In 2010, a small Bangalore-based startup revolutionized stock trading in India. Zerodha, once an outsider, now processes over 15+ million daily orders and is valued above $3.6B—becoming the world’s largest retail brokerage in trade volume. Its success came from simplicity, ultra-low fees, and technology-first operations.

In 2026, the global retail trading apps market is expected to surpass $19.8B, driven by young investors, mobile-first adoption, and AI-led trading tools. For entrepreneurs, a Zerodha-style platform represents one of the most profitable fintech opportunities: low overheads, scalable revenue, and continuous demand.

A Zerodha Clone Script gives founders the mechanics of a modern trading ecosystem—charting tools, order placement, real-time feeds, KYC, reporting, portfolio tracking, and broker APIs—all without spending years building the core architecture from scratch.

Miracuves empowers entrepreneurs with production-ready trading platforms, engineered for speed, security, compliance, and a flawless user experience.

What Makes a Great Zerodha Clone?

A world-class Zerodha Clone isn’t just a trading app—it’s a high-precision financial engine built for speed, accuracy, and regulatory trust. In 2026, users expect brokerage platforms to execute trades instantly, offer transparent pricing, provide reliable charting tools, and never go down during peak market hours. A great clone must replicate Zerodha’s strengths while giving founders the flexibility to innovate.

At its core, a Zerodha Clone must deliver real-time market data, millisecond-level order execution, and a frictionless user experience. Performance matters: even a 200ms delay can cause slippage losses for active traders. That’s why top-tier brokerage platforms ensure 99.9% uptime and response times under 150ms for order placements.

Security and compliance are equally critical. A robust trading platform must include advanced fraud detection, bank-grade encryption, role-based access, audit logs, and exchange-compliant reporting. With increasing regulatory scrutiny, the backend must be as strong as the frontend.

In 2026, investors want more than charts and buy/sell buttons—they want AI-driven insights, automated strategies, personalized alerts, and intelligent nudges. A great Zerodha Clone integrates these advanced capabilities while maintaining stability and transparency.

Key Attributes of a High-Quality Zerodha Clone

- Ultra-Fast Order Execution under 100–150ms

- Real-Time Market Feeds (Level I & Level II data)

- High Uptime & Load Handling for peak hours

- Professional Charting Tools (50+ indicators, candlestick, Heikin Ashi)

- Regulatory-Ready Systems (KYC, AML, audit logs)

- Advanced Security Stack (256-bit encryption, MFA, secure APIs)

- Cross-Platform Accessibility (Android, iOS, Web)

- Customizable Architecture for multiple asset classes

Comparison Table — Modern Zerodha Clones & Their Differentiators

| Feature | Standard Trading Apps | Modern Zerodha Clone (2026) |

|---|---|---|

| Order Execution Speed | 300–500ms | 100–150ms |

| Charting | Basic | Pro-level charting + 50+ indicators |

| Scalability | Moderate | 50k+ concurrent users |

| Data Feeds | Delayed | Real-time Level 1/Level 2 |

| Security | Standard | Bank-grade + fraud analytics |

| Smart Tools | Few | AI insights + strategy automation |

Essential Features Every Zerodha Clone Script Must Have

A successful Zerodha Clone must combine market-grade trading performance with intuitive user experience, compliance readiness, and institutional security. Traders expect instant execution, accurate data, and smooth navigation, while founders need a backend that is stable, scalable, and easy to manage. A modern trading platform must handle thousands of simultaneous users, real-time chart updates, market volatility spikes, and multi-exchange integration without slowing down. Your Zerodha Clone must deliver a seamless user journey—from onboarding and KYC to portfolio management, order execution, and reporting—while supporting advanced tools like smart alerts, AI-driven insights, and strategy automation. At the backend, the admin panel must allow complete visibility across user activity, compliance logs, order books, deposits/withdrawals, analytics, and risk controls. Broker integrations, API management, and system monitoring should be streamlined to support 24/7 reliability. With Miracuves, all these essential components are engineered for speed, accuracy, regulatory fit, and long-term scalability.

