From a small UK-based processor to serving millions of merchants worldwide, Worldpay didn’t scale by accident — it scaled through trust, compliance, and infrastructure that could handle billions in transactions. In 2026, the global digital payments market crossed $11.8T+ in annual volume, with fintech funding exceeding $164B. For founders entering this ecosystem, building a Worldpay-style payment gateway is no longer about copying features — it’s about matching reliability, compliance readiness, and transaction architecture.

This is where the idea of a Worldpay Clone becomes powerful. Instead of spending 18–24 months building payment architecture from scratch, entrepreneurs can start with a proven framework, customize it for their market, and launch monetization models faster using Best Worldpay Clone Script 2026 by Miracuves.

Understanding how Worldpay works — merchant onboarding, settlement cycles, payment routing, KYC/KYB standards, PCI DSS compliance — gives entrepreneurs a blueprint to build something scalable, ownable, and investment-ready. The real opportunity is not in copying Worldpay; it’s in building the next localized version of it for your market with Miracuves.

What Makes a Great Worldpay Clone?

A great Worldpay Clone in 2026 isn’t just a payment app — it is a transaction infrastructure. Founders aren’t looking for a basic payment button; they need a system that can onboard merchants, process global transactions, support settlement cycles, handle failed payments intelligently, and maintain compliance standards. A modern Worldpay-style clone must behave like a financial backbone, not a feature bundle.

Stability, uptime, transaction routing logic, and fraud prevention decide whether the platform scales. Equally important are KYC/KYB systems, tokenization, PCI compliance, payout rules, and audit trails. In 2026, fintech investors no longer ask “What app did you build?” Their question is “Can your system handle 100,000 requests per minute without breaking?”

That’s why Best Worldpay Clone Script 2026 must be built for performance, growth, and compliance from day one.

Key Elements That Define a Great Worldpay Clone in 2026:

• 99.9% uptime with AWS or GCP-grade infrastructure

• Average response time under 300ms for transaction requests

• PCI-DSS, PSD2, and SOC-level compliance readiness

• Tokenized card storage and secure vaulting for sensitive data

• Intelligent routing for multiple payment rails (domestic + international)

• Built-in KYC/KYB onboarding funnels to approve merchants

• Multi-currency settlement system for cross-border merchants

• APIs and SDKs for integration with websites, POS, and apps

Why These Features Matter for Entrepreneurs:

• Faster onboarding = faster revenue cycles

• Better routing = lower transaction failure rates

• Compliance-first architecture = reduces regulatory risk

• Tokenization + encryption = investor trust and operational credibility

Modern Worldpay Clone vs Traditional Payment Systems :

| Capability | Modern Worldpay Clone | Basic Payment System |

|---|---|---|

| Processing Speed | <300ms average API response | 1–2 seconds |

| Uptime | 99.9% cloud-architecture | Unstable, shared hosting |

| Compliance | PCI-DSS, KYC/KYB, PSD2 ready | Limited or missing |

| Multi-Currency Support | Yes, built-in settlements | Minimal or plugin-based |

| Developer Integration | Full API + SDK ecosystem | Basic checkout plugin |

| Scalability | 100K+ req/min scalable | Breaks under load |

A great Worldpay Clone is not about copying the interface — it’s about replicating the transaction intelligence. Miracuves builds exactly that: performance-first, compliance-ready, globally scalable infrastructure.

Essential Features Every Worldpay Clone Must Have

A Worldpay-style system runs on three layers working in coordination: the user side, the merchant/admin panel, and the transaction-routing engine. If any layer fails, the platform loses trust, revenue, or regulatory standing. That’s why modern clones are engineered like financial infrastructure, not apps.

A powerful Worldpay Clone must deliver a seamless user payment experience, a stable merchant onboarding process, a transparent admin control center, and automated compliance workflows. Entrepreneurs launching in 2026 need more than “accept payments” — they need retention systems, dispute-resolution logic, smart routing, multi-currency handling, automated settlements, and compliance dashboards that keep operations clean and investor-ready.

