From a bootstrapped startup to India’s most trusted fintech gateway, Razorpay scaled into a $7.5B powerhouse by solving one problem: making digital payments effortless for businesses. By 2025, the global payment gateway market is projected to surpass $150B+, driven by subscription platforms, SaaS ecosystems, and cross-border commerce. This growth is exactly why building a Razorpay-style payment solution has become one of the most profitable fintech business models for entrepreneurs. A Razorpay Clone allows founders to enter the fintech market with a platform that supports instant onboarding, automated settlements, multi-currency billing, subscription management, and API-driven integration — without spending years in development.

For entrepreneurs in 2025, the opportunity is clear: instead of building from scratch, launch with a proven technology base and accelerate time-to-revenue. Miracuves Razorpay Clone Script enable fintech founders to do exactly that — with performance, security, and monetization already engineered in.

What Makes a Great Razorpay Clone Script in 2025

A great Razorpay Clone in 2025 is not just a payment gateway — it is an infrastructure engine built for reliability, transaction safety, and scale. Founders are no longer looking for basic payment processing; they want a platform that handles multi-currency transactions, recurring billing, automated settlements, and API-first integration that SaaS businesses can depend on. This is where most clones fail: they copy the interface, not the architecture. A modern Razorpay-style platform in 2025 must be designed with the same engineering mindset as a fintech core system — not a simple checkout tool. The standard now demands performance at every layer: under 300ms response time, 99.9% uptime, PCI-DSS compliant security flows, KYC-ready onboarding, and compliance-based scalability to handle thousands of merchants with differentiated fee slabs.

Core Elements of a Great Razorpay Clone

• Real-time transaction processing with bank-grade encryption

• Multi-currency gateways and global settlement compatibility

• Subscription billing + tokenized payments for SaaS platforms

• API-first architecture to integrate with eCommerce, apps, and SaaS

• Chargeback automation + dispute dashboard for merchants

• AI-based fraud detection to reduce payment risk and false declines

• 99.9% uptime guarantee with scalable load balancing

Technical Performance Benchmarks

• Average API response time: under 300ms

• Server uptime guarantee: 99.9%

• Multi-node hosting for load balancing and traffic spikes

• Scalable architecture: 10,000+ concurrent requests

• Bank-grade encryption: AES-256 + tokenization model

Modern Differentiators (2025 Expectations)

• AI-led fraud prevention & anomaly alerts

• Blockchain transaction history for transparency

• Instant settlement options + automated bank routing

• Multiplatform integration (web, Android, iOS, SaaS)

• Dynamic pricing engine for fee slabs & merchant tiers

Razorpay Clone Comparison Table 2025

| Feature | Basic Clones | Traditional Gateways | Miracuves Razorpay Clone |

|---|---|---|---|

| Real-time processing | Limited | Moderate | High-speed <300ms |

| Subscription billing | No | Partial | Full automation + APIs |

| Merchant dashboard | Basic | Outdated UI | Modern, analytics-first |

| AI anti-fraud | No | Manual checks | Smart, AI-driven |

| Scalability | Weak | Average | Enterprise ready |

| Global payments | No | Limited | Multi-currency enabled |

| Code ownership | No | No | Full source-code access |

Essential Features Every Razorpay Clone Must Have

A Razorpay-style payment gateway is more than just a checkout button. It is a multi-layer architecture built to handle user experience, real-time security checks, merchant onboarding, settlements, and developer integrations at scale. In 2025, entrepreneurs expect to onboard merchants fast, process payments instantly, and deliver analytics without needing an internal IT team. That requires a clone designed with clarity, flow, and monetization in mind from day one

User Side (Customer Experience & Retention)

Users expect checkout to feel invisible — fast, frictionless, and secure. A great Razorpay Clone must provide:

• Single-click checkout + saved cards

• UPI, cards, wallets, net banking, EMI, BNPL support

• Smart retry engine for failed payments

• AI personalization based on device, region, and past transactions

• Real-time invoice and transaction status

This side determines conversion rate — even a 0.5 second delay can drop conversions by 7-10%.

Admin Panel (Control, Automation, Governance)

A gateway fails if the admin is blind. The admin panel must give founders control without requiring engineering dependency:

• Merchant onboarding + automated KYC/KYB

• Real-time ledger view of inflow/outflow

• Dynamic pricing + settlement fee slabs

• Dispute management and chargeback module

• Integrated analytics for conversion, risk, and merchant performance

• 99.9% uptime monitoring dashboard

This is how fintech founders scale without adding unnecessary staff.

