Remember the time you had to wait five business days just to transfer your own money? Yeah, not fun. Now imagine building an app that turns that nightmare into a fintech dream — fast transfers, sleek budgeting tools, crypto, and international payments all under one digital roof. That’s exactly what Revolut did — and why smart entrepreneurs are now eyeing the Revolut App route.

If you’re a startup founder or digital creator looking to break into fintech without reinventing the (banking) wheel, a Revolut-like app could be your golden ticket. It’s not just about being the “next big thing.” It’s about solving real money problems with tech that feels like magic — and works on any smartphone.

Curious how it all comes together? Buckle up. We’re about to explore how a Revolut Clone works and why companies like Miracuves are your best bet for launching one that’s slick, secure, and ready to shake up the market.

What is a Revolut App?

Revolut is a financial super app that offers digital banking services through a mobile app. It allows users to open a multi-currency account, send and receive money globally, exchange currencies at interbank rates, and use a prepaid debit card for online and offline purchases. Revolut also offers features like budget tracking, cryptocurrency trading, stock investments, travel insurance, and international ATM withdrawals.

Originally launched in the UK in 2015, Revolut has grown into a global fintech platform, aiming to replace traditional banking with a more flexible, app-driven experience.

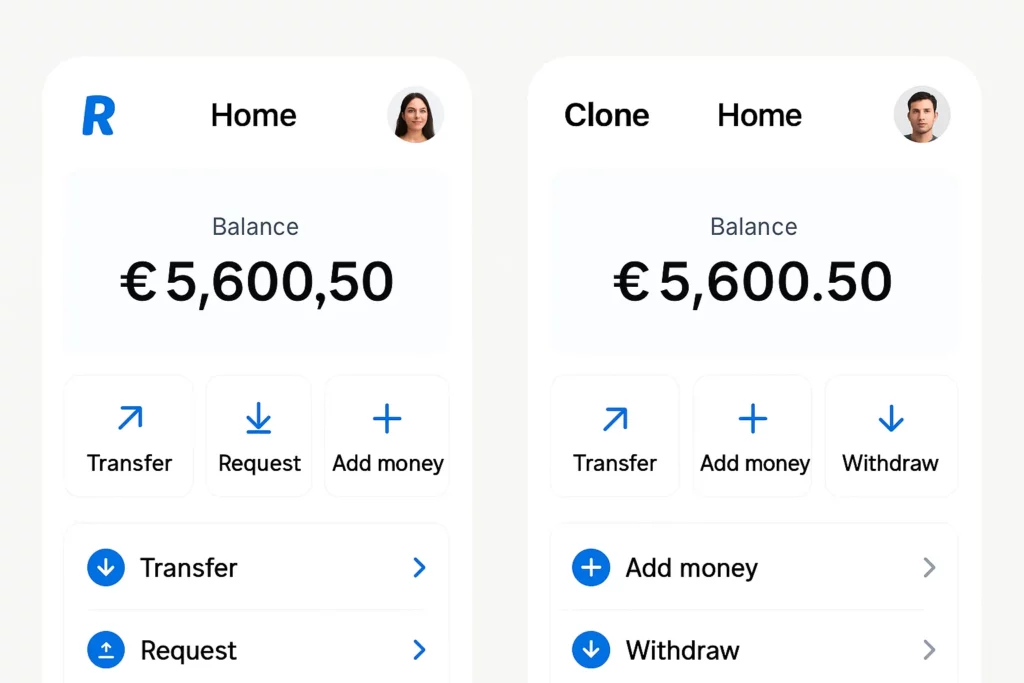

But it’s not just a copy-paste job. A true clone is customizable, scalable, and packed with the core elements needed to compete with the likes of N26, Monzo, or Cash App:

- Multi-currency accounts

- Budgeting tools

- Crypto trading

- P2P payments

- Instant money transfers

- Debit card integrations

Read Also :-Best Revolut Clone Scripts in 2025: Features & Pricing Compared

Why Revolut App Are Gaining Traction

Let’s face it — traditional banking is slow, stuffy, and stuck in the past. Fintech, on the other hand, is fast, flashy, and way more personal. Revolut kicked off a new generation of neobanks that offer real-time finance features with user-centric design.

