Imagine needing a personal loan but skipping the long bank queues, mountains of paperwork, and slow approval times. Instead, you apply online, get matched instantly, and receive the funds directly in your bank account. That’s the convenience LendingClub brought to the United States.

Founded in 2006, LendingClub began as a peer-to-peer lending pioneer — connecting borrowers directly with investors. Over time, it evolved into one of America’s largest digital lenders and became a full-service digital bank. Today, it offers personal loans, business loans, auto refinancing, high-yield accounts, and credit-building tools, all designed around faster approvals and transparent lending.

In 2025, LendingClub continues to be a trusted choice for millions of Americans seeking flexible loans with fair rates. It’s known for its data-driven approvals, modern banking experience, and customer-first approach.

By the end of this guide, you’ll understand exactly how LendingClub works, how it makes money, what technology powers it, and how you can build a LendingClub-like lending & banking platform.

What is LendingClub? The Simple Explanation

LendingClub is a U.S.-based peer-to-peer lending and digital banking platform that connects borrowers directly with investors instead of relying on traditional banks. It started in 2007 as one of the first major online lending marketplaces, giving consumers a faster, simpler way to access personal loans while allowing investors to earn returns by funding those loans.

The core problem LendingClub solves is the high cost and slow process of traditional bank loans. By removing the middle layer and using technology-driven underwriting, it offers borrowers lower rates and provides investors with access to a new asset class.

Its primary users include individuals seeking personal loans, debt consolidation, auto refinancing, and small business financing — along with retail and institutional investors looking for predictable fixed-income returns.

Since becoming a full-fledged digital bank in 2021, LendingClub now offers checking accounts, savings accounts, and enhanced credit products, creating a unified banking and lending ecosystem.

As of 2025, LendingClub has issued over $80 billion in loans, maintains millions of customers, and continues to lead the U.S. personal loan market thanks to its efficient online model and strong risk-assessment algorithms.

How Does LendingClub Work? Step-by-Step Breakdown

LendingClub operates as a digital lending marketplace where borrowers can apply for personal loans and investors (or institutions) can fund those loans. Over time, the platform shifted from peer-to-peer lending to a fully regulated digital bank, but the core model remains the same: fast online borrowing, transparent rates, and data-driven approvals.

For Borrowers

1. Online Application

Borrowers apply through the LendingClub website or app. They enter income details, employment information, loan purpose, and credit history.

A soft credit check is performed first, so credit score isn’t affected.

2. Loan Offers and Approval

Based on credit profile, LendingClub provides personalized loan offers. These include:

- Loan amount (usually $1,000–$40,000)

- APR based on creditworthiness

- Repayment term (usually 36 or 60 months)

Borrowers choose an offer and complete identity verification before final approval.

3. Funding and Disbursement

Funds are deposited into the borrower’s bank account, typically within 24–48 hours.

Borrowers repay the loan through fixed monthly installments.

4. Consolidation and Auto-Pay

Many users take LendingClub loans to consolidate credit card debt. Auto-pay options help reduce missed payments and may qualify borrowers for lower rates.

For Investors / Institutions

Though LendingClub ended traditional P2P investing, institutional investors and banks still fund a large portion of loans. They receive structured returns based on borrower interest payments. LendingClub earns a margin from servicing and origination.

Key Functionalities Explained

- Digital loan comparison

- Automated underwriting

- Debt consolidation calculators

- Hardship plans for financial emergencies

- Credit score monitoring (for some customers)

Technical Overview (Simple)

LendingClub uses a cloud-based architecture with automated decision models to evaluate borrower risk.

Core components include:

- Machine learning algorithms for credit scoring

- API connections to banks for instant identity and income verification

- Secure payment gateways for monthly installments

- Real-time dashboards for loan tracking

This technology allows LendingClub to process thousands of applications quickly, providing fast decisions and transparent terms.

