What makes the Business Model of Farfetch fascinating—and highly relevant for entrepreneurs in 2025—is that it does not behave like a traditional eCommerce company. Instead, it blends:Farfetch operates as a two-sided luxury marketplace, supported by enterprise SaaS infrastructure for brands, integrated logistics, data and personalization technology, and strategic ownership stakes that strengthen ecosystem control.

For founders exploring marketplace apps, high-ticket platforms, SaaS + commerce hybrids, or global-scale ecosystems, Farfetch offers a masterclass in how technology can modernize even the most tradition-bound industries—without owning inventory.

At Miracuves, we closely study models like Farfetch because they demonstrate how platform-first thinking, modular monetization, and ecosystem leverage can unlock massive scale—even in complex, regulated, brand-sensitive markets like luxury.

How the Farfetch Business Model Works

Farfetch operates as a hybrid luxury technology platform, not a traditional retailer.

At its core, Farfetch connects luxury consumers, independent boutiques, and global brands through a unified digital infrastructure that handles discovery, transactions, logistics, and data intelligence—without owning most of the inventory.

This platform-first architecture is the key to Farfetch’s scalability.

Core Business Model Framework

Type of Model

- Primary: Two-sided marketplace

- Secondary: Enterprise SaaS + logistics enablement

- Structure: Asset-light, platform-driven, globally distributed

Unlike D2C luxury brands, Farfetch does not manufacture or stock products at scale. Instead, it orchestrates supply from thousands of boutiques and brand partners .

Value Proposition by User Segment

For Luxury Consumers

- Access to global luxury inventory unavailable locally

- Authenticity-guaranteed products

- Personalized discovery using AI-driven recommendations

- Cross-border luxury shopping with local delivery experience

For Boutiques & Brands

- Global reach without building direct eCommerce infrastructure

- End-to-end services: storefronts, payments, logistics, fraud, customer service

- Demand insights and pricing intelligence

- Reduced operational complexity while retaining brand control

For Partners

- APIs and modular services enabling white-label or embedded commerce

- Access to high-value luxury consumers

Key Stakeholders & Their Roles

- Consumers: Demand engine and data generator

- Boutiques: Inventory suppliers and local expertise

- Luxury Brands: Anchor demand and credibility

- Farfetch Platform: Orchestrator of trust, logistics, data, and monetization

- Logistics & Payment Partners: Fulfillment reliability and global reach

Ecosystem balance is maintained by strict brand governance, quality control, and compliance—critical in luxury markets.

Evolution of the Model

Farfetch’s model has evolved through clear phases:

- Marketplace Aggregation (2007–2015)

Connecting independent boutiques to global buyers. - Luxury Platform Expansion (2016–2020)

Adding brand partnerships, private APIs, and logistics. - Ecosystem & Infrastructure Play (2021–2024)

Enterprise solutions like Farfetch Platform Solutions (FPS), data services, and operating system ambitions. - Restructuring & Focus (2024–2025)

Streamlining operations, reducing cost structures, and focusing on profitable platform layers.

This evolution reflects a shift from growth-at-all-costs to sustainable platform economics.

Why the Model Works in 2025

- Luxury consumers expect global choice + local experience

- Brands want control without tech overhead

- Cross-border commerce is normalized

- AI-driven personalization increases conversion for high-ticket items

- Asset-light models outperform inventory-heavy retailers during demand volatility

Farfetch thrives because it sits at the intersection of luxury, technology, and logistics—while letting each stakeholder do what they do best.

Read more : What is Farfetch and How Does It Work?

Target Market & Customer Segmentation Strategy

Farfetch’s growth is powered not by mass-market reach, but by precision targeting of high-value luxury segments. Its customer strategy is designed around high lifetime value, global mobility, and brand loyalty, not impulse buying.

Primary & Secondary Customer Segments

Primary Segment: Global Luxury Consumers

- High-income individuals (HNWIs & affluent professionals)

- Age group: 25–45, digitally native luxury buyers

- Behavior-driven rather than location-driven

- Value exclusivity, authenticity, and access over discounts

Secondary Segments

- Fashion-forward millennials and Gen Z aspirational buyers

- Cross-border shoppers in emerging luxury markets (Middle East, Asia-Pacific)

- Brand-loyal customers seeking limited editions and hard-to-find items

Luxury for Farfetch is not about volume—it’s about frequency × basket size × retention.

Customer Journey Mapping

Discovery

- Organic search and brand-led SEO

- Editorial content, runway curation, influencer collaborations

- Social commerce integrations and app-based discovery

Conversion

- Personalized product feeds using browsing and purchase signals

- Localized pricing, currency, duties, and shipping transparency

- Trust signals: authentication, brand partnerships, buyer protection

Retention

- Personalized styling recommendations

- Early access to collections and exclusive drops

- Loyalty-driven re-engagement and tailored communication

Farfetch optimizes customer lifetime value (LTV) rather than transaction volume.

Acquisition Channels by Segment

- High-LTV buyers: Editorial storytelling, luxury brand partnerships

- Emerging market users: Localized mobile-first experience

- Repeat customers: App-based personalization and CRM intelligence

Paid acquisition exists, but brand equity and organic demand dominate Farfetch’s funnel—an important lesson for premium platforms.

Market Positioning & Competitive Edge

Farfetch positions itself as a neutral luxury technology partner, not a competing retailer.

Key differentiation points:

- Largest distributed luxury inventory network

- Brand-safe marketplace governance

- Tech infrastructure that scales globally without inventory risk

- Ability to serve both consumers and enterprise brands

In a market where Amazon can’t win on brand trust and traditional luxury brands can’t scale tech fast enough, Farfetch owns the middle ground.

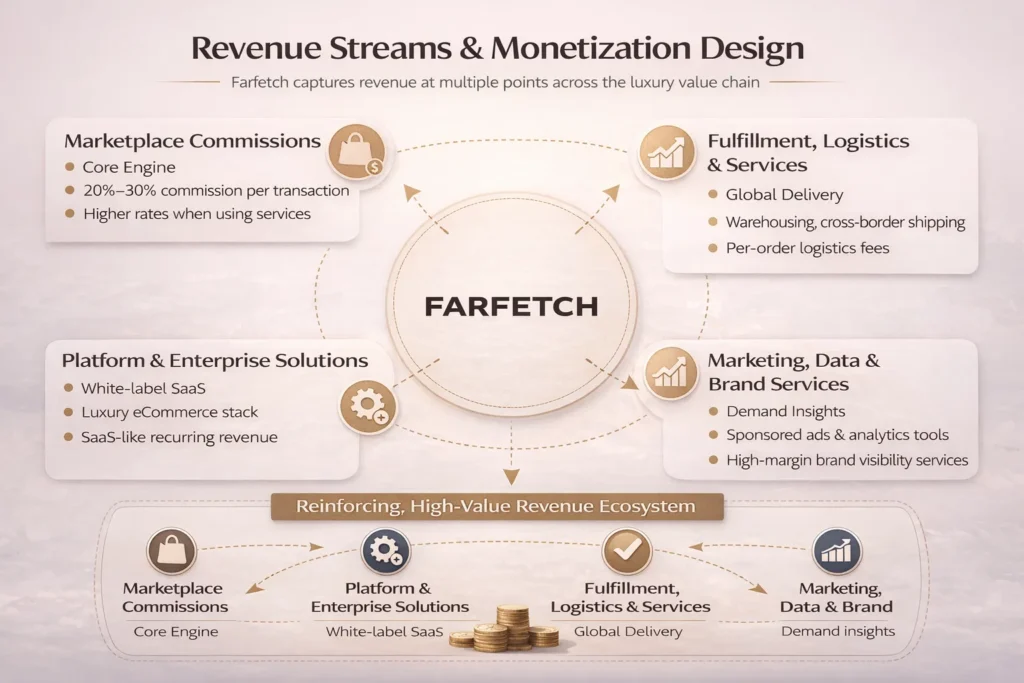

Revenue Streams and Monetization Design

Farfetch’s monetization strategy is intentionally layered and modular. Instead of relying on a single revenue lever, it captures value at multiple points across the luxury value chain—from transactions to technology to services.

This diversification is critical in luxury, where margins, demand cycles, and brand power fluctuate.

Primary Revenue Stream 1: Marketplace Commissions (Core Engine)

Mechanism

Farfetch earns a commission on every transaction completed on its marketplace between consumers and boutiques or brands.

Pricing Model

- Commission-based, typically 20%–30% depending on partner type and services used

- Higher take rates when Farfetch handles logistics, payments, and customer service

Revenue Contribution

- Largest share of Farfetch’s revenue

- Directly tied to Gross Merchandise Value (GMV)

Growth Trajectory

- Expansion into high-growth luxury categories (sneakers, accessories, beauty)

- Increased attach rate of platform services to raise effective take rate

This stream scales efficiently because Farfetch does not carry inventory risk.

Secondary Revenue Stream 2: Platform & Enterprise Solutions (FPS)

Mechanism

Farfetch provides white-label eCommerce infrastructure to luxury brands, enabling them to run their own digital channels using Farfetch’s technology stack.

Includes

- Website and app infrastructure

- Payments, fraud prevention, and compliance

- Data analytics and personalization tools

Why It Matters

- Recurring, SaaS-like revenue

- Deepens brand dependency on Farfetch’s ecosystem

- Improves margin stability versus pure marketplace income

Secondary Revenue Stream 3: Fulfillment, Logistics & Services

Mechanism

- Warehousing, cross-border shipping, returns, and last-mile delivery

- Premium services for faster or white-glove delivery

Pricing Model

- Per-order and service-based fees

- Margin-enhancing when bundled with marketplace commissions

This turns operational complexity into a monetizable advantage.

Secondary Revenue Stream 4: Marketing, Data & Brand Services

Mechanism

- Sponsored placements and visibility tools for brands

- Data insights on consumer demand, pricing, and trends

- Editorial and campaign integrations

Strategic Value

- High-margin, low-cost revenue

- Monetizes attention without harming brand equity

- Strengthens Farfetch’s role as a demand intelligence hub

How the Monetization System Works Together

Farfetch’s revenue streams are designed to reinforce each other:

- Marketplace drives volume

- Platform services lock in partners

- Logistics increases take rate

- Data services improve conversion and retention

Pricing psychology is subtle and brand-safe—focused on value creation, not discounting. Tiered services encourage upselling while preserving luxury positioning.

This interconnected architecture makes Farfetch’s business model more resilient than single-stream marketplaces.

Read more : Farfetch Revenue Model: How Farfetch Makes Money in 2025

Operational Model & Key Activities

Farfetch’s business model works because of a highly orchestrated operational engine running behind the scenes. While the brand appears elegant and minimal to consumers, the underlying system is complex, data-driven, and globally distributed.

This is where Farfetch truly behaves like a luxury operating system, not just a marketplace.

Core Operations

Platform Management

- Marketplace governance and quality control

- Brand onboarding and compliance verification

- Product catalog normalization across thousands of sellers

Technology Infrastructure

- Scalable cloud architecture for global traffic

- AI-driven personalization and search ranking

- Fraud detection, payments, and identity verification

- API-first design for enterprise integrations

Customer Experience & Support

- Multilingual, multi-time-zone customer support

- Returns and dispute resolution

- Authentication and trust assurance processes

Marketing & Merchandising

- Editorial content and digital storytelling

- Personalized campaigns and push notifications

- Brand-safe merchandising rules

Resource Allocation Strategy (2024–2025)

Farfetch allocates resources toward technology and ecosystem efficiency, not inventory accumulation.

- Technology & Product: ~35–40%

Platform stability, AI, personalization, enterprise tools - Marketing: ~20–25%

Brand storytelling, partnerships, retention campaigns - Operations & Logistics: ~20%

Fulfillment, cross-border delivery, returns optimization - People, Compliance & R&D: ~15–20%

Security, governance, regional expansion readiness

Operational Advantages

- Asset-light structure reduces capital risk

- Centralized tech with decentralized inventory

- Data visibility across global demand and supply

- Ability to scale new regions without warehouses

These advantages allow Farfetch to adapt quickly to demand shifts, regulatory changes, and market volatility—something inventory-heavy luxury retailers struggle with.

Strategic Partnerships & Ecosystem Development

Farfetch’s long-term advantage does not come from owning brands or inventory—it comes from owning the connective tissue of the luxury ecosystem. Its partnership strategy is designed to create mutual dependency, not simple vendor relationships.

Farfetch positions itself as a neutral, technology-first enabler, which allows it to collaborate with brands, boutiques, and institutions that would otherwise avoid third-party platforms.

Core Partnership Philosophy

- Enable partners to grow without losing brand control

- Monetize services, not ownership

- Build long-term platform reliance through technology and data

- Avoid direct competition with partners’ D2C channels

This philosophy is critical in luxury, where brand sovereignty matters more than reach alone.

Key Partnership Types

1. Technology & API Partners

- Cloud infrastructure and AI tooling partners

- Commerce APIs integrated into brand-owned digital channels

- Data and personalization engines

These partnerships allow Farfetch to scale globally while keeping its core platform modular and upgradeable.

2. Payment, Logistics & Fulfillment Alliances

- Cross-border payment providers

- Customs, tax, and duty automation partners

- Last-mile delivery and reverse logistics providers

Instead of building everything in-house, Farfetch orchestrates best-in-class providers, turning complexity into a competitive moat.

