Grofers — now operating as Blinkit — disrupted India’s grocery retail space by offering superfast delivery of daily essentials at the tap of a screen. What began as a hyperlocal grocery app soon scaled into a logistics-powered tech platform enabling users to get everything from milk to mobile chargers delivered in under 10 minutes.

With millions of active users, strong backend logistics, and integration with Zomato, Grofers has created a compelling business model that blends convenience, speed, and scale. But how exactly does Grofers make money while offering deep discounts and lightning-fast service?

In this blog, we’ll explore the detailed revenue model of Grofers, uncover its income sources, and show how startups can build a similar monetization engine using a ready-made Grofers clone by Miracuves.

If you’re inspired by how the Grofers app works to make grocery delivery seamless, partner with a trusted grocery delivery app development company that can build you a scalable, feature-rich platform tailored for growth.

How Grofers Makes Money

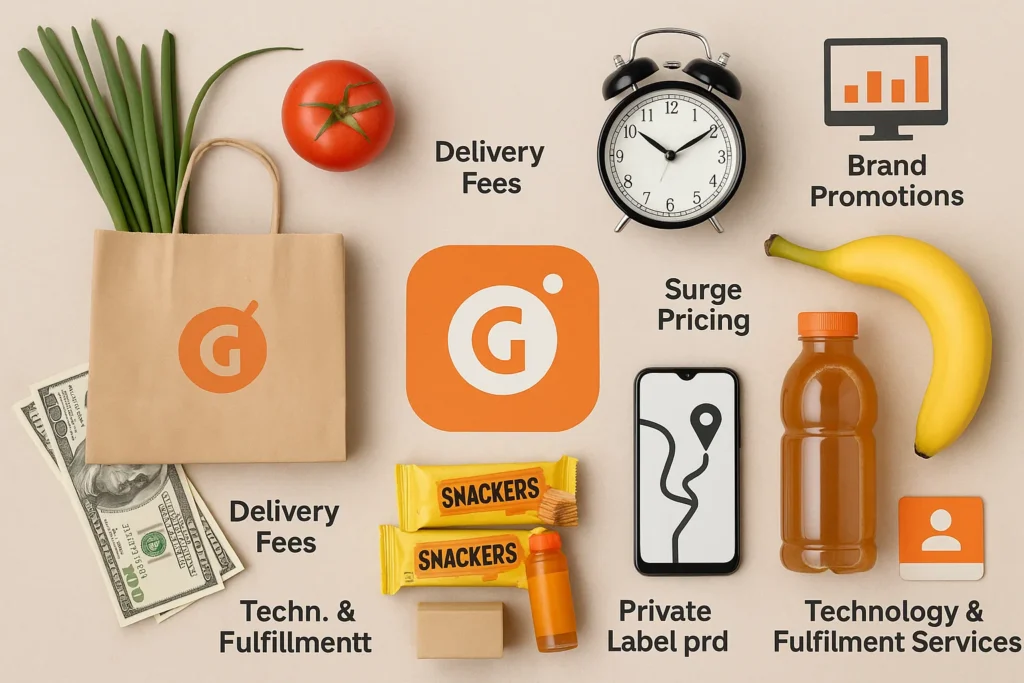

Grofers (Blinkit) operates on a multi-channel revenue model that combines product margins, service fees, and tech integrations. Here are the main ways it earns:

- Product Margins – Earns a margin on every grocery item sold, typically 8–20% depending on the product category.

- Delivery Fees – Charges users a small delivery fee on orders below a certain threshold.

- Surge Pricing – Applies dynamic pricing during peak hours or for urgent deliveries.

- Brand Promotions – Partners with FMCG brands for in-app promotions and banner placements.

- Private Label Products – Sells its own branded products like staples, snacks, and household goods at higher margins.

- Subscription Plans – Offers membership models like Blinkit Prime with benefits such as free delivery and priority access.

- Technology & Fulfillment Services – Provides backend logistics and tech support for partner stores and cloud kitchens.

This combination allows Grofers to not only survive on thin grocery margins but also thrive by building a scalable and flexible monetization framework.

Grofers scaled by blending low-cost operations with high-volume demand—explore the Grofers business model to see how it earns revenue.

Detailed Breakdown of Revenue Channels

Product Margins

The core of Grofers’ income comes from the margin between wholesale buying prices and consumer selling prices. Grocery and household items typically yield margins ranging from 8% to 20%. For private-label products, the margins are even higher — often exceeding 30%.

- Who Pays? End consumers.

- Why It Scales? Daily-use products mean high order frequency and repeat business.

Delivery Fees

To offset logistics costs, Grofers charges a delivery fee on small-value orders (typically below ₹250–₹500). These fees usually range from ₹15 to ₹49 and increase during surge hours or for ultra-fast delivery slots.

- Who Pays? Users placing low-value or urgent orders.

- Why It Scales? A consistent revenue stream from every order not covered under subscription plans.

Surge Pricing

Grofers uses demand-based pricing logic to increase service charges during peak hours or under high demand. This is often applied subtly via added fees for preferred delivery slots or faster delivery timeframes.

- Who Pays? Customers opting for speed or convenience.

- Why It Scales? Dynamic pricing boosts revenue without affecting product pricing.

Brand Promotions

Grofers monetizes its in-app real estate by offering brands paid placements, sponsored banners, and priority listings. FMCG companies pay to feature their products during festivals, launches, or price drops.

- Who Pays? Consumer goods brands and marketing partners.

- Why It Scales? Ads are embedded seamlessly within the shopping flow.

Private Label Products

From pulses to personal care, Grofers promotes its own private-label products like “Happy Day” and “G Fresh.” These yield significantly higher margins and help with brand recall.

- Who Pays? Consumers buying these high-margin alternatives.

- Why It Scales? Better control over pricing, quality, and profitability.

Subscription Plans

Grofers offers Blinkit Prime (or similar memberships) that give customers benefits like zero delivery fees, faster support, and exclusive deals for a monthly or yearly fee.

- Who Pays? Power users and frequent shoppers.

- Why It Scales? Recurring revenue with predictable cash flow.

Technology & Fulfillment Services

Behind the scenes, Grofers also powers warehousing, inventory, and last-mile delivery tech for third-party vendors or D2C brands. This B2B stream adds stability and helps Grofers monetize its operations as a service.

- Who Pays? Partner sellers, cloud kitchens, and local stores.

- Why It Scales? Creates platform revenue beyond customer transactions.

From bulk grocery orders to flexible delivery slots, Grofers sets the standard—explore the Grofers app features every startup should know.

Why This Revenue Model Works in 2025

Grofers’ revenue model continues to thrive in 2025 due to key shifts in consumer behavior, retail logistics, and digital adoption across Tier 1 and Tier 2 cities in India.

10-Minute Delivery Demand is Booming

Consumers now expect groceries faster than food delivery. Grofers capitalized on this need by setting up dark stores and hyperlocal hubs — enabling faster fulfillment with minimal operational cost per order. The faster the service, the more orders per day — and the greater the revenue per km.

Consumer Willingness to Pay for Convenience

While groceries are price-sensitive, the urban consumer is increasingly willing to pay delivery fees, surge charges, or subscribe to premium plans for time-saving benefits. This shift makes delivery fees and subscriptions a sustainable revenue stream.

Private Labels Are Gaining Ground

The rise of store-brand products is changing the FMCG landscape. Grofers leverages this by offering its own labels with better margins — winning price-conscious shoppers while improving profitability.

Digital Ads Meet Retail

Grofers’ in-app promotion model attracts FMCG brands eager to win digital shelf space. With first-party shopper data and native ad slots, Grofers creates performance-driven ad inventory brands can’t ignore.

Dark Store Model = Low Overheads

Unlike traditional retail, Grofers doesn’t rely on expensive retail space. Its dark store model allows faster fulfillment with lower overhead costs, increasing net margins per square foot.

AI and Inventory Automation

Inventory demand forecasting and warehouse automation help minimize spoilage and stockouts, which further optimize the supply chain and enhance gross margins — crucial in the grocery business.

Grofers built loyalty with affordability, variety, and smart branding—explore the Grofers marketing strategy that took it beyond just groceries.

Can Startups Replicate Grofers’ Revenue Model?

Yes — and it’s more achievable today than ever before.

The infrastructure Grofers uses — dark stores, on-demand delivery tech, inventory algorithms — may seem out of reach for early-stage startups. But with the right tools and a focused market approach, replicating this successful monetization model is possible.

Miracuves makes it even easier.

With our ready-made Grofers Clone solution, startups and digital agencies can instantly launch a grocery delivery app that comes preloaded with:

- Multi-vendor inventory and order management

- Real-time delivery tracking and logistics integration

- Commission and fee configuration for each product or category

- Ad placement modules for in-app brand promotion

- Subscription system like Grofers/Blinkit Prime

- Private label product support

- Admin dashboards to manage surge pricing and partner payouts

Instead of spending months on development and backend logistics, founders can launch a full-featured instant grocery app — with built-in monetization features — in a matter of weeks.

The Grofers Clone by Miracuves is a hyperlocal grocery delivery platform priced at $2,899.00 (original price $3,699.00).

It includes real-time inventory tracking, vendor management, and fast order fulfillment for smooth operations.

Go live in 3-9 days with Miracuves’ scalable and fully customizable solution.

With Miracuves, you get more than a clone. You get a revenue-ready engine modeled after a proven unicorn.

Startups launch faster by choosing our clone over custom builds, scaling with the best scripts in 2025, planning ahead using the cost guide, and following the developer guide to build a Grofers-style app the right way.

Conclusion

Grofers (now Blinkit) has built a powerful revenue model on the back of product margins, tech-enabled logistics, dynamic pricing, and platform monetization. It’s a blend of low-margin essentials and high-margin private labels, topped with smart delivery fees and brand partnerships — all working together to create a scalable grocery delivery business.

The best part? You don’t need a billion-dollar budget to build something similar.

With Miracuves’ Grofers Clone solution, entrepreneurs can tap into the booming quick-commerce space with a monetization strategy already built-in. Whether it’s earning from delivery fees, private labels, ads, or subscriptions — we give you the tools to replicate and adapt Grofers’ success to your local market.

FAQs

How does Grofers generate revenue?

Grofers earns revenue through product margins, delivery fees, surge pricing, private label sales, brand promotions, subscriptions, and backend fulfillment services. These channels collectively drive both B2C and B2B income.

Is Grofers profitable in 2025?

While profitability in quick-commerce is challenging, Grofers (Blinkit) is moving closer to breakeven by optimizing operations, promoting high-margin private labels, and leveraging Zomato’s infrastructure.

What are the main income sources for Grofers?

Grofers’ key income sources include grocery margins, delivery charges, surge pricing, in-app brand advertising, subscription fees, and fulfillment partnerships with third parties.

Can startups use the same revenue model as Grofers?

Yes. With the right tech and operational setup, startups can implement the same monetization model. Miracuves’ Grofers Clone helps fast-track this with built-in monetization modules and delivery logic.

Does Miracuves offer a Grofers clone with monetization features?

Yes. Miracuves provides a customizable Grofers Clone that supports commission settings, surge fees, ad placements, private label product support, and subscription systems — all optimized for fast scaling.