In just over a decade, Lazada transformed from a Rocket Internet-backed startup into one of Southeast Asia’s most dominant e-commerce ecosystems, valued at billions and serving over 160 million active consumers across the region. Backed by Alibaba’s technology, logistics intelligence, and super-app infrastructure, the company has redefined how digital commerce operates in emerging markets.

Lazada’s rise is more than a success story — it is a masterclass in platform economics, logistics innovation, and marketplace scalability. The Business Model of Lazada blends marketplace dynamics, cross-border commerce, last-mile logistics, fintech rails, and seller services into a unified growth engine that continues to scale across Southeast Asia.

For entrepreneurs in 2025 exploring marketplace, multi-vendor, or super-app opportunities, understanding the Business Model of Lazada offers practical insights into supply aggregation, demand generation, network effects, and monetization architecture. It also demonstrates how technology and operations combine to create sustainable competitive moats.

How the Lazada Business Model Works

Lazada operates as a hybrid e-commerce ecosystem that combines a multi-vendor marketplace, first-party retail, logistics infrastructure, and financial services under one scalable platform. This model allows Lazada to balance control, efficiency, and growth—something few online marketplaces in emerging regions achieve.

At its core, Lazada connects millions of shoppers with local sellers, international brands, and cross-border merchants across Southeast Asia. The platform solves three major problems in the region: fragmented supply, low trust in online buying, and inconsistent logistics. By centralizing discovery, payments, and delivery under one system, Lazada creates frictionless commerce for every stakeholder.

Key Insights Into Lazada’s Business Model

1. Type of Model

Lazada follows a Hybrid Marketplace Model, consisting of:

- Marketplace (3P) – sellers list and fulfill orders.

- Retail (1P) – Lazada buys inventory and sells directly.

- Cross-Border Commerce – especially from China via Alibaba’s network.

- Logistics-as-a-Service – through Lazada Logistics / LEL Express.

- Fintech Layer – LazPay (wallet), BNPL, seller loans, and credit scoring.

2. Value Proposition

For Consumers

- Fast shipping via Lazada Logistics

- Wide variety: local stores + global brands

- Competitive pricing & abundant deals

- Secure payments + buyer protection

- App gamification to boost engagement

For Sellers / Brands

- Ready-made storefront

- Fulfillment & warehousing solutions

- Analytics, ads, and promotional tools

- Access to regional markets

- Cross-border selling infrastructure

For Partners

- Payment rails, marketing partnerships, logistics collaboration

- API access for integrations

3. Stakeholders in the Ecosystem

- Shoppers

- Local sellers and MSMEs

- Global brands through LazMall

- Third-party logistics providers

- Financial partners

- Government/regulatory bodies

- Cross-border merchants

Each group contributes to network effects, increasing value as more users join.

Read more : What is Lazada and How Does It Work?

Target Market & Customer Segmentation Strategy

Lazada’s customer base spans across one of the fastest-growing digital regions in the world — Southeast Asia. The company doesn’t just target “online shoppers”; it strategically segments users based on behavior, spending power, and product intent. This segmentation helps Lazada optimize acquisition costs, conversion rates, and lifetime value.

1. Primary Customer Segments

A. Mass Market Shoppers (Core Segment)

- Ages 18–45

- Price-sensitive, value-driven

- Frequent buyers across fashion, beauty, home goods

- Highly responsive to flash sales, vouchers, and free shipping

- Heavy app engagement via games, coins, and rewards

B. LazMall Premium Buyers

- Mid- to high-income consumers

- Prioritize authenticity, brand warranties, faster delivery

- Higher AOV (Average Order Value)

- Attracted by premium brands like Samsung, Apple, Xiaomi, Unilever

C. Cross-Border Consumers

- Seek global/Chinese products at lower prices

- Popular categories: electronics accessories, lifestyle, gadgets

- Trust Lazada’s logistics guarantees and buyer protection

2. Secondary Customer Segments

A. Small & Medium Sellers

- Local MSMEs digitizing their stores

- Need visibility, logistics, and payment processing

- Use Lazada Seller Center & ads tools

B. Global Brands and Retailers

- Use LazMall for brand stores

- Rely on Lazada for performance marketing and distribution

C. Influencers & Live Commerce Creators

- Drive real-time sales through LazLive

- Act as acquisition engines for niche categories

3. Customer Journey Mapping

Discovery → Conversion → Retention

Discovery

- Social ads (TikTok, Facebook, Instagram)

