Upwork is one of the largest freelance marketplaces in the world, generating hundreds of millions in revenue every year across millions of transactions. Its platform connects businesses, startups, and independent professionals in a way that turns digital collaboration into a scalable business model. In 2025, Upwork strengthened its income strategy even further—shifting more focus to enterprise contracts, AI-powered tools, subscription-based offerings, and high-value clients.

What makes Upwork truly impressive is its ability to monetize multiple user types at the same time. From freelancers buying connects and membership upgrades to employers paying for premium job posts and managed hiring solutions, every interaction becomes an opportunity for revenue. This is exactly why Upwork’s model continues to scale globally without increasing operational cost at the same pace—proving the strength of a well-executed digital marketplace.

For entrepreneurs planning to build a freelance marketplace, Upwork offers a blueprint of how to structure monetization, retain users, and scale profitably with a smart fee-based architecture.

Upwork Revenue Overview – The Big Picture

Current valuation and revenue (2025):

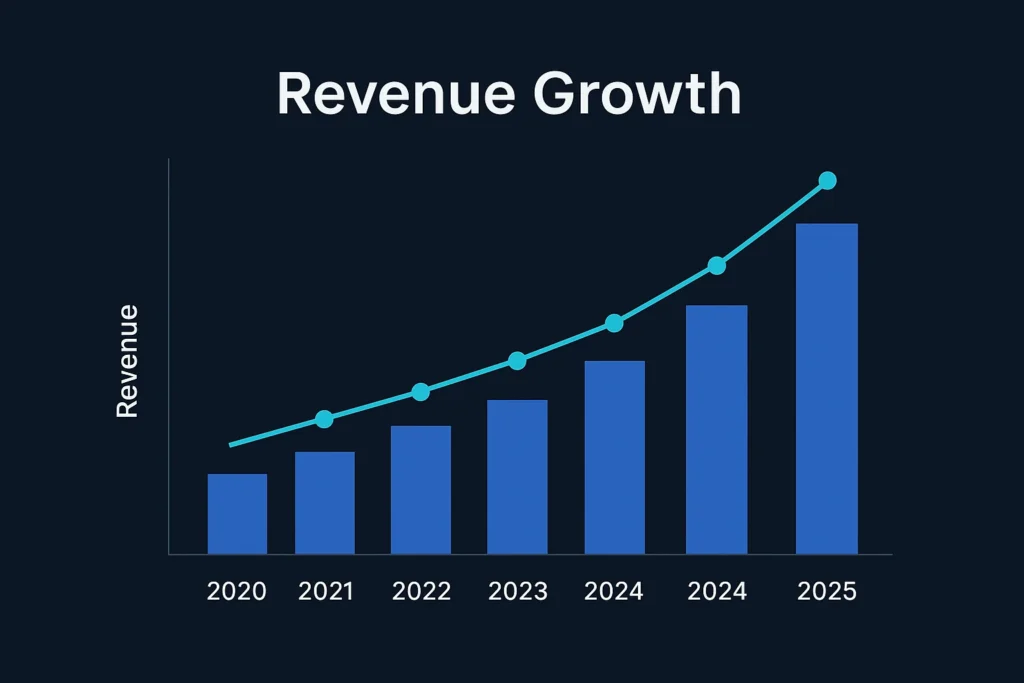

Upwork reported approximately USD 201.7 million in revenue in Q3 2025, with full-year revenue expected to exceed USD 780 million.

Year-over-year growth:

Upwork experienced roughly 4% YoY growth in Q3, reflecting stable demand and rising enterprise adoption.

Revenue breakdown by region:

The platform earns the most from North America and Europe, followed by strong expansion in Asia, Latin America, and the Middle East.

Profit margin analysis:

With a net income of around USD 29 million in Q3 2025, Upwork’s profitability improved due to enterprise contracts and reduced operating expenses.

Market position vs competitors:

Upwork remains a top global freelancing marketplace, competing with platforms like Fiverr while leading in enterprise hires and long-term freelance contracts.

Read More: Upwork App Explained – Features, Benefits & How It Works

Primary Revenue Streams Deep Dive

1. Service Fees / Commissions

Upwork earns its largest revenue share from commissions charged on freelancer earnings. On most contracts, the platform charges around 10%.

2. Premium Subscriptions

Freelancers purchase premium memberships that include extra visibility, job bidding benefits, and reduced fees. Employers can also upgrade to premium hiring plans.

3. Connects (Proposal Credits)

Freelancers must purchase “connects” to submit proposals, creating a high-volume micro-transaction revenue stream.

4. Add-On Services & Boosted Listings

Employers pay to post premium jobs with special visibility. Freelancers pay to boost their profiles or pin proposals.

5. Enterprise Solutions

Large companies use Upwork for managed hiring, workforce solutions, and long-term contractor management. This generates significant and predictable revenue.

Read More: Business Model of Upwork : Complete Strategy Breakdown 2025

Revenue streams percentage breakdown

| Revenue Stream | Approx % of Total Revenue |

|---|---|

| Commissions | 50–70% |

| Premium Subscriptions | 10–15% |

| Connects | 5–10% |

| Add-Ons & Visibility Tools | 5–10% |

| Enterprise Services | 10–20% |

The Fee Structure Explained

User-Side Fees (Freelancers)

• 10% commission on most contracts

• Paid connects for submitting proposals

• Optional premium membership

Employer-Side Fees

• Paid upgrades for featured job posts

• Subscription plans for premium hiring tools

• Agency and enterprise hiring fees

Hidden Revenue Layers

• AI-based recommendations

• Profile boosts

• Talent-matching fees

• Contract management services

Regional Pricing Differences

Upwork adjusts pricing based on region, spending power, marketplace maturity, and demand.

Complete fee structure by user type

| User Type | Fee Type | Typical Range |

|---|---|---|

| Freelancer | Commission | ~10% of earnings |

| Freelancer | Connects | Per credit purchase |

| Freelancer | Premium Membership | Monthly/annual |

| Employer | Featured Job Posts | Fixed upgrade fee |

| Employer | Premium Hiring Plans | Subscription |

| Enterprise | Managed Hiring | Contract-based |

How Upwork Maximizes Revenue Per User

Segmentation:

Users are segmented by skill, spend, region, and contract type, enabling personalized monetization.

Upselling:

Freelancers are encouraged to buy connects, join premium tiers, and boost profiles. Employers are nudged into upgraded hiring plans.

Cross-selling:

Users often combine upgrades, memberships, and connects, increasing average revenue per user.

Dynamic pricing:

Upwork adjusts fees based on job type, contract longevity, and client-freelancer history.

Retention monetization:

Long-term contracts and repeat clients increase revenue consistency and lifetime value.

LTV optimization:

Frequent transactions, connects, and enterprise contracts keep the revenue cycle strong.

Psychological pricing:

Tiered memberships, discounts, and limited-time boosts drive upgrades.

Real examples:

With quarterly revenues exceeding USD 200 million, Upwork’s estimated take-rate averages around 5–7% of total contract value processed.