3. Luxury Brand & Boutique Partnerships

- Thousands of independent boutiques worldwide

- Strategic brand alliances with top luxury houses

- Brand-specific rules for pricing, visibility, and merchandising

These partners supply inventory while Farfetch supplies demand, technology, and data intelligence.

4. Marketing & Distribution Partners

- Fashion media and editorial platforms

- Influencer and cultural collaborations

- Event-driven and seasonal campaign partners

This reinforces Farfetch’s positioning as a luxury authority, not just a sales channel.

5. Regulatory & Market Expansion Alliances

- Local compliance and tax advisors

- Regional logistics operators

- Market-entry partners in Asia, Middle East, and emerging luxury markets

These partnerships reduce friction in new regions without heavy capital investment .

Ecosystem Strategy: Why It Works

Farfetch’s ecosystem creates multi-layered network effects:

- More boutiques → broader selection → more consumers

- More consumers → higher GMV → better partner economics

- More data → better personalization → higher conversion

Monetization is embedded into the ecosystem through:

- Platform fees

- Service upgrades

- Data and visibility tools

This ecosystem-centric approach makes Farfetch difficult to displace—even by brands that could technically build their own platforms.

Read more : Best Farfetch Clone Scripts 2025 – Launch a Scalable Fashion Marketplace

Growth Strategy & Scaling Mechanisms

Farfetch’s growth has never been about rapid inventory expansion—it has been about systematic ecosystem scaling. The company grows by deepening platform value, expanding services, and unlocking new demand layers rather than chasing raw user volume.

Primary Growth Engines

1. Organic Demand & Brand-Led Virality

- Strong SEO and editorial-driven discovery

- Cultural relevance through fashion weeks and luxury events

- Word-of-mouth among high-value luxury buyers

Farfetch benefits from prestige-driven virality, where brand association fuels organic growth.

2. Platform Expansion & Enterprise Adoption

- Onboarding more luxury brands onto Farfetch Platform Solutions

- Selling modular services (payments, data, logistics)

- Expanding white-label infrastructure usage

This creates non-linear revenue growth without proportional marketing spend.

3. Category & Product Line Expansion

- Expansion into sneakers, streetwear, beauty, and luxury resale

- Focus on high-frequency luxury categories to improve repeat usage

- Capsule collections and exclusive drops to increase engagement

4. Geographic Scaling Model

- Market-by-market rollout using local partners

- Localization of language, currency, taxes, and delivery

- Focus on high-growth luxury regions: Asia-Pacific, Middle East

Farfetch scales regions digitally first—without physical store investments.

Scaling Challenges & How Farfetch Addressed Them

Operational Complexity

- Thousands of sellers with inconsistent standards

→ Solved via strict platform governance and product normalization

Margin Pressure

- High logistics and return costs

→ Mitigated by service bundling and operational optimization

Brand Trust & Control

- Luxury brands resist marketplaces

→ Addressed through brand-safe rules and enterprise tooling

Regulatory Friction

- Cross-border compliance and taxes

→ Managed through specialized partnerships and automation

Growth Discipline in 2025

Post-2023 restructuring, Farfetch shifted toward:

- Cost rationalization

- Profit-focused platform layers

- Core-market optimization over aggressive expansion

This transition reflects a maturing platform optimizing for sustainable growth, not vanity metrics.

Competitive Strategy & Market Defense

Farfetch operates in one of the most competitive and brand-sensitive industries in the world. Its survival and leadership depend on defensibility, not just growth. Farfetch’s competitive strategy is built around structural advantages that are difficult to replicate quickly.

Core Competitive Advantages

1. Network Effects

- More boutiques and brands → broader luxury inventory

- More inventory → better customer choice

- More customers → higher GMV and partner value

This creates a self-reinforcing ecosystem that strengthens over time.

2. Brand Equity & Trust

- Authentication guarantees

- Strong luxury brand partnerships

- Editorial positioning rather than price-led selling

Luxury brands trust Farfetch because it protects pricing integrity and brand storytelling.

3. Technology & Data Advantage

- AI-driven personalization for high-ticket items

- Demand forecasting across global markets

- Real-time insights for brand partners

Farfetch doesn’t just sell products—it sells intelligence.

4. High Switching Costs

- Deep integrations with brand tech stacks

- Dependence on Farfetch logistics, payments, and data

- Operational complexity makes exit costly for partners

Market Defense Tactics

Handling New Entrants

- Focus on service depth over price competition

- Reinforce brand-safe positioning rather than discounts

- Expand enterprise services that competitors lack

Responding to Pricing Wars

- Avoids margin-eroding race-to-the-bottom tactics

- Uses exclusivity and access as leverage

Strategic Moves

- Acquisitions and investments to protect ecosystem control

- Partnerships instead of direct competition with brands

- Controlled feature rollouts aligned with brand expectations

Why Farfetch Is Hard to Displace

Competitors can build marketplaces.

Few can build trust, infrastructure, data, and global partnerships simultaneously.

Farfetch’s defense lies in being indispensable, not just popular—a powerful lesson for platform founders.

Lessons for Entrepreneurs & Implementation

Farfetch’s journey offers practical, hard-earned lessons for founders building marketplaces, platforms, or ecosystem-driven apps—especially in complex or premium industries.

This is where insight turns into execution.

What Made Farfetch Successful

1. Platform Thinking Over Retail Thinking

Farfetch never tried to “own luxury.”

It focused on enabling luxury through technology.

2. Asset-Light, Intelligence-Heavy Model

By avoiding inventory ownership, Farfetch:

- Reduced capital risk

- Scaled globally faster

- Invested more in data, personalization, and infrastructure

3. Ecosystem Before Monetization

Farfetch built trust and utility first—then layered monetization:

- Commissions

- SaaS tools

- Logistics

- Data services

This sequencing is critical for sustainable platforms.

4. Brand-Safe Governance

Strict rules protected partners, not just users—creating long-term loyalty.

Replicable Principles for Startups

Entrepreneurs can adapt Farfetch’s model by focusing on:

- Fragmented markets with inefficient supply distribution

- High-value transactions where trust matters

- Two-sided ecosystems where one side lacks technology

- Service-based monetization, not just commissions

You don’t need luxury—you need structural inefficiency + platform leverage.

Common Mistakes to Avoid

- Scaling users before ecosystem readiness

- Competing with your own suppliers

- Over-reliance on a single revenue stream

- Ignoring governance and quality control

Farfetch’s challenges show that discipline matters as much as innovation.

Adapting the Model for Local or Niche Markets

Founders can localize this approach by:

- Starting with a single category or region

- Offering white-label or managed services

- Using modular monetization (pay-as-you-scale)

- Prioritizing trust, compliance, and experience early

This is especially powerful in B2B marketplaces, services platforms, and cross-border commerce.

Ready to implement Farfetch’s proven business model for your market?

Miracuves builds scalable platforms with tested business models and growth mechanisms. We’ve helped 200+ entrepreneurs launch profitable marketplace and platform apps.

Get your free business model consultation today.

Conclusion :

Farfetch proves that the most powerful platforms don’t replace industries—they rewire them.

By transforming luxury from a fragmented, location-bound industry into a globally connected digital ecosystem, Farfetch demonstrated that technology, trust, and orchestration can unlock scale even in the most tradition-driven markets.

Its journey also offers a sobering lesson for 2025 and beyond:

Innovation alone isn’t enough. Sustainable platforms require disciplined execution, ecosystem balance, and monetization maturity.

As platform economies evolve, the winners won’t be those who move fastest—but those who design systems strong enough to last.

FAQs :

What type of business model does Farfetch use?

Farfetch uses a hybrid luxury marketplace model that combines a two-sided marketplace with enterprise SaaS, logistics, and data services.This allows it to scale without owning inventory.

How does Farfetch’s business model create value?

It connects global luxury demand with distributed boutiques and brands. Farfetch manages technology, payments, logistics, and personalization for both sides.

What are Farfetch’s key success factors?

Strong network effects, asset-light design, and brand-safe governance drive its success. Advanced data and personalization further increase conversion and retention.

How scalable is Farfetch’s business model?

Farfetch is highly scalable because it expands digitally without physical stores or inventory. This makes global market entry capital-efficient.

What are the biggest challenges Farfetch faces?

Logistics costs pressure margins in cross-border luxury commerce. Brand control concerns and regulatory complexity add operational challenges.

How can entrepreneurs adapt Farfetch’s model to their region?

Start niche-first and digitize fragmented supply using platform services. Build trust early and scale ecosystem layers gradually.

What are alternatives to Farfetch’s business model?

Alternatives include pure D2C luxury brands, inventory-led retailers, and vertical marketplaces. Each offers more control but less scalability.

How has Farfetch’s business model evolved over time?

It evolved from a boutique aggregator into a global luxury technology platform. The focus has shifted toward enterprise services and profitability.

Related Article :