Picture this: You’re a founder with a killer idea for disrupting cross-border payments. You’re tired of seeing people pay steep fees just to send $100 overseas. You use Wise (formerly TransferWise) and think, “Why not build something like this — only better, smarter, faster?” That’s the moment your fintech journey begins.

But here’s the twist. You don’t want to build everything from scratch — the core tech, compliance, multi-currency support, user flow. You want a proven foundation to kickstart your app. That’s where the Wise clone comes in — a shortcut without the compromises, tailor-made for entrepreneurs who want to win big without wasting years in development purgatory.

This blog breaks down exactly what a Wise App is, how it works, what makes it tick under the hood, and how Miracuves helps you launch your very own fintech super app — faster than you can say “SWIFT fee.”

What is a Wise App?

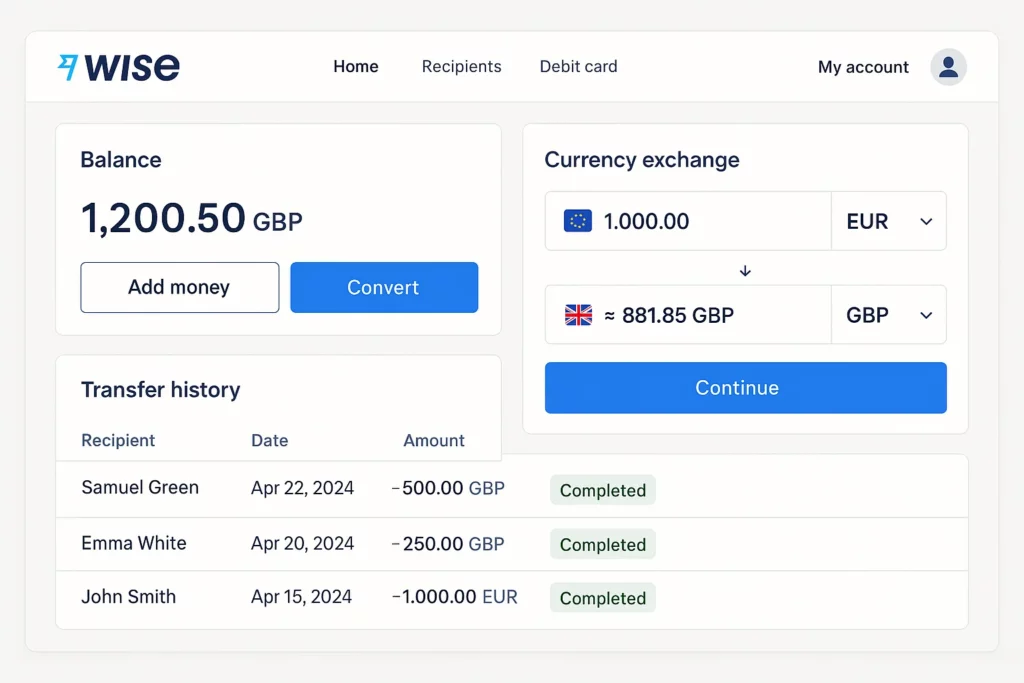

Wise is a money transfer app that lets users send, receive, and hold money internationally at low fees and real exchange rates. Formerly known as TransferWise, it offers multi-currency accounts, local bank details, and a debit card for global spending. Wise is ideal for travelers, freelancers, and businesses managing cross-border payments.

But it’s not just a copy-paste job. It’s a customizable replica built with features like:

- Multi-currency wallets

- Real-time forex rates

- Peer-to-peer transfers

- Compliance modules (KYC/AML)

- Low-fee international transfers

How Does a Wise App Work?

Let’s peel the layers like a fintech onion. Here’s what happens under the hood:

1. User Onboarding with KYC/AML Checks

Every legit money transfer app starts with one thing: trust. The onboarding flow includes:

- Photo ID upload

- Facial recognition (selfie match)

- Address verification

2. Multi-Currency Wallet System

Users get a digital wallet that can hold USD, EUR, GBP, INR, and more. The wallet behaves like a bank account — allowing deposits, transfers, and conversions.

