From a challenger bank launched in the UK to a digital-first financial institution trusted by millions, Starling Bank’s rise highlights one truth about modern banking: users no longer tolerate slow, branch-dependent, legacy systems. In 2024 alone, digital-only banks globally crossed $1.3 trillion in total transaction value, and neobanks attracted over $18 billion in venture funding, proving that app-first banking is no longer experimental—it is the default expectation.

For entrepreneurs and fintech founders in 2026 , understanding the Starling Bank clone model is not about copying an interface. It is about replicating a proven operating system for trust, speed, compliance, and customer-centric financial experiences. Starling’s success lies in how seamlessly it blends real-time banking, automation, transparency, and security into one mobile-first platform—something traditional banks still struggle to achieve.

This is exactly why Starling Bank Clone Development has become a high-demand opportunity for founders targeting niche markets, regional banks, SME-focused finance, and digital wallets. With the right technology foundation, a Starling-style neobank can launch faster, adapt to regulations, and scale without the technical debt that slows most financial startups.

At Miracuves, we help founders turn this model into a production-ready fintech product using the Best Starling Bank Clone Script 2026, engineered for real-world banking, not demos. Our approach focuses on building a compliant, scalable, and revenue-ready digital bank that investors trust and users rely on daily.

What Makes a Great Starling Bank Clone in 2026

A great Starling Bank clone is not defined by how closely it copies screens. It is defined by how reliably it performs under real banking pressure. In 2026, users expect instant transactions, zero downtime, transparent fees, and intelligent automation as baseline standards. Regulators expect audit-ready systems. Investors expect scalable architecture. A “great clone” balances all three without compromise.

At its core, a successful Starling-style neobank is built on real-time infrastructure, not batch processing. Transactions must reflect instantly, balances must update without delay, and notifications must be accurate to the second. This requires an event-driven backend, low-latency APIs, and infrastructure designed for continuous uptime rather than maintenance windows.

Equally important is product intelligence. Modern clones go beyond basic banking by embedding AI-driven insights that help users understand spending, automate savings, detect fraud patterns, and receive contextual financial nudges. This is where many low-quality clones fail—they replicate features but not financial intelligence.

Security and compliance are non-negotiable. A serious Starling Bank clone must be engineered with bank-grade encryption, role-based access control, audit logs, and regulatory adaptability from day one. Retrofitting compliance later is expensive and risky, which is why architecture decisions matter more than UI polish.

From a business perspective, monetization readiness separates prototypes from platforms. A great clone supports interchange revenue, premium accounts, SME banking modules, lending hooks, and API monetization without restructuring the core system. Scalability is not just about users; it is about revenue models evolving without breaking the product.

Key characteristics of a great Starling Bank clone in 2026

• Average API response time under 300ms for real-time transactions

• 99.9% uptime with auto-failover infrastructure

• Modular architecture supporting retail, SME, and wallet use cases

• AI-driven spending insights and fraud monitoring

• Compliance-ready logging, KYC, and AML workflows

• Native iOS, Android, and web dashboards with consistent UX

• Secure integration with payment rails, cards, and third-party APIs

Modern Starling Bank Clone Differentiation Comparison

| Capability Area | Basic Clone | Modern Clone | Miracuves Starling Clone |

|---|---|---|---|

| Transaction Speed | Delayed or batch-based | Near real-time | Real-time under 300ms |

| Scalability | Limited user handling | Cloud scalable | Auto-scaling, enterprise-ready |

| Security Layer | Standard encryption | Advanced encryption | Bank-grade + audit logs |

| AI Automation | Not available | Partial | Spending insights, alerts, fraud AI |

| Monetization Ready | Minimal | Moderate | Multi-revenue architecture |

| Compliance Adaptability | Rigid | Semi-flexible | Region-ready compliance modules |

This is where Miracuves Clone Solutions stand apart. Instead of delivering a surface-level script, Miracuves engineers Starling Bank clones as financial operating systems—capable of handling real users, real money, and real regulatory scrutiny from the first release.

Essential Features Every Starling Bank Clone Must Have

A Starling Bank–style product succeeds because it feels effortless to the user while handling extreme complexity behind the scenes. In 2026, founders can no longer afford feature gaps between user experience, admin control, and operational intelligence. A strong clone must operate as a three-layer ecosystem where each role feeds data and automation into the other.

