Banking isn’t what it used to be. Brick-and-mortar branches are becoming relics, while mobile-first neobanks, digital wallets, and fintech apps are redefining how people handle money. From bill splitting to crypto savings to instant loans, consumers now expect banking to be fast, personalized, and app-driven. And if you’re an entrepreneur looking to launch your own digital banking platform, there’s no need to start from zero. Banking Solution Clone scripts are making it easier than ever to step into the fintech arena.

These clone scripts take inspiration from platforms like Revolut, N26, Chime, and Monzo, offering a full stack of digital finance tools—ready to customize, rebrand, and deploy. This blog explores the best banking solution clones in 2025, their must-have features, pricing tiers, and how to choose the one that fits your vision.

Why Build a Banking Solution Clone?

Building a banking app from scratch is expensive, time-consuming, and regulation-heavy. Clone scripts help founders skip months of development and launch a robust MVP or even a full-fledged product faster. Whether you’re targeting underbanked regions, launching a niche financial tool, or building a digital wallet for a specific sector, banking clones let you focus on market fit—not foundational code.

Key Reasons Founders Choose Banking Clone Scripts

- Faster Time to Market: Prebuilt modules for KYC, wallets, transfers, and cards reduce development time by 70–80%

- Custom Business Models: Adapt for personal banking, small business banking, freelancer accounts, or community credit

- Full Source Code Ownership: Many clones allow full customization with admin rights to modify every function

- Built-In Compliance Tools: KYC, AML, and transaction logging are often baked into the script architecture

- Modern UX/UI Standards: These apps are designed to match the sleek, minimalist style users expect from fintech tools