User Side Features

- Real-time market data streaming

- Advanced charting with 50+ indicators

- Instant order placement & modification

- Smart price alerts & notifications

- Easy KYC & onboarding

- Portfolio management & PnL tracking

- Multiple order types (MIS, CNC, BO, CO)

Admin Panel Features

- User verification & KYC/AML controls

- Exchange integration dashboards

- Order book monitoring & logs

- Real-time performance tracking

- API & brokerage management

- Compliance reports & audit trails

- Risk analytics & fraud detection

Broker/Trading Engine Features

- Millisecond-level order execution

- API rate-limit management

- Automated trade routing

- Market-depth visualization

- Real-time logs & error reporting

- AI-driven trade insights & anomaly detection

Advanced 2026-Level Capabilities

- AI-powered trading recommendations

- Automated strategies & rule-based trading

- Behavioral analytics for user retention

- Blockchain-backed transaction logs

- Multi-asset support (Equity, F&O, Commodities, Crypto – optional)

- Biometric login & multi-layer authentication

Technical Architecture Requirements

- Sub-150ms execution time

- Scalable concurrency for 50k+ users

- High-load handling for peak volatility

- Secure WebSockets for real-time feeds

- Encrypted APIs with rate-limiting

- Cloud auto-scaling infrastructure

- Exchange-compliant data pipelines

Feature Comparison Table — Basic vs Professional vs Enterprise

| Feature | Basic | Professional | Enterprise |

|---|---|---|---|

| Real-Time Market Data | ✔ | ✔ | ✔ |

| Level 2 Market Depth | ✖ | ✔ | ✔ |

| Pro Charting (50+ Indicators) | ✖ | ✔ | ✔ |

| Strategy Automation | ✖ | Optional | ✔ |

| AI Trade Insights | ✖ | Optional | ✔ |

| Multi-Asset Support | Limited | Medium | Full |

| White-Label Branding | ✔ | ✔ | ✔ |

How Miracuves Implements These Features

Miracuves builds Zerodha Clone platforms with optimized trading engines, fast WebSocket data handling, multi-exchange connectivity, advanced security, and modular architecture. Every component—from charting to execution—runs with institutional-grade precision. Miracuves ensures smooth scaling, high uptime, AI-enhanced tools, compliance readiness, and complete customization based on your trading model.

Read More: What is Zerodha and How Does It Work?

Cost Factors & Pricing Breakdown

Zerodha-Like Trading & Brokerage Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Core Trading MVP | User onboarding, KYC basics, trading dashboard, equity buy/sell flows, order history, and a simple admin panel. | $80,000 |

| 2. Mid-Level Brokerage Platform | Mobile-first UI, real-time market data, advanced order types, portfolio analytics, notifications, and reporting dashboards. | $190,000 |

| 3. Advanced Zerodha-Level Platform | High-performance trading engine, derivatives & commodities trading, margin logic, risk management systems, compliance automation, and enterprise-grade scalability. | $360,000+ |

These figures represent the typical global investment required to build a low-cost, high-performance trading platform similar to Zerodha, focused on speed, reliability, and large-scale retail trading.

Miracuves Pricing for a Zerodha-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete brokerage and trading foundation with user onboarding, portfolio and order management, real-time market data integration, trade execution workflows, risk-ready architecture, compliance-oriented controls, and a centralized admin dashboard — built for scalable fintech operations.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard and mobile integration, and deployment assistance — allowing you to launch a fully branded Zerodha-style trading platform under your own ownership.

Launch Your Zerodha-Style Trading Platform — Contact Us Today

Delivery Timeline for a Zerodha-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Supported asset classes (equity, F&O, commodities)

- Market-data and exchange integrations

- Order-matching and execution logic

- Compliance, KYC, and regulatory requirements

- Risk management and reporting features

- Branding and UI/UX customization

Tech Stack

Built using a JS-based architecture, ideal for brokerage and trading platforms that require real-time data streaming, secure transaction handling, scalable APIs, low-latency execution, and enterprise-level reliability.

Customization & White-Label Option

Building a Zerodha-style stockbroking and trading platform is not just about providing charts and order placement — it’s about creating a complete, regulation-ready trading ecosystem that is fast, reliable, transparent, and designed for both beginners and experienced traders. A platform inspired by Zerodha must support real-time market data, scalable order execution, portfolio analytics, SIP-style investing flows, back-office reporting, and strong compliance layers while keeping the interface clean and distraction-free.

