In global ecommerce, few platforms have reshaped cross-border trade as quietly and effectively as DHgate. Instead of competing with Amazon or Alibaba in consumer retail, business model of DHgate focused on a transaction-driven B2B wholesale marketplace, directly connecting small and mid-sized international buyers with Chinese manufacturers and exporters. This strategic positioning allowed it to dominate a niche that large platforms often overlook—SME sourcing.

By 2026, DHgate serves millions of buyers across more than 200 countries, facilitating billions of dollars in annual cross-border trade for resellers, dropshippers, and small businesses. A key strength of the business model of DHgate is its ability to operate with thin margins, complex logistics, and global trust challenges while remaining completely asset-light, owning neither inventory nor warehouses.

For entrepreneurs building marketplaces, cross-border ecommerce platforms, or B2B transaction-driven systems, DHgate offers a powerful blueprint. At Miracuves, we reference DHgate-style architectures because they prove success depends not on branding dominance, but on liquidity, trust infrastructure, and disciplined monetization.

How the DHgate Business Model Works

DHgate operates as a cross-border B2B online marketplace designed to simplify global trade between Chinese manufacturers/suppliers and international small-to-medium buyers. Unlike traditional wholesale platforms that rely on large bulk orders, DHgate’s model supports low minimum order quantities (MOQs)—which dramatically expands its buyer base.

At its core, DHgate does not sell products. It orchestrates transactions, manages trust, and monetizes the flow of commerce.

Type of Business Model

DHgate uses a hybrid marketplace model, combining:

- B2B Marketplace – Connecting suppliers and buyers globally

- Transaction-based Platform – Monetizing successful trades

- Service-driven Model – Payments, logistics, dispute handling, and compliance

This hybrid approach allows DHgate to stay asset-light while controlling critical parts of the transaction lifecycle.

Value Proposition by User Segment

For Global Buyers (SMEs, Resellers, Dropshippers)

- Access to factory-direct pricing

- Low MOQs compared to traditional wholesalers

- Escrow-based payments reducing fraud risk

- Global shipping options with tracking

For Suppliers (Manufacturers & Exporters)

- Immediate access to international demand

- Built-in traffic and buyer discovery

- Payment protection and dispute resolution

- Optional promotion tools to boost visibility

For DHgate (Platform Owner)

- No inventory risk

- Revenue scales with transaction volume

- Strong data control over pricing, demand, and behavior

Key Stakeholders & Their Roles

- Suppliers: List products, fulfill orders, maintain quality ratings

- Buyers: Place orders, make payments, leave reviews

- Logistics Partners: Enable cross-border delivery

- Payment Providers: Support multi-currency transactions

- DHgate Platform: Ensures trust, liquidity, and dispute management

The system stays balanced because no single party can bypass the platform without losing trust, protection, or reach.

Evolution of the Model

DHgate’s model has evolved significantly:

- Early years: Focus on listing scale and global reach

- Growth phase: Introduction of escrow payments and buyer protection

- Recent years (2024–2026):

- Improved seller vetting

- Smarter dispute resolution

- Logistics integration

- Mobile-first experience for international buyers

- Improved seller vetting

Each evolution strengthened trust—critical in cross-border B2B commerce.

Why DHgate’s Model Works in 2026

In today’s market:

- SMEs want direct sourcing to protect margins

- Buyers prefer smaller test orders before scaling

- Trust and payment security matter more than brand awareness

- Cross-border trade is fragmented but growing

DHgate fits perfectly into this environment by acting as a trade infrastructure layer, not just a marketplace.

This is why Miracuves often models similar B2B marketplace architectures for clients targeting wholesale, sourcing, or international trade platforms—because DHgate proves that control of transactions beats ownership of products.

Read more : What is DHgate and How Does It Work?

Target Market & Customer Segmentation Strategy

DHgate’s success is deeply tied to precision targeting. Instead of chasing mass consumers, the platform deliberately focused on underserved global buyers who were priced out or ignored by traditional wholesale systems.