From the user’s perspective, digital banking must feel instant, personal, and trustworthy. From the admin’s perspective, it must be fully observable, controllable, and compliant. From the service and operations layer, it must continuously optimize risk, revenue, and engagement through automation.

User Side Experience Layer

The user app is the trust engine of a neobank. Every interaction must reinforce speed, clarity, and control. Users expect real-time visibility of money movement, proactive alerts, and intelligent insights that reduce financial stress rather than create it.

Key user-side capabilities include instant account creation with eKYC, real-time balance updates, smart spending categorization, automated savings rules, virtual and physical card management, and contextual notifications. Advanced clones now embed AI that predicts cash flow issues, recommends savings actions, and flags unusual spending before users notice it themselves. Performance benchmarks matter here—average response time under 300ms and zero perceptible lag during peak usage.

Admin Panel Control Layer

The admin panel is where most clone products quietly fail. In 2026, manual dashboards are operational liabilities. A modern Starling Bank clone requires an automation-first admin system that centralizes compliance, analytics, and user lifecycle control.

Admins need real-time transaction monitoring, KYC and AML verification queues, risk scoring dashboards, configurable fee engines, and automated reporting for regulators. AI-assisted anomaly detection and audit-ready logs are no longer optional; they are baseline expectations. Miracuves builds admin panels that act as operational command centers rather than static control screens.

Operations and Service Intelligence Layer

Behind the interface sits the intelligence layer that keeps the bank profitable and safe. This includes real-time ledger systems, card network integrations, fraud detection engines, and AI-based recommendation services.

Service intelligence features include live transaction tracking, earnings and fee analytics, automated dispute handling, and smart routing across payment rails. Blockchain-backed verification modules are increasingly used for immutable logs and settlement transparency, especially in cross-border and SME banking use cases.

Advanced 2026 Features That Separate Leaders from Clones

Modern Starling-style platforms go beyond “banking features” and move into financial orchestration.

• AI-based personalization for offers, limits, and insights

• Predictive fraud detection using behavioral analysis

• AR-assisted onboarding for complex KYC flows

• Blockchain-based audit trails for compliance confidence

• Open banking APIs for ecosystem expansion

• Cross-platform consistency across mobile, web, and admin

Technical Architecture Requirements

A production-grade Starling Bank clone must be built on a microservices architecture with horizontal scalability. Core requirements include containerized services, event-driven processing, encrypted data storage, role-based access control, and secure third-party API gateways. Load handling must support sudden transaction spikes without downtime, maintaining 99.9% uptime even under stress.

Feature Scope Comparison

| Feature Scope | Basic | Professional | Enterprise (Miracuves) |

|---|---|---|---|

| User Banking Features | Core only | Extended | Full AI-driven experience |

| Admin Automation | Limited | Moderate | Fully automated + analytics |

| Security & Compliance | Standard | Advanced | Bank-grade, audit-ready |

| Scalability | Fixed limits | Cloud scalable | Auto-scaling, global-ready |

| Custom Integrations | Minimal | Selected | Unlimited APIs & rails |

At Miracuves, these features are not add-ons. They are built into the Best Starling Bank Clone Script 2026 by default, ensuring founders do not rebuild their platform every time they grow. This is how Miracuves transforms a clone into a long-term banking asset.

Cost Factors & Pricing Breakdown

Starling Bank-Like Digital Banking & Neobank Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Core Neobank MVP | User onboarding, KYC basics, digital accounts, balance management, transaction history, and a simple admin panel. | $70,000 |

| 2. Mid-Level Digital Banking Platform | Mobile-first UI, real-time notifications, spending insights, virtual cards, payments & transfers, and analytics dashboards. | $180,000 |

| 3. Advanced Starling-Level Platform | Business & personal accounts, physical & virtual cards, savings spaces, overdraft & lending logic, compliance automation, fraud monitoring, and enterprise-grade scalability. | $350,000+ |

These figures represent the typical global investment required to build a secure, mobile-first digital banking platform similar to Starling Bank, focused on real-time control, transparency, and scalable financial services.

