Remember the first time you tried explaining Bitcoin to someone back in 2017? Their face probably looked like you’d just asked them to solve a Rubik’s cube blindfolded. Fast forward to 2025, and your Uber driver, dentist, and even grandma are talking about staking coins, cold wallets, and altcoins. Welcome to the era where peer-to-peer (P2P) crypto marketplaces aren’t just a buzzword—they’re booming businesses.

Startups today are diving head-first into the P2P crypto exchange space not just because it’s trendy, but because it’s lucrative. And decentralized. And, let’s be honest, it sounds way cooler than building yet another food delivery app. But here’s the kicker: if you want to start a crypto trading platform, it’s not just about copying Binance or Paxful. It’s about knowing the nitty-gritty—especially the cost side—before your wallet ends up lighter than a meme coin after a market dip.

Whether you’re a creator-turned-founder or a startup on the hunt for the next big thing, you’re probably wondering, “How much damage will this do to my bank account?” Well, that’s what we’re unpacking today. And yes, Miracuves has helped several visionaries launch profitable crypto ventures—so keep reading if you want to avoid burning cash faster than a pump-and-dump coin.

Read more: What is a LocalBitcoins App and How Does It Work?

The Crypto Marketplace Craze: Why P2P Is Dominating in 2025

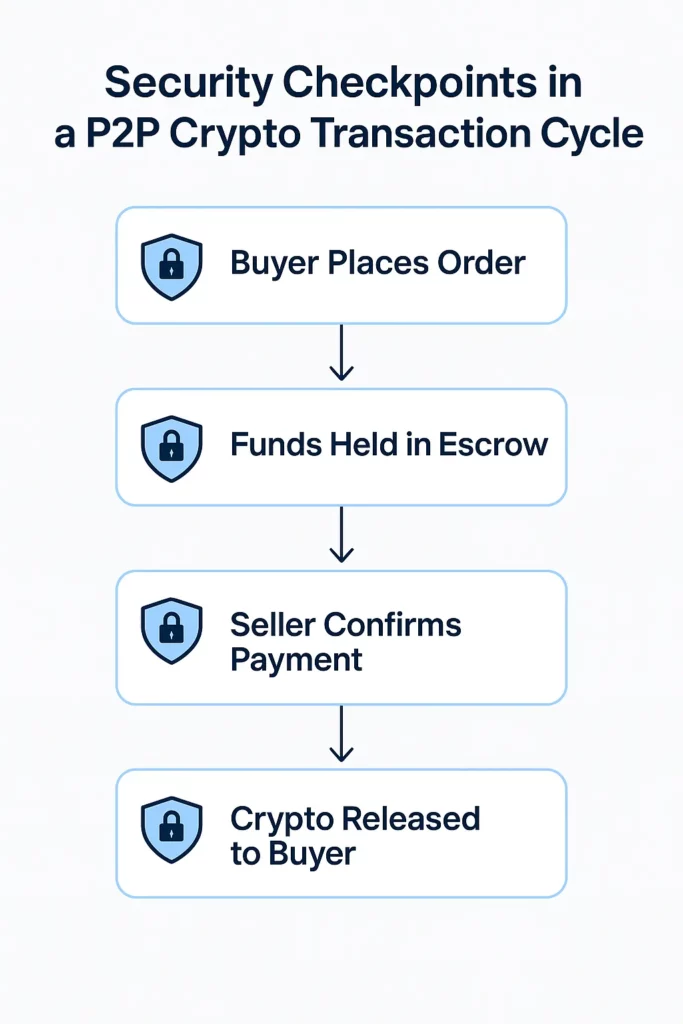

The P2P crypto model has one big advantage over centralized exchanges: users trade directly with each other. No middleman, no frozen funds, and definitely no “we’ll get back to you in 48 hours” customer support loop.

Think of it like the Airbnb of crypto trading. You’re connecting buyers and sellers without owning any of the inventory (or coins). The platform just provides the infrastructure, escrow services, and dispute resolution.

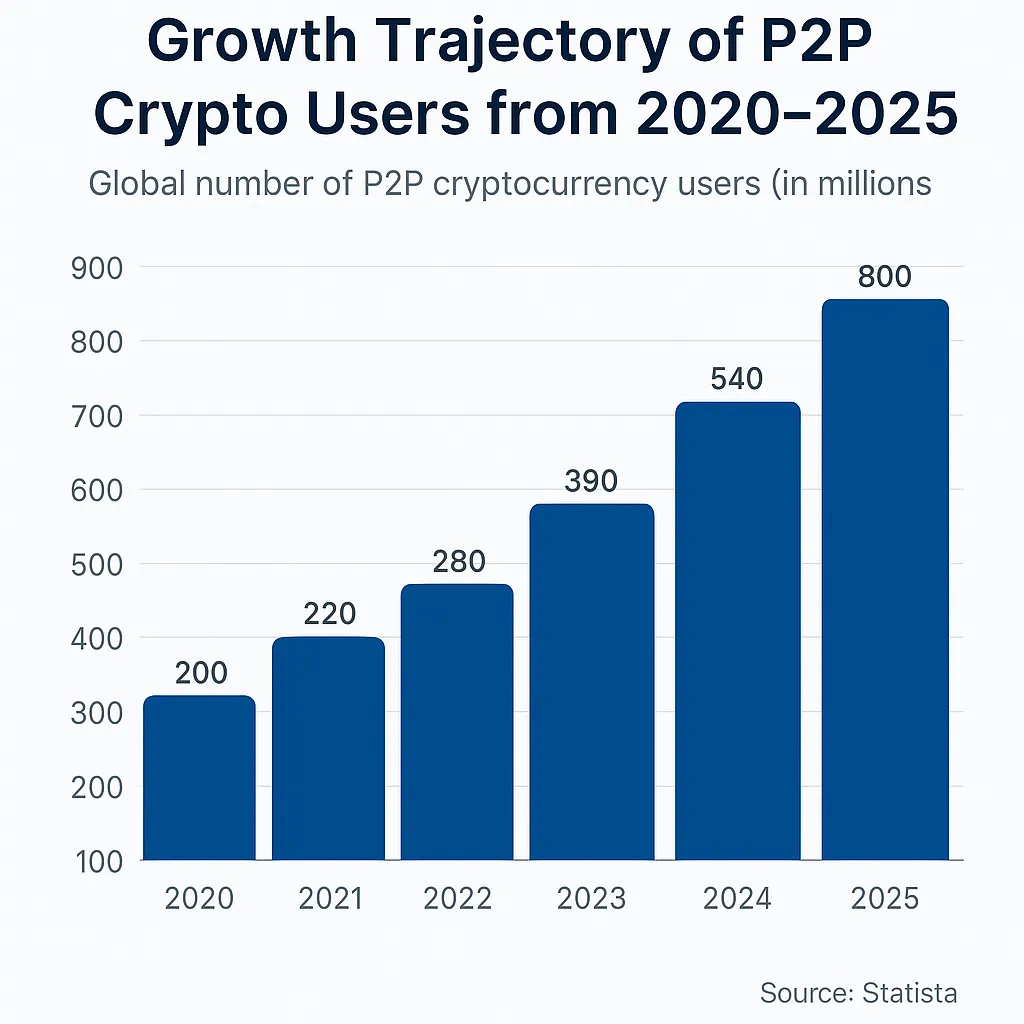

And the numbers speak volumes:

- According to Statista, global crypto users are projected to surpass 900 million by the end of 2025.

- Platforms like Paxful and LocalBitcoins report millions in daily trade volume—without being traditional exchanges.

Cost Breakdown: What Goes Into Building a P2P Crypto Marketplace?

Alright, let’s break it down. Building a P2P crypto platform isn’t just about “slapping a UI on a blockchain.” Each component comes with its own tech, time, and price tag.

1. Core Features & Functionalities

You’ll need the basics, but make them solid:

- User registration and KYC

- Wallet integration (multi-currency support is a big plus)

- Escrow system for secure trading

- Live chat & dispute resolution

- Real-time price charts

- Two-factor authentication

- Smart contract support for decentralized escrow

Expect this core set to cost anywhere between $25,000 to $45,000, depending on complexity and integrations.

2. Technology Stack & Blockchain Integration

Behind the scenes, it’s all about robustness:

- Backend: Node.js or Python (fast, scalable)

- Frontend: React or Vue.js (clean UX is non-negotiable)

- Blockchain: Ethereum, Binance Smart Chain, or even custom layer-2

- Database: PostgreSQL, MongoDB

- Hosting: AWS, Google Cloud

Custom smart contract development alone can run you $5,000–$15,000 depending on how “smart” you want them to be.

3. Security & Compliance

Crypto and hacks go together like peanut butter and jelly—unfortunately. Don’t cut corners here.

- SSL, DDoS protection

- Anti-money laundering (AML) compliance tools

- KYC/ID verification API (like Jumio, Shufti Pro)

- Bug bounty or 3rd-party security audit

Budget an additional $10,000–$20,000 here.

4. UI/UX Design

Don’t underestimate design. If users can’t figure out how to make a trade, they’ll bounce faster than a failed transaction.

- Custom wireframes and UI: $3,000–$7,000

- Mobile-first design (responsive is default, but native apps cost extra)

- Optional: Dark mode, dashboard customizations, theme toggles

You’re not building for crypto nerds alone anymore—your audience includes TikTok traders and normies.

5. Admin Panel & Analytics Dashboard

You’ll want a backend to:

- View trades and volumes

- Manage disputes

- Ban bad actors

- Monitor traffic

Custom admin panels with analytics can cost $4,000–$8,000, depending on depth.

6. Optional Features That Are Totally Worth It

Want to stand out? Consider:

- Referral/invite system

- NFT support

- AI-driven fraud detection

- Gamified trading rewards (yes, people love badges)

These extras can range from $2,000 to $10,000.

Read more: How Much Does It Cost to Develop a LocalBitcoins App

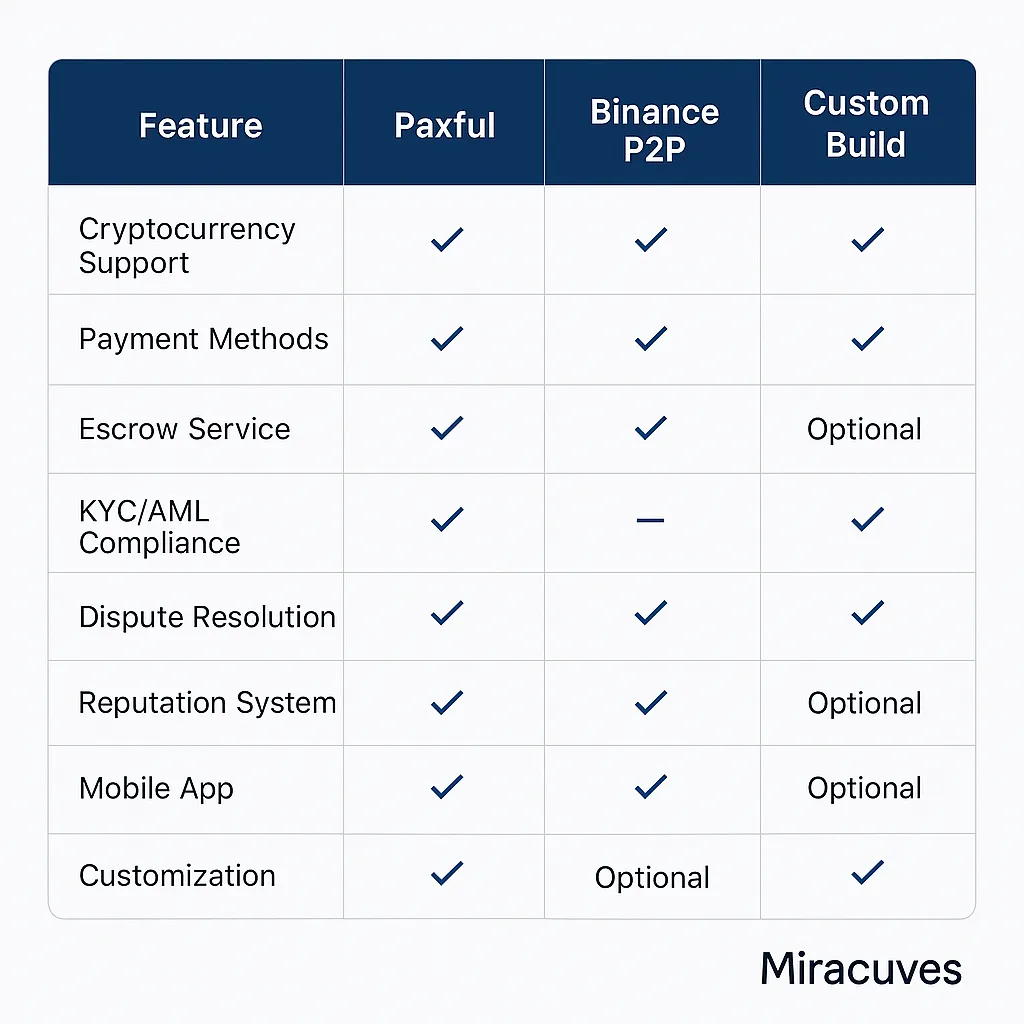

Development Models: In-house vs Clone vs Custom from Scratch

🔹 In-house Team

Sure, you can hire your own devs. But unless you already have a crypto-savvy tech team, you’ll be bleeding money and time.

- Avg. cost: $100,000–$250,000+

- Timeline: 6–12 months

🔹 From Scratch via Agency

Great if you want 100% custom logic, but again—expensive and time-consuming.

- Avg. cost: $70,000–$150,000

- Timeline: 4–6 months

🔹 Miracuves Clone-Based Solution (Sweet Spot)

Using a white-label Paxful Clone or Binance P2P Clone, you’ll save on dev time without sacrificing features.

- Avg. cost: $15,000–$40,000

- Timeline: 3–6 weeks

- Bonus: Scalable, fast-to-market, monetization-ready

Real Talk: What Drives the Final Cost?

Just like Bitcoin’s price, your project cost depends on multiple variables:

- Features: More bells and whistles = more dollars

- Team location: Devs in the US ≠ Devs in India

- Tech choices: Using existing APIs vs building from scratch

- Time to market: Faster = pricier (rush jobs always cost more)

- Post-launch support: Bugs will crawl out of hiding eventually—who’s fixing them?

Expect to spend anywhere between $25,000 and $150,000+, depending on the route you choose.

Launch your next-gen digital finance product with our cryptocurrency platform development solutions designed for scalability, security, and real-time performance.

Conclusion

Building a P2P crypto marketplace in 2025 isn’t cheap—but it’s a whole lot more doable (and scalable) than it was a few years ago. If you’ve got a solid idea, a clear revenue model, and the right tech partner, you can launch faster than Dogecoin memes spread on Twitter.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q:1 How long does it take to build a P2P crypto exchange?

If you go custom from scratch, expect 4–6 months. With a clone-based solution like Miracuves offers, it can be live in under 6 weeks.

Q:2 Can I monetize the platform from Day 1?

Absolutely. You can charge transaction fees, promote premium listings, run ads, or offer withdrawal charges.

Q:3 What’s the biggest mistake startups make?

Trying to over-engineer everything in version 1. Focus on MVP, get users, then iterate. Don’t let “perfect” kill “launchable.”

Q:4 Is it safe to build a crypto exchange in 2025?

Yes—if your platform has robust security measures like escrow, KYC/AML, and proper encryption. The demand is rising, so opportunity is ripe.

Q:5 Do I need blockchain developers for this?

Not always. If you’re using a clone script or existing blockchain protocols, your team can work with APIs and SDKs. Custom smart contracts will need blockchain devs.

Q:6 What about legal compliance?

Depends on your region. You’ll likely need KYC, AML, and a legal opinion letter. Miracuves can help guide you through the compliance checklist.

Related Articles: