When I first paid an extra ₹25 to get a single packet of Maggi delivered at 11:30 PM, I wasn’t thinking about business models—I just wanted noodles. But somewhere behind that late-night comfort was a finely-tuned machine, pulling in revenue through commissions, fees, and probably some clever ad placements I didn’t even notice.

Now here’s the real kicker: on-demand delivery apps aren’t just surviving—they’re thriving. Even when margins look razor-thin on paper, smart monetization tactics make these platforms quietly profitable. If you’re building a Glovo Clone or any delivery app in 2025, understanding how the money flows isn’t optional—it’s the blueprint for growth.

And no, it’s not just about delivery charges. There are layers to this game—from vendor commissions and subscriptions to dark store partnerships and branded placements. Stick around, because we’re unpacking the full revenue playbook here. And yes, we’ll also show how teams like Miracuves help startups bake in monetization from day one.

The Real Cost of Convenience (and Why Users Pay It)

Let’s start with the obvious: people are willing to pay for time. When users need food, essentials, or a last-minute gift, convenience outweighs cost. That’s where delivery apps strike gold. From service fees to surge pricing, users are paying a premium to avoid queues, traffic, and wasted hours.

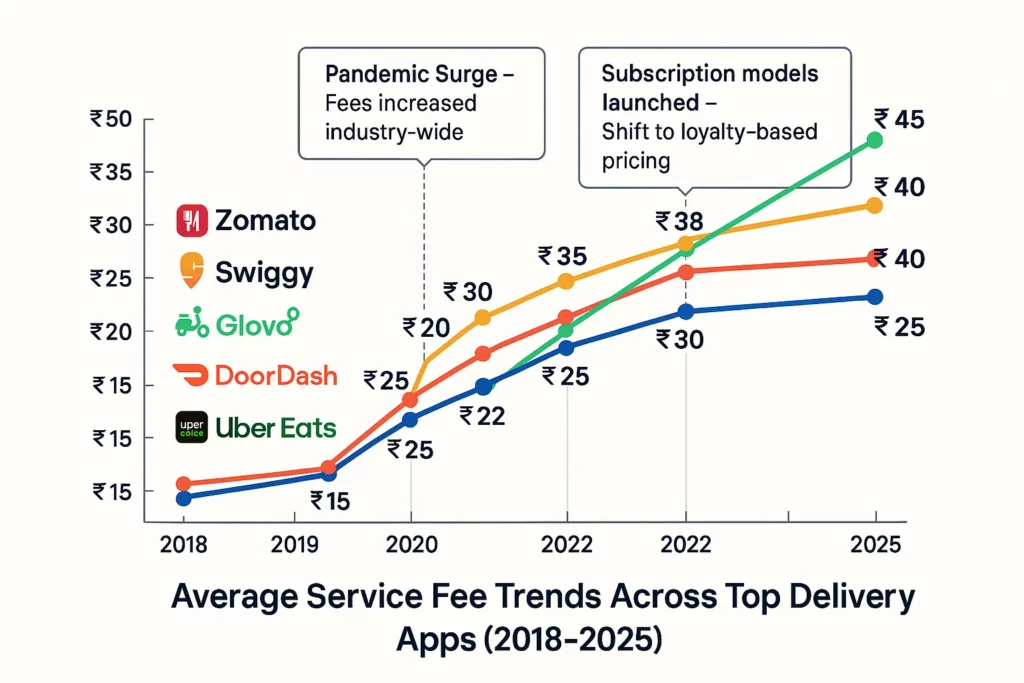

In fact, Statista reported a 35% increase in willingness to pay for faster delivery post-pandemic. Users have normalized paying ₹20–₹100 extra for immediate service. And that’s just the beginning of the revenue funnel.

The Glovo Clone App: How It Makes Money

Glovo Clone apps aren’t just clones—they’re high-performance revenue machines when built right. Here’s how a well-developed Glovo-style platform stacks its income sources:

1. Delivery Charges

The most visible revenue stream. Apps often use dynamic pricing—based on distance, time, and demand.

2. Vendor Commissions

Restaurants, pharmacies, and stores pay a commission (10%–35%) on each order. High-volume vendors often opt for premium placement too.

3. Platform Fees

Apps may charge a flat ₹10–₹30 “convenience” fee—especially on small basket sizes.

4. Surge/Peak Pricing

Weekend rush? Holiday eve? Charge extra. It’s fair, and it works.

5. Ad Placements & Promoted Listings

Let’s say two cafes sell coffee. One pays for a top spot on the homepage. That’s sponsored visibility, and it’s lucrative.

Hidden Revenue Channels You Didn’t See Coming

Some of the most profitable revenue models hide in plain sight. Let’s break down a few smart ones:

Subscription Models

Apps now offer “Pro” or “Plus” versions with free delivery, cashback, and priority support. Users love it. Predictable recurring revenue = growth stability.

Dark Store Logistics

Glovo Clone apps can partner with or create mini-warehouses (dark stores) to fulfill grocery and FMCG orders faster. These partnerships often include shared revenue from shelf space and inventory turnover.

Data Licensing & Analytics

Retail partners often pay for access to ordering behavior, heat maps, and regional trends. Data is the new oil—yep, even in delivery.

Which Model Works Best for Which User Type?

You can’t treat all users the same. Let’s segment:

- Casual Users = Pay-per-delivery, minimal friction.

- Power Users = Monthly subscriptions for free delivery + perks.

- Vendors = Pay for exposure, analytics, and access to a loyal user base.

- Logistics Partners = Share delivery earnings or fixed-pay contracts.

What Startups Must Know Before Monetizing

Here’s where it gets real. Your revenue model has to balance user value and unit economics. You can’t afford churn. So ask yourself:

- Can I bundle value into the delivery fee?

- Should I offer first-order free, then convert to Pro?

- What if I monetize vendors, not users?

There’s no one-size-fits-all. But you need one golden rule: make your value visible—users pay when they understand what they’re getting.

Revenue Growth Trends in 2025

What’s next? Well, delivery isn’t going away—it’s getting smarter.

- AI-based price prediction is helping apps optimize per-order margins.

- Hyper-personalization is driving more upsells during checkout.

- Loyalty gamification is increasing repeat orders by 20–30%.

Conclusion

Revenue in the on-demand delivery space isn’t just about charging more—it’s about charging smarter. The most successful Glovo Clones use layered monetization that feels natural, not pushy.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q1. How much can a Glovo Clone app earn per order?

Depending on the model, apps can make anywhere from ₹10 to ₹100 per order through combined fees and commissions.

Q2. Is subscription-based monetization better than pay-per-use?

Not always—it depends on your audience. Subscription works well with frequent users; casual users prefer pay-per-use.

Q3. What’s the biggest hidden cost in delivery apps?

Logistics inefficiencies—like poor routing and idle riders—can eat into margins fast.

Q4. How do Glovo and similar apps make money from vendors?

They take a percentage cut on each order and may charge for featured listings or analytics access.

Q5. Can I start monetizing from day one?

Absolutely—but keep it light early on. Focus on user experience, then layer monetization as you scale.

Q6. Do delivery apps earn from data?

Yes, anonymized behavioral data can be valuable for vendors and brand partners—especially in large volume ecosystems.