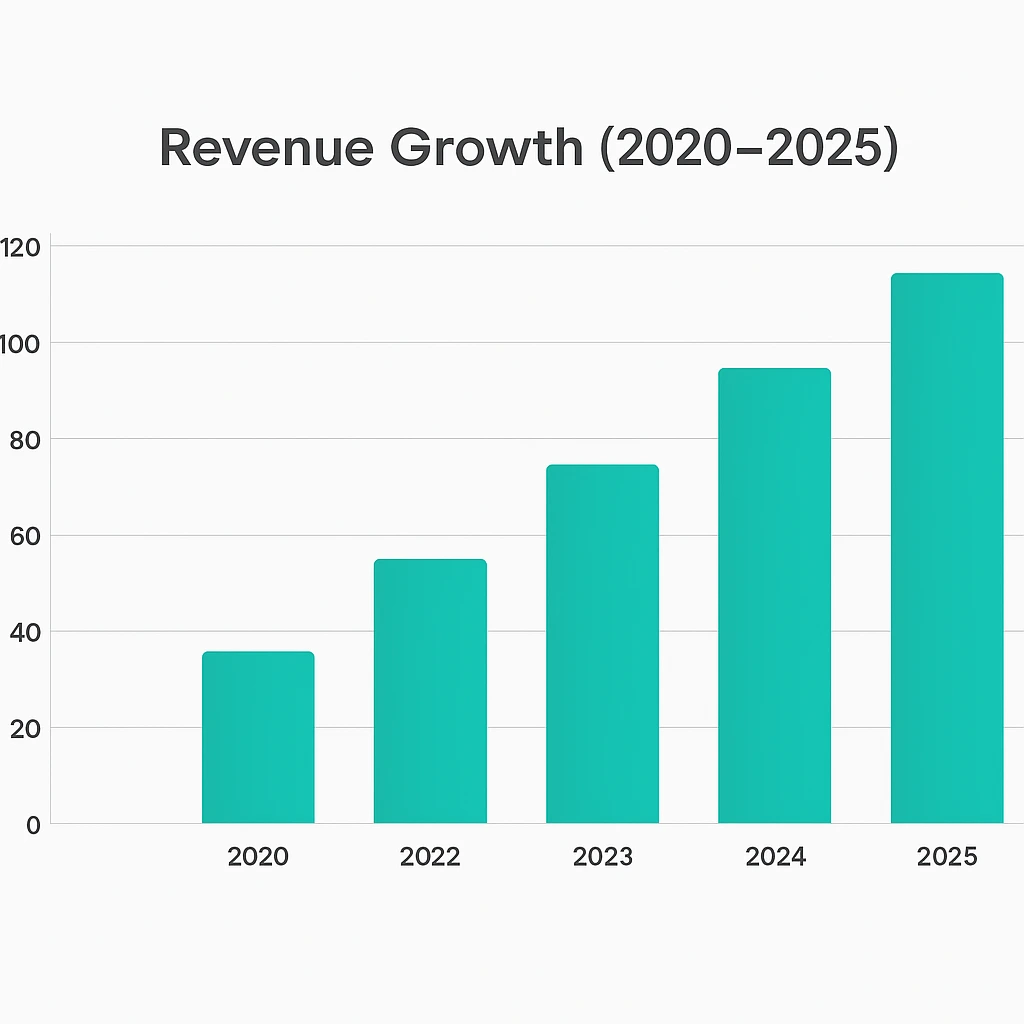

In 2025, TransferNow stands as one of the most trusted large-file–transfer platforms, generating close to $120 million annually. What began as a simple, free tool for sending files up to 5 GB has matured into a scalable SaaS business powered by premium plans, enterprise features, and secure data delivery. Its growth shows how a streamlined freemium model—supported by global accessibility and strong security—can create dependable recurring revenue. For entrepreneurs, TransferNow’s monetization framework offers clear, practical insights for building successful file-transfer or SaaS platforms using Miracuves’ TransferNow Clone solutions.

Understanding TransferNow’s monetization model offers valuable lessons for founders building their own file-transfer or SaaS products through Miracuves clone solutions.

TransferNow Revenue Overview – The Big Picture

Valuation & Revenue (2025): ≈ $120 million

YoY Growth: +12 % from 2024’s $107 million

Primary Market: Europe (≈ 60 % of total revenue)

Other Regions: North America 25 %, Asia 15 %

Gross Margins: ≈ 78 %

Operating Margin: ≈ 32 %

TransferNow positions itself between free consumer tools (like WeTransfer) and enterprise file-management suites (like Dropbox Business). Its hybrid model—freemium plus paid subscriptions—lets it monetise individuals, professionals, and teams efficiently.

Read More: TransferNow App Explained – Features, Benefits & How It Works

Primary Revenue Streams Deep Dive

Revenue Stream #1 – Premium Subscriptions

Users upgrade from free accounts (limited size and duration) to paid plans unlocking bigger file limits, permanent storage, and security features.

- Share of revenue: ≈ 75 %

- ARPU (2025): ≈ $95 / year

- Tiers: Pro (Individuals), Team (SMBs), Business (Enterprises)

- Growth: Driven by remote work and data-sharing compliance.

Revenue Stream #2 – Business & Enterprise Licensing

Enterprise clients get custom domains, branding, and admin dashboards.

- Share: ≈ 15 %

- Pricing: Per-seat or usage-based storage plans

- Value drivers: Security, GDPR compliance, data encryption.

Revenue Stream #3 – Add-on Storage & Bandwidth

Extra storage and extended link durations for premium users.

- Share: ≈ 5 %

- Pricing: Tiered (100 GB → 1 TB → 5 TB)

Revenue Stream #4 – API and Integration Partnerships

Corporate clients integrate TransferNow via API for internal file flows.

- Share: ≈ 3 %

- Model: Usage-based billing (API calls, bandwidth).

Revenue Stream #5 – Affiliate & Reseller Programs

Regional partners sell premium subscriptions for a commission.

- Share: ≈ 2 %

- Purpose: Low-cost acquisition in emerging markets.

Read More: Business Model of TransferNow : Complete Strategy 2025

Revenue streams percentage breakdown

| Revenue Stream | Share of Total Revenue |

|---|---|

| Premium Subscriptions | 75 % |

| Business Licensing | 15 % |

| Add-on Storage & Bandwidth | 5 % |

| API Integrations | 3 % |

| Affiliate Programs | 2 % |

The Fee Structure Explained

User-Side Fees

- Free Users: Limited file size (5 GB), short link expiry (7 days)

- Pro Users: Monthly or annual fee for bigger limits (20–500 GB), password protection, tracking

- Business Plans: Per-seat licence, custom branding, team storage

- Add-ons: Extra storage or bandwidth sold on demand

Provider-Side Fees

There are no provider commissions; TransferNow monetises directly from users and enterprises.

Hidden Revenue Tactics

- Storage thresholds drive upgrades (freemium conversion)

- Limited link expiry creates urgency to go Pro

- Tier naming (“Pro”, “Business”) adds psychological value

Regional Pricing

Adjusted per country — euro, dollar or local currency pricing for better conversion.

Complete fee structure by user type

| User Type | Fee Structure | Notes |

|---|---|---|

| Free User | $0 | 5 GB limit, short link duration |

| Pro User | $8–12 / month | Larger files, security features |

| Business Team | $20–25 / seat | Custom domain + storage |

| Enterprise | Custom | API access, integration support |

| Add-ons | $5–10 | Extra storage or bandwidth |

How TransferNow Maximizes Revenue Per User

- Segmentation: Free → Pro → Business → Enterprise.

- Upselling: Prompted upgrades when storage or transfer limits hit.

- Cross-Selling: Add-ons, extra bandwidth, branding tools.

- Dynamic Pricing: Annual plans with discounts, team tier bundles.

- Retention Monetisation: Cloud stickiness + multi-device sync reduce churn.

- Lifetime Value (LTV): ≈ $110–$130 per paying user / year.

- Psychological Pricing: “Free → Pro → Business” clearly communicates progression and value.

Read More: How Safe Is a White-Label WeTransfer App? Security Guide 2025

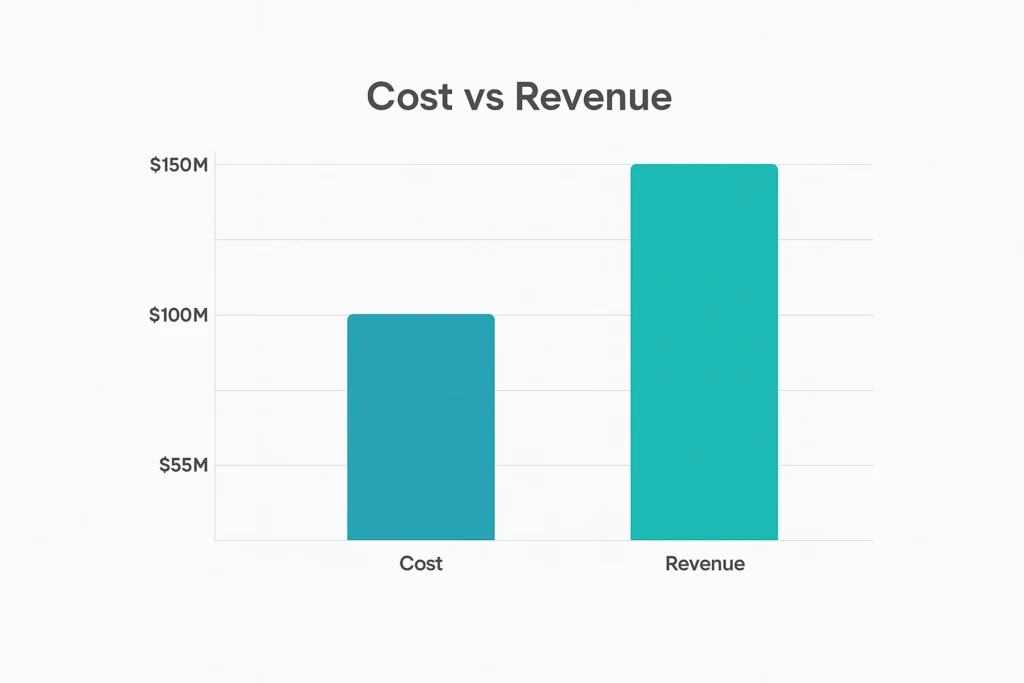

Cost Structure & Profit Margins

Major Costs: Infrastructure (servers, storage providers), bandwidth, marketing, R&D, and support.

Gross Margin: ≈ 78 %

Operating Margin: ≈ 32 %

Cost Reduction Strategies: partnerships with CDNs, AI-driven infrastructure optimisation, and subscription automation.

Future Revenue Opportunities & Innovations

- AI Expansion: Auto-summaries, content recognition, and data insights for enterprise clients.

- New Markets: Asia and Latin America where business data transfer is rising fast.

- API Marketplace: Developers building apps on top of TransferNow’s platform.

- Partnerships: Integrations with CRM, HR, and project tools for cross-selling.

- Threats: Free alternatives, privacy regulations, and storage commoditisation.

- Opportunities: Vertical-focused file-transfer solutions (e.g., media, finance, legal).

Lessons for Entrepreneurs & Your Opportunity

Key Takeaways

- Freemium conversion can be a stable growth engine.

- High-margin subscription revenue scales fast.

- User experience and security drive retention.

What to Replicate

- Simple free tier → upgrade path.

- Business plans for higher ARPU.

- Automated onboarding and renewal flows.

What to Improve

- Industry-specific pricing.

- AI-driven premium features early in cycle.

Want to build a platform with TransferNow’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating file-transfer solutions with customisable monetisation features. Our TransferNow Clone Scripts let you earn within 30 days of launch. Get your free consultation today.

Final Thought

TransferNow proves that simplicity, reliability, and a well-structured pricing ladder can fuel a multi-million-dollar SaaS business. Its success highlights how a clean user experience paired with premium upgrades creates long-term recurring revenue. Entrepreneurs can leverage this proven approach through Miracuves’ ready-made TransferNow Clone, customizing it for specific industries, regions, or audiences. With built-in monetisation systems and scalable infrastructure, it becomes easier to launch quickly, attract paying users, and achieve sustainable growth in a competitive digital market.

FAQs

Q 1. How does TransferNow make money?

Through premium subscriptions, business plans, and storage add-ons.

Q 2. What’s its main revenue source?

Paid subscriptions contribute around 75 % of total revenue.

Q 3. How profitable is TransferNow in 2025?

It maintains an operating margin of around 32 %.

Q 4. Does TransferNow charge commissions?

No, its revenue is subscription-based, not transactional.

Q 5. Can small start-ups copy this model?

Yes, the freemium plus subscription structure is scalable for any size.

Q 6. How fast can a TransferNow-like platform start earning?

With Miracuves’ TransferNow Clone solutions, entrepreneurs can start monetizing in just 3–9 days with guaranteed delivery, thanks to its full integration and launch-ready system.