Remitly didn’t start as a giant. It began as a focused idea — solving slow, expensive international transfers for everyday people. Today, its model powers a billion-dollar fintech ecosystem serving global migrant workers, freelancers, expats, and international families. In 2025, the global remittance market is projected to cross $860B+, driven by mobile payments, cross-border trade, and digital wallet adoption. Entrepreneurs entering this industry are not just building an app — they’re entering a high-demand, high-return territory where speed, compliance, and user trust define who wins.

A Remitly Clone Script helps founders launch faster by using an already optimized blueprint: instant transfers, multi-currency support, identity verification, fraud prevention, and global payout routes. That’s where Miracuves Clone Solutions becomes the advantage — ready-made architecture, customizable features, and a delivery timeline designed for rapid go-to-market.

What Makes a Great Remitly Clone?

A great Remitly Clone in 2025 is more than a money transfer app. It is a high-performance, compliance-ready, trust-focused infrastructure that handles cross-border payouts, multi-currency routing, verification, and fraud prevention without delays. Entrepreneurs are not just replicating features; they are building a financial backbone capable of scaling globally. That means fast load times, strong security, low transaction failure rates, and automation that reduces support overheads. A modern Remitly-style system must deliver a frictionless UX where a user can sign up, verify identity, add beneficiary, send money, and track payout status in seconds. Anything slower increases churn, cost, and compliance risk. Performance benchmarks matter: average response time under 300ms, 99.9% uptime, and optimized routing across regions. Modern clones also demand transparent fee displays, compliance modules, AML/KYC integration, blockchain audit trails, and payout automation. These elements turn a clone from “just an app” into a business-building engine.

Core Attributes of a High-Quality Remitly Clone

• Cross-border routing engine with regional payout partners

• Multi-currency support with real-time FX rate calculation

• 2FA + biometric login + encrypted session tokens

• AI-based fraud detection and transaction pattern monitoring

• In-built KYC/AML compliance workflow

• 300ms average load speed and 99.9% uptime reliability

• Modular architecture for adding new countries or payout corridors

Technical Differentiators for 2025

• AI underwriting for high-risk profile detection

• Blockchain-based transaction verification for audit transparency

• Cross-platform web + Android + iOS deployment

• PCI-DSS grade payment gateway compliance

• Microservices with autoscaling for peak transaction hours

• Cloud environments: AWS / DigitalOcean / Azure

Remitly Clone Comparison Overview

| Factor | Traditional Builds | Basic Clone Scripts | Miracuves Remitly Clone |

|---|---|---|---|

| Deployment Time | 8–14 months | 4–6 months | 30–90 days |

| Compliance Setup | Manual & Expensive | Limited | Built-in AML/KYC + PCI-DSS |

| Scalability | Low without rebuild | Moderate | High with microservices |

| Cost Efficiency | Highest | Medium | Best ROI for startup launch |

| Global Readiness | Not optimized | Partial | Multi-region ready |

Essential Features Every Remitly Clone Must Have

A Remitly-style platform succeeds when every user flow feels effortless: onboarding, verification, adding beneficiaries, sending money, and tracking payouts. If even a single step feels confusing or slow, users abandon the transaction. That’s why a 2025-ready Remitly Clone must deliver speed, clarity, global routing intelligence, and compliance baked into the experience. A proper build is not just a “remittance app”—it is a layered financial ecosystem connecting users, admin teams, and payout partners across countries in real time.

User Side (Sender)

• Smooth registration with KYC verification

• Multi-currency wallet + live FX rate visibility

• Country-wise fees, delivery speed, payout options

• Instant payments, scheduled transfers, recurring transfers

• Real-time transfer tracking + delivery confirmation

• Biometric login + encrypted identity storage

• Auto-detection of high-risk routes for user safety

Admin Panel (Control Center)

• Dynamic fee management and FX markup controls

• AML rules, sanctions list screening, fraud prevention alerts

• Manual/automated verification for flagged transfers

• Agent/partner onboarding with tiered permissions

• Settlement reports, corridor-wise analytics, payout reconciliation

• API keys and regional compliance configuration

• Chargeback management and dispute handling

Recipient/Partner Side

• Earnings dashboard with withdrawal controls

• KYC-based onboarding for beneficiaries or partner agents

• Payout selection: bank, wallet, agent pick-up, card

• Real-time transaction confirmation and issue reporting

Advanced 2025 Features

• AI-based personalization for transfer suggestions

• AR onboarding for identity + document scanning

• Blockchain-based verification for transaction audit trails

• Smart routing engine to reduce payout delays and banking failures

• Global tax schema mapping for cross-region regulations

Technical Architecture Requirements

• Microservices architecture for scalability

• Load balancing for peak transfer hours

• AES-256 + tokenization + SSL pinning for security

• PCI-DSS grade handling for payment data

• Third-party integrations: currency API, ID verification API, fraud detection API

• Cloud deployment on AWS, DigitalOcean, or Azure with auto-scale support

Feature Comparison Matrix

| Features | Basic | Professional | Enterprise |

|---|---|---|---|

| Android + iOS App | ✔ | ✔ | ✔ |

| Web Portal | ✔ | ✔ | ✔ |

| Multi-Currency Routing | ✖ | ✔ | ✔ |

| AI Fraud Detection | ✖ | Limited | ✔ |

| Blockchain Audit Layer | ✖ | ✖ | ✔ |

| Global Corridor Expansion | Manual | Semi-auto | Fully automated |

| Delivery Time | 30–60 days | 45–75 days | 30–90 days |

Miracuves doesn’t just include these features; it implements them with production-ready code, real routing logic, and scalable architecture so founders can go live confidently instead of experimenting.

Read More : What is Remitly and How Does It Work?

Cost Factors & Pricing Breakdown

Remitly-Like International Money Transfer Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Remittance MVP | User onboarding, KYC basics, send & receive money flow, exchange rate display, transaction history, and a simple admin panel. | $60,000 |

| 2. Mid-Level Cross-Border Payments Platform | Web dashboards, multi-currency support, real-time FX rates, bank & wallet integrations, notifications, fee configuration, and analytics dashboards. | $150,000 |

| 3. Advanced Remitly-Level Platform | Local & international payouts, corridor-based pricing, compliance automation, fraud detection, delivery speed optimization, reporting, and enterprise-grade scalability. | $300,000+ |

These figures represent the typical global investment required to build a trusted cross-border money transfer platform similar to Remitly, focused on speed, transparency, and regulatory compliance.

Miracuves Pricing for a Remitly-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete international remittance foundation with user onboarding, multi-currency handling, FX rate management, transfer workflows, fee configuration, compliance-ready architecture, fraud-prevention hooks, and a centralized admin dashboard — built for long-term scalability and global operations.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard integration, and deployment assistance — allowing you to launch a fully branded Remitly-style money transfer platform under your own ownership.

Launch Your Remitly-Style Money Transfer Platform — Contact Us Today

Delivery Timeline for a Remitly-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Number of supported countries and corridors

- Compliance, KYC, and AML requirements

- Bank, wallet, or payout partner integrations

- Exchange rate and fee logic complexity

- Branding and UI/UX customization

- Reporting and admin control depth

Tech Stack

Built using a JS-based architecture, ideal for cross-border fintech platforms that require secure transaction processing, real-time FX updates, scalable APIs, and high availability across regions.

Customization & White-Label Option

Building a Remitly-style international remittance platform isn’t just about sending money across borders — it’s about creating a compliance-ready, trust-centric financial system that supports global transfers, multi-currency settlement, payout corridors, KYC verification, and risk controls without compromising on user experience. A platform inspired by Remitly must balance speed, regulatory alignment, banking integrations, and operational transparency for both senders and receivers.

Miracuves delivers a fully white-label Remitly-style solution that can be customized for regional money transfer operators, cross-border fintechs, expat-focused remittance services, or financial brands expanding into global payments. The system is structured so you can adapt corridors, fees, onboarding flows, security layers, and branding to your own market model.

Why Customization Matters

Cross-border money movement varies by:

- Destination country regulations

- Local banking rails and payout methods

- KYC requirements and transfer limits

- FX margins and operational cost structure

Customization ensures your remittance platform is not generic — it becomes a purpose-built solution for the regions and user segments you serve.

What You Can Customize

Complete UI/UX Personalization

- Sender/receiver dashboards for app and web

- Transfer history, receipt pages, and status tracking

- Branding, color systems, typography, and layout

- Language/locale customization for regional markets

Transfer & Settlement Flows

- Bank deposit, cash pickup, wallet credit, and mobile money routes

- Real-time or delayed settlement rules (depending on payout rails)

- Transfer corridor configuration (country → country routes)

- FX margin logic, conversion handling & rate visibility

KYC, KYB & Compliance Workflow

- ID verification flows, document checks, address proof

- AML risk scoring & transaction surveillance

- Region-based transfer limits and approval rules

- Audit logs, record retention, and compliance reporting

Payout Network & Banking Integrations

- API connections to local banks, IMTOs, money wallets, and payout agents

- Automated settlements, batch payouts, or manual approval models

- Integration with SWIFT, RTP, ACH, SEPA, or regional rails (as applicable)

Fees, Margins & Pricing

- Corridor-wise fee brackets

- FX markup rules and margin controls

- Tiered pricing for loyal or high-volume users

- Partner/agent commission models

Communication & Support Tools

- SMS/email/push notifications for transfer updates

- Chat, ticketing, and multilingual help center support

- Status escalation rules for delayed transactions

APIs, Webhooks & Extensions

- REST APIs for partner apps and integrations

- Webhooks for status events and settlement confirmations

- Accounting, ERP, CRM, and analytics connectors

How Miracuves Handles Customization

- Requirement Understanding

We map your target corridors, compliance regime, KYC category, and user experience goals. - Architecture & Planning

Transfer engine, FX logic, KYC layer, settlement flow, payout routing, and dashboards are structured as modular systems. - Design & Development

Custom UX, transfer rules, and compliance logic implemented to your operational model. - Testing & QA

Transaction accuracy checks, security audits, KYC data validation, and controlled sandbox flow verification. - Deployment

A fully white-labeled remittance platform is deployed with your domain, branding, and operational configuration.

Real Examples from the Miracuves Portfolio

Miracuves has powered 600+ fintech and marketplace deployments, including:

- International remittance apps with multi-currency support

- Wallet-to-bank and bank-to-bank transfer systems

- Fintech onboarding & KYC automation platforms

- White-label global payout systems for regional operators

These implementations show how customization transforms a Remitly-style platform into a scalable, compliant, and trust-focused remittance product that aligns with real-world financial operations.

Launch Strategy & Market Entry for Your Remitly Clone

Launching a Remitly-style platform is not only a tech project — it is a compliance, marketing, and trust-building mission. The fastest-growing remittance startups in 2025 follow a focused strategy: pick the right corridor, establish payout partners early, validate acquisition channels, and launch with a minimum-complexity operational model. Miracuves structures the launch roadmap so founders avoid common traps like unclear KYC policies, blocked store approvals, unsupported payout regions, or unstable FX flows.

Pre-Launch Checklist

• Corridor selection + user persona targeting (one send country → one receive country)

• KYC/AML setup: accepted documents, threshold rules, verification sequence

• FX + fee model configuration (flat fee, percentage, FX markup, hybrid)

• Payment gateway integrations + local payout partners

• App store readiness: screenshots, compliance text, permissions mapping

• Legal pages: terms, privacy, refund & dispute policy, compliance disclosures

Regional Market Entry Strategies

Asia: Strong for wallet-to-bank transfers and agent pickup. Focus: low fees, multi-language UI, WhatsApp onboarding.

MENA: Compliance-first markets; emphasize AML clarity, identity screening, and partner onboarding.

Europe: Requires licensing clarity and PSD2-aligned flows. Prioritize frictionless UX and SEPA payout options.

U.S.: Most competitive but high revenue per user; marketing must highlight transparency, delivery speed, and fee logic.

User Acquisition Framework (Start Fast, Scale Smart)

• Influencer partnerships in diaspora communities

• Referral loops with bonus credits for first transfer

• Localized ads targeting specific corridors, not broad countries

• Onboarding funnels using WhatsApp, Facebook Groups, regional communities

• Retention triggers: scheduled transfers, saved beneficiaries, auto FX lock reminders

Monetization Models Proven in 2025

Fee-based transfers: Fixed, percentage, or hybrid.

FX markup: Silent revenue layer through rate differentials.

Subscription premium: Faster payouts, priority support, lower fees.

Partner revenue: Wallets, banks, and agents share fees on corridor volume.

Technical & Operational Launch Support by Miracuves

• Hosting setup on AWS / DigitalOcean / Azure

• API configurations for ID verification + currency feeds

• App store submission guidance + compliance text recommendations

• Admin training for transaction review, dispute control, and corridor expansion

• First 90-day growth roadmap with KPI targets (onboarding rate, activation %, CAC, CTR)

Go-To-Market Formula (Compact)

Corridor selection → Compliance setup → Payout partner onboarding → MVP launch → Community marketing → Retention + referrals → Scale corridors.

Miracuves’ delivery promise keeps founders launch-ready within 30–90 days, not stuck in endless development.

Why Choose Miracuves for Your Remitly Clone

In cross-border fintech, the difference between a “launched app” and a “scaling business” usually comes down to the technology partner behind it. Many founders discover this the hard way—after burning months with fragmented teams, unstable code, and compliance headaches. Miracuves enters at the opposite end of that spectrum: as a specialized partner for Best Remitly Clone Script 2025 builds, with real-world experience and a repeatable delivery model.

With 600+ successful deployments across fintech, marketplaces, and on-demand ecosystems, Miracuves doesn’t rely on theory. The Remitly Clone stack is built from modules that have already survived production traffic, real payments, and high-stakes compliance scenarios. That is why founders use Miracuves when they want to move fast without gambling on untested prototypes.

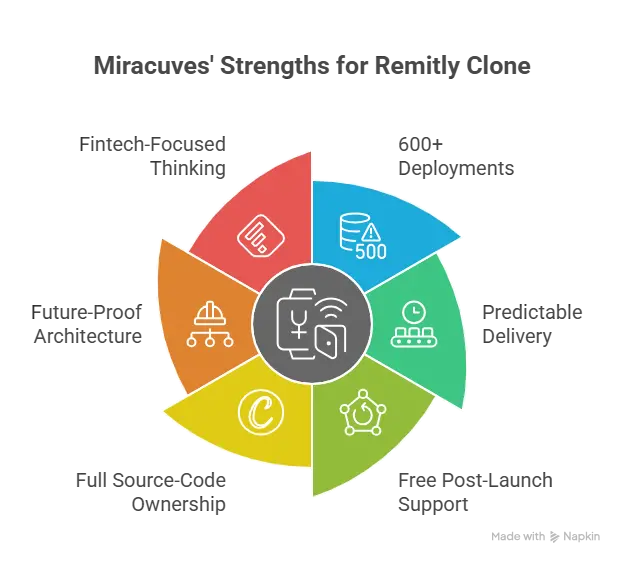

Key Strengths That Matter To Founders

• 600+ deployments: A deep library of patterns for remittance, KYC, payouts, and multi-region operations.

• Predictable 30–90 days delivery window: From discovery to launch, aligned with your customization level and corridor complexity.

• Free post-launch support (60 days): Bug fixes, stability tuning, minor refinements, and handholding through early user feedback.

• Full source-code ownership: No lock-in. You control the roadmap, integrations, and future teams.

• Future-proof architecture: Microservices, cloud-native deployment, and modular integrations for new corridors and partners.

• Fintech-focused thinking: Miracuves treats your clone as a regulated-grade platform, not just another “app project.”

Real Stories, Real Outcomes (Condensed Case Snapshots)

Case 1 – Niche Africa–Europe Corridor Startup

A founder targeting a very specific Africa–Europe remittance corridor came to Miracuves after months of stalled progress with freelancers. Using Miracuves Clone Solutions, they:

• Launched an MVP within a 30–60 days window.

• Integrated corridor-specific KYC rules and local payout partners.

• Hit consistent four-figure monthly transaction volumes within the first few months, with room to scale corridors later.

Case 2 – Multi-Brand Fintech Group

A small fintech group wanted to operate multiple brands on top of a single core engine. Miracuves delivered a customized Remitly Clone setup with:

• Multi-tenant architecture for several brand front-ends.

• Shared compliance and routing logic with brand-level configuration.

• A roadmap to expand from one region to multiple markets without rewriting the core.

Case 3 – Compliance-Heavy Market Entry

A founder entering a compliance-heavy region needed strong AML/KYC workflows built in from day one. Miracuves implemented:

• Advanced rule-based AML engine and document flows.

• Sanctions screening integration and audit-ready logs.

• An admin panel that made regulatory reporting predictable instead of painful.

In each scenario, the combination of Best Remitly Clone Development practices, proven modules, and clear timelines allowed founders to spend more energy on partnerships, licenses, and growth—rather than debugging basic flows.

Final Thought

A Remitly-style platform is not just a digital product. It is an operational, regulatory, and user-trust machine. In 2025, founders who win in the remittance space are not the ones who reinvent everything from scratch — they are the ones who leverage proven architectures, launch faster, validate with real users, secure partnerships early, and scale with intent. Miracuves turns that philosophy into practice. By combining ready-made modules, full source-code ownership, white-label flexibility, and a 30–90 days delivery window, the Remitly Clone Solution becomes more than a shortcut — it becomes a launchpad.

Instead of waiting a year to enter the market, you can start validating your corridor, onboarding early users, and optimizing acquisition channels. Instead of struggling with fragmented development, you get a structured roadmap backed by fintech experience. And instead of gambling your budget on experimentation, you invest in scalability, security, and growth.

Your competitive advantage will not just be the app you launch — it will be the speed, clarity, and confidence with which you operate it.

Ready to launch your Remitly Clone? Get a free consultation and detailed project roadmap from Miracuves — trusted by 200+ entrepreneurs worldwide.

FAQs

How quickly can Miracuves deploy my Remitly Clone?

Delivery depends on scope and customization, but a market-ready version is typically launched within 30–90 days, including branding, onboarding flows, and corridor setup.

What’s included in the Miracuves Remitly Clone package?

You get Android + iOS apps, web portal, admin panel, KYC/AML setup, multi-currency support, payout routing logic, basic compliance configuration, and API integration structure.

Can I get full source-code access?

Yes. Full source-code ownership is included so you can scale, customize, or build future features without dependency or license lock-ins.

How does Miracuves ensure scalability for high transaction volume?

The system uses microservices architecture, load balancing, optimized database structure, autoscaling servers, and PCI-DSS aligned handling to handle region-based demand spikes.

Does Miracuves assist with app store approval?

Yes. Guidance is provided for app store submission, permission mapping, compliance wording, and policy pages to avoid rejection or delays.

Is post-launch maintenance included?

A 60-day support period is included covering stability fixes, minor adjustments, and early feedback improvements once live.

Can Miracuves integrate custom payment gateways and local banks?

Yes. Regional gateways, local banks, wallet payouts, partner settlements, and corridor-specific payment flows can be integrated based on market needs.

What’s the upgrade/update policy after delivery?

Post-launch upgrades, new feature modules, and regional expansion are handled using a structured request model so improvements never affect system stability.

How does white-labeling work?

Branding, UI, naming, logos, color palette, and store listings are configured with your identity, ensuring the app is fully presented as your product.

What kind of ongoing support can I expect?

Support includes maintenance plans, security updates, performance tuning, corridor expansion, and optional growth partnership for long-term scaling.

Related Articles

- Best Square Clone Scripts 2025: Build a Scalable POS & Payment Ecosystem Faster

- Best Binance Clone Scripts in 2025: Features & Pricing Compared

- Best Wise Clone Scripts in 2025: Features & Pricing Compared

- Best Checkout.com Clone Scripts 2025: Build a High-Performance Payment Gateway

- Best Stripe Clone Scripts 2025: Build a Scalable Global Payment Infrastructure for Your Startup

- Best PayPal Clone Scripts 2025 Launch a Secure Global Digital Payment Platform