Service Provider / Merchant Side (Business Engine)

Merchants need clarity — not confusion. The merchant module must feel like a revenue cockpit:

• Earnings dashboard + daily settlement reports

• API keys management + integration sandbox

• AI-based payment routing for higher success rates

• Fraud analytics + dispute notification center

• Automated GST invoicing + reconciliation

This helps merchants operate profitably with less support overhead.

Advanced 2025-Grade Features

• AI payment routing to the best-performing gateway in real time

• AR onboarding flows for merchant identity validation

• Blockchain-based transaction logging for audit and compliance

• Multi-layer security with tokenization + encryption

• Serverless components for instant traffic scaling

Technical Architecture Requirements

• Microservices-based modular build

• Load handling: 10,000+ concurrent requests

• Auto-scaling with container orchestration (Docker/Kubernetes)

• Third-party Banking, UPI, EMI, BNPL, and PSP integration

• PCI-DSS Level 1 compliant security stack

Feature Comparison – Basic vs Professional vs Enterprise

| Module | Basic | Professional | Enterprise |

|---|---|---|---|

| UPI, Cards, Net Banking | Yes | Yes | Yes |

| EMI/BNPL Integrations | No | Optional | Yes |

| Subscription Billing | Limited | Full | Advanced + Custom |

| Analytics Dashboard | Basic | Detailed | AI + Predictive |

| White-label Branding | No | Partial | Full |

| Setup Time | 15–30 days | 30–60 days | 30–90 days |

How Miracuves Implements These Features

Miracuves builds Razorpay Clone solutions with an enterprise-first mindset. Every deployment includes full source code, future scalability, and merchant-focused UI/UX. It’s not a template — it’s a fintech product foundation.

Cost Factors & Pricing Breakdown

Razorpay-Like Payment Gateway Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Payment Gateway MVP | Merchant onboarding, card & UPI payments, transaction logs, settlement basics, and a simple admin panel. | $60,000 |

| 2. Mid-Level Payment Processing Platform | Web dashboards, multiple payment methods, refunds, webhooks, notifications, reconciliation, and analytics dashboards. | $150,000 |

| 3. Advanced Razorpay-Level Platform | Subscription billing, marketplace payouts, smart routing, automated settlements, compliance workflows, reporting, and enterprise-grade scalability. | $300,000+ |

These figures represent the typical global investment required to build a scalable, API-driven payment gateway platform similar to Razorpay, capable of supporting high transaction volumes and merchant growth.

Miracuves Pricing for a Razorpay-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete payment gateway foundation with merchant onboarding, secure payment processing APIs, multi-method payment support, transaction and settlement management, webhook infrastructure, refund handling, and a centralized admin dashboard — built for long-term scalability and operational control.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard integration, and deployment assistance — allowing you to launch a fully branded Razorpay-style payment platform under your own ownership.

Launch Your Razorpay-Style Payment Gateway Platform — Contact Us Today

Delivery Timeline for a Razorpay-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Number of supported payment methods and regions

- Subscription, payout, or marketplace logic

- Compliance and security requirements

- API and webhook complexity

- Branding and UI/UX customization

- Reporting and admin controls

Tech Stack

Built using a JS-based architecture, ideal for modern payment platforms that require API-first design, secure transaction processing, high availability, scalable microservices, and real-time payment handling.

Customization & White-Label Option

Building a Razorpay-style payment gateway and digital collection platform is not just about accepting online payments — it’s about creating a developer-friendly, business-ready payment layer that supports multiple instruments, smart routing, robust reconciliation, and compliance for Indian and global merchants. A platform inspired by Razorpay must seamlessly handle cards, UPI, net banking, wallets, EMI, subscriptions, payouts, and marketplace-style flows while keeping the experience simple for both merchants and end users.

Miracuves delivers a fully white-label Razorpay-style solution that can be customized for SaaS products, ecommerce stores, marketplaces, fintech apps, and service businesses. The platform is designed so you can adapt payment flows, dashboards, risk controls, and integrations to your own brand, geography, and monetization strategy.