Miracuves delivers a fully white-label Zerodha-style solution that can be customized for stock brokerages, discount trading platforms, investment apps, or multi-asset trading systems. Every component—from order engines to UI/UX and back-office modules—can be adapted to your operational and regulatory model.

Why Customization Matters

Trading apps differ across:

- Regulations & licensing models (regional compliance, broker partnerships)

- Asset classes offered (stocks, ETFs, mutual funds, derivatives, commodities, crypto where allowed)

- Order handling systems

- Users’ trading behavior

- Back-office workflow requirements

Customization ensures the trading platform matches your technology stack, your compliance regime, and your product philosophy, instead of copying a generic trading flow.

What You Can Customize

1. UI/UX & User Experience

- Market watchlists, charting layouts, order screens

- Themes, typography, colors, and minimalist interface styling

- Navigation structure for web and app

- Dashboard for portfolio, P&L, holdings, and funds summary

2. Order Execution & Trading Workflows

- Market, limit, stop-loss, bracket, cover, and GTT-style orders

- Intraday, delivery, and derivatives flow (region-dependent)

- Real-time orderbook, tradebook, and execution alerts

- Multi-exchange or multi-market support

3. Portfolio & Investment Layer

- Holdings, P&L tracking, asset allocation views

- Mutual fund-style SIP flows (region and licensing dependent)

- Long-term charts, tax reports, transaction history

- Performance analytics and insights

4. User Onboarding & Compliance

- KYC/KYB onboarding with document uploads

- AML screening and risk profiling

- Regulatory disclosures & consent flows

- Eligibility checks for derivatives or advanced modules

5. Charting & Market Data Modules

- Advanced charting with technical indicators

- Multi-timeframe views

- Depth, bid/ask levels (if provided via data partner)

- Real-time refresh with low latency

6. Back-Office & Settlement

- Ledger statements, contract notes, reports

- Funds management (add, withdraw, transfer)

- DP operations, corporate action updates

- Audit logs & reconciliation layers

7. Security & Risk Management

- Role-based access

- Suspicious activity monitoring

- Velocity checks, trading limits

- Encrypted transactions & API security

8. Integrations & Extensions

- Broker APIs / Exchange APIs

- Charting engines, data vendors

- CRM, analytics, and ticketing systems

- Partner apps via REST APIs and webhooks

9. Monetization Models

- Subscription tiers

- Brokerage fee models (zero brokerage, flat fee, discount brokerage)

- Premium charting or advanced data packages

- Partner marketplace for add-ons

How Miracuves Handles Customization

- Requirement Understanding

Define your asset classes, trading model (discount/full-service), regulatory region, and target users. - Architecture & Planning

Modular structure: onboarding → trading engine → market data → portfolio → back-office → compliance. - Design & Development

Branding, UI/UX customizations, order logic, API integrations, and data structuring. - Testing & QA

Latency checks, execution accuracy tests, compliance readiness, load testing, and security audits. - Deployment

Complete white-label rollout with branded dashboards, app publishing, and operational setup.

Real Examples from the Miracuves Portfolio

Miracuves has delivered 600+ fintech and trading solutions, including:

- Stock/ETF trading platforms with real-time dashboards

- Mobile-first discount broker–style apps

- Mutual fund SIP platforms

- Multi-asset trading ecosystems with analytics

- White-label wealth-tech and investment apps

These implementations showcase how a Zerodha-style platform can be transformed into a scalable, fast, and regulation-ready trading ecosystem under your own brand.