Primary & Secondary Customer Segments

Primary Buyer Segment (Demand Side)

- Small and medium businesses (SMEs)

- Online resellers and dropshippers

- Amazon, eBay, Etsy, and Shopify sellers

- Retail store owners sourcing inventory

- Entrepreneurs testing new product categories

Behavioral Traits

- Price-sensitive but margin-focused

- Willing to trade brand certainty for cost advantage

- Repeat buyers once trust is established

- Prefer low MOQs and flexible logistics

Secondary Buyer Segment

- Large-volume importers testing suppliers

- Regional distributors in emerging markets

- Promotional merchandise buyers

Primary Supplier Segment (Supply Side)

- Chinese manufacturers

- Export-focused trading companies

- OEM and private-label producers

- Factory clusters specializing in electronics, apparel, accessories, and home goods

Supplier Motivation

- Access to global buyers without overseas sales teams

- Faster cash flow compared to traditional export channels

- Ability to scale orders gradually

Customer Journey: Discovery → Conversion → Retention

1. Discovery

- Google search for wholesale products

- Marketplace browsing by category

- Supplier recommendations and internal search

- External seller referrals

2. Conversion

- Product comparison and MOQ evaluation

- Supplier credibility signals (ratings, transaction history)

- Escrow-based payment assurance

- Transparent logistics options

3. Retention

- Repeat supplier relationships

- Better pricing for returning buyers

- Platform dispute protection

- Loyalty built through reduced risk, not branding

DHgate’s retention strategy relies more on operational trust than emotional loyalty.

Acquisition Channels & Lifetime Value Optimization

Buyer Acquisition

- SEO-driven product pages

- Long-tail wholesale keyword capture

- Country-specific landing pages

- App-based reordering convenience

Supplier Acquisition

- Regional factory onboarding programs

- Export incentives and platform education

- Tiered seller benefits based on performance

LTV Optimization

- Higher buyer LTV through repeat sourcing

- Higher supplier LTV through promotion tools and data access

- Switching costs created by transaction history and ratings

Market Positioning & Competitive Edge

DHgate positions itself as:

- Accessible global trade for SMEs

- A mid-layer between Alibaba (large B2B) and AliExpress (B2C)

- A practical sourcing engine, not a brand marketplace

Differentiation Strategies

- Lower MOQs than traditional B2B platforms

- Simpler onboarding for international buyers

- Strong escrow and dispute framework

- Focus on functionality over consumer branding

This clear positioning helps DHgate protect its niche despite competition from Alibaba, Made-in-China, and emerging vertical marketplaces.