Why Customization Matters

Payment behavior and regulations differ by market, industry, and business model. Some businesses need UPI-first flows, others depend on cards and EMIs; some operate one-time payments, others run heavy subscription and marketplace business. Customization ensures your payment gateway:

- Fits your target industries and ticket sizes

- Aligns with local rules, tax logic, and compliance

- Supports your own dashboards, analytics, and workflows instead of generic ones

What You Can Customize

Complete UI/UX Personalization

- Merchant dashboards and admin panels

- Settlement and reconciliation views

- Onboarding and KYC journey

- Branding, typography, and color system for web and mobile

Payment Flows & Instruments

- Card, UPI, net banking, wallet, BNPL/EMI support (as per your model)

- One-time payments, subscriptions, payment links, QR-based flows

- Custom checkout experiences (hosted checkout, drop-in, or fully embedded)

Merchant & Partner Management

- Merchant onboarding and verification workflows

- Role-based access for teams and agencies

- Multi-business accounts and partner/reseller structures

- Commission logic for aggregators, PSPs, or ISVs

Subscriptions, Billing & Invoices

- Plan creation, upgrades, downgrades, trials

- Auto-debit, retries, and dunning flows

- Tax-aware invoices and billing rules

- Webhook-driven automation for SaaS and membership products

Payouts & Marketplace Logic

- Split payments for sellers and service providers

- Scheduled or instant payouts (depending on banking layer)

- Escrow-style logic and settlement rules

- Internal wallets and balance views for stakeholders

Risk, Fraud & Compliance

- KYC/KYB checks, documentation flows

- Transaction limits, velocity rules, blacklist/whitelist controls

- Alerting for suspicious patterns and chargeback-prone accounts

- Audit logs and exportable compliance reports

APIs, Webhooks & Integrations

- Developer-friendly REST APIs and webhook callbacks

- SDKs and integration kits (ecommerce, billing tools, etc.)

- Connectors for ERP, CRM, accounting, and analytics platforms

- Integration with notification systems (email, SMS, push)

Monetization & Pricing Controls

- Transaction fee rules per method or merchant type

- Subscription pricing tiers for merchants

- Premium API / premium feature bundles

- Discounted pricing for volume or partner networks

How Miracuves Handles Customization

Miracuves follows a clear, staged approach to build and adapt a Razorpay-style gateway to your business:

- Requirement Understanding

Detailed analysis of your payment use cases, target sectors, countries, and compliance constraints. - Architecture & Planning

Design of modular components: core payments, subscription engine, payouts, risk layer, and dashboards. - Design & Development

Implementation of branded UX, payment flows, merchant tools, and integration endpoints as per your roadmap. - Testing & Quality Assurance

Functional testing, stress and load testing, security validation, and end-to-end transaction simulations. - Deployment & Handover

Environment setup, go-live support, documentation, and training so your team can operate and scale the gateway under your own brand.

Real Examples from the Miracuves Portfolio

Miracuves has delivered 600+ production-grade platforms, including:

- Payment gateways for ecommerce and SaaS ecosystems

- Fintech applications with UPI-style and card-based flows

- Marketplaces with split payments and scheduled settlements

- White-label payment hubs integrated with ERP, CRM, and analytics

These deployments show how a Razorpay-style solution, when fully customized and white-labeled, can become the payment backbone for your own digital ecosystem rather than just another plug-in gateway.

Read More : What is Razorpay and How Does It Work?

Launch Strategy & Market Entry for a Razorpay Clone

Launching a Razorpay-style payment gateway in 2025 is not just a technical rollout — it’s a market positioning exercise. Success depends on how quickly you establish credibility, onboarding velocity, and transaction volume. The faster merchants trust your platform, the faster revenue compounds. That means your launch strategy must combine compliance, onboarding flow, marketing, and GTM execution from day one.

Pre-Launch Readiness (Before Going Live)

• Secure domain, SSL, hosting, and PCI-DSS aligned stack

• Merchant onboarding workflow tested end-to-end

• Settlement engine configured for T+0 / T+1 / T+2 cycles

• KYC/KYB partner APIs integrated and verified

• Basic brand kit ready (logo, email templates, merchant documents)

• Sandbox environment prepared for developer testing

This stage defines credibility. A weak launch erodes trust before the first transaction happens.