Launch Strategy & Market Entry

Launching a Zerodha-style trading platform requires a precise, compliance-ready, and strategically structured market-entry approach. Trading apps are not like typical SaaS products; they operate in a highly regulated, data-sensitive environment where accuracy and reliability determine user trust. Your launch strategy must address pre-launch testing, regulatory preparation, exchange connectivity, user acquisition, and long-term retention from day one. A strong launch begins with ensuring the full trading engine is stable—order execution, chart updates, order book syncing, alerts, margin calculations, and account funding must work flawlessly across devices. Compliance checks for KYC, AML, audit logs, and reporting systems must be completed before onboarding your first user. Exchange APIs must be verified under load conditions to avoid failures during volatility spikes. Market entry varies by region. In India and Southeast Asia, users demand low fees, high-speed execution, and advanced charting. In the Middle East, Sharia-compliant instruments are increasingly important. In Europe, regulation-first branding builds trust. In the U.S., multi-asset access—including equities, options, crypto, and ETFs—helps platforms stand out. A powerful acquisition strategy drives your first wave of traders. Creators and finance influencers play a major role in trader onboarding. Referral programs accelerate virality. Structured educational funnels convert beginners into active traders, while smart notifications, personalized alerts, and AI signals help retain them long-term. Miracuves provides full launch assistance—server setup, app store readiness, exchange API integration, security hardening, and a guided 90-day growth roadmap—ensuring your Zerodha Clone enters the market strong and scales fast.

Pre-Launch Checklist

- Complete KYC/AML integration

- Validate order execution workflow

- Ensure real-time WebSocket performance

- Test margin, PnL, and risk engines

- Prepare app store assets

- Optimize cross-device compatibility

- Set up server monitoring, logs, and backups

Regional Market Entry Strategies

- India & SE Asia: Low-cost trading, advanced charting, F&O tools

- MENA: Sharia-compliant assets, regional indices

- Europe: Regulation-first onboarding and transparent fee structures

- United States: Multi-asset offerings (options, crypto, ETFs)

User Acquisition Framework

- Influencer-led stock market education campaigns

- Referral bonuses to accelerate early growth

- Content funnels explaining trading strategies

- Smart alerts to increase retention

- Goal-based progress rewards for user activation

Proven Monetization Models for 2026

- Brokerage fees (flat or percentage-based)

- Premium analytics subscriptions

- API revenue for algorithmic traders

- Margin interest fees

- Strategy marketplace commissions

Miracuves’ Role in Your Launch Success

Miracuves ensures secure deployment, app store compliance, high-load optimization, stable exchange connectivity, and strategic onboarding to deliver a successful launch and immediate scalability for your trading platform.

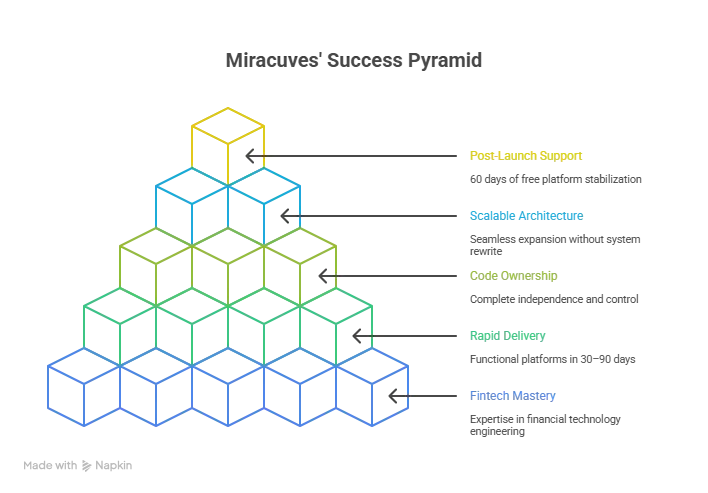

Why Choose Miracuves for Your Zerodha Clone

Choosing the right technology partner determines whether your trading platform becomes a reliable brokerage brand or struggles under the pressure of real-time market demands. A trading platform is not just another app—it is a high-stakes financial system where users trust you with their money, trades, and long-term portfolios. This is why Miracuves stands out as the most dependable partner for Zerodha Clone development. Miracuves combines fintech engineering mastery with high-speed execution technology, secure trading infrastructure, and the ability to deliver fully functional platforms in 30–90 days. With 600+ successful deployments across trading, fintech, banking, lending, and digital wallet ecosystems, Miracuves has firsthand experience dealing with market volatility, compliance challenges, API failures, load spikes, and high-volume trading conditions. Founders value Miracuves not only for delivery speed but also for the assurance of full-source code ownership, giving them complete independence, security, and long-term control. Miracuves’ future-proof modular architecture allows founders to scale seamlessly—whether you want to add new exchanges, expand to global markets, introduce F&O analytics, or build AI-powered trading intelligence without rewriting the system. And after launch, the support continues. With 60 days of free post-launch support, Miracuves stabilizes the platform, monitors live activity, optimizes execution performance, and ensures your system is ready for real traders and high-volume conditions.