Core Functional Layers Explained

User / Customer Side

• Smooth, lightweight payment checkout to reduce drop-offs

• Tokenized card storage + 3DS2 for high-trust transactions

• Multiple payment options (cards, bank transfer, UPI, wallets, BNPL, crypto optional)

• Auto-retry for failed transactions to increase successful conversions

• Real-time transaction status and invoice records

Admin & Merchant Control Panel

• Compliance dashboard for KYC/KYB approvals

• Smart routing engine to reduce payment failure percentages

• Granular transaction logs + automated reconciliation

• Multi-currency wallets and settlement scheduling

• Fraud detection, blacklist/whitelist filters, IP/device scoring

• Chargeback management + dispute workflow tools

Service Provider / Partner & Routing Layer

• Support for domestic + international payment rails

• PCI-DSS grade encryption + token vaulting

• Webhooks, APIs, and SDKs for integration across platforms

• Real-time notification engine for payouts and settlements

• AI recommendations for risk scoring and routing optimization

Advanced 2026 Capabilities for a Worldpay Clone

• AI-based personalization for merchant risk categories

• AR onboarding for guided KYC/KYB document capture

• Blockchain-backed transaction verification options

• Automated AML flagging with rules engine

• Open Banking integrations for EU, UK, and APAC regions

Technical Architecture Requirements

• Built for 100K+ concurrent requests without breakdown

• Auto-scaling server clusters via AWS / GCP / Azure

• Load balancers for peak traffic handling

• Encrypted communication tunnels + TLS 1.3

• Third-party integrations (Swift, SEPA, ACH, UPI, etc.)

Feature Comparison Table

| Tier | Basic | Professional | Enterprise |

|---|---|---|---|

| Multi-Currency Support | Limited | Full | Full + Region-Based Routing |

| KYC/KYB Automation | Manual | Semi-Automated | Fully Automated + AI |

| Settlement Cycles | Standard | Customizable | Multi-Layer Global Settlement |

| API/SDK Ecosystem | Basic Checkout | Full REST API | Webhooks + Partner APIs |

| Compliance Tools | Basic Logs | PCI Alignment | PSD2/AML/Bank-Level Controls |

| Deployment Timeline | 30–45 days | 45–75 days | 30–90 days (global scale) |

Miracuves integrates all these features into the Best Worldpay Clone Script 2026, giving founders a ready-to-scale financial architecture instead of a template.

Cost Factors & Pricing Breakdown

Worldpay-Like Enterprise Payment Processing Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Core Payment Processing MVP | Merchant onboarding, card payment processing, transaction lifecycle management, basic settlement logic, and a simple admin panel. | $80,000 |

| 2. Mid-Level Global Payments Platform | Web dashboards, multi-currency support, international card networks, refunds, chargeback handling, webhooks, notifications, and analytics dashboards. | $200,000 |

| 3. Advanced Worldpay-Level Platform | Global acquiring, smart routing, recurring payments, enterprise reconciliation, compliance automation, risk management, and high-availability scalability. | $380,000+ |

These figures represent the typical global investment required to build a large-scale, enterprise-grade payment processing platform similar to Worldpay, designed to support high transaction volumes across multiple regions.

Miracuves Pricing for a Worldpay-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete enterprise payment processing foundation with merchant onboarding, secure payment APIs, multi-currency transaction handling, settlement and reconciliation workflows, webhook infrastructure, compliance-ready architecture, and a centralized admin dashboard — built for global scale and long-term operational reliability.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard integration, and deployment assistance — allowing you to launch a fully branded Worldpay-style payments platform under your own ownership.

Launch Your Worldpay-Style Payment Processing Platform — Contact Us Today

Delivery Timeline for a Worldpay-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Number of supported currencies and regions

- Acquiring and settlement logic

- Chargeback and dispute management workflows

- Compliance and security requirements

- API and webhook complexity

- Branding and UI/UX customization

- Reporting and admin control depth

Tech Stack

Built using a JS-based architecture, ideal for enterprise payment processors that require secure transaction handling, scalable microservices, real-time authorization, global availability, and high-throughput performance.

Customization & White-Label Option

Building a Worldpay-style enterprise payment processing platform isn’t just about handling online transactions — it’s about operating a high-availability financial infrastructure that supports multi-channel payments, merchant onboarding, risk controls, international processing, and settlement logic at scale. A platform inspired by Worldpay must be engineered for uptime, routing intelligence, and regulatory alignment across industries and regions.

Miracuves delivers a fully white-label Worldpay-style solution that can be customized for PSPs, aggregators, enterprise merchants, SaaS billing systems, or marketplace payment networks. The platform is structured so you can own the branding, business logic, and operational outcomes without depending on restrictive third-party frameworks.

