So, you’ve decided to build a Wise clone. Bold move—and a smart one. With cross-border payments booming and users demanding real-time, low-fee transfers, fintech is hotter than a Mumbai summer. But let me guess: you’re laser-focused on the product—API integrations, KYC flows, and compliance headaches. Marketing strategies of wise clone? You’ll “get to it.”

Here’s the reality: even if your app can move money across the globe in seconds, it won’t go anywhere if no one hears about it. Pre-launch marketing is like setting the GPS, while post-launch is hitting the gas. Both matter—immensely.

At Miracuves, we’ve helped fintech founders go from stealth mode to market leaders with clone solutions that don’t just work—they wow. Let’s break down exactly how to market your Wise clone before and after launch like a pro.

What is Pre-launch Marketing & Why Fintech Startups Can’t Skip It

Think of pre-launch marketing as warming up the engine. It sets expectations, builds credibility, and makes sure people are actually waiting for your app to drop—not discovering it six months too late.

Why Pre-launch is Crucial for Fintech Apps

- Trust is currency—and you can’t build it overnight

- Investors and early adopters need social proof

- You’ll collect real feedback that shapes your UX/UI

- SEO and backlinks take time to mature—so start early

Pre-launch Marketing Checklist for Your Wise Clone

1. High-Impact Landing Page

Showcase what your app does, who it’s for, and why it beats Wise, Revolut, or Payoneer. Use phrases like “Real-time global transfers” or “Send money across borders—no nonsense, no hidden fees.”

2. Early Access Waitlist with Incentives

Entice early adopters with “first 100 users get 6 months of zero fees” or “get $10 for every referral pre-launch.”

3. Segment-based Email Marketing

Split your email list into creators, freelancers, SMEs, and digital nomads. Each group values something different—automated invoicing, transparent FX rates, etc.

4. Build-in-Public + Teaser Drops

Post behind-the-scenes updates on LinkedIn and X (Twitter). Show mockups, logo drafts, your decision-making process. Founders who tell stories win hearts.

Stat Source: According to TechCrunch, 70% of successful fintech app launches involved some form of “build-in-public” strategy.

Post-launch Marketing: Time to Accelerate

Congrats, your app is live. But now, the hard part begins: turning installs into trust, transactions, and testimonials.

Post-launch Objectives

- Acquire high-intent users

- Retain them through smart UX & updates

- Generate organic growth via referrals

- Position your app as a market alternative to Wise

Post-launch Tactics for Fintech Domination

1. ASO for Fintech-Specific Keywords

Optimize your Play Store/App Store listings for terms like:

“Send money globally”, “Instant FX transfer app”, “Wise alternative India”, “International remittance app”

2. Retargeting with Conversion Triggers

Use Meta and Google Ads to target users who visited your site but didn’t convert. Serve them visuals like “Transfer ₹50,000 internationally for under ₹200 fees.”

3. Referral-Driven Growth Loops

Add double-sided rewards: “Invite a friend and you both get 1 free cross-border transfer.” It’s the digital form of word-of-mouth.

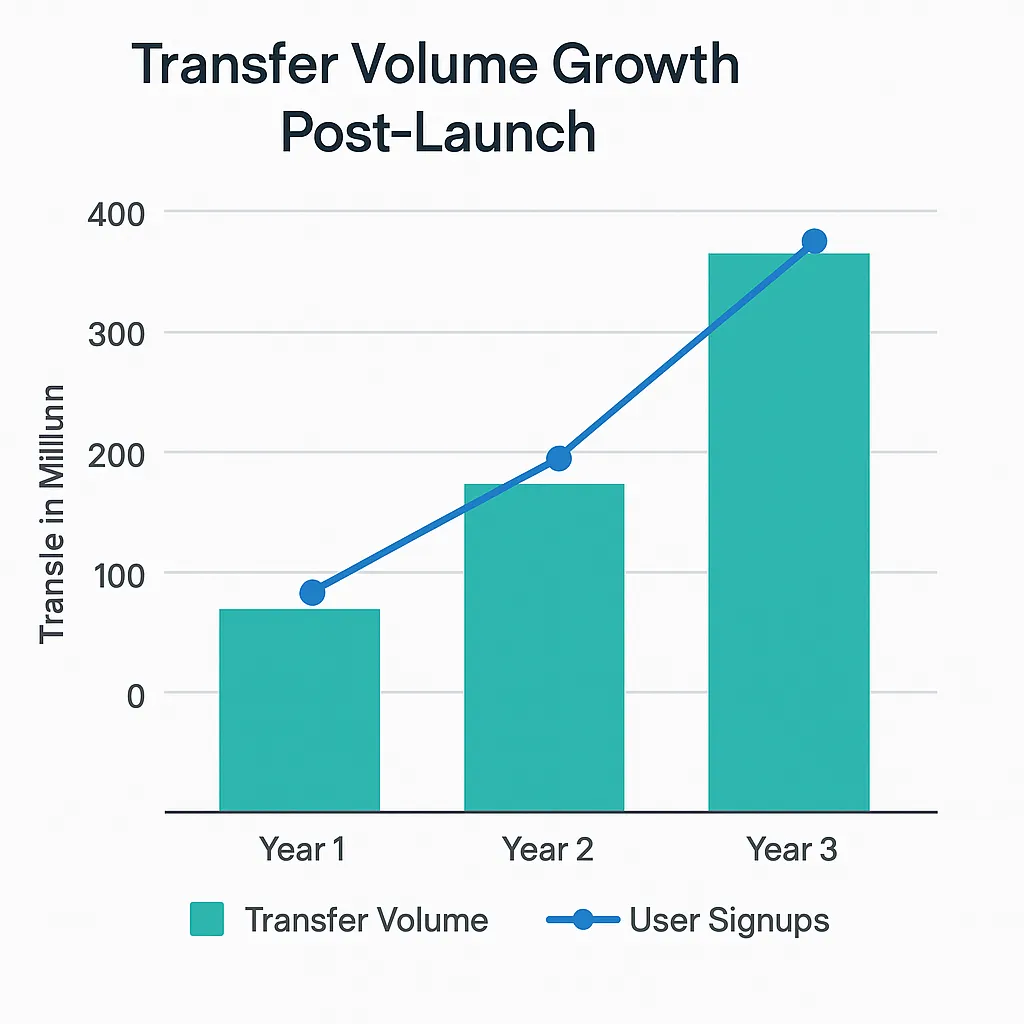

4. Publish Transparent Metrics

Monthly updates like “$200k+ transferred in April with 97% success rate” build trust like nothing else in fintech.

Pre-launch vs Post-launch: A Side-by-Side Breakdown

| Feature | Pre-launch | Post-launch |

|---|---|---|

| Main Goal | Awareness + Lead Generation | Conversion + Retention |

| Primary Channels | Landing Pages, Email, LinkedIn Teasers | ASO, Retargeting Ads, Push Notifications |

| Tools | Carrd, Mailchimp, Typeform | Firebase, Appsflyer, Mixpanel |

| Messaging Style | Curious, Exclusive, Value Teasers | Confident, Transparent, Data-backed |

Don’t Fall into These Common Traps

- Waiting till launch to think about SEO

You’re months behind already. - Launching without a referral strategy

Every user should bring another. - Focusing only on installs

Installs ≠ engagement. Retention is king. - Skipping KYC/AML UX audits

One painful identity check = churn.

Features of Wise Clone Development

A Wise clone app offers features for seamless international money transfers, including multi-currency wallet support, real-time exchange rates, and low transaction fees. Users can send and receive money globally, track transfers, and manage accounts with high security. The app includes KYC verification, bank account linking, currency conversion, transaction history, and push notifications. Admin features include user management, fee settings, transaction monitoring, and fraud detection tools, making it ideal for launching a secure and efficient money transfer platform.

Learn More: Top Wise App Features That Power Borderless Banking

Conclusion

The next-gen fintech apps are getting personal: real-time fraud alerts, AI expense tracking, crypto-friendly wallets, and even voice-command transfers. The startups that pre-position these as brand differentiators—not just features—are the ones we’ll be talking about next year.

Build Your Own Digital Banking App with Miracuves

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready.

Ready to turn your idea into reality? Let’s build together.

FAQs

1) How long should my pre-launch campaign last?

Start immediately — with Miracuves delivering your solution in just 3–9 days with guaranteed delivery, you can begin gathering feedback, building anticipation, and refining your pitch right from day one.

2) Do I need a financial license to launch a Wise clone?

Yes, most countries require at least a basic financial services license or partnership with a licensed entity.

3) What if my app isn’t feature-complete yet?

That’s fine! Use pre-launch to validate your MVP and iterate with user feedback.

4) What are the best channels for fintech user acquisition?

SEO, influencer marketing on LinkedIn, YouTube explainers, and strategic PPC for keywords like “international transfer app.”

5) Is ASO really that effective for fintech apps?

Yes! Many users still discover fintech tools via app stores, especially when looking for alternatives to big names.

6) Should I market differently to freelancers vs SMEs?

Absolutely. Freelancers care about fees and payouts. SMEs value bulk transfers, accounting integrations, and dashboard access.