LendingClub’s Business Model Explained

LendingClub operates on a marketplace lending and digital banking model, combining borrower-friendly loans with investor-driven capital and traditional banking revenue streams. Since transitioning into a full-service digital bank in 2021, LendingClub now earns from both loan origination and core banking activities.

1. Loan Origination Fees

When borrowers take a personal loan, LendingClub charges an origination fee ranging from 3% to 8% depending on credit profile, term, and risk band.

This is one of LendingClub’s primary revenue drivers.

2. Interest Income from Loans

Since becoming a bank, LendingClub now keeps many loans on its balance sheet instead of selling them to investors.

This means it earns:

- Interest from personal loans

- Interest from auto refinancing

- Interest from small business loans

Holding loans allows LendingClub to generate steady, recurring interest revenue.

3. Marketplace Investor Fees (Legacy Model)

Historically, LendingClub connected borrowers with retail and institutional investors.

It earned fees such as:

- Service fees for collecting payments

- Investor management fees for facilitating investments

Although LendingClub now focuses more on banking, marketplace-originated loans still contribute revenue.

4. Deposit-Based Revenue (LendingClub Bank)

As a digital bank, LendingClub receives customer deposits via:

- High-yield savings accounts

- Checking accounts

- Certificates of deposit (CDs)

These deposits lower funding costs and enable LendingClub to issue more loans cost-effectively.

5. Interchange Fees

LendingClub earns interchange revenue every time customers use their LendingClub debit card for purchases.

6. Investor Services & Portfolio Management

Institutional investors use LendingClub for:

- Consumer loan portfolio purchases

- Loan analytics

- Performance tracking and risk modeling

This provides additional fee-based revenue.

7. Credit & Risk-Based Pricing

By using AI-driven underwriting, LendingClub can price risk more accurately and improve loan approval rates while maintaining healthy margins.

Market Size & Growth

As of 2025:

- LendingClub serves over 4.5 million customers

- Manages billions in loan originations annually

- Continues shifting from a marketplace lender to a high-margin digital bank

Its hybrid banking-lending model has positioned it as a major fintech player in the U.S. personal loan market.

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Key Features That Make LendingClub Successful

LendingClub became one of the most influential consumer-lending platforms in the U.S. by combining technology, transparency, and a borrower-friendly lending experience. Here are the features that contributed to its success:

1. Fully Digital Personal Loans

LendingClub allows users to apply, get approved, and receive funds completely online. The process is fast, paperless, and designed for borrowers who need quick access to cash.

2. Credit-Based Risk Assessment

The platform uses advanced credit modeling and alternative data to evaluate borrower profiles. This helps LendingClub provide fair APRs tailored to each individual’s creditworthiness.

3. Quick Approvals and Fast Funding

Most borrowers receive approval decisions within minutes and get funds deposited as quickly as the next business day after verification.

4. Debt Consolidation Made Simple

LendingClub is widely used for debt consolidation. Borrowers can combine credit card balances into one fixed-rate loan with predictable monthly payments.

5. Fixed Interest Rates

Unlike variable credit card rates, LendingClub offers fixed APRs, giving borrowers full clarity on their repayment schedule.

6. Payment Flexibility

Users can choose loan terms (typically 24–60 months), change payment dates, and make extra payments without penalties.

7. Business Loans & Auto Refinancing

Beyond personal loans, LendingClub also offers:

- Small business loans

- Auto loan refinancing

- Specialized credit products

These expansions help serve a broader financial audience.

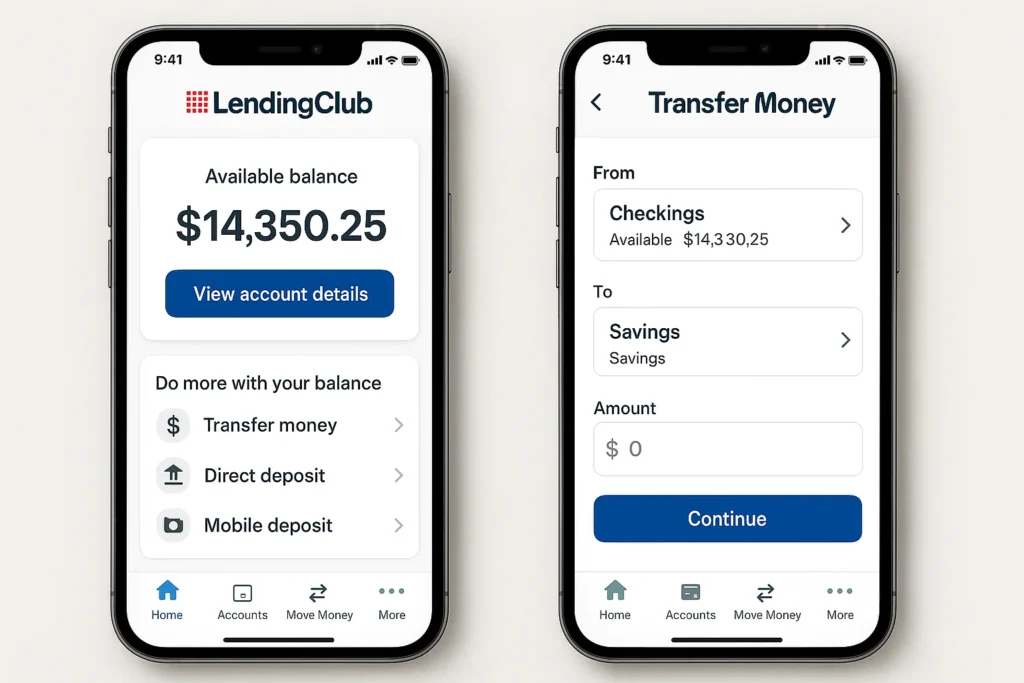

8. Partner Banking Features

Since acquiring Radius Bank, LendingClub now offers:

- High-yield savings accounts

- Checking accounts

- Cashback debit cards

- Integrated loan management

This makes LendingClub a hybrid between a lender and a digital bank.

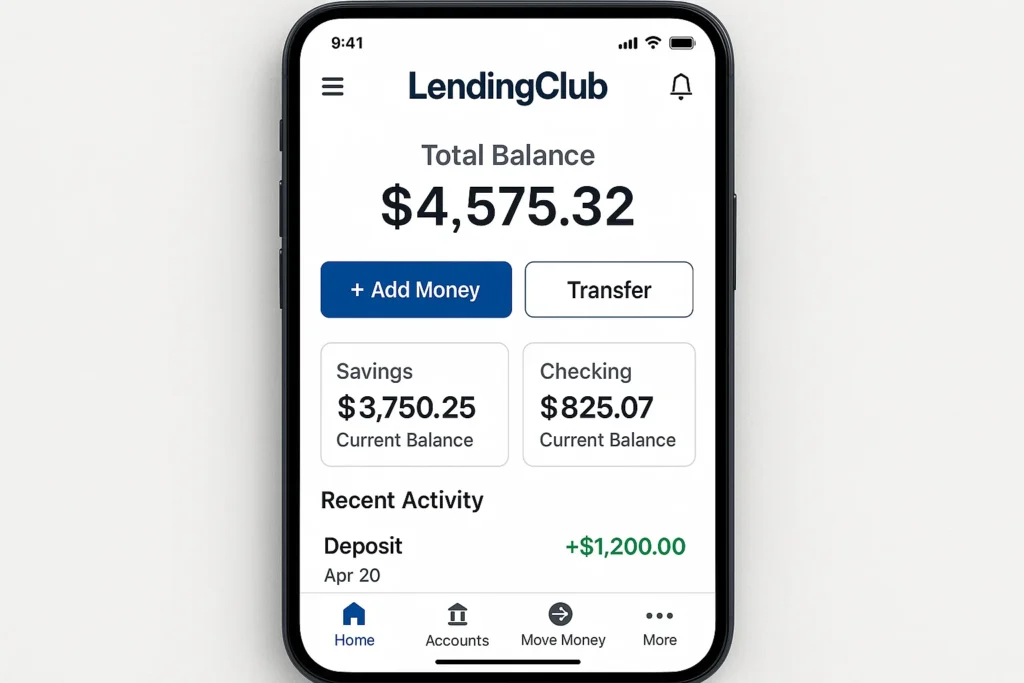

9. Mobile App & Dashboard

The LendingClub app gives borrowers:

- Payment reminders

- Loan tracking

- Credit score insights

- Bank account management

Everything is optimized for easy financial control.

10. Lower Fees Compared to Traditional Lenders

LendingClub keeps costs predictable with transparent fees and no prepayment penalties, making it appealing to cost-conscious borrowers.

2025 Updates:

LendingClub added real-time credit health monitoring, AI-based loan recommendations, and faster verification tools to reduce funding time even further.

The Technology Behind LendingClub

LendingClub operates on a highly secure, scalable, and data-driven technology infrastructure that enables lending, investing, risk assessment, and payment processing to happen smoothly for millions of borrowers and investors. Since shifting its focus from peer-to-peer lending to a full digital banking model, its technology stack has evolved into a modern fintech architecture built for speed, reliability, and compliance.

Tech Stack Overview (Simplified)

LendingClub uses a cloud-native architecture designed for high availability and strong data security. Its core technologies include:

- AWS cloud infrastructure for hosting, storage, and scalable compute power

- Java, Python, and Go for backend services

- React and Angular for web and dashboard interfaces

- Native iOS (Swift) and Android (Kotlin) for mobile apps

- PostgreSQL, MySQL, and MongoDB for storing customer, loan, and payment data

- Kafka and Redis for real-time message streaming and caching

This setup helps LendingClub handle loan applications, underwriting, and investor operations with low latency.

Real-Time Data and Automated Underwriting

LendingClub’s underwriting engine evaluates thousands of data points in seconds. It uses:

- Credit bureau reports

- Banking transaction data

- Employment and income verification

- Alternative financial data

- Machine learning risk models

These inputs allow the system to calculate borrower risk, loan eligibility, and pricing instantly.

Security and Compliance

As a U.S. digital bank regulated under OCC and FDIC, LendingClub maintains bank-grade security through:

- Encryption of customer data in transit and at rest

- Multi-factor authentication

- Tokenized API communication

- Continuous fraud monitoring with ML algorithms

- Full compliance with PCI DSS, SOC 2, GLBA, and U.S. banking standards

Deposits are FDIC-insured, and all financial operations follow strict audit and reporting rules.

Scalability and Reliability

LendingClub’s microservices-based architecture allows it to scale specific functions independently — such as loan processing, payment scheduling, investor dashboards, or credit monitoring — without affecting other parts of the system. This ensures high uptime during peak traffic, especially around due dates and application surges.

API Integrations

The platform integrates with:

- Credit bureaus

- Payment processors (ACH, debit, bank rails)

- Identity verification providers

- Banking partners

- Investment and analytics tools

APIs allow LendingClub to automate approvals, schedule repayments, communicate with banks, and power dashboards for both borrowers and investors.

Data Analytics & Machine Learning

LendingClub leverages data analytics platforms such as Snowflake and Databricks for:

- Loss forecasting

- Credit scoring improvements

- Investor returns analysis

- Portfolio performance forecasting

- Fraud pattern recognition

These insights help reduce delinquency rates and optimize loan pricing.

Mobile and Web Experience

Its apps offer:

- Loan application and tracking

- Credit score updates

- Payment scheduling

- Savings and banking tools

- Account analytics

The interface emphasizes simplicity, transparency, and financial wellness.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

LendingClub’s Impact & Market Opportunity

LendingClub has reshaped the U.S. lending industry by proving that technology-driven lending can be faster, safer, and more transparent than traditional banking. What began as a peer-to-peer lending platform has now become a fully regulated digital bank offering personal loans, auto refinancing, and high-yield savings — all powered by data intelligence.

Industry Disruption

Before LendingClub, personal loans typically meant long bank visits, manual checks, and slow approvals. LendingClub disrupted this by:

- Using alternative data and AI for quick underwriting

- Offering fully online loan applications

- Creating higher approval opportunities for underserved borrowers

- Giving investors new ways to diversify (in its earlier P2P model)

By converting into a digital bank in 2021, LendingClub further disrupted the lending landscape with better interest rates and automated processing.

Market Statistics & Growth

As of 2025:

- LendingClub serves millions of members across the U.S.

- The platform has facilitated over $85 billion in loans since inception

- Its digital banking unit continues to grow due to high-yield savings and personal loan demand

- The U.S. digital lending market is projected to surpass $350 billion by 2030

LendingClub remains a top choice for borrowers seeking fast approvals and lower rates than traditional banks.

User Demographics & Behavior

Most LendingClub users include:

- Working professionals seeking debt consolidation

- Borrowers with good credit looking for lower interest rates

- Users refinancing high-APR credit card debt

- Individuals looking for quick, paperless personal loans

- Small-business owners who prefer alternative lending

The platform attracts users who value speed, transparency, and digital convenience.

Geographic Presence

LendingClub operates across the United States, offering loans, savings, and checking products nationwide. Its online-only model gives it reach without the limitations of physical branches.

Future Projections

By 2030, LendingClub is expected to expand into:

- AI-driven predictive lending

- Smarter credit-score modeling

- Business loans and merchant financing

- Broader digital banking services

- Real-time credit decisioning powered by machine learning

The platform will likely compete directly with major neobanks and digital lenders.

Opportunities for Entrepreneurs

The lending sector remains one of the fastest-growing fintech categories, especially in emerging markets. Entrepreneurs can build LendingClub-like platforms to:

- Provide fast personal loans

- Offer BNPL-style lending

- Support small business financing

- Build niche-focused credit solutions (students, freelancers, etc.)

- Integrate AI-driven underwriting and instant approvals

With Miracuves, anyone can launch a personalized digital lending platform — with risk engines, onboarding, EMI automation, dashboards, and loan management ready for global markets.

Building Your Own LendingClub-Like Platform

LendingClub pioneered peer-to-peer and marketplace lending in the United States by connecting borrowers with investors through a digital-first model. Its success shows that modern credit platforms can scale rapidly when built on transparency, automation, and smart risk assessment. If you’re planning to build a similar lending marketplace, here’s what you need to know.

Why Businesses Want LendingClub-Style Platforms

A LendingClub-like system allows companies to:

- Offer personal loans without traditional bank overhead

- Connect investors directly with borrowers

- Use intelligent risk-based pricing for profitable margins

- Operate with digital onboarding and faster approvals

- Expand into hybrid models (marketplace + balance sheet lending)

- Target underserved credit segments with data-driven decisioning

This model reduces friction for borrowers and provides attractive yield opportunities for investors.

Cost Factors & Pricing Breakdown

LendingClub–Style App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic P2P Lending MVP | User onboarding, loan listings, basic matching engine, wallet, admin panel | $25,000 |

| 2. Mid-Level Lending Platform | Automated EMIs, borrower–lender matching logic, KYC/AML flows, dashboards | $40,000 |

| 3. Advanced LendingClub–Level Platform | Full underwriting engine, credit-scoring logic, payment gateway automation, risk modules, multi-role admin | $50,000+ |

LendingClub–Style P2P Lending Platform Development

The prices above reflect the global market cost of developing a LendingClub–style P2P lending/SaaS platform — typically ranging from around $25,000 to over $50,000, with a delivery timeline of 4–10 months depending on features, integrations, compliance depth, and scalability requirements.