Read More : How to Start a Digital Banking App Business in 2025

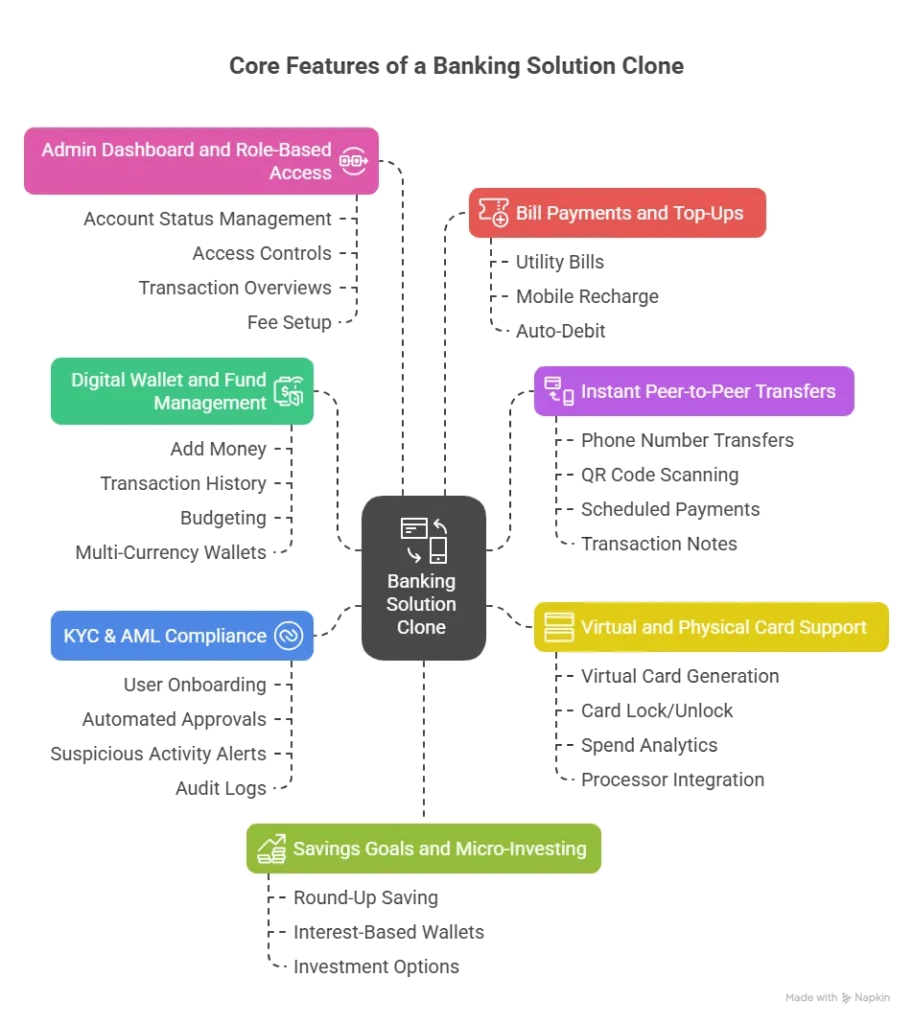

Core Features Every Banking Solution Clone Scripts Must Include

In 2025, a successful banking app isn’t just about holding funds—it’s about how users interact with money. If your clone script is missing any of these, you’ll struggle to gain traction.

1. Digital Wallet and Fund Management

Every user should be able to:

- Add money via bank, card, or UPI

- View transaction history

- Set monthly budgets or limits

- Manage multi-currency wallets

2. Instant Peer-to-Peer Transfers

Transfers should be seamless, with no hidden fees. Your clone must support:

- Phone number-based transfers

- QR code scanning

- Scheduled recurring payments

- Internal notes or tags per transaction

3. Virtual and Physical Card Support

Offer:

- Instant virtual card generation for online purchases

- Card lock/unlock features

- Spend analytics per card

- Integration with card processors like Stripe, Marqeta, or Mastercard

4. KYC & AML Compliance

Your clone should support:

- User onboarding with ID upload and live selfie checks

- Automated KYC approvals via third-party APIs

- Suspicious activity alerts and transaction caps

- Admin audit logs and reporting tools

5. Bill Payments and Top-Ups

Integrate APIs that let users:

- Pay utility bills (water, gas, electricity)

- Recharge mobile phones and internet plans

- Schedule auto-debit instructions

6. Savings Goals and Micro-Investing

Help users grow their money with:

- Round-up saving (e.g., round $1.75 to $2.00 and save the difference)

- Interest-based savings wallets

- Investment options in ETFs, mutual funds, or crypto

7. Admin Dashboard and Role-Based Access

Backend features should include:

- Account status management (active, suspended, flagged)

- Access controls for finance team, support agents, auditors

- Transaction overviews and trend reports

- Fee and commission setup per transaction type

Technology Stack That Powers Banking Clone Scripts

Financial apps must be secure, scalable, and fast. Look for clone scripts built with these technologies:

- Frontend: Flutter, Swift, or React Native for smooth cross-platform mobile experiences

- Backend: Node.js or Django for real-time processing and robust API connections

- Database: PostgreSQL or Oracle for secure, scalable transaction storage

- Security: SSL encryption, 2FA, biometric login, tokenized payments

- Compliance Tools: Integrations with KYC/AML platforms like Sumsub, Onfido, or Trulioo

- Payment APIs: Stripe, Razorpay, Plaid, or PayPal for handling deposits and withdrawals

Read More : How to Market a Digital Banking App Successfully After Launch

Key Metrics for Script Comparison

Before purchasing a clone, use these benchmarks to guide your decision:

- Security Standards: Does it meet PCI DSS, GDPR, and regional finance regulations?

- Transaction Speed: How fast can users deposit, withdraw, and transfer funds?

- Customization Flexibility: Can you create savings plans, card types, or niche workflows?

- User Load Capacity: Can the platform handle 100,000+ users without downtime?

- Open APIs: Is the script future-proof with RESTful APIs for third-party services?

Cost Factors & Pricing Breakdown

Banking-Style Digital Finance Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Digital Banking MVP | User onboarding, KYC, account creation, basic wallet, fund transfers, transaction history, admin controls | $70,000 |

| 2. Full-Feature Digital Banking Platform | Virtual accounts, multi-currency support, bill payments, card management, compliance tools, advanced security, analytics dashboards, dispute workflow | $140,000 |

| 3. Enterprise Core Banking Ecosystem | Automated KYC/AML, lending modules, investment features, interest logic, regional scaling, micro-services finance engine, API banking integrations | $250,000+ |

These prices reflect global development costs for building a compliant, high-security digital banking system — where teams spend months designing financial workflows, KYC/AML compliance, payment rails, and transaction security infrastructure before launch.

Miracuves Pricing for a Banking-Style Platform

Miracuves Price: Starts at $3,699

Miracuves delivers a fully functional digital banking solution including user onboarding, KYC, wallet management, transfers, payment modules, secure transaction workflows, dashboards, and an enterprise-grade admin system — all at a fraction of global development costs. Built on a secure and scalable PHP architecture, this Banking Solution provides a robust foundation for fintech startups, neobanks, and digital finance platforms.

Note

This package includes full non-encrypted source code, complete deployment assistance, backend/API setup, admin panel configuration, and publishing support for both Android and iOS — ensuring your banking system is fully operational and ready for compliance-driven environments.

Launch your digital banking platform in days while others spend $250,000+ and wait months — start with Miracuves and go live faster.

Delivery Timeline for a Banking-Like Platform with Miracuves

Estimated deployment timeline: 3–9 days, depending on:

- KYC/AML automation depth

- Payment gateway & financial API configuration

- Wallet, transfers & multi-currency workflows

- Branding, UI customization & security layers

- Compliance rules & country-specific finance logic

Tech Stack

This solution is developed using stable and secure frameworks — PHP, MySQL & Flutter, optimized for financial stability, regulatory compliance, and high-traffic banking operations.

Real-World Applications and Use Cases

A well-built banking solution clone can adapt to dozens of fintech niches. Here’s how some founders are positioning theirs:

- Neobank for Freelancers: Custom tools for tracking income, issuing invoices, and saving tax

- Youth Savings App: Gamified savings plans with parental oversight and learning modules

- Crypto-Friendly Bank: Multi-wallets for stablecoins, cross-border remittances, and swap features

- Banking for Migrant Workers: Zero-fee transfers, low-KYC accounts, and local language interfaces

Mistakes to Avoid When Launching a Banking Clone

- Skipping Legal Review: Even clone scripts need legal compliance before going live

- Ignoring Mobile UX: Banking apps must load fast, reduce taps, and use simple flows

- Overcomplicating Launch Features: Start with the core. Don’t launch with savings, crypto, loans, and trading all at once

- Neglecting Data Encryption: If user data isn’t secure, nothing else matters

- Choosing Closed Systems: Look for clone scripts with API access so you can evolve and expand

Read More : Top UI/UX Mistakes in Digital Banking & Fintech Apps

Conclusion: The New Age of Digital Banking Is Just Getting Started

Banking is now as much about user experience as it is about money. The winners in 2025 will be those who simplify finance, offer trust through transparency, and move fast with secure, scalable tech. Whether you’re creating a wallet for a small niche or building a global challenger bank, a banking solution clone script helps you get started without getting stuck in code or compliance chaos. At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

Still have questions about Banking Solution Clone scripts? Let’s clear them up.

Is it legal to launch a banking clone?

Yes, but you must comply with regional banking laws and obtain the appropriate licenses or partner with a licensed financial institution.

Can I launch without a banking license?

Yes, many startups partner with Banking-as-a-Service (BaaS) providers or operate under the license of a regulated institution.

What monetization options are available?

You can earn through transaction fees, card fees, currency exchange, lending, paid features, and affiliate products.

How long does it take to launch?

Basic apps can launch in 3–9 days with minor customization. Full-featured platforms can take 8–12 weeks, especially if legal approvals are needed.

Can I add crypto features later?

Yes, if your script supports modular updates and open APIs, you can add crypto wallets, trading, or staking at any time.

Will I need a developer after launch?

Yes, ongoing maintenance, performance tuning, and feature releases require a technical partner or in-house team.

Related Articles