Ever tried sending money across borders and ended up feeling like you just donated to your bank’s secret yacht fund? Yeah, we’ve been there. Hidden fees, shady conversion rates, and long wait times — not exactly what you signed up for. That’s the pain point Wise (formerly TransferWise) laser-focused on.

Launched by two Estonian founders frustrated by international transfers, Wise decided to flip the table. No BS, no “banking lingo,” just low-cost, real exchange rates, and a radically transparent promise. And guess what? That honesty built a loyal fanbase and a global fintech brand.

If you’re a startup eyeing the fintech game — especially international transfers or borderless banking — understanding how Wise marketed itself into a billion-dollar brand is a must. And if you’re planning to build your own Wise-style money app, Miracuves is your launchpad.

How Wise Won the Trust of the Global Audience

1. Radical Transparency as a Brand Positioning

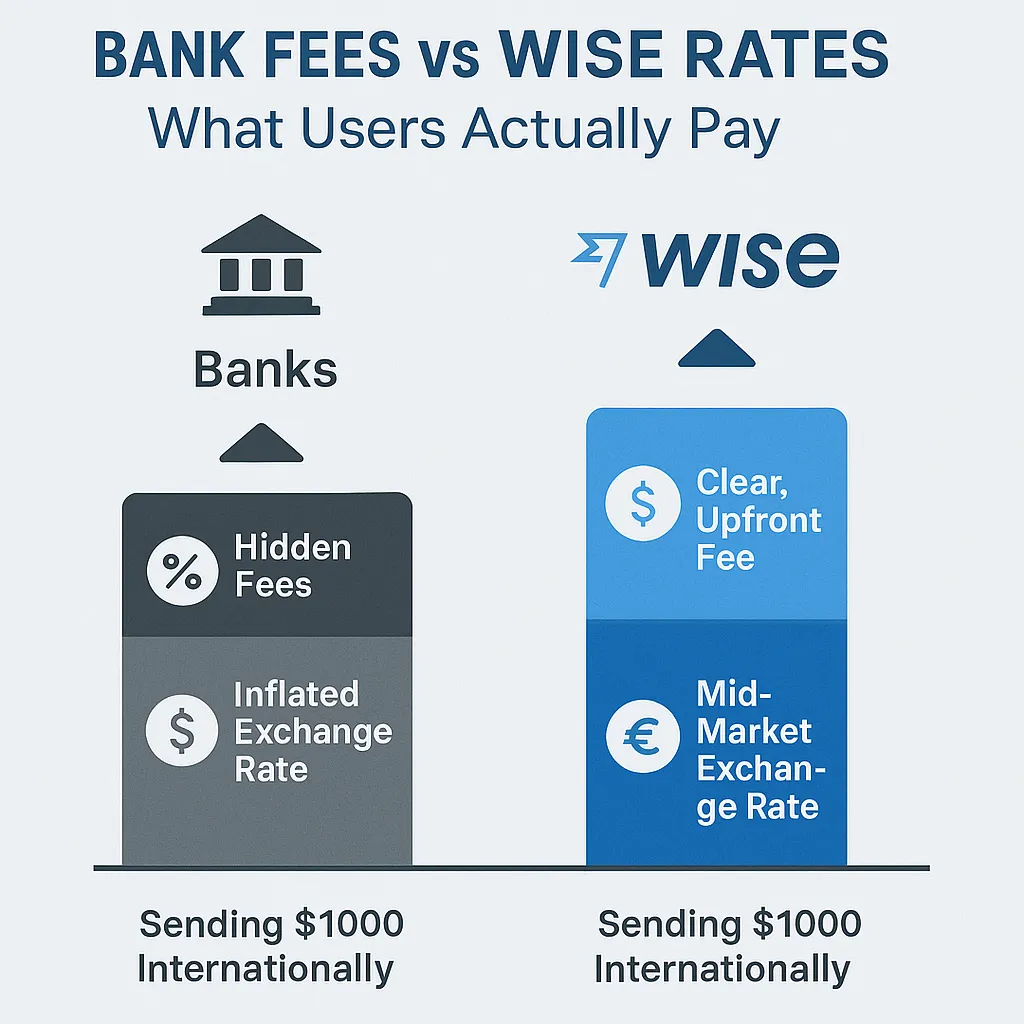

Wise didn’t just market a product — it marketed a rebellion. Their first campaigns compared actual bank rates vs their real-time mid-market rate. With cheeky billboards reading “Banks Rip You Off,” they poked the financial giants in the eye.

Transparency wasn’t a feature — it was the message.

2. Word-of-Mouth + Community Love = Growth Hack Gold

Wise’s early growth came from grassroots trust. They asked happy users to refer friends — and paid them a small commission. It sounds simple, but it exploded in markets like the UK, India, and Australia, where remittances are frequent and people talk.

They also opened up public roadmaps, shared changelogs, and let users suggest features. This participatory marketing approach made customers feel heard — and hyped.

3. Localized Campaigns for Hyper-Relevance

Wise didn’t take a one-size-fits-all route. In India, they talked about tuition payments and freelancers. In Europe, they leaned into SEPA compatibility. For African markets, it was about speed and access to hard currency.

Every region got content, ads, and partnerships tailored to their economic reality — a localization masterclass.

