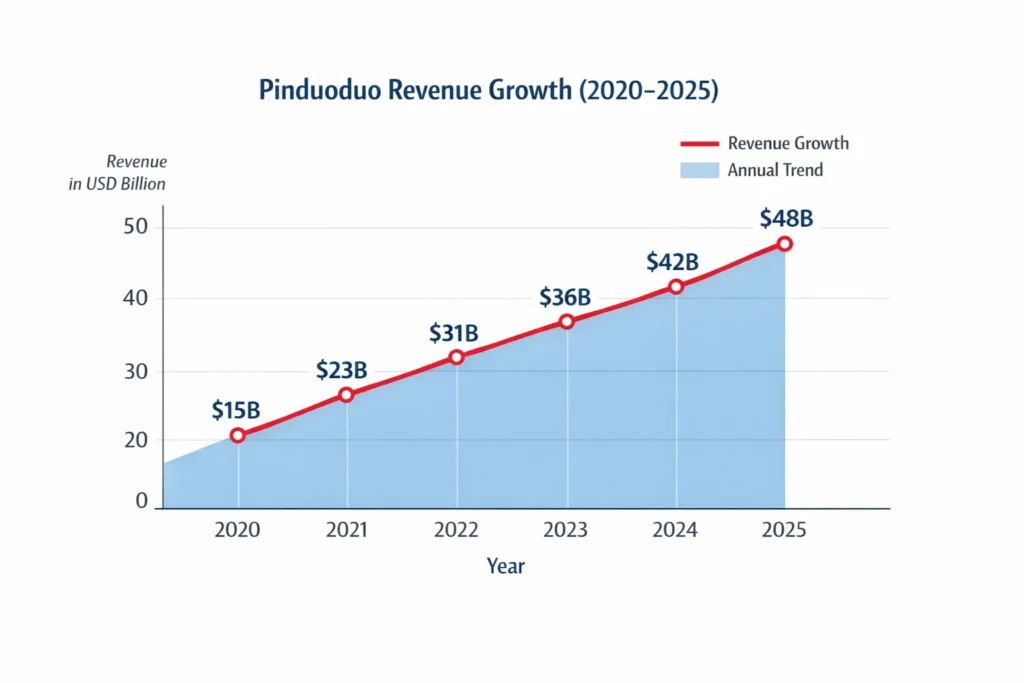

Pinduoduo crossed $48 billion in revenue in 2025, proving that social commerce at scale can outperform traditional e-commerce models. This growth is powered by high-frequency transactions, community-driven buying behavior, and a marketplace structure that scales without holding inventory. By prioritizing volume over high margins, Pinduoduo turns everyday purchases into a massive, repeatable revenue engine.

What makes this remarkable is not just the volume, but how the platform monetizes millions of price-sensitive users without relying on heavy discounts alone. Instead, Pinduoduo shifts monetization to the supply side through advertising fees, visibility bidding, and data-driven promotions. This allows users to feel they are always getting value, while sellers compete—and pay—for attention inside the ecosystem.

For founders building marketplaces, Pinduoduo offers one of the clearest playbooks for turning engagement into revenue. Social interactions are not treated as vanity metrics but as conversion tools, feeding directly into purchases and seller spending. The model shows that when engagement, pricing intelligence, and seller monetization are aligned, marketplaces can grow rapidly without sacrificing long-term profitability.

Pinduoduo Revenue Overview – The Big Picture

- 2025 Revenue: ~$48 billion

- Valuation: ~$190–200 billion

- YoY Growth: ~8%

- Primary Market: China (with global expansion via ecosystem brands)

- Operating Profit Margin: ~26%

- Net Margin: ~23%

Pinduoduo’s strength lies in high transaction frequency, viral user acquisition, and a seller-funded monetization structure. Unlike inventory-heavy models, it operates as a pure marketplace with scalable economics.

Compared to competitors, Pinduoduo monetizes engagement density rather than premium pricing, allowing it to outperform peers in cost efficiency.

Read More: What is Pinduoduo and How Does It Work?

Primary Revenue Streams Deep Dive

Revenue Stream #1: Merchant Advertising & Promotions

This is the core revenue engine. Sellers pay to boost product visibility inside feeds, flash deals, and group-buy campaigns. These ads are performance-based, making them attractive to merchants.

- Share of revenue: ~48%

- Pricing: CPC / performance-based bidding

- 2025 impact: Largest profit driver

Revenue Stream #2: Transaction Commissions

Pinduoduo takes a small commission per completed transaction. Low percentages are compensated by massive order volume.

- Share of revenue: ~32%

- Typical commission: 0.6%–1%

- High scalability, low resistance from sellers

Revenue Stream #3: Merchant Services & Tools

Advanced analytics, demand forecasting, logistics integrations, and automation tools sold to merchants.

- Share of revenue: ~10%

- Subscription or usage-based pricing

Revenue Stream #4: Data-Driven Optimization Services

Insights on pricing, demand trends, and consumer behavior sold to large sellers and brands.

- Share of revenue: ~6%

- High margin, low incremental cost

Revenue Stream #5: Ecosystem & Cross-Platform Monetization

Revenue from ecosystem synergies, cross-border commerce, and traffic sharing across platforms.

- Share of revenue: ~4%

Revenue Streams Percentage Breakdown

| Revenue Stream | % Share (2025) |

|---|---|

| Merchant Advertising | 48% |

| Transaction Commissions | 32% |

| Merchant Tools & Services | 10% |

| Data & Optimization Services | 6% |

| Ecosystem & Cross-Platform | 4% |

The Fee Structure Explained

Pinduoduo’s fee structure is intentionally seller-heavy, keeping buyer friction minimal while maximizing platform take rate.

User-Side Fees

- No platform usage fees

- No subscription charges

- Free participation in group-buying

Provider-Side Fees

- Transaction commission per order

- Advertising spend for visibility

- Optional paid tools and analytics

Hidden Revenue Layers

- Algorithmic ranking boosts

- Time-bound promotional auctions

- Volume-based incentive structures

Regional Pricing Variation

Fees are dynamically adjusted based on category margins, competition density, and regional demand.

Complete Fee Structure by User Type

| User Type | Fee Type | Typical Range |

|---|---|---|

| Buyers | Platform usage | Free |

| Sellers | Transaction commission | 0.6%–1% |

| Sellers | Advertising spend | Variable |

| Enterprise | Data & analytics tools | Custom |

How Pinduoduo Maximizes Revenue Per User

Pinduoduo focuses on frequency over ticket size.

- Segmentation: Price-sensitive vs bulk buyers

- Upselling: Visibility upgrades for sellers

- Cross-selling: Bundled group deals

- Dynamic Pricing: Real-time demand-driven price shifts

- Retention Monetization: Gamified rewards tied to repeat purchases

- LTV Optimization: Higher seller lifetime value through recurring ad spend

- Psychological Pricing: Scarcity timers, social proof, and group unlocks

In 2025, top merchants spend 3–5× more on ads than in 2022, showing rising monetization efficiency.

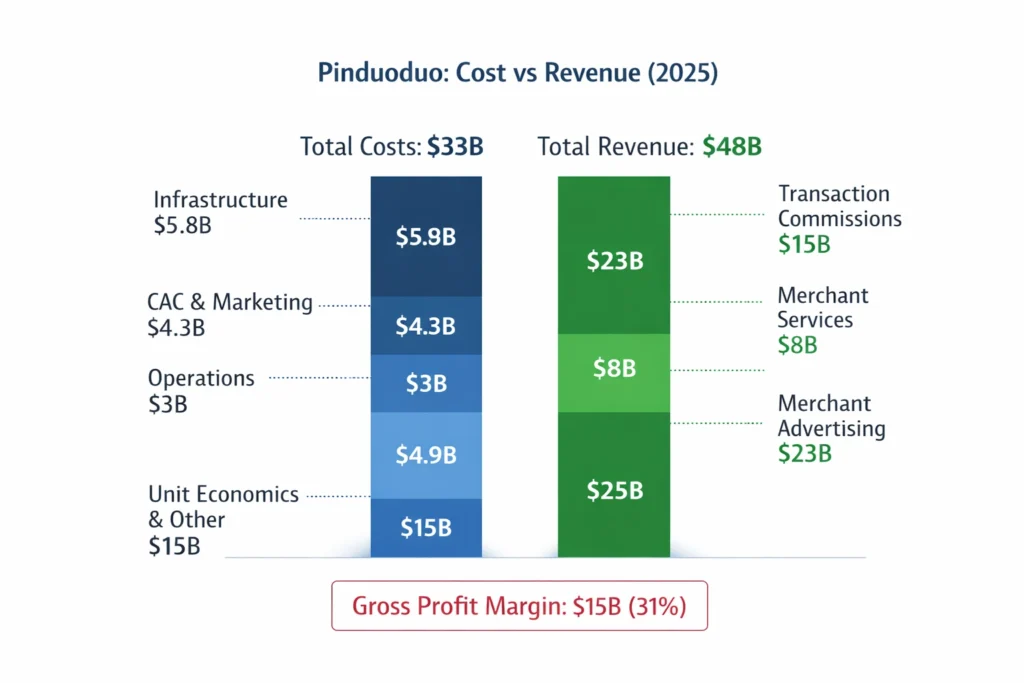

Cost Structure & Profit Margins

Pinduoduo’s cost discipline is a major reason for its profitability.

- Infrastructure: Cloud, data, AI (~12% of revenue)

- Customer Acquisition: Social-driven, low CAC (~9%)

- Operations: Support, compliance (~7%)

- R&D: Algorithms, AI pricing, logistics (~10%)

Unit Economics:

High order volume + low marginal cost = expanding margins.

Profitability Path:

Break-even achieved early due to seller-funded monetization.

Read More: Best Pinduoduo Clone Script 2025 | Social Commerce Platform

Future Revenue Opportunities & Innovations

- AI-driven merchant bidding optimization

- Predictive group-buy demand engines

- Deeper rural and cross-border penetration

- Automated pricing intelligence for sellers

Predicted Trends (2025–2027):

- More AI-based ad monetization

- Higher take rates from enterprise sellers

- Increased regulation pressure on pricing transparency

For new founders, niche-focused social commerce remains underpenetrated.

Lessons for Entrepreneurs & Your Opportunity

What Works

- Social-first acquisition

- Seller-funded growth

- Low buyer friction

What to Replicate

- Group buying mechanics

- Performance-based ads

- Dynamic pricing logic

Market Gaps

- Vertical-specific group commerce

- B2B bulk buying platforms

- Regional social marketplaces

Want to build a platform with Pinduoduo’s proven revenue model?Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Pinduoduo clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it, we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Pinduoduo proves that community-driven commerce can outperform traditional e-commerce at scale. By embedding social interactions, group buying, and shared incentives directly into the purchase journey, the platform increases transaction frequency without increasing acquisition costs. This approach turns users into active participants in growth rather than passive shoppers.

Its success lies in aligning seller incentives with platform growth while keeping buyers engaged and cost-free. Sellers fund visibility, promotions, and data-driven tools, while buyers enjoy lower prices and gamified experiences without platform fees. This creates a self-reinforcing ecosystem where higher engagement leads to more seller spending and stronger platform margins.

For founders, this model offers one of the clearest paths to scalable, profitable marketplaces. It demonstrates that monetization does not need to come from users directly—when engagement, data, and seller value are tightly integrated, marketplaces can scale rapidly while maintaining healthy long-term economics.

FAQs

1. How much does Pinduoduo make per transaction?

Roughly 0.6%–1% commission, plus advertising revenue from sellers.

2. What’s Pinduoduo’s most profitable revenue stream?

Merchant advertising and promotions.

3. How does Pinduoduo’s pricing compare to competitors?

Lower commissions, higher ad-based monetization.

4. What percentage does Pinduoduo take from providers?

Effective take rate ranges between 3%–5% including ads.

5. How has Pinduoduo’s revenue model evolved?

From transaction-focused to data and ad-driven monetization.

6. Can small platforms use similar models?

Yes, especially in niche or regional markets.

7. What’s the minimum scale for profitability?

Typically 50k–100k monthly active users with active sellers.

8. How to implement similar revenue models?

Combine group buying, seller ads, and dynamic pricing.

9. What are alternatives to Pinduoduo’s model?

Subscription marketplaces or inventory-led commerce.

10. How quickly can similar platforms monetize?

Some platforms generate revenue within weeks of launch if liquidity is achieved.