Why Customization Matters

Enterprise payment environments vary across:

- Regulation (local vs. cross-border)

- Volume models (retail, recurring, B2B, high-ticket SaaS)

- Checkout channels (in-store POS, online, hybrid)

- Reporting depth (merchant vs. portfolio-level)

Customization ensures your payment stack matches the industries you serve, not a generic template.

What You Can Customize

1. UI/UX & Merchant Experience

- Merchant dashboards, onboarding flows, and admin controls

- Account hierarchy for ISO/PSP/aggregator models

- Transaction monitoring, analytics, and settlement insights

- Full white-label interface adaptation for branding

2. Payment Routing & Processing

- Authorization logic, capture, void, refund layers

- Dynamic routing by region, issuer, or payment rail

- Failover routing for uptime continuity

- Partial settlement and batch settlement rules

3. Marketplace & Payout Models

- Split settlements for vendors and service providers

- Escrow-style holding accounts and release triggers

- Wallet logic for multi-party payout handling

- Payout cycles (daily, weekly, on-demand depending on rails)

4. Compliance, Risk & Security

- KYC/KYB onboarding checks

- AML/transaction screening logic

- Fraud rules, velocity alerts, risk scoring

- Audit logs, regulatory export, and compliance reporting

5. Checkout Channels & Integrations

- Hosted checkout, embedded checkout, API-based checkout

- POS integration (if required for retail/hybrid)

- CRM, ERP, eCommerce, and billing platform connectors

- Webhooks, sandbox, and SDK availability

6. Developer & API Ecosystem

- REST API layer for merchant systems

- API key control, sandbox access, webhook testing

- Integration documentation and versioning

- Partner/agency developer access levels

How Miracuves Handles Customization

- Requirement Definition

Identify target industries, processing regions, compliance scope, and volume expectations. - Architecture Planning

Segmenting system into core payment engine, compliance layer, merchant stack, routing logic, and payout infrastructure. - Development & UX Layer

Branding updates, API exposure, merchant tools, marketplace logic, and settlement engine setup. - Testing & Verification

Transaction accuracy checks, latency testing, security validations, regulatory readiness. - Deployment & Operationalization

White-label rollout with dashboards, merchant accounts, settlement configurations, and support tools.

Real Examples from Miracuves Deployments

Miracuves has powered 600+ fintech and commerce stacks, including:

- Payment gateways for SaaS and marketplaces

- Merchant onboarding platforms with compliance automation

- Split-settlement systems for aggregator models

- White-label PSP systems operating under regional rules

These real-world implementations demonstrate how a Worldpay-style system becomes a scalable, branded payment infrastructure that you can operate under your own identity.

Launch Strategy & Market Entry for a Worldpay Clone in 2026

Launching a Worldpay-style payment gateway is no longer just about technical deployment — it is about sequencing decisions, compliance timing, market validation, acquisition channels, and merchant onboarding velocity. A successful launch plan mixes structured execution with aggressive go-to-market systems. When done right, a payment gateway can secure its first 50–100 merchants within the initial 60–120 days.

A strong launch begins with a foundation: product readiness, regulatory alignment, and a market entry map. At the same time, growth depends on merchant onboarding funnels, credibility signals, and the transaction success rate. The combination of both turns a launch into a growth engine, not a rollout.

Before Launch: Core Readiness Checklist

| Stage | Requirement | Outcome |

|---|---|---|

| Product Validation | Test routing, settlements, dashboards | Confidence in transaction performance |

| Compliance Prep | KYC/KYB workflow, AML triggers, PCI alignment | Reduces audit & security risk |

| Infrastructure Setup | Cloud scaling, API rate limits, monitoring | Handles load during traffic spikes |

| GTM Alignment | Identify merchant segments, onboarding script | Faster early conversions |

- Internal load testing and sandbox evaluations are non-negotiable.

- API/SDK documentation should be ready for third-party developer adoption.

Regional Launch Strategies

Entering the market isn’t the same everywhere. Different geographies demand different compliance and user behavior approaches, and the positioning must adapt to that.

| Region | Priority Focus | Market Advantage |

|---|---|---|

| Asia | Multi-wallet + UPI/QR readiness | User familiarity with mobile-first payments |

| MENA | Compliance relationships + FX corridors | Cross-border revenue opportunities |

| Europe (EU/UK) | PSD2/Open Banking alignment | Banking partner integration leverage |

| U.S. | Risk controls + ACH/Stripe alternatives | High merchant ARPU & SaaS ecosystem |

The real differentiator is acquisition speed. Founders must combine credibility-driven outreach (bank partnerships, ISO channels, regional processors) with performance-driven marketing: merchant webinars, partner referral programs, integration incentives, and interchange-based discounts for early adopters. Merchant onboarding must feel guided, not manual. A Worldpay Clone that includes AR KYC guidance, automated document scoring, and smart routing rules decreases friction and improves merchant completion rate. With this structure, momentum is measurable within the first 12 weeks.

User Acquisition & Growth Systems

• Referral bonuses for API-based integrations (+10–20% faster adoption rates)

• Influencer or partner-led acquisition for niche industries (ecommerce, SaaS, marketplaces)

• Automated onboarding drip campaigns for merchants who start but don’t complete verification

• Transaction-based pricing promotions for the first 90-day merchant batch

Simple Growth Formula:

More onboarding = more active merchants = more processed volume = higher settlement revenue

Monetization Models Proven in 2026

- Transaction Fees: Standard per-transaction revenue

- Settlement Charges: Premium for accelerated payouts

- Subscription Add-ons: White-label dashboards or analytics suites

- Value-Added Services: Chargeback automation, advanced fraud tools

Miracuves Launch Support Overview

Miracuves doesn’t leave founders post-deployment. Support spans both infrastructure and strategy:

• Infrastructure setup, scaling, and API monitoring

• Assisted app store/web app submission and debugging

• UI/UX onboarding refinement for conversion boosts

• Merchant onboarding scripts + sales pipeline enablement

• 90-day GTM roadmap with partnership suggestions

With this framework, founders move from deployment to revenue within a structured growth path instead of experimental steps.

Why Choose Miracuves for Your Worldpay Clone

When investors look at a payment gateway or PSP in 2026, they don’t just ask “What’s your product?” They ask: How resilient is your infrastructure? How fast can you scale? Who built your core? This is where Miracuves becomes a strategic advantage, not just a vendor.

Miracuves combines clone engineering, fintech domain knowledge, and execution discipline so founders can launch Worldpay-style platforms with confidence. Instead of reinventing rails, you are building on a battle-tested backbone that already knows how to handle real merchants, real disputes, and real settlements.

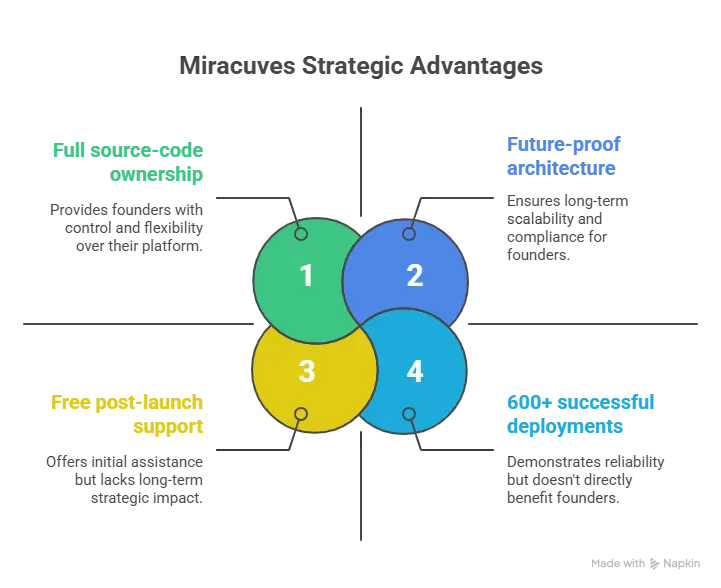

Key Strengths That Matter to Founders

- 600+ successful deployments across fintech, marketplaces, and transaction-heavy platforms, giving Miracuves a deep library of payment, routing, and risk patterns.

- Predictable 30–90 days delivery window for more complex, global, or heavily customized builds.

- Free post-launch support for 60 days, covering monitoring, bug fixes, minor optimizations, and stability tuning.

- Full source-code ownership, so you’re never locked into a black-box SaaS with unpredictable pricing.

- Future-proof architecture that supports multi-region scaling, new payment rails, and compliance upgrades without wholesale rewrites.

Mini Success Story 1 – Regional PSP That Outgrew Its Prototype

A regional fintech wanted to move away from a patchwork payment system built on plugins and freelancers. Using Miracuves Clone Solutions, they migrated to a Worldpay-style architecture with merchant dashboards, routing logic, and automated settlements. Within the first 6 months:

• Transaction failure rates dropped by over 30%

• Merchant onboarding time went from days to hours

• Their platform became “due-diligence ready” for a new funding round

Mini Success Story 2 – Niche B2B Payment Platform for SaaS Merchants

A founder targeting SaaS subscription platforms needed a gateway that could handle recurring billing, card vaulting, and smart retries for failed payments. Starting with the Best Worldpay Clone Script 2026 from Miracuves, they customized fees, dashboards, and risk flows for their niche. Outcome in year one:

• 50+ B2B merchants onboarded

• Stable recurring volume with predictable ARR

• Strong technical narrative for investor pitches (“built on compliant, scalable rails”)

Mini Success Story 3 – Cross-Border Corridor Gateway

Another client focused on a specific cross-border corridor and needed currency conversion, compliance workflows, and settlement visibility for merchants. Miracuves configured the clone with corridor-specific rules, risk scoring, and clear settlement dashboards. The result:

• Faster corridor validation without building everything from scratch

• Easier regulatory communication due to structured logs and audit trails

• A defensible, infrastructure-based moat instead of just a UI difference

Miracuves Is Not Just a Dev Shop – It’s a Fintech Launch Partner

From architectural decisions to GTM-aligned delivery, Miracuves helps you make choices that keep your payment platform scalable, fundable, and exit-ready. You are not just buying code; you are partnering with a team that understands the business side of payments as deeply as the technical side.

Final Thought

In 2026, the real advantage in fintech does not belong only to the giants; it belongs to founders who understand payment logic and move fast with the right technology partner. A Worldpay-style gateway is not just a product idea; it is a long-term infrastructure play. When you combine the proven business model behind Worldpay with a robust, ready-to-customize framework like the Best Worldpay Clone Script 2026, you remove years of trial and error from your journey.

Instead of wrestling with unstable prototypes, scattered freelancers, and compliance surprises, you can step into the market with a platform that is already engineered for scale, security, and merchant trust. That is exactly what Miracuves Clone Solutions offers: a shortcut to a bank-grade foundation without sacrificing ownership, flexibility, or future innovation.

For entrepreneurs who want to launch smarter, scale faster, and dominate niche payment segments, a well-executed Worldpay Clone Development project with Miracuves is not just a technical decision—it is a strategic one.

Ready to launch your Worldpay Clone? Get a free consultation and detailed project roadmap from Miracuves — trusted by 200+ entrepreneurs worldwide.

FAQs

How quickly can Miracuves deploy my Worldpay Clone?

A branded, ready-to-use Worldpay Clone can be deployed within a structured 30–90 days timeline, including setup, customization, integrations, testing, and launch support.

What’s included in the Miracuves Worldpay Clone package?

Merchant onboarding, payment processing, settlements, multi-currency support, admin panel, APIs, routing logic, and compliance-ready features, with branding and customization options.

Can I get full source-code access?

Yes, full ownership is provided so you control the platform, roadmap, and integrations without vendor lock-in or recurring licensing traps.

How does Miracuves ensure scalability?

Cloud-native architecture, auto-scaling, optimized APIs, and load balancing ensure stable performance as merchant volume grows.

Does Miracuves assist with deployment or app store approval?

Yes, support includes deployment, configuration, debugging, and guidance for app stores or live production rollout.

Is post-launch maintenance included?

60 days of free post-launch support is included, with optional long-term maintenance plans.

Can I integrate custom gateways or banking partners?

Yes, integrations for UPI, ACH, SEPA, and other regional rails or acquirers are supported based on market needs.

What about upgrades or updates?

You own the code and can evolve it anytime. Miracuves also offers upgrade modules, security improvements, and feature enhancements.

How does white-labeling work?

Your branding, your domain, your interface — fully white-labeled with zero Miracuves branding anywhere.

What ongoing support can I expect?

Extended technical support, feature development, compliance updates, and scaling assistance to move from launch to growth.

Related Articles

- Best Square Clone Scripts 2025: Build a Scalable POS & Payment Ecosystem Faster

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best Wise Clone Scripts in 2025: Features & Pricing Compared

- Best Remitly Clone Scripts 2025: Launch Your Global Remittance App Faster & Smarter

- Best Stripe Clone Scripts 2025: Build a Scalable Global Payment Infrastructure for Your Startup

- Best PayPal Clone Scripts 2025 Launch a Secure Global Digital Payment Platform