Market Entry Framework by Region

- India & South Asia:

Focus on UPI, net banking, EMI partners, marketplace onboarding, and D2C brands. - Middle East / MENA:

Local wallet support, Arabic UI, cross-border settlement rules, fee-slab flexibility. - Europe (EU):

GDPR alignment, SEPA integrations, localized compliance-driven onboarding. - United States:

Strong onboarding with KYB, card-first traffic, SaaS merchant billing, BNPL add-ons.

Your entry strategy should not target “everyone.” It should target high-intent early users who adopt fast and generate social proof.

User Acquisition & Growth Loops

User acquisition for a payment gateway is conversion psychology, not mass marketing. Instead of chasing traffic, convert businesses already searching for a better payment experience.

• Influencer partnerships in fintech, SaaS, eCommerce

• Referral loops: merchants invite other merchants, reward structure based

• Co-branded onboarding with SaaS apps and marketplaces

• Content funnels: “How to accept payments online in X region” blogs

• Webinars + onboarding workshops for early merchant trust

Once 10–20 merchants start transaction flow, growth becomes compounding.

Retention & Revenue Scaling Tools

These elements increase lifetime value and reduce churn:

- Subscription billing with automated retries

- Smart routing for higher transaction success rates

- Analytics dashboards to show merchants their growth

- Merchant education content + onboarding guidance

When merchants earn more, they stay longer — and your revenue compounds.

Top Monetization Models in 2025

| Monetization Model | Why it Works |

|---|---|

| Per transaction fee | Stable recurring revenue & growth compounding |

| Tiered merchant plans | Converts SMBs + enterprise at different LTV levels |

| Subscription billing | Predictable monthly ARR model |

| Add-ons (BNPL, EMI, Fraud engine) | High-margin upgrades for scaling merchants |

| Cross-border markup fees | Strong earnings from international settlements |

Miracuves End-to-End Launch Support

Miracuves does not just ship code — it supports the rollout:

• Infrastructure setup + security hardening

• App store & domain integration support

• Merchant onboarding playbooks

• First 90-day growth roadmap for positioning, pricing, and scaling

• Predictable go-live schedule within 30–90 days

You are not left to figure out fintech alone — Miracuves functions as a product partner, not a vendor.

Why Choose Miracuves for Your Razorpay Clone (Proof, Performance, Trust)

Choosing a Razorpay Clone provider is not just a tech decision — it’s a business risk decision. In fintech, the wrong architecture, unsecured APIs, or a vendor without real deployment history can become a financial liability. Miracuves eliminates that risk by delivering a platform engineered for security, performance, and scale from day one.

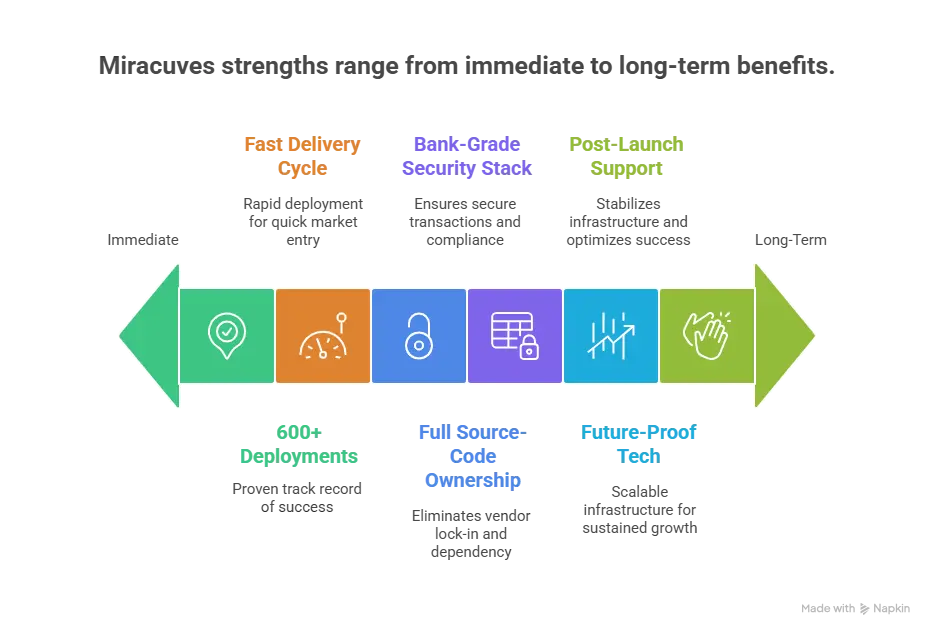

Miracuves Strengths That Matter to Founders

• 600+ successful deployments across fintech, SaaS, marketplaces, and global merchant ecosystems

• Full source-code ownership so founders never face vendor lock-in or forced dependency

• Bank-grade security stack with encryption, tokenization, and compliance-ready architecture

• Future-proof tech with scalable microservices, containerization, and growth-ready infrastructure

• Post-launch support (60 days free) to stabilize infrastructure, optimize success rates, and onboard early merchants

Results That Speak (Realistic Scenarios)

• A regional SaaS billing platform onboarded 120+ merchants in 90 days after launching with Miracuves

• An international gateway achieved 3x higher success rate by implementing AI-based routing and retry logic

• A niche fintech startup entered the MENA market with localized billing and custom fee slabs in under 60 days

Founder-Centric Engineering Mindset

Miracuves builds Razorpay Clone solutions like a fintech product foundation — not a template. That means:

- Designed for traffic spikes

- Ready for merchant volume scale

- Monetization models built in from day one

- Onboarding optimized for conversion, not confusion

Final Thought

Launching a Razorpay Clone in 2025 is not just about entering the fintech market — it’s about entering with clarity, confidence, and a strategic advantage. The businesses winning today are the ones that move fast, secure their merchant base early, and scale with systems engineered for growth. When entrepreneurs understand Razorpay’s business logic — recurring revenue, automated settlements, transaction-based monetization, and API-first expansion — the opportunity becomes obvious: a payment gateway is not a feature. It’s a financial engine.

Miracuves gives founders the leverage to build on proven technology instead of starting from zero. With faster deployment, full source-code ownership, and a growth-focused foundation, your Razorpay-style platform is not just software — it becomes infrastructure for your business future. Enter the market with confidence. Scale with data. Grow with purpose.

Ready to launch your Razorpay-style payment gateway? Build faster, scale smarter, and own your code fully. Miracuves is the partner trusted by 200+ entrepreneurs worldwide.

Start your Razorpay Clone journey today — request a free consultation + project roadmap from Miracuves.

FAQs

How quickly can Miracuves deploy my Razorpay Clone?

Standard builds can be delivered in 30 to 50 days, while advanced and enterprise versions typically launch within 30–90 days depending on customization and integrations.

What’s included in the Miracuves Razorpay Clone package?

Core payment processing engine, merchant/ admin dashboards, settlement logic, API integration layer, fraud prevention tools, and full documentation for onboarding.

Can I get full source-code access?

Yes. Miracuves provides complete source-code ownership so you maintain full control, avoid vendor lock-in, and can scale independently.

How does Miracuves ensure scalability?

The architecture is built with microservices, auto-scaling servers, Kubernetes containers, load balancers, and async job queues to handle high-volume traffic.

Does Miracuves assist with app store approval?

Yes. Guidance and technical support are provided for app store publishing, including API setup, compliance checks, and deployment steps.

Is post-launch maintenance included?

Yes. 60 days of post-launch support is included to ensure stability, onboarding success, and optimization.

Can Miracuves integrate custom payment gateways or regional methods?

Yes. UPI, cards, EMI, BNPL, international wallets, crypto, and regional banking connectors can be added as required.

What’s the upgrade/update policy?

You can request custom upgrades anytime. Modular structure makes enhancements easier without affecting the core system.

How does white-label branding work?

Your brand, logo, UI, emails, invoices, and communications are fully customized. No Miracuves branding appears on the final product.

What kind of ongoing support can I expect?

Dedicated support for scaling, onboarding, infrastructure monitoring, and merchant-side improvements to maintain success and stability.

Related Articles

- Best Square Clone Scripts 2025: Build a Scalable POS & Payment Ecosystem Faster

- Best Binance Clone Scripts in 2025: Features & Pricing Compared

- Best Wise Clone Scripts in 2025: Features & Pricing Compared

- Best Checkout.com Clone Scripts 2025: Build a High-Performance Payment Gateway

- Best Stripe Clone Scripts 2025: Build a Scalable Global Payment Infrastructure for Your Startup

- Best PayPal Clone Scripts 2025 Launch a Secure Global Digital Payment Platform