Miracuves Pricing for a LendingClub–Style Custom Platform

Miracuves Price: Starts at $14,999

This is positioned for a feature-rich P2P lending platform that can include user onboarding, loan listings, matching engine, repayment schedules, basic underwriting logic, KYC/AML flows, and admin dashboards, with room to extend into more advanced credit-scoring, risk analytics, and multi-entity lending workflows as your business scales.

Compared to typical global custom development quotes, Miracuves gives you a much lower entry cost while still focusing on robust architecture, security, and long-term maintainability.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational P2P lending ecosystem ready for launch and future expansion.

Delivery Timeline for a LendingClub–Style Platform with Miracuves

For a LendingClub–style, JS-based custom build, the typical delivery timeline with Miracuves is approximately 30–90 days, depending on:

- Scope and complexity of underwriting and credit-scoring logic

- Depth of KYC/AML, regulatory, and reporting workflows

- Number of payment gateways, payout partners, and verification APIs

- Custom dashboards, role-based access, and analytics requirements

This approach ensures a predictable, business-ready launch window instead of long, open-ended development cycles.

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged when you request a consultation, based on your internal team preferences, compliance needs, or infrastructure choices.

Read More :- Read the complete guide on fintech app development costs

Conclusion

LendingClub reshaped consumer lending in the U.S. by proving that transparent, tech-driven personal loans can outperform traditional banking models. Its marketplace approach — connecting borrowers directly with investors — created an entirely new category of fintech lending and opened the door for millions who lacked access to fair, fast, and affordable credit.

Today, as a fully chartered digital bank, LendingClub blends marketplace lending with traditional banking strengths. This hybrid model enables better risk management, improved loan pricing, and a smoother user experience — all while remaining true to its mission of financial inclusion.

For entrepreneurs, LendingClub’s journey highlights a major opportunity: lending is changing fast. Consumers now prefer digital-first platforms with instant approvals, personalized offers, and clear terms. Whether your goal is personal lending, SME lending, P2P, or neobanking, a LendingClub-style platform can thrive in any market where credit access is complex or underserved.

The future of lending is digital, transparent, and user-first. Your platform could be the next big name in fintech — and Miracuves can help you make it a reality.

FAQs :-

How does LendingClub make money?

LendingClub earns through origination fees charged to borrowers, interest spreads from loans held on its balance sheet, and service fees charged to investors who fund loans.

Is LendingClub a bank?

Yes. Since its acquisition of Radius Bank, LendingClub operates as a full-service digital bank in the United States, offering checking, savings, and lending products.

What types of loans does LendingClub offer?

LendingClub offers personal loans, auto refinancing loans, small-business loans, and patient financing options. It also provides banking services like checking and savings accounts.

Is LendingClub safe to use?

Yes. LendingClub Bank is FDIC-insured, uses encrypted communications, multi-factor authentication, and complies with federal banking regulations.

How quickly can I get a loan from LendingClub?

Most borrowers receive loan approval within minutes and funding within 24–48 hours after verification.

Does LendingClub check credit?

Yes. LendingClub performs a soft credit check during pre-qualification and a hard credit pull when the user accepts the loan offer.

What are LendingClub’s fees?

Borrowers may pay origination fees depending on credit profile. Investors (where applicable) may pay servicing fees on repayments from borrowers.

Who can invest in LendingClub loans?

LendingClub discontinued its retail investor marketplace. Only institutional investors and LendingClub itself now fund loans.

How does LendingClub compare to traditional banks?

LendingClub offers faster approvals, digital-first onboarding, competitive rates, and streamlined loan processing compared to many traditional banks.

Can I build an app like LendingClub?

Yes. With Miracuves, you can create a lending and digital-banking platform — including borrower onboarding, credit scoring, loan matching, and automated repayments, fully customizable for your market.

Related Articles :-

- What is Affirm and How Does It Work?

- What is Afterpay and How Does It Work?

- What is Klarna App and How Does It Work?

- What is Groww and How Does It Work?