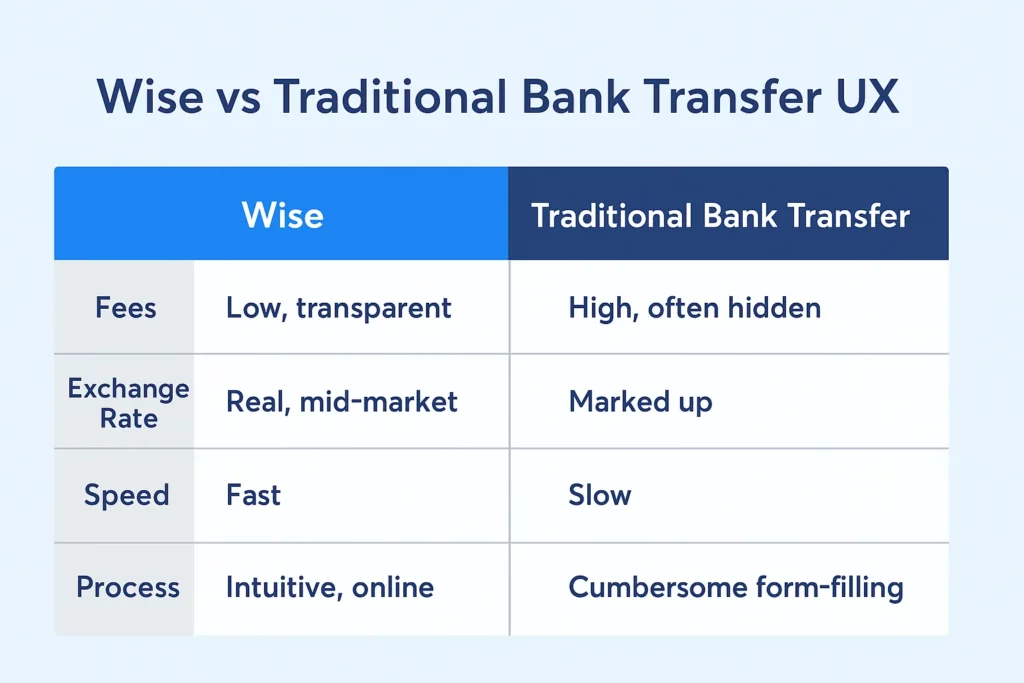

4. Design-Led Experience = Instant Trust

Fintech is one place where design equals credibility. Wise gets this. Clean UI, straightforward language, and gentle animations make even complex actions (like IBAN setups) feel like ordering a coffee.

Their visual identity — blue, bold, geometric — consistently reflects confidence and simplicity. It’s not “fintech boring.” It’s “fintech inviting.”

5. Social Proof + Real Reviews

They actively promote TrustPilot reviews, user testimonials, and Reddit shoutouts. Every time someone posts “Just used Wise, saved $47,” they amplify it — not through braggy ads, but with a humble “Real people, real savings” vibe.

That builds social proof and reinforces their David-vs-Goliath narrative.

6. Content Engine + SEO That Educates

Wise doesn’t just rank for “money transfer.” Their blogs dominate keywords like “how to get paid as a freelancer in USD from India,” or “best bank for international students in Germany.” Why? Because they write like humans for humans.

Their SEO content is educational, detailed, and emotionally resonant. Smart founders take note: give value first, convert later.

Statista: Digital Remittance Growth Trends

7. Transparent Pricing UX That Converts

You know how most money apps hide fees behind 14 clicks? Wise flips that. On the homepage, you get a calculator that shows exactly what you’ll pay — and what the recipient gets. Boom. Confidence built.

That transparency doesn’t just help conversions — it builds advocacy. Because users feel respected.

Building a Wise-Style Money App? Read This First.

If you’re dreaming of creating your own money transfer or fintech app, know this — you don’t need to reinvent the wheel. You need to innovate on trust, UX, and niche targeting.

At Miracuves, we specialize in crafting fintech clones like Wise, but tailored to your audience, features, and business model. From real-time conversion APIs to multi-currency wallets and compliance modules — we’ve got you covered.

Build Your Own Fintech App with Miracuves

Learn More: Inside the Revenue Model of Wise and How Wise Makes Money

Hot Features in Cross-Border Fintech Apps

- Crypto Remittance: Sending Bitcoin or stablecoins instead of USD or GBP? It’s picking up speed.

- AI-Powered FX Prediction: Some platforms now suggest when to transfer for the best rate.

- Micro-Remittance: Apps focused on sending tiny amounts ($5–$50) instantly for gig workers.

Learn More: Top Wise App Features That Power Borderless Banking

Get in early. Ride the wave.

Conclusion

Wise clone built more than an app — they built a movement. A movement of financial freedom, transparency, and user-first design. And it worked, beautifully.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

How did Wise become popular without heavy advertising?

They focused on transparency, referral rewards, and content marketing — letting word-of-mouth do the rest.

What made Wise different from traditional banks?

They offered real exchange rates, transparent fees, and better UX — no jargon, no surprises.

Did Wise only focus on expats and freelancers?

Nope. They started there, but quickly expanded to students, migrants, remote teams, and even businesses.

How does Wise build trust with new users?

Real-time calculators, real user reviews, and open communication — they show value, not just promise it.

Can startups compete with Wise today?

Absolutely, especially by serving under-addressed markets or focusing on niche remittance corridors.

Can Miracuves build a Wise clone app?

Yes! We can help you build a powerful Wise-style fintech app with FX tools, compliance layers, and mobile-ready design.