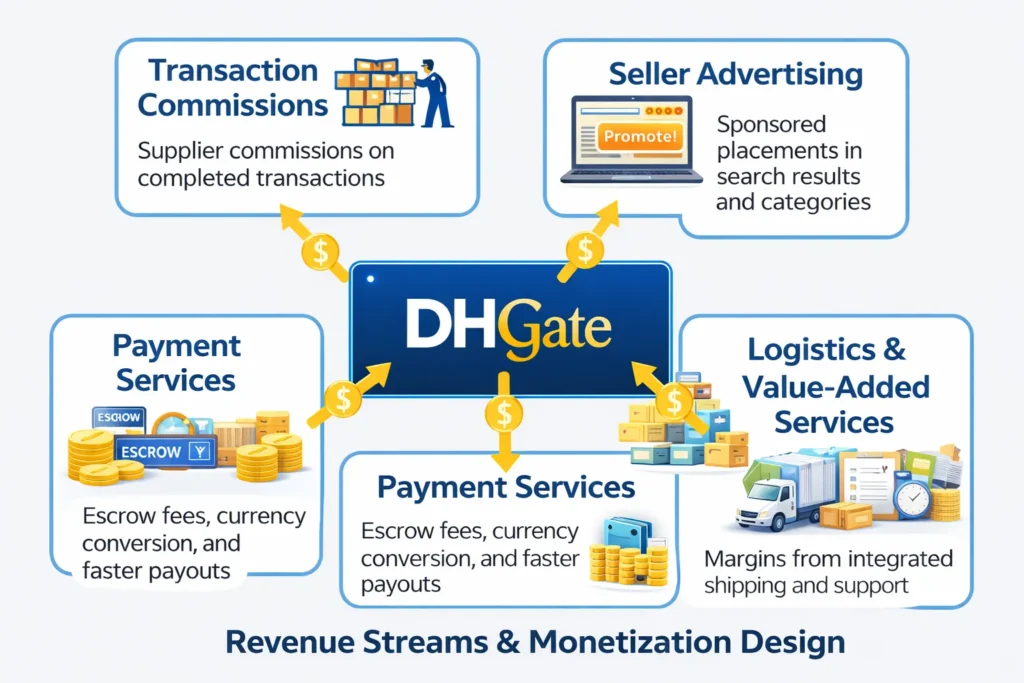

Revenue Streams and Monetization Design

Once DHgate established liquidity and trust between buyers and suppliers, monetization became a transaction-first, service-supported system. Unlike consumer ecommerce platforms that push subscriptions or ads early, DHgate’s revenue model is designed to extract value only when trade happens.

This keeps adoption friction low while ensuring revenue scales directly with platform usage.

Primary Revenue Stream 1: Transaction Commission (Core Engine)

Mechanism

DHgate charges suppliers a commission on every successfully completed transaction. The fee is deducted after the buyer confirms receipt or the escrow period ends.

Pricing Model (2026)

- Percentage-based commission per order

- Varies by product category and supplier tier

- Performance-linked incentives for high-rated sellers

Revenue Contribution

- Largest and most stable revenue source

- Directly tied to Gross Merchandise Volume (GMV)

- Predictable because it scales with repeat trade

Growth Trajectory

- Rising cross-border SME trade volumes

- Increased repeat buying from trusted suppliers

- Higher average order values as buyers scale sourcing

This stream works because DHgate controls the payment flow—suppliers cannot access funds without platform completion.

Secondary Revenue Stream 2: Seller Promotion & Advertising Tools

Mechanism

Suppliers pay to improve product visibility within search results and category listings.

Examples

- Sponsored product placements

- Category-level promotions

- Seasonal exposure campaigns

Why It Works

- Seller competition increases as categories mature

- Visibility directly impacts sales volume

- Ads feel like growth tools, not platform taxes

Secondary Revenue Stream 3: Payment & Financial Services

Mechanism

DHgate earns margins through:

- Escrow-based payment handling

- Currency conversion services

- Faster payout options for suppliers

Value Creation

- Reduces fraud and trust barriers

- Improves supplier cash flow

- Locks users into the platform ecosystem

Secondary Revenue Stream 4: Logistics & Value-Added Services

Mechanism

DHgate partners with logistics providers and earns margins or referral fees through:

- Integrated shipping options

- Tracking and customs support

- Optimized delivery routes

While DHgate doesn’t own logistics infrastructure, it monetizes coordination.

Overall Monetization Strategy

DHgate’s monetization design is layered but intentional:

- Commissions power the core engine

- Ads monetize competition, not users

- Payments & logistics monetize trust and convenience

Each stream reinforces the others:

- More transactions → more data

- More data → better targeting

- Better targeting → higher seller spend

The psychology is simple:

DHgate charges businesses when they make money, not before.

This is a monetization philosophy Miracuves often recommends when building B2B marketplaces and trade platforms—because it aligns platform success with customer success.

Read more : DHgate Revenue Model: How DHgate Makes Money in 2026

Operational Model & Key Activities

Behind DHgate’s marketplace sits a highly structured operations-first organization. Because cross-border B2B trade involves trust, compliance, and logistics complexity, DHgate’s operational model is designed to reduce friction without owning physical assets.

Instead of warehouses or inventory, DHgate invests in systems, automation, and governance.