Miracuves Pricing for a Starling-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete digital banking foundation with user onboarding, account & wallet management, real-time transaction processing, notification systems, card-ready architecture, compliance-ready workflows, and a centralized admin dashboard — built for long-term scalability and modern banking use cases.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard and mobile integration, and deployment assistance — allowing you to launch a fully branded Starling-style digital bank under your own ownership.

Launch Your Starling-Style Digital Banking Platform — Contact Us Today

Delivery Timeline for a Starling-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Personal and business account structures

- Card issuing and transaction logic

- Lending, overdraft, or savings features

- Compliance, KYC, and regulatory requirements

- Branding and UI/UX customization

- Reporting and admin control depth

Tech Stack

Built using a JS-based architecture, ideal for modern digital banking platforms that require secure financial transactions, scalable APIs, real-time processing, mobile-first performance, and enterprise-level reliability.

Customization & White-Label Option

Building a Starling Bank-style digital banking platform isn’t just about launching a mobile app — it’s about delivering a secure, regulation-ready banking experience that combines real-time transactions, intuitive money management, and operational transparency. A platform inspired by Starling Bank must support account management, payments, insights, and integrations while remaining scalable and resilient.

Miracuves delivers a fully white-label Starling-style solution that can be customized for challenger banks, SME-focused banking products, or digital-first financial institutions. The platform is structured so you retain full control over branding, workflows, permissions, and feature evolution.

Why Customization Matters

Modern digital banks operate across varying:

- Regulatory frameworks and onboarding rules

- Payment rails and settlement expectations

- Retail vs. SME customer needs

- Reporting and compliance depth

Customization ensures your platform aligns with your market, your compliance scope, and your customer segments, rather than forcing generic banking flows.

What You Can Customize

Complete UI/UX Personalization

Customize mobile and web dashboards, transaction timelines, card views, notifications, typography, themes, and brand elements for a clean, user-first experience.

Onboarding & Identity Verification

Configure digital signup journeys, document capture, verification steps, approvals, risk scoring, and escalation workflows based on regional compliance requirements.

Accounts, Wallets & Transactions

Set up balances, transaction categorization, statements, real-time notifications, dispute handling, and user-level controls for limits and permissions.

Cards & Payments

Virtual/physical card management, freeze/unfreeze controls, spending limits, merchant controls, recurring payments, and card security features.

Insights & Money Management

Enable spending analytics, budgeting tools, category insights, cash-flow views, smart alerts, and data-driven dashboards for engagement and trust.

Security, Risk & Compliance

Define AML monitoring rules, velocity checks, suspicious activity triggers, audit logs, role-based access, and regulatory reporting exports.

Support & Communication

In-app chat, ticketing workflows, automated alerts, dispute tracking, and multilingual support structures.

Backend & Integrations

Integrate compliance APIs (KYC/AML), payment rails, card-issuing partners, analytics pipelines, CRM tools, and customer support systems.

Monetization & Growth Models

Subscription tiers, premium features, fee-based services, rewards logic, and add-on financial products.

How Miracuves Handles Customization

- Requirement Understanding

Mapping your target users, compliance region, and feature priorities. - Architecture & Planning

Modular design covering onboarding, accounts, cards, transactions, risk, insights, and integrations. - Design & Development

UI/UX branding, workflow logic, financial controls, and system integrations implemented as per roadmap. - Testing & Quality Assurance

Security testing, transaction validation, permission checks, and scalability verification. - Deployment

Full white-label rollout with branded environments, dashboards, and operational configuration.

Real Examples from the Miracuves Portfolio

Miracuves has delivered 600+ fintech and digital banking platforms, including:

- Card-first challenger banking apps

- SME-focused digital banking systems

- Compliance-driven onboarding and verification solutions

- White-label banking platforms adapted to regional rules

Launch Strategy & Market Entry for a Starling Bank Clone

Launching a Starling-style neobank is less about “going live” and more about entering the market with trust, compliance clarity, and a growth loop that keeps users active after the first download. In 2026 , the best fintech launches look like product rollouts, not app releases: controlled beta, tightly defined niche, measurable onboarding, and fast iteration based on real usage data.

Pre-Launch Checklist (Founder-Ready)

Before you spend on ads or influencer campaigns, make sure the product is operationally launch-ready:

Product & Engineering

• Load testing for peak signups and peak transaction windows

• Real-time notifications tested across devices and network conditions

• Security hardening: encryption, device binding, session control, rate limiting

• Failover and monitoring: logs, alerts, incident workflows, uptime verification

Compliance & Risk

• KYC/AML workflows tested with edge cases (rejections, retries, document issues)

• Audit logs enabled (who did what, when, and why) across admin actions

• Dispute and chargeback processes documented and operable

• Data retention and privacy policies aligned to your target region

App Store & Operations

• App store metadata, screenshots, privacy labels, and permissions review

• Support stack ready: helpdesk, FAQs, in-app chat, escalation playbook

• Analytics instrumentation: onboarding drop-offs, activation events, retention cohorts

Market Entry by Region (How to Choose Your First Geography)

Your first geography should match your regulatory comfort, payments ecosystem, and niche demand. A common winning approach is to start in one region with one core promise, then expand once retention is proven.

Asia (India/SEA)

• Growth lever: mobile-first adoption, UPI-style payments, fast wallet behavior

• Winning play: start with a niche (students, gig workers, SME micro-businesses) and build habit through bill pay, savings pots, and rewards

• Localization: language, regional KYC flows, local rails, lightweight onboarding UX

MENA

• Growth lever: high smartphone usage, cross-border corridors, premium banking demand

• Winning play: diaspora + remittance + multi-currency wallet with transparent fees

• Localization: strong compliance posture, bilingual UX, clear fee breakdowns

Europe/UK-style markets

• Growth lever: trust, transparency, budgeting tools, open banking ecosystems

• Winning play: personal finance intelligence + SME features that reduce admin burden

• Localization: privacy, data controls, strong audit readiness, predictable reliability

U.S.

• Growth lever: niche communities, creator economy, SME banking bundles

• Winning play: feature-led differentiation (cash flow insights, budgeting automation, subscription perks) and partnerships with card/finance providers

• Localization: strict security posture, clear dispute handling, high support quality

User Acquisition Frameworks That Work in 2026

Neobanks grow when acquisition and retention are designed together. Use one primary engine and one secondary engine, not ten scattered tactics.

1) Influencer-to-Activation Funnel

• Partner with niche creators (freelance, small business, personal finance)

• Drive to a single onboarding promise (example: “smart tax pots” or “fee-free FX clarity”)

• Measure: install-to-KYC completion, KYC-to-first transaction, week-4 retention

2) Referral Loops Built Into Banking Moments

• Referral triggers tied to meaningful actions: first salary deposit, first bill payment, first savings goal achieved

• Tiered rewards that improve product value (premium month, fee waiver, partner perks)

3) Retention Funnels That Prevent Dormant Accounts

• Behavioral nudges: “spend summary,” “cash-flow alert,” “goal progress,” “unusual activity check”

• Weekly value delivery: insights that make the app feel indispensable

Monetization Models Proven in 2026

A Starling-style clone can monetize without hurting trust when it is transparent and value-based:

• Interchange revenue from card usage (scaled by active spenders)

• Subscription tiers (premium insights, higher limits, insurance bundles, priority support)

• SME monetization (expense cards, invoicing, payroll tools, analytics)

• FX and cross-border services (transparent margin, premium conversion features)

• Partner marketplace (offers, savings products, lending partners, affiliate bundles)

The key is to align monetization to your niche: SME banks monetize through tools, consumer banks monetize through convenience and premium experiences.

Miracuves End-to-End Launch Support (From Servers to 90-Day Growth)

Miracuves supports founders beyond development by structuring the launch like a real product rollout. Your build is delivered in a controlled 30–90 days window based on scope and compliance depth, and we align the delivery with a launch roadmap so you are not scrambling after deployment.

What Miracuves helps you execute

• Infrastructure setup and deployment planning (staging, production, monitoring)

• Analytics and event tracking so growth decisions are data-driven

• Go-live checklists and risk controls for a smoother first launch phase

• A practical first 90-day plan focused on activation, retention, and iteration

A simple first 90-day roadmap (how founders actually win)

• Days 1–15: private beta + fix onboarding friction + stabilize support

• Days 16–45: niche-focused launch + referral loop + retention nudges

• Days 46–90: scale acquisition channels + add monetization layer + expand features based on retention data

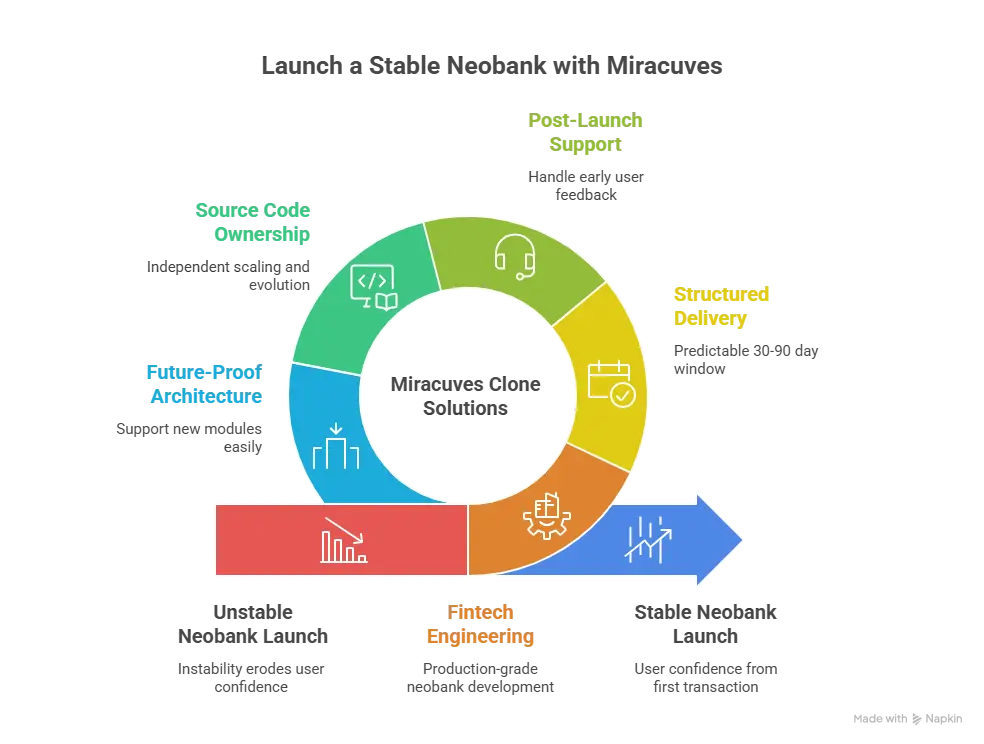

Why Choose Miracuves for Your Starling Bank Clone

A Starling-style neobank is a trust product. People will forgive a new brand, but they will not forgive instability with money. That is why the “development partner” decision becomes a business decision. The right team does not just build screens—they help you launch a financial product that is stable, scalable, and designed to earn user confidence from the first transaction.

Most founders start with a clear idea: build a digital bank that feels fast, modern, and transparent. The challenge begins when reality hits—KYC edge cases, support workflows, security hardening, fraud scenarios, performance at peak traffic, and the operational load that comes with real users moving real money. Miracuves is built for that reality.

Miracuves approaches Starling Bank Clone Development as fintech engineering, not template customization. The goal is to help you ship a production-grade neobank within a predictable 30–90 days window, depending on scope, integrations, and compliance depth, while keeping the architecture modular so your platform can expand without rebuilds.

What You Get With Miracuves Clone Solutions

600+ successful deployments

Miracuves has delivered large-scale fintech and digital platform deployments across multiple industries, helping founders avoid the common mistakes that cause post-launch instability.

Delivery in 30–90 days

A structured delivery plan that matches real fintech complexity, rather than rushed timelines that create technical debt.

Free post-launch support (60 days)

Stabilization matters. You get a support window designed to help you handle early user feedback, performance tuning, and production issues.

Full source-code ownership

You stay independent. No lock-ins. No hidden restrictions. Your product remains yours to scale, fundraise with, and evolve.

Future-proof architecture

Built to support new modules—SME banking, lending, FX, partner marketplaces—without rewriting the foundation.

What This Looks Like in Real Founder Outcomes

A founder targeting SME banking does not win because they have “more features.” They win because their banking workflows reduce friction: faster onboarding, clearer financial visibility, better admin automation, and fewer operational breakdowns. Miracuves builds with this outcome-first mindset so your product becomes an asset rather than a constant repair project.

A niche neobank founder trying to capture a regional market cannot afford downtime during their first marketing push. Miracuves ensures monitoring, scaling readiness, and operational visibility are part of the delivery plan—not something you remember after launch.

A fintech startup preparing for investor conversations needs predictable execution. When you can say your core banking foundation is engineered for scalability and compliance readiness, you reduce perceived risk and improve confidence.

The Difference Is Not “A Clone,” It’s a Banking Foundation

The Best Starling Bank Clone Script 2026 should not just help you enter the market. It should help you stay there. Miracuves builds Starling-style platforms with real-world readiness—so you can focus on growth, partnerships, and retention instead of rebuilding infrastructure every time your user base spikes.

Final Thought

Building a Starling-style neobank in 2026 is not about recreating a popular banking app. It is about understanding why that model works and translating those principles into a product designed for your market, your users, and your long-term vision. Starling Bank succeeded because it removed friction, delivered transparency, and made everyday banking feel intuitive rather than intimidating.

For entrepreneurs, the opportunity lies in applying this logic to underserved niches—freelancers, SMEs, students, creators, or regional markets—where legacy banks still move slowly. With the right strategy, a focused launch, and a scalable technical foundation, a Starling Bank clone can become a trusted financial platform rather than just another fintech app.

This is where Miracuves plays a decisive role. By combining fintech-grade engineering, compliance-aware architecture, and a delivery framework built around real-world banking needs, Miracuves enables founders to launch faster without sacrificing stability or future growth. Instead of experimenting with fragile systems, you start with a banking core designed to evolve.

In a market where trust compounds and technology debt kills momentum, the smartest move is not to build everything from scratch—it is to build intelligently. With a clear understanding of the Starling Bank model and the right development partner, you position your startup to scale smarter, attract users confidently, and compete with established players on experience, not just branding.

Ready to launch your Starling Bank clone? Get a free consultation and detailed project roadmap from Miracuves — trusted by 200+ entrepreneurs worldwide.

FAQs

How quickly can Miracuves deploy my Starling Bank clone?

Miracuves delivers Starling Bank–style platforms within a structured 30–90 days timeline, depending on feature scope, integrations, and compliance requirements. This ensures stability without rushing critical fintech components.

What’s included in the Miracuves Starling Bank clone package?

You receive a complete neobank foundation including user apps, admin dashboard, real-time transaction engine, KYC/AML workflows, security layers, analytics, and scalability-ready architecture aligned to your business model.

Can I get full source-code access?

Yes. Miracuves provides 100% source-code ownership, giving you long-term independence to scale, customize, and raise funding without vendor lock-in.

How does Miracuves ensure scalability for future growth?

The platform is built on modular, cloud-ready architecture with auto-scaling support, event-driven processing, and performance benchmarks designed to handle rapid user and transaction growth.

Does Miracuves assist with app store approval?

Yes. Miracuves supports app store readiness by aligning permissions, privacy disclosures, security practices, and technical compliance required for smoother approvals.

Is post-launch maintenance included?

Miracuves includes 60 days of free post-launch support, focused on stabilization, performance tuning, and early user feedback handling after go-live.

Can Miracuves integrate custom payment gateways and banking APIs?

Absolutely. The Starling Bank clone supports custom integrations for payment gateways, card issuers, open banking APIs, fraud tools, and regional financial services.

What is the upgrade and update policy?

Upgrades are handled through modular updates, allowing you to add features or expand regions without disrupting the core banking system.

How does white-labeling work for my brand?

White-labeling covers complete rebranding including app identity, UI/UX, dashboards, communication templates, and admin branding—so the product launches fully under your brand.

What kind of ongoing support can I expect after launch?

Beyond the initial support period, Miracuves offers flexible long-term support plans covering monitoring, updates, security patches, and feature expansion as your neobank scales.

Related Articles

- Best Nubank Clone Scripts 2025: Build the Future of Digital Banking

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best Wise Clone Scripts in 2025: Features & Pricing Compared

- Best Remitly Clone Scripts 2025: Launch Your Global Remittance App Faster & Smarter

- Best Stripe Clone Scripts 2025: Build a Scalable Global Payment Infrastructure for Your Startup

- Best N26 Clone Scripts 2026 for Digital Banking Startups

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally