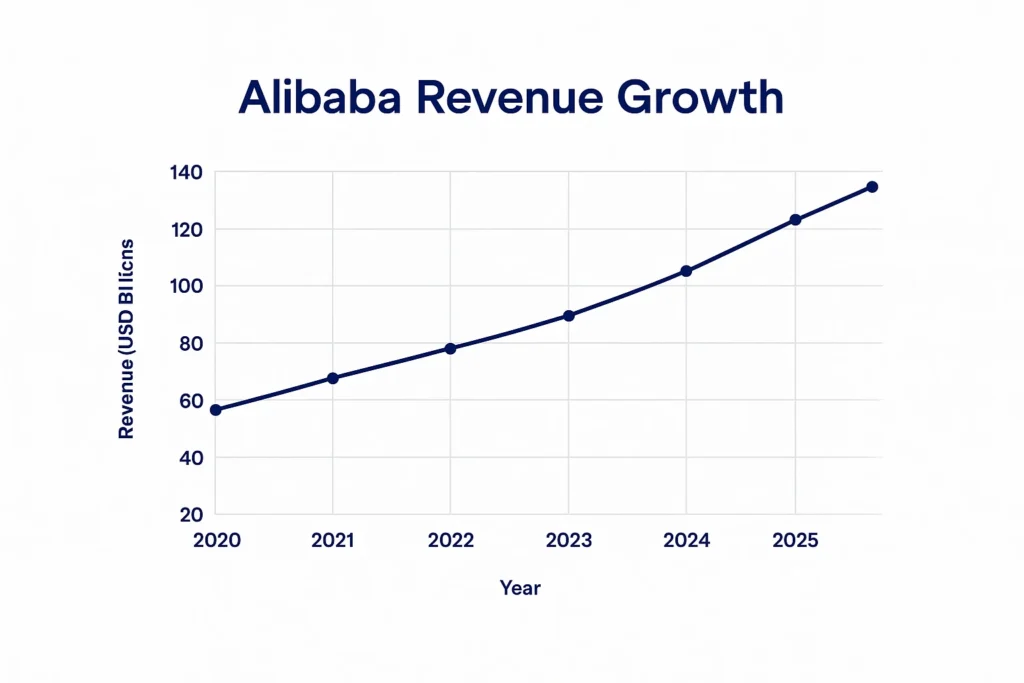

Alibaba made an impressive US $137 billion in fiscal 2025, reaffirming its dominance as a global e-commerce and digital services powerhouse. The platform seamlessly integrates retail, wholesale, cloud computing, logistics, digital media, and fintech into a unified ecosystem.

For entrepreneurs aiming to build multi-revenue digital platforms, understanding Alibaba’s model is crucial. It demonstrates how scale, data, and ecosystem synergy can drive sustained profitability — something Miracuves helps replicate through its ready-to-launch Alibaba Clone solutions.

Alibaba Revenue Overview – The Big Picture

Alibaba’s FY 2025 revenue reached approximately RMB 996 billion (US $137 billion), marking about 6 % year-on-year growth. Its operating income was around RMB 141 billion (US $19 billion), and net income touched RMB 129 billion (US $18 billion) — yielding a net margin near 13 %.

By region, China remains the core market contributing roughly 70 % of total revenue, while international commerce (AliExpress, Lazada, Trendyol, and Daraz) grew over 30 % year-on-year, reflecting strong cross-border expansion.

Alibaba continues to lead in gross merchandise volume among B2B and B2C marketplaces, competing with Amazon, JD .com, and Pinduoduo — yet maintaining higher profitability due to its asset-light platform approach.

Read More: How Alibaba App Works for Buyers & Sellers

Primary Revenue Streams Deep Dive

| Revenue Stream | Description | Share of Total Revenue (2025) |

|---|---|---|

| Core Commerce | Includes Taobao, Tmall, AliExpress, and 1688.com platforms. Generates revenue via commissions, ads, and logistics services. | ~65 % |

| Cloud Computing | Alibaba Cloud offers IaaS, SaaS, and AI services to enterprises globally. | ~12 % |

| Digital Media & Entertainment | Youku and other streaming platforms monetize via ads and subscriptions. | ~6 % |

| Cainiao Logistics Services | Revenue from fulfillment, cross-border shipping, and storage solutions. | ~10 % |

| Innovation Initiatives & Others | AI labs, fintech ventures, and technology licensing. | ~7 % |

Core Commerce:

Alibaba earns through merchant fees, commissions (0.5 – 5 %), ad placements, and premium store memberships. Its B2B platform 1688.com and international marketplace Alibaba.com charge sellers annual membership fees starting around $2,000–$3,000.

Cloud Computing:

Alibaba Cloud contributes over $16 billion annually with 30 % year-on-year growth. It monetizes via pay-as-you-go pricing, enterprise packages, and AI tools.

Digital Media & Entertainment:

Youku and other media platforms use a freemium model — ads for free viewers and subscriptions for premium content.

Logistics (Cainiao):

Revenue arises from parcel handling, warehousing, and international shipping solutions, often bundled into merchant services.

Innovation & Others:

This includes emerging technologies like smart devices, cloud AI, and fintech licensing.

Read More: Business Model of Alibaba: How It Makes Money and Scales

The Fee Structure Explained

| User Type | Fee Components | Typical Rate / Range |

|---|---|---|

| Buyers | Transaction fee, payment processing fee (for cross-border), premium subscription (optional) | 1 % – 2 % |

| Sellers / Merchants | Commission per sale, storefront subscription, advertising spend, logistics charges | 0.5 % – 5 % + monthly membership |

| International Vendors | Cross-border commission, compliance fee, service tax on AliExpress | 2 % – 8 % |

| Enterprise Clients (Alibaba Cloud) | Usage-based fees per GB or API, subscription tiers | $0.03 – $0.12 per GB |

Alibaba’s monetization is structured around low merchant commissions, encouraging massive seller growth. It supplements this with optional paid ads, analytics tools, and cross-border services. Hidden revenue streams include data analytics sales, AI-powered advertising, and financial commissions through Ant Group.

How Alibaba Maximizes Revenue per User

Alibaba segments users by purchase frequency, order value, and business tier, enabling dynamic pricing and targeted upselling.

- Upselling & Cross-Selling: Premium store analytics, featured placements, and logistics bundles increase merchant spend.

- Dynamic Pricing: AI-driven algorithms adjust product visibility based on bidding value and conversion likelihood.

- Retention Monetization: Loyalty programs and cashback campaigns encourage repeat purchases.

- Lifetime Value Optimization: Through Alipay integration, Alibaba captures financial activity across its ecosystem, raising ARPU steadily.

Average Revenue Per User (ARPU) has grown around 8 % year-on-year through these strategies.

Cost Structure & Profit Margins

Major cost categories:

- Technology infrastructure (servers, AI computing, security)

- Marketing and Customer Acquisition Cost (CAC)

- Fulfillment and logistics operations via Cainiao

- R&D and international expansion initiatives

Alibaba maintains an operating margin around 14 – 15 %, supported by economies of scale and asset-light operations. Ongoing AI automation reduces manual costs, while logistics integration drives efficiency.

Future Revenue Opportunities & Innovations

Alibaba is testing AI-powered product recommendations, automated merchant support, and cross-border financing for sellers. Its cloud division is expanding into AI model training and B2B SaaS solutions.

Future growth drivers for 2025 – 2027 include:

- Monetizing AI and data analytics platforms

- Greater integration of logistics and finance for SMEs

- Subscription-based enterprise solutions

- Deeper penetration into Europe, India, and Africa

Challenges include regulatory oversight, rising competition, and economic slowdowns, but the diversified model mitigates risk and supports long-term profitability.

Read More: Build an App Like Alibaba | Full-Stack Clone Guide

Lessons for Entrepreneurs & Your Opportunity

What works: diversification of income streams, ecosystem integration, and AI-driven personalization.

What to replicate: low merchant fees to encourage volume and recurring ad revenue from seller promotion.

Market gaps: localized B2B marketplaces in specific industries (like furniture, construction, wellness) that can mirror Alibaba’s model on a smaller scale.

Want to build a platform with Alibaba’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating marketplaces with built-in monetization features. Our Alibaba Clone script comes with flexible revenue modules you can customize. Many clients start earning within 30 days of launch. Get a free consultation to map your revenue strategy today.

Final Thought

Alibaba’s success proves that scalability depends on a balanced ecosystem — commerce, cloud, logistics, and finance working in unison. Entrepreneurs who adapt this model with localized innovation can tap massive growth potential in the digital commerce space.

Revenue Model FAQs

How much does Alibaba make per transaction?

Between 0.5 % and 5 % depending on category and region.

What’s Alibaba’s most profitable revenue stream?

Core Commerce — especially merchant advertising and commissions from Tmall and 1688.com.

How does Alibaba’s pricing compare to competitors?

Its fees are lower than Amazon’s and JD.com’s, making it highly attractive for millions of SMEs — and with Miracuves, you can build a similar cost-efficient platform starting at just $2899.

What percentage does Alibaba take from providers?

Typically 0.5 % to 5 % per sale plus optional advertising spend.

How has Alibaba’s revenue model evolved?

It moved from pure e-commerce to a data-driven ecosystem covering cloud, fintech, and AI.

Can small platforms use similar models?

Yes — by focusing on specific niches and using white-label solutions like Miracuves Alibaba Clone.

What’s the minimum scale for profitability?

Usually a few thousand active merchants and steady transaction volume per day.

How to implement similar revenue models?

Adopt tiered merchant plans, low base commissions, and paid promotion features.

What are alternatives to Alibaba’s model?

Subscription-based B2B marketplaces, ad-driven directories, and SaaS commerce tools.

How quickly can similar platforms monetize?

With Miracuves’ Alibaba Clone, entrepreneurs can start earning in just 3–9 days with guaranteed delivery, ensuring a fast and revenue-ready launch.