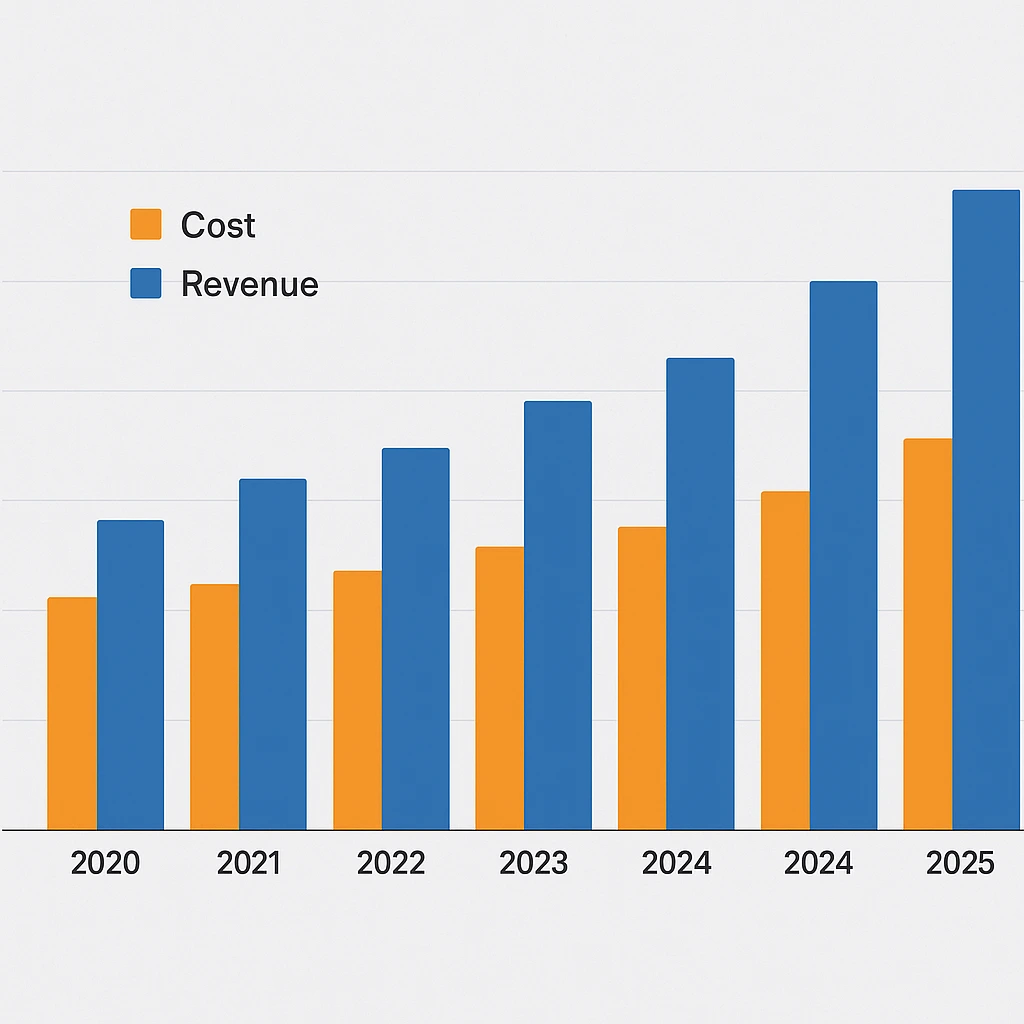

Cost Structure & Profit Margins

Tech infrastructure:

Cloud hosting, platform development, cybersecurity, and AI tools.

Marketing & CAC:

Advertising, influencer campaigns, SEO, and partnerships to attract freelancers and employers.

Operations:

Support teams, compliance checks, dispute resolution, and fraud monitoring.

R&D:

AI-driven matching, talent-vetting automation, and workflow optimization.

Unit economics:

As a digital marketplace, incremental cost per additional user is low, making scale the key to profitability.

Profitability path:

In 2025, Upwork demonstrated improved profitability due to higher enterprise revenue and streamlined operating expenses.

Margin optimization:

The shift toward memberships, connects, and enterprise services boosts margins significantly.

Future Revenue Opportunities & Innovations

AI-driven hiring:

Intelligent matching, automated proposals, and predictive skill identification can unlock premium pricing.

Enterprise workforce solutions:

More companies outsource work, expanding Upwork’s B2B opportunities.

Expansion into emerging markets:

Huge opportunities in India, Africa, and LATAM due to rising freelancing adoption.

New monetization angles:

Micro-services marketplace, packaged services, advanced reporting tools for employers, and agency-level subscriptions.

2025–2027 predictions:

Continued growth in enterprise adoption, higher take-rate, expanded subscription ecosystem, and increased AI monetization.

Risks:

Competition, regulatory challenges, withdrawal of freelancers due to fees.

Opportunities for new players:

Niche marketplaces with specialized skills or regions can outperform general platforms.

Lessons for Entrepreneurs & Your Opportunity

What works:

Commission-based income, memberships, and micro-transactions create strong recurring revenue.

What to replicate:

Tiered pricing, connects, enterprise solutions, boosted listings, and long-term contract management.

Market gaps:

Industry-specific marketplaces (AI, medical, fintech, legal, creative tech) remain underdeveloped.

How to improve the model:

Lower fees in emerging markets, better user onboarding, certification systems, built-in project management tools.

Want to build a platform with Upwork’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization features. Our Upwork Clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and Miracuves delivers ready-to-launch solutions in 3–9 days guaranteed. Get a free consultation to map out your revenue strategy.

Final Thought

Upwork’s revenue model is powerful, scalable, and built for long-term profitability. It not only generates income through commissions, connects, and memberships—but also through intelligent monetization, user segmentation, and enterprise-level hiring solutions. This makes the platform far more than just a marketplace; it operates as a complete ecosystem where every user interaction can be monetized strategically.

With the right approach, this model can be replicated efficiently. Miracuves transforms this proven strategy into a ready-to-launch solution: theUpwork Clone script comes with built-in monetization streams, optimized fee logic, and flexible revenue control. Many entrepreneurs start earning within weeks—and Miracuves delivers fully launch-ready platforms in just 3–9 days.

FAQs

1. How much does Upwork make per transaction?

Around 10% of freelancer earnings.

2. What’s Upwork’s most profitable revenue stream?

Commissions, followed by premium upgrades and connects.

3. How does Upwork’s pricing compare to competitors?

The pricing is competitive — lower than Fiverr and similar to Upwork, offering strong marketplace value. With Miracuves, you can build such a platform starting at just $2899.

4. What percentage does Upwork take from freelancers?

Approximately 10%, with no tiered reductions as in older models.

5. How has Upwork’s revenue model evolved?

More focus on enterprise, subscriptions, and AI-powered services.

6. Can small platforms use the same model?

Yes, even niche platforms can monetize successfully.

7. What’s the minimum scale for profitability?

Stable GMV and reduced CAC allow faster break-even for niche platforms.

8. How can entrepreneurs implement this model?

Use commissions, connects, premium memberships, and enterprise hiring features.

9. What alternatives exist to Upwork’s model?

Subscription-only hiring, SaaS talent platforms, or pay-per-lead systems.

10. How quickly can an Upwork Clone start earning?

With Miracuves, platforms can start monetizing in just 3–9 days with guaranteed delivery, ensuring rapid growth from day one.