Core Operational Functions

1. Platform & Technology Management

- Marketplace infrastructure (web + mobile)

- Search, ranking, and recommendation algorithms

- Secure payment and escrow systems

- Seller dashboards and analytics tools

2. Supplier Quality Control

- Supplier verification and onboarding

- Rating and review systems

- Performance monitoring (delivery, refunds, disputes)

- Tier-based seller classification

3. Trust & Dispute Resolution

- Escrow-based transaction monitoring

- Buyer–seller dispute handling

- Refund and arbitration workflows

- Fraud detection and risk scoring

4. Customer Support Operations

- Multilingual buyer support

- Seller training and compliance support

- Region-specific resolution teams

5. Marketing & Demand Generation

- SEO-driven category traffic

- Country-level localization

- Campaign coordination for peak seasons

Resource Allocation Strategy (2026)

DHgate’s spending priorities reveal how platform businesses should think:

- Technology & Infrastructure: ~35–40%

(Platform stability, security, automation, AI-driven moderation) - Operations & Trust Systems: ~25–30%

(Dispute teams, compliance, quality control) - Marketing & Growth: ~20%

(SEO, performance marketing, supplier acquisition) - People, R&D & Expansion: ~10–15%

(New markets, partnerships, product innovation)

This allocation reflects a key insight:

In B2B marketplaces, trust costs more than traffic.

Operational Advantage in 2026

What gives DHgate resilience today:

- Automation reduces manual intervention at scale

- Data-driven supplier enforcement improves quality

- Escrow protects both sides without legal overhead

- Regional ops teams adapt to local trade rules

For Miracuves clients building marketplace platforms, this operational blueprint is critical. Many startups fail not due to lack of demand—but because operations are under-designed.

DHgate proves that scalable marketplaces are systems businesses, not product businesses.

Read more : Best DHgate Clone Scripts 2025: Build a Global B2B Wholesale Marketplace Faster

Strategic Partnerships & Ecosystem Development

DHgate understood early that no marketplace can scale cross-border trade alone. Instead of building everything in-house, it focused on ecosystem orchestration—partnering with specialized players to strengthen speed, trust, and reach.

Its partnership strategy is not about branding—it is about removing friction from global commerce.

DHgate’s Partnership Philosophy

DHgate partners where:

- Control is expensive or inefficient

- Speed-to-market matters more than ownership

- Specialization improves trust and compliance

By doing this, DHgate remains asset-light while still delivering a full-stack trade experience.

Key Partnership Categories

1. Technology & API Partners

- Cloud infrastructure providers

- Data security and fraud detection vendors

- API integrations for seller tools and analytics

Impact:

Improves platform stability, scalability, and risk prevention.

2. Payment & Financial Service Partners

- Global payment gateways

- Escrow and settlement providers

- Currency conversion and compliance partners

Impact:

Enables multi-currency transactions, reduces fraud, and accelerates supplier payouts.

3. Logistics & Fulfillment Alliances

- International courier services

- Cross-border shipping networks

- Customs and documentation partners

Impact:

Expands delivery coverage without capital-heavy logistics ownership.

4. Marketing & Distribution Partners

- Affiliate networks

- Regional ecommerce communities

- Influencer and reseller ecosystems

Impact:

Drives buyer acquisition in cost-sensitive markets.

5. Regulatory & Market Entry Partners

- Trade compliance advisors

- Country-specific regulatory consultants

- Local market representatives

Impact:

Reduces legal risk during geographic expansion.

Ecosystem Strategy & Competitive Moat

DHgate’s ecosystem creates compounding advantages:

- More partners → better service coverage

- Better coverage → higher transaction success

- Higher success → more buyers and suppliers

This produces network effects not just from users, but from partners embedded into workflows.

Monetization within the ecosystem happens indirectly:

- Higher GMV increases commissions

- Better logistics improve repeat orders

- Financial tools increase seller lifetime value

This is a model Miracuves actively applies when building scalable B2B and cross-border platforms—designing ecosystems where partners grow with the platform, not outside it.

Growth Strategy & Scaling Mechanisms

DHgate’s growth has never been driven by hype or heavy consumer branding. Instead, it scales through trade volume compounding—where every successful transaction increases the likelihood of the next.

Its growth strategy is built around liquidity, efficiency, and geographic reach.

Core Growth Engines

1. Organic Demand Through Global Search

- Strong SEO for wholesale and sourcing keywords

- Category-level dominance in long-tail queries

- Country-specific language and currency localization

This brings in high-intent buyers, not casual browsers.

2. Supplier-Led Growth

- As suppliers succeed, they reinvest in promotions

- High-performing sellers attract more buyers

- Supplier competition increases marketplace depth

Growth is partially self-funded by sellers.

3. Repeat Transaction Loops

- Buyers reorder from trusted suppliers

- Platform data improves matching quality

- Reduced friction increases order frequency

Retention drives scale more than acquisition.

4. Mobile-First Expansion

- App-based reordering

- Push notifications for price drops and restocks

- Simplified dispute and tracking flows

5. Geographic Expansion

- Focus on emerging markets with strong SME growth

- Localization over aggressive advertising

- Gradual rollout of logistics and payment options

Scaling Challenges & How DHgate Solved Them

Challenge 1: Trust at Scale

Solution:

- Escrow-based payments

- Supplier performance tiers

- Automated dispute workflows

Challenge 2: Operational Complexity

Solution:

- Heavy automation

- Regional ops teams

- Standardized processes

Challenge 3: Logistics Fragmentation

Solution:

- Partner-based logistics model

- Multi-carrier integrations

- Transparent delivery expectations

Challenge 4: Margin Pressure

Solution:

- Volume-based economics

- Value-added services

- Promotion monetization

Why DHgate’s Scaling Model Works

DHgate grows by:

- Increasing transaction success rate

- Improving repeat usage

- Expanding supplier competition

- Lowering per-transaction cost

This is not explosive growth—it is durable growth.

For Miracuves, this mirrors how we advise founders to scale marketplaces:

Fix trust first, optimize operations second, and accelerate growth last.

Competitive Strategy & Market Defense

DHgate operates in one of the most competitive environments in global ecommerce. It faces pressure from Alibaba, Made-in-China, AliExpress, emerging vertical B2B platforms, and even direct supplier websites. Yet DHgate continues to defend its position by focusing on structural advantages, not short-term pricing wars.

Core Competitive Advantages

1. Deep Network Effects

- More suppliers → better pricing and variety

- More buyers → higher supplier competition

- Higher competition → better value for buyers

Once liquidity is achieved, competitors struggle to replicate it quickly.

2. High Switching Costs

- Supplier ratings and transaction history

- Buyer–seller trust relationships

- Platform dispute protection

- Payment and logistics integration

Leaving the platform means starting from zero.

3. Brand Trust Over Brand Fame

DHgate is not a consumer brand—but it is a trusted trade brand.

- Buyers trust the escrow system

- Suppliers trust predictable payouts

- Both sides trust platform enforcement

4. Data-Driven Marketplace Control

- Pricing intelligence

- Demand forecasting

- Fraud detection

- Algorithmic search and ranking

Data gives DHgate control without owning inventory.

5. Compliance & Risk Management

- Trade regulations

- Payment compliance

- Buyer protection frameworks

In 2026, compliance is a competitive moat, not a cost.

Market Defense Tactics

Against New Entrants

- Rapid category saturation

- Supplier exclusivity via performance incentives

- Platform lock-in through tools and analytics

Against Pricing Wars

- Focus on total cost of sourcing, not unit price

- Emphasis on reliability and dispute protection

- Long-term supplier relationships

Against Platform Disintermediation

- Escrow and buyer protection enforcement

- Dispute resolution that favors platform usage

- Incentives for on-platform communication

Strategic Moves

- Feature rollouts timed with seasonal demand

- Geographic expansion into less contested markets

- Partner alliances instead of acquisitions

Why DHgate’s Defense Strategy Is Effective

DHgate does not try to be everything. It defends its core SME sourcing niche with:

- Trust

- Efficiency

- Infrastructure

This defensive clarity is something Miracuves emphasizes when helping entrepreneurs design marketplace platforms—dominate one ecosystem before expanding outward.

Lessons for Entrepreneurs & Implementation

DHgate’s journey offers one of the most practical playbooks for founders building marketplaces, sourcing platforms, or cross-border ecosystems. Its success was not driven by viral growth or aggressive branding—but by disciplined execution and trust-led design.

This section bridges insight to action.

Key Factors Behind DHgate’s Success

- Transaction Control Over Inventory Ownership

DHgate never owned products. It owned the flow of money, trust, and data. - Low-MOQ Strategy to Unlock Liquidity

By enabling small orders, DHgate massively expanded its buyer base. - Escrow as a Growth Lever

Trust infrastructure increased conversions and repeat transactions. - Operations Before Marketing

Strong dispute resolution and supplier enforcement reduced churn. - Aligned Monetization

The platform earns only when users earn—creating long-term loyalty.

Replicable Principles for Startups

Entrepreneurs can adapt DHgate’s model by:

- Starting with one narrow trade niche

- Solving trust before scale

- Designing marketplace rules early

- Monetizing transactions, not listings

- Building partner ecosystems instead of assets

Common Mistakes to Avoid

- Launching without escrow or buyer protection

- Over-investing in ads before liquidity

- Ignoring supplier quality enforcement

- Underestimating operational costs

- Expanding markets too early

Adapting DHgate’s Model to Local or Niche Markets

This model works especially well for:

- Regional wholesale marketplaces

- Vertical B2B platforms (fashion, electronics, construction)

- Import–export sourcing apps

- Dropshipping and reseller ecosystems

Localization is key—especially for:

- Payment methods

- Delivery expectations

- Dispute handling norms

Implementation Timeline & Investment Priorities

Phase 1 :

- Core marketplace MVP

- Escrow and payments

- Supplier onboarding

Phase 2 :

- Trust systems and ratings

- Dispute workflows

- SEO-driven demand

Phase 3 :

- Promotion tools

- Logistics partnerships

- Geographic expansion

This phased approach mirrors how Miracuves helps founders launch scalable, revenue-ready marketplace platforms—reducing risk while accelerating traction.

Ready to implement DHgate’s proven business model for your market?

Miracuves builds scalable marketplace platforms with tested business models, trust systems, and growth mechanisms. We’ve helped 200+ entrepreneurs launch profitable apps.

Get your free business model consultation today.

Conclusion

DHgate’s business model proves that true scale does not come from flashy branding or aggressive discounting, but from engineering trust, efficiency, and discipline into every transaction. By focusing on SME buyers, lowering entry barriers, and controlling trade flows through the platform, DHgate built a marketplace that compounds value steadily while remaining asset-light. Its journey highlights a critical lesson for founders: in platform businesses, execution outperforms ideas, and systems matter more than features.

As we move deeper into 2026, the future of platform economies will favor businesses that control trust instead of inventory, monetize outcomes rather than access, and build ecosystems—not just apps. DHgate stands as a clear blueprint for the next generation of cross-border marketplaces and digital trade platforms, especially for entrepreneurs willing to build patiently, strategically, and at scale.

FAQs :

What type of business model does DHgate use?

DHgate uses a B2B cross-border marketplace model. It connects global buyers with manufacturers and earns primarily through transaction-based commissions and services.

How does DHgate’s business model create value?

It simplifies global trade by offering low MOQs, escrow payments, and supplier verification. This reduces risk and cost for small and medium businesses.

How scalable is DHgate’s business model?

The model is highly scalable because DHgate does not own inventory or logistics. Growth happens by adding users, suppliers, and partners with minimal capital.

What are the biggest challenges in DHgate’s model?

Maintaining trust at scale, managing disputes, and coordinating cross-border logistics are key challenges. DHgate addresses these through automation and partnerships.

How can entrepreneurs adapt DHgate’s model to their region?

Founders can localize payments, logistics, and dispute rules while focusing on one niche market first. Trust systems should be built before scaling.

What are alternatives to the DHgate business model?

Alternatives include vertical B2B marketplaces, inventory-led wholesale platforms, or subscription-based supplier directories, each with different risk profiles.

How has DHgate’s business model evolved over time?

DHgate evolved from a simple listing platform into a full trade infrastructure with escrow, logistics integration, and data-driven supplier enforcement.

Related Article :