- SEO + Google Shopping

- Influencers, livestreams, brand KOL campaigns

- In-app events and mega sales (11.11, 12.12, Birthday Sale)

Conversion

- Personalized product recommendations

- Seller ratings and reviews

- Fast delivery promises

- One-click checkout via LazPay

Retention

- App gamification (coins, vouchers, campaigns)

- Loyalty rewards for LazMall shoppers

- Subscription perks: free shipping, seasonal credits

- Push notifications and dynamic price drops

Revenue Streams and Monetization Design

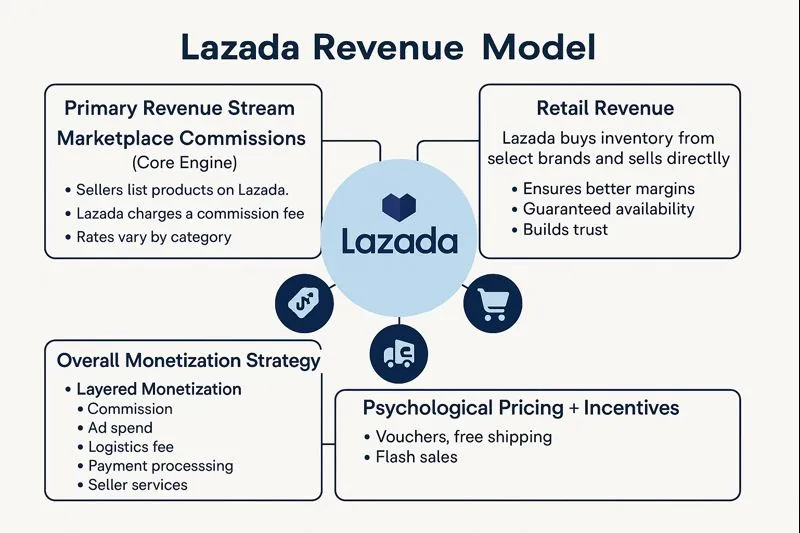

Lazada’s monetization engine is one of the most sophisticated in Southeast Asia. Instead of depending on a single source of income, Lazada blends marketplace commissions, retail margins, logistics fees, advertising revenue, fintech services, and cross-border commerce into a unified revenue architecture. This diversified design protects the business from seasonal fluctuations and category volatility.

Let’s break down how money flows through Lazada’s ecosystem.

1. Primary Revenue Stream: Marketplace Commissions (Core Engine)

This is Lazada’s largest and most stable source of revenue.

How It Works

- Sellers list products on Lazada.

- Lazada charges a commission fee on every completed sale.

- Rates vary by category (electronics, fashion, beauty, home, etc.).

- Sellers may also pay a fixed platform fee depending on their region.

Contribution

- Makes up the bulk of overall revenue, especially in 2025 where seller onboarding is at an all-time high.

- High-margin stream due to minimal fulfilment involvement on Lazada’s side.

Why it grows

- More sellers → more SKUs → more buyers → more orders

- Strong network effects create compounding revenue growth

2. Retail Revenue

Lazada buys inventory from select brands and sells directly.

Mechanism

- Lazada purchases inventory at wholesale prices

- Sells it at retail prices (like Amazon 1P)

- Ensures product authenticity, better margins, and guaranteed availability

Why They Use 1P

- To dominate high-demand categories

- To compete with offline retail

- To build trust by controlling the supply chain

Overall Monetization Strategy

Lazada’s revenue design is built around three core principles:

1. Layered Monetization

Each order triggers multiple revenue streams:

- Commission

- Ad spend

- Logistics fee

- Payment processing

- Seller services

2. Flywheel Economics

More sellers → more ads → more buyers → more orders → more logistics revenue → reinvestment → repeat.

