing LTV.

User Acquisition Frameworks That Work

• Influencer-led conversion funnels to build initial credibility

• Referral loops offering rewards on onboarding and first transaction

• Retention funnels triggered by personalized alerts and insights

• Trust building through financial transparency, predictable fees, and instant support

This combination accelerates time-to-profit rather than time-to-launch.

Monetization Models Proven in 2026

• Interchange fee from card usage

• Subscription-based credit management plans

• Interest margin through lending engine

• Cross-border markup percentage

• Merchant fee revenue via partner onboarding

When structured correctly, even a controlled niche banking launch can become cash-flow positive in under 12 months.

How Miracuves Supports End-to-End Launch Execution

• Technical deployment + server scaling

• Compliance checkpoint mapping

• UI polishing and app store delivery

• 90-day performance roadmap focused on traction

• Revenue model setup + analytics configuration

With Miracuves, founders don’t just get an app. They get a system engineered for scale.

Why Choose Miracuves for Your Nubank Clone Script

Choosing the right development partner determines how fast you launch, how confidently you scale, and how sustainable your business becomes. Miracuves is engineered for founders who don’t want experimental systems — they want banking technology that works from day one. With real deployment history, fintech-grade engineering, and fast delivery cycles, Miracuves positions entrepreneurs for market advantage instead of technical struggle.

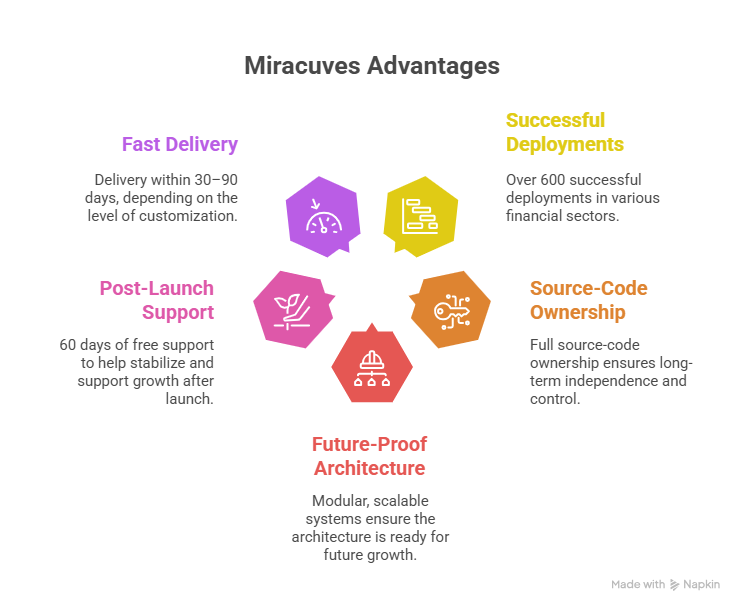

Miracuves’ Core Advantages

• 600+ successful deployments across fintech, banking, lending, and digital wallets

• Full source-code ownership for long-term independence

• Future-proof architecture built on modular, scalable systems

• 60 days of free post-launch support included to stabilize growth

• Delivery in 30–90 days based on customization scope

Why Founders Trust Miracuves

• Systems designed for regulatory environments and compliance readiness

• Clear roadmap, structured milestones, no vague development cycles

• Scalable architecture so you don’t rebuild every time you grow

• UI/UX engineering that builds user trust through clarity and simplicity

This is not a theory-based development model — it’s field-tested execution.

Real Success Stories

A Gulf-region entrepreneur launched a micro-lending neobank serving 15K users in 4 months using Miracuves’ compliance-first architecture.

A Latin American startup built a freelancer-focused bank with automated invoice-to-wallet settlement, achieving 9,000+ accounts and stable onboarding growth.

A European fintech founder integrated co-branded debit cards and achieved merchant onboarding from day one due to automated KYC & AML flows.

Final Thought

Launching a Nubank-style digital bank isn’t just about replicating features — it’s about understanding the business logic that made Nubank a global success. When entrepreneurs combine the right product architecture with clear market positioning, trust-building UI, and scalable infrastructure, they don’t compete with traditional banks — they outperform them.

Miracuves gives founders the advantage of starting strong instead of starting from zero. With ready-built banking frameworks, compliance-aware workflows, and flexible customization paths, entrepreneurs launch faster, scale smarter, and expand into profitable regions without technical bottlenecks.

In a world where financial technology is evolving faster than regulation, the winning strategy is clarity, speed, and execution. That is exactly what the Miracuves Nubank Clone is built for — a foundation you can grow into a financial brand, not just an app.

Ready to launch your Nubank clone? Get a free consultation and a detailed project roadmap from Miracuves — trusted by 200+ entrepreneurs worldwide.

FAQs

How quickly can Miracuves deploy my Nubank clone?

Delivery ranges from 30–90 days depending on customization, region-specific compliance, and feature depth.

What’s included in the Miracuves clone package?

Core banking modules, KYC onboarding, cards management, admin panel, APIs, UI/UX layer, deployment support, and 60 days of post-launch assistance.

Can I get full source-code access?

Yes. Miracuves provides full source-code ownership, giving you long-term independence and scalability.

How does Miracuves ensure scalability?

Through microservices architecture, load balancing, auto-scaling servers, and 99.9% uptime cloud-based deployment standards.

Does Miracuves assist with app store approval?

Yes. Guidance is provided for iOS, Android, and web onboarding, including compliance-friendly app store listing preparation.

Is post-launch maintenance included?

Yes. Founders receive 60 days of free maintenance, then optional long-term support plans based on growth goals.

Can Miracuves integrate custom payment gateways?

Yes. Gateways like Stripe, Razorpay, Adyen, Checkout, and regional payment systems can be added depending on market needs.

What’s the upgrade/update policy?

Upgrade cycles are modular. You can enhance features without rebuilding the system, thanks to the clone’s scalable architecture.

How does white-labeling work?

All branding, UI identity, domain, and product ownership transfer to you. No external branding or template references remain.

What kind of ongoing support can I expect?

Performance monitoring, bug resolution, feature expansion options, compliance advisory, and scaling support based on region and user load.

Related Articles

- Best Square Clone Scripts 2025: Build a Scalable POS & Payment Ecosystem Faster

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best Wise Clone Scripts in 2025: Features & Pricing Compared

- Best Remitly Clone Scripts 2025: Launch Your Global Remittance App Faster & Smarter

- Best Stripe Clone Scripts 2025: Build a Scalable Global Payment Infrastructure for Your Startup

- Best PayPal Clone Scripts 2025 Launch a Secure Global Digital Payment Platform

- Best Worldpay Clone Scripts 2025: Launch Your Own Global Payment Gateway