That means opportunity for you. A Revolut app lets you ride the fintech wave with:

- Faster time to market

- Lower development costs

- Flexible monetization strategies

- Global scalability

Key Features of a Revolut App

1. Multi-Currency Wallets

Users can hold, send, and receive money in multiple currencies — ideal for freelancers, expats, and frequent travelers.

Real-time FX rate conversions make your app a go-to for global finance.

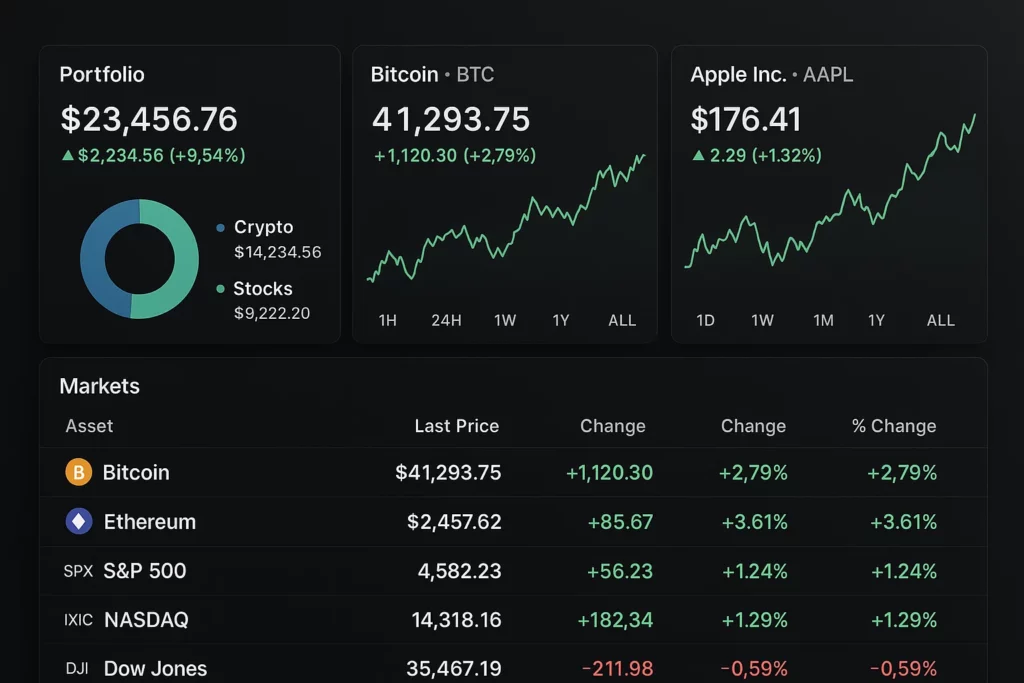

2. Crypto & Stock Trading

Allow users to dabble in Bitcoin, Ethereum, or fractional stock trading — all from their mobile app.

3. Instant P2P Transfers

Tap, type, and zap — money moves instantly between users, just like Venmo or Zelle, but smarter.

4. Virtual & Physical Debit Cards

Let users generate virtual cards for online purchases or order a sleek branded card in-app. Add budgeting limits and freeze options for safety.

5. Advanced Budgeting Tools

AI-powered spend tracking, savings goals, spending analytics, and alerts. Help users build better money habits.

6. Bill Splitting & Group Payments

Perfect for roommates, travel buddies, or startup teams splitting costs. Add reminders and auto-payments for a stress-free experience.

Learn More :-Business Model of Revolut : Key Features and Revenue

How a Revolut App Works (Behind the Scenes)

User Registration & KYC

It starts with a simple onboarding process — sign up, ID verification, selfie check, and boom: your user is ready to roll. You can integrate providers like Jumio or Onfido for automated compliance.

Core Banking API Integrations

Connect with banking-as-a-service platforms like Solaris, Marqeta, or ClearBank to power the backend without owning a license.

Security, Encryption, and Compliance

From end-to-end encryption to PCI DSS and GDPR compliance — a secure infrastructure is a non-negotiable. Miracuves bakes this into every deployment.

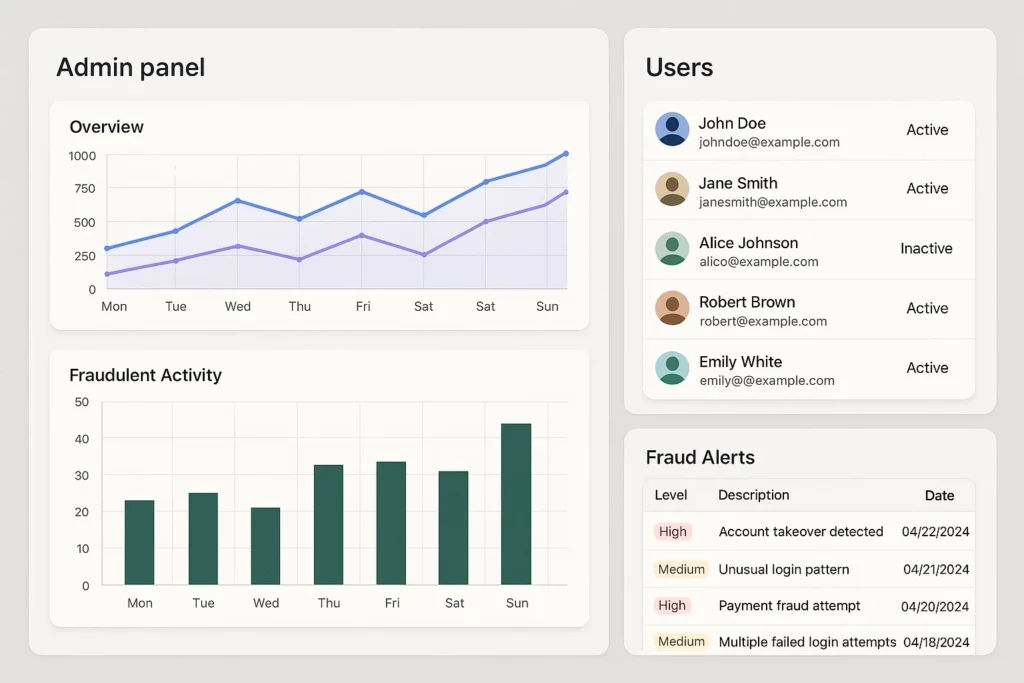

Admin Dashboard for Superpowers

Admins get tools to manage users, freeze accounts, analyze KPIs, and tweak app behavior without touching code.

Monetization Models for Your Revolut App

Launching a Revolut-style app isn’t just about UX — it’s about ROI. Here’s how you can make money:

- Subscription tiers (free, premium, metal)

- Card issuance & interchange fees

- Currency conversion markups

- Trading commissions

- Partnered services (insurance, loans)

- ATM withdrawal charges

Why Build a Revolut Clone with Miracuves?

Look, building a full-stack fintech app from scratch is like trying to bake a croissant blindfolded. There’s tech, compliance, integrations, and oh — the stress of scaling.

Miracuves gives you a ready-to-launch clone that’s not only beautiful but also:

- Secure

- Fully customizable

- API-integrated

- Compliant with major financial regulations

You get a launchpad, not a template. So whether you’re targeting your country’s unbanked users or launching a niche financial service — we help you get there, faster.

Discover how Revolut’s structure drives growth and revenue — explore our full analysis on the Revolut revenue model, and monetization approach.

Cost Factors & Pricing Breakdown

Revolut-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Neobank (MVP Money App) | Digital account creation, eKYC onboarding, basic multi-currency wallet, transaction history, simple money transfers, FX rate display, basic alerts & notifications, admin panel for user & limits management, web dashboard with mobile-responsive experience | $90,000 |

| 2. Mid-Level Revolut-Style Money Platform | Full current/spending account features, stronger multi-currency wallet, card management hooks, richer transaction categorisation, budgeting & analytics, international transfers, integrations with payment rails/banks, stronger security & audit logs, full web + Android/iOS apps | $160,000 |

| 3. Advanced Revolut-Level Global Finance Super App | Multi-currency accounts at scale, advanced card controls, FX optimisation, vaults/spaces, partner & merchant integrations, premium tiers, advanced risk & fraud monitoring, regulatory/compliance workflows, detailed analytics & reporting, cloud-native, scalable microservices architecture | $260,000+ |

Revolut-Style Money App Development

The prices above reflect the global market cost of developing a Revolut-like digital banking and multi-currency money app — typically ranging from $90,000 to over $260,000, with a delivery timeline of around 4–12 months depending on the mix of features (multi-currency accounts, cards, FX, premium tiers, etc.), the depth of compliance and risk controls, third-party integrations, and long-term scalability goals.

Miracuves Pricing for a Revolut-Like Platform

Miracuves Price: Starts at $18,999

Miracuves offers a ready-to-launch Revolut-style money platform based on its proven Wise/Revolut-type multi-currency solution. This starting price is positioned for a powerful, production-ready JS-based app that can include digital onboarding and eKYC, multi-currency wallets, international transfers, card-ready flows, spending analytics, notifications, and modern web + mobile apps—so you avoid six-figure custom builds and can move quickly in your market.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational digital banking ecosystem ready for launch and future expansion.

Delivery Timeline for a Revolut-Like Platform with Miracuves

For a Revolut-style readymade solution, the typical delivery timeline with Miracuves is approximately 3–9 days, depending on:

- The set of currencies, countries, and features you want enabled at launch

- Number and complexity of payment, FX, and KYC/AML integrations to be configured

- Branding, UI adjustments, and initial configuration of limits, roles, and fee logic

This accelerated timeline lets you go live far faster than a full custom build, validate your market, and start onboarding users in days instead of months.

Tech Stack

This solution is built with robust frameworks — Web using JavaScript (Node/Next.js), PostgreSQL & Apps using Flutter, optimized for performance, stability, and easy maintenance.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Conclusion

The world doesn’t need another clunky bank. It needs smart, accessible, and mobile-first finance tools. A Revolut Clone helps you deliver that — while carving out a profitable spot in one of the hottest tech markets today.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

What exactly is a Revolut Clone?

It’s a pre-built app solution inspired by Revolut, designed to offer mobile banking features like currency exchange, P2P payments, and budgeting tools.

Is it legal to launch a Revolut Clone?

Absolutely — as long as you’re not copying branding or violating IP. Miracuves builds custom clones with unique design and full legal safety.

Do I need a banking license?

Not necessarily. With the right Banking-as-a-Service (BaaS) integrations, you can launch under a partner’s license.

How long does it take to launch?

Depending on features, your Revolut Clone could go live in as little as 6–8 weeks with Miracuves.

Can I offer crypto features?

Yes! Many clones include optional crypto wallets and trading features — though regional compliance may apply.

What if I want to target a specific niche?

Great idea! You can tailor your Revolut Clone for specific audiences like gig workers, students, or travelers.

Related Articles :-

- What is a Neobank App and How Does It Work?

- How to Market a Digital Banking App Successfully After Launch

- Revenue Model of Neobank: How Digital-Only Banks Make Money

- Revenue Model for Digital Banking: How Fintech Banks Are Really Making Money in 2025

- Inside the Revenue Model of Wise and How It Makes Money