3. Psychological Pricing + Incentives

- Vouchers increase order frequency

- Free shipping thresholds boost AOV

- Flash sales create FOMO

- Wallet cashback increases stickiness

This integrated revenue structure gives Lazada financial resilience + scalability.

Operational Model & Key Activities

Lazada’s business model works because its operations are engineered for scale — balancing technology, logistics, seller management, and customer experience across six Southeast Asian countries. Unlike traditional marketplaces that rely heavily on third parties, Lazada built a vertically integrated operational engine that gives it speed, control, and efficiency.

Below is a structured breakdown of how Lazada runs the machine behind its billion-dollar ecosystem.

1. Core Operational Pillars

A. Platform Management & Technology

Lazada’s tech stack (supported by Alibaba Cloud) ensures platform stability during high-traffic mega-sales like 11.11 and 12.12, where orders reach millions within hours.

Key activities:

- AI-driven product recommendations

- Fraud detection and payment security

- Seller dashboard & analytics

- Search ranking algorithms

- Personalized homepage feeds

- Live commerce infrastructure

B. Logistics & Fulfillment (LEL Express)

Logistics is Lazada’s backbone — a major differentiator in Southeast Asia’s fragmented geography.

Core logistics activities:

- Warehousing and inventory management

- First-mile pickup

- Sortation centers and hubs

- Last-mile delivery fleet

- COD (Cash on Delivery) handling

- Fulfilled by Lazada (FBL) operations

Lazada processes millions of parcels per day with industry-leading delivery times.

C. Merchant & Seller Operations

Sellers fuel marketplace growth; Lazada invests heavily in their success.

Key responsibilities:

- Seller onboarding & KYC verification

- Policy enforcement & quality control

- Inventory performance monitoring

- Seller performance scoring

- Training and education (Lazada University)

These workflows reduce counterfeit risk and ensure a trusted shopping environment.

D. Customer Service & Trust Infrastructure

Lazada’s reputation relies heavily on customer satisfaction.

Activities include:

- 24/7 multi-language support

- AI chatbots + human escalations

- Refund and return processing

- Dispute resolution

- Buyer protection guarantees

2. Resource Allocation Strategy (2025)

Tech & Infrastructure (30–35%)

- Cloud computing

- Personalization engines

- Cybersecurity

- App performance optimization

Marketing Spend (25–30%)

- Mega campaigns (11.11, 12.12)

- Creator/Influencer partnerships

- Cashback and vouchers

- Cross-channel advertising

Logistics & Fulfillment (25%)

- Delivery fleet

- Warehouse expansion

- Cross-border integrations

Strategic Partnerships & Ecosystem Development

Lazada’s rise across Southeast Asia is not just due to technology or logistics—it’s the result of strategic alliances that amplify reach, trust, and ecosystem depth. Lazada functions as the core platform, but its partnerships form the connective tissue that enables seamless commerce across a diverse region.

Below is a structured breakdown of how Lazada builds, manages, and benefits from ecosystem partnerships

1. Collaboration Philosophy

Lazada’s partnership strategy is built on three principles:

- Integrate deeply rather than lightly collaborate

- Co-create value for brands, sellers, and consumers

- Scale regionally, but localize execution in each country

This model strengthens Lazada’s competitive moat and accelerates network effects across Southeast Asia’s fragmented markets.

2. Key Partnership Types

A. Technology & API Partners

These collaborations build core platform capabilities.

Examples:

- Alibaba Cloud → computing, AI, data intelligence

- Payment API providers → fraud detection, security

- Marketing tech APIs → analytics, campaign automation

- Chat & CX integrations → AI chatbots, live support tools

These partners support millions of daily transactions with high reliability.

B. Payment, Banking & Fintech Alliances

Essential for trust in COD-heavy markets.

Partnership scope:

- Wallet top-ups & cashbacks with banks

- EMI/BNPL options

- Card promotions and bank-led discounts

- Cross-border currency handling

- Seller financing via partner banks

Banks benefit from transaction volume; Lazada benefits from increased conversion rates.

C. Logistics & Supply Chain Partners

Although Lazada runs LEL Express, partnerships extend reach.