A freelancer in India receives USD payments, converts to INR, and pays rent — all in-app.

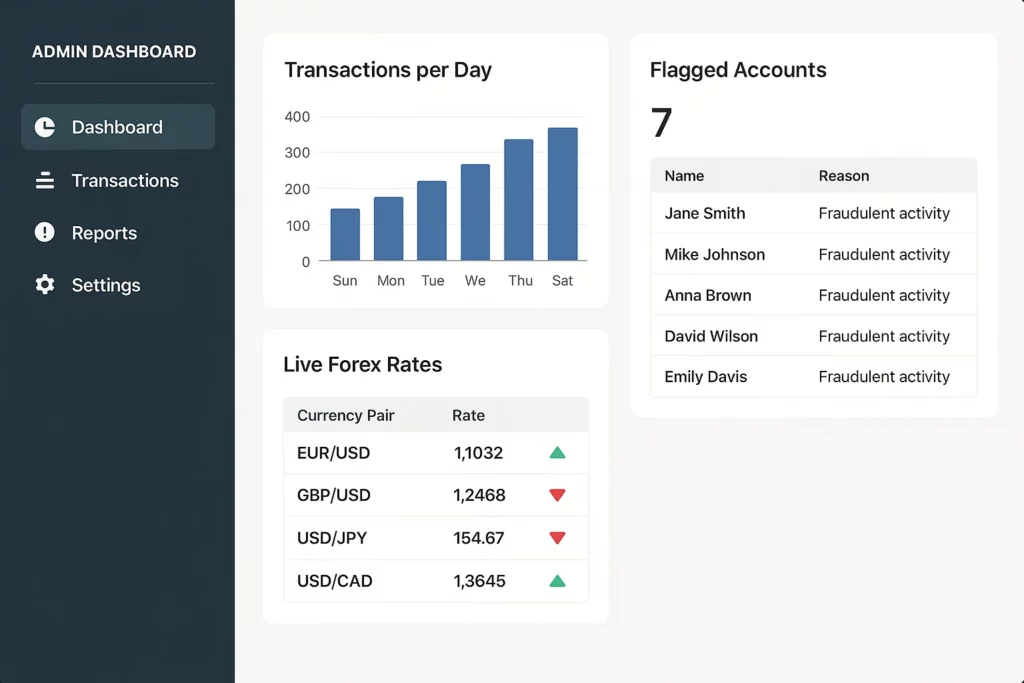

3. Real-Time Currency Exchange Engine

No hidden markups, no guesswork. The app pulls live forex rates using third-party APIs and charges a transparent fee (or none, if you want a freemium model).

4. Cross-Border Transfers with Local Routing

Instead of wiring money internationally (slow + expensive), a Wise clone uses a “local payout” strategy:

- Senders pay locally in their country

- Receivers get paid from a local partner bank in theirs

It’s the fintech version of teleportation. Fast, cheap, and borderless.

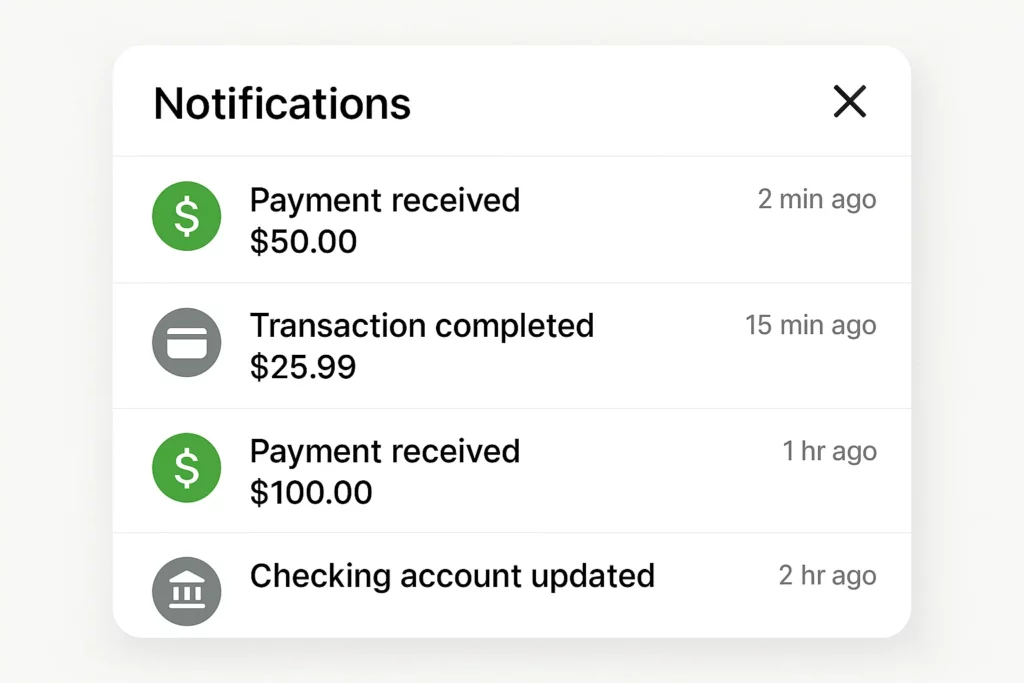

5. Transaction Tracking & Notifications

Like pizza delivery but for money. Users can:

- Track transfers in real-time

- Get alerts for status changes

- Receive monthly statements

Read More :-Best Wise Clone Scripts in 2025: Features & Pricing Compared

Core Features of a Wise App

Multi-Currency Wallet

Hold multiple currencies, convert on demand, and view balances instantly.

Transparent Fees

No guesswork. Users see fees and exchange rate upfront.

Local & Global Transfer Options

Transfer to banks, wallets, or other app users — domestically and internationally.

Secure Identity Verification

Built-in KYC tools and optional biometric login (Face ID, Fingerprint)

Admin Panel & Analytics

Admins can view user metrics, adjust fees, monitor fraud, and handle disputes.

Learn More :-Wise App Features List: What Makes This Fintech Darling Tick?

Who Can Launch a Wise Clone?

This isn’t just for giant fintech unicorns. The Wise clone model fits:

- Fintech startups looking to disrupt banking in their country

- Remittance companies wanting a digital upgrade

- SaaS founders bundling money movement into their core offering

- Crypto entrepreneurs integrating fiat-to-crypto ramps

Want to launch in Latin America, Africa, or Southeast Asia? A Wise clone helps you localize faster than reinventing the wheel.

Why Choose a Wise Clone Over Building From Scratch?

- Speed: Go live in weeks, not years

- Cost: Avoid reinventing APIs and integrations

- Flexibility: Customize design, currencies, limits, and more

- Compliance: Use pre-built KYC/AML workflows

Cost Factors & Pricing Breakdown

Wise-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Multi-Currency Wallet (MVP App) | User registration & login, eKYC onboarding, basic multi-currency balances, simple add money/top-up, P2P transfers in a limited corridor, basic FX rate display, transaction history, basic notifications, admin panel for user & wallet management, web dashboard with mobile-responsive experience | $80,000 |

| 2. Mid-Level Wise-Style Remittance Platform | Multi-currency accounts, multi-corridor cross-border transfers, dynamic FX & fee engine, improved KYC/AML checks, multiple funding & payout methods (cards/bank), richer transaction tracking, alerts & notifications, role-based admin tools, reporting dashboard, full web + Android/iOS apps | $150,000 |

| 3. Advanced Wise-Level Global Money Platform | Global corridor coverage, advanced compliance & AML rules engine, partner/bank network management, complex FX & fee structures, debit card integration layer, fraud/risk monitoring, detailed analytics & reporting, multi-language & multi-currency support, scalable cloud-native microservices architecture | $230,000+ |

Wise-Style Cross-Border & Multi-Currency Platform Development

The prices above reflect the global market cost of developing a Wise-like cross-border money transfer and multi-currency account platform — typically ranging from $80,000 to over $230,000, with a delivery timeline of around 4–12 months depending on the number of corridors, multi-currency features, payout options, compliance depth, partner integrations, and scalability targets.

Miracuves Pricing for a Wise-Like Platform (Readymade Wise Clone)

Miracuves Price: Starts at $18,999

Miracuves offers a readymade Wise Clone that gives you a production-ready Wise-style platform at a fraction of typical global development cost. This starting price is positioned for a feature-rich solution that can include digital onboarding and eKYC, multi-currency balances, FX rate & fee calculation, cross-border transfers, transaction tracking, notifications, and modern web + mobile apps—so you can focus on corridor expansion, licensing, and partnerships instead of building the core system from scratch.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational cross-border payments ecosystem ready for launch and future expansion.

Delivery Timeline for a Wise-Like Platform with Miracuves

For the Wise Clone readymade solution, the typical delivery timeline with Miracuves is approximately 3–9 days, which usually covers:

- Deployment on your preferred server or cloud environment

- Configuration of domains, environment variables, and external APIs

- Setup of admin panel, wallets, FX/fee rules (as per scope), and core security configurations

- Guidance for Android & iOS app submissions (Google Play and Apple App Store)

This accelerated delivery helps you launch and start testing your Wise-style product in days instead of the many months required for full custom development.

Tech Stack

This Wise Clone solution is built with robust frameworks — Web using JavaScript (Node/Next.js), PostgreSQL & Apps using Flutter, optimized for performance, stability, and easy maintenance.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

How Miracuves Helps You Launch a Fintech-Grade Wise Clone

At Miracuves, we’ve engineered our Wise clone to be developer-friendly, investor-ready, and future-proof. We handle:

- Frontend & backend setup

- Currency API integration

- KYC/AML systems

- Mobile app development

- Ongoing maintenance & scaling

Whether you’re targeting remote workers, international students, or diaspora communities — your money transfer app should feel seamless, secure, and stunning.

Discover how Wise’s structure drives growth and revenue — explore our full analysis on the Wise business model and revenue model and how to build a similar money transfer platform.

Conclusion

Cross-border money movement is broken — and users are sick of being robbed by hidden bank fees. A Wise clone helps you give them what they really want: speed, clarity, and control.

So whether you’re solving remittances in Nigeria or digital wallets in Brazil, the opportunity is massive.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Is a Wise clone legal to operate?

Yes, if you follow local financial regulations, integrate KYC/AML, and partner with licensed payment providers.

Can I customize the clone for my country or currency?

Absolutely. You can add/remove currencies, change UI languages, and localize for regulations.

How long does it take to launch a Wise clone?

With Miracuves, you can get your MVP up in 4–6 weeks depending on customization needs.

What’s the cost of building a Wise clone?

Get your Wise clone with Miracuves starting at $4,099 — a secure, scalable, and ready-to-launch fintech solution tailored for your business.

Do I need a banking license to run a Wise clone?

You may need partnerships with licensed entities or apply for EMI licenses, depending on your region.

Can I integrate crypto features into the clone?

Yes! Many clients request fiat-to-crypto and stablecoin conversion modules.

Related Articles :-

- How to Market a Digital Banking App Successfully After Launch

- Business Model for Digital Banking: How Neobanks Are Actually Making Money

- Revenue Model of Neobank: How Digital-Only Banks Make Money

- Revenue Model for Digital Banking: How Fintech Banks Are Really Making Money in 2025

- Exploring the Revenue Model Behind Revolut