Miracuves’ Core Strengths

- 600+ fintech deployments

- 30–90 days rapid delivery

- Full-source code ownership

- Modular, future-proof architecture

- Enterprise-grade security

- Global regulatory readiness

- 60 days of free post-launch support

- Expert guidance for scaling and monetization

Real Client Success Stories

- A retail trading startup launched a full Zerodha-style platform with custom F&O analytics and onboarded 8,000+ active traders in 6 months.

- A European brokerage integrated AI-driven alerts that reduced high-risk trade exposure by 28%.

- A Middle-East fintech used a customized white-label system with local asset support, increasing user retention by 40% in 90 days.

Final Thought

Building a Zerodha-style trading platform in 2026 is more than a business venture—it is an opportunity to empower a new generation of traders with fast, intelligent, and transparent market access. Understanding Zerodha’s model gives entrepreneurs the foundation for success, but pairing that model with Miracuves’ technology creates a powerful advantage: speed, reliability, and scalable infrastructure. With Miracuves, founders gain more than a ready-made clone—they gain a battle-tested fintech backbone that can evolve into a full-fledged brokerage brand. Whether you want to introduce advanced F&O tools, build AI-powered trade assistants, enable multi-asset trading, or expand globally, Miracuves provides the engineering strength and strategic clarity needed to launch fast and scale confidently. Your vision combined with Miracuves’ proven fintech expertise can help you enter the market faster, serve users better, and dominate your segment of the trading economy.

Ready to launch your Zerodha Clone? Get a free consultation and a detailed project roadmap from Miracuves—trusted by 200+ global founders.

FAQs

How quickly can Miracuves deploy my Zerodha Clone?

Miracuves delivers a fully functional, exchange-ready Zerodha Clone within 30–90 days, depending on custom features, integrations, and compliance needs.

What’s included in the Miracuves Zerodha Clone package?

You get the complete trading app, admin panel, real-time charting tools, order engine, user onboarding system, KYC/AML modules, portfolio dashboards, and secure payment integrations.

Will I receive full source-code ownership?

Yes. Miracuves provides 100% source-code ownership, ensuring total control, security, and long-term independence from third-party vendors.

How does Miracuves ensure high-speed order execution?

The platform is built with optimized WebSockets, low-latency APIs, multi-layer caching, and an execution engine capable of handling 100–150ms order placement.

Does Miracuves handle app store approval?

Yes. Miracuves prepares and submits your trading app for Play Store and App Store approval, ensuring compliance with fintech and technical guidelines.

Is post-launch maintenance included?

You receive 60 days of free post-launch support, covering live user monitoring, execution optimization, bug fixes, and early-stage scaling assistance.

Can I integrate multiple exchanges or trading APIs?

Absolutely. Miracuves supports integration with NSE/BSE, global exchanges, crypto platforms, commodity markets, and advanced third-party APIs.

What is the upgrade and update policy?

You can request new features, modules, redesigns, or integrations anytime. The modular architecture allows updates without breaking the core system.

Does Miracuves support white-label branding?

Yes. Every element—from the theme and logo to dashboards, chart skins, and onboarding screens—can be fully white-labeled to reflect your brand identity.

What ongoing support can I expect after the initial period?

Miracuves offers long-term maintenance, server scaling, trading engine enhancements, security updates, premium feature add-ons, and growth consulting for brokerages.

Related Articles

- Best Nubank Clone Scripts 2025: Build the Future of Digital Banking

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best Wealthfront Clone Scripts 2025: Launch Your Automated Investing Platform Faster

- Best Robinhood Clone Scripts 2026 — Build a Modern Trading App That Scales

- Best Betterment Clone Scripts 2026 for Automated Investing Platforms

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Starling Bank Clone Scripts 2026 : Build a Digital Bank That Scales in the Real World