Collaborators include:

- Local courier companies

- Regional last-mile delivery player

- Warehouse service providers

- Customs and border clearance agencies

- International freight and shipping partners

These partners ensure reliable delivery across 6 countries and remote areas.

3. Ecosystem Strategy Insight

A. Network Effects

More partners → better infrastructure → more sellers → more buyers → more demand → more partners.

B. Monetization Opportunities

Partnerships unlock:

- Co-funded marketing campaigns

- Payment processing margins

- BNPL and credit revenue

- Sponsored events and seller programs

C. Competitive Moat Building

Strategic alliances create:

- High switching costs

- Exclusive brand relationships (LazMall)

- Superior logistics coverage

- Loyal payment ecosystems

In 2025, Lazada’s ecosystem strength is a major reason for its resilience against competitors like Shopee and TikTok Shop.

Growth Strategy & Scaling Mechanisms

Lazada’s growth strategy is a blend of aggressive market acquisition, deep ecosystem integration, and long-term infrastructure development. Unlike lightweight marketplaces that primarily scale through marketing, Lazada scales through a full-stack approach — technology → logistics → fintech → seller enablement → brand partnerships.

Below is a complete breakdown of how Lazada grows and sustains momentum in 2025.

1. Core Growth Engines

A. Organic Virality & Community-Led Growth

Lazada fuels organic discovery through:

- Referral incentives

- Creator-driven livestreaming

- Gamification (coins, vouchers, missions)

- Social sharing of price drops & deals

This significantly reduces acquisition cost per user.

B. Paid Marketing & Performance Acquisition

Lazada runs massive region-wide campaigns, especially during mega sales.

Key channels:

- TikTok, Instagram, Facebook ads

- Google Shopping

- Influencers & KOLs

- TV + OTT ads during 11.11 & 12.12 events

- Affiliate programs

These campaigns bring millions of first-time shoppers during peak seasons.

C. New Product Lines & Category Expansion

Lazada continuously expands beyond traditional e-commerce.

Growth categories include:

- Grocery (LazMart)

- Health & wellness

- Home & living

- Electronics & appliances

- Cross-border mega categories

- Live commerce shows

Each new category increases AOV and customer lifetime value.

D. Geographic Expansion Strategy

Lazada grows market-by-market with:

- Localized supply + local sellers

- Country-specific promotions

- Regional brand partnerships

- Tailored logistics solutions for each geography

- Language and cultural customization

Countries like the Philippines, Thailand, and Malaysia show particularly strong YoY growth.

2. Scaling Mechanisms

A. Technology Scalability

Powered by Alibaba Cloud:

- Handles millions of concurrent shoppers

- Auto-scaling servers during mega campaigns

- AI-driven pricing, ads, and recommendations

- Automated fraud detection

This stack supports hyper-scale events without downtime.

B. Logistics Scaling

Lazada’s logistics growth includes:

- Expanding warehouse capacity

- Adding last-mile fleet partners

- Increasing sorting center automation

- Using AI to predict delivery demand

- Strengthening cross-border pipelines (China → SEA)

This ensures 2-hour to 2-day delivery, depending on the region.

C. Seller & Brand Scaling

Lazada enables sellers through:

- Lazada University

- Sponsored ads automation

- Loyalty programs for high-performing sellers

- Regional seller tools for multi-country expansion

As sellers scale, Lazada’s SKU depth and consumer choice expand.

Competitive Strategy & Market Defense

Southeast Asia is one of the most competitive e-commerce battlegrounds in the world, with Shopee, TikTok Shop, Amazon (in select markets), and hundreds of local players vying for consumer attention. Lazada survives and wins because its competitive strategy is structural, long-term, and ecosystem-driven, not just promotional.

Below is the full breakdown of how Lazada defends its market position.

1. Competitive Advantages

A. Deep Network Effects

More sellers → more assortment → more buyers → more orders → more logistics volume → lower delivery cost → more sellers.

This flywheel is extremely hard for new entrants to replicate.

B. Strong Brand Trust & LazMall Advantage

LazMall gives Lazada a strong defensive edge:

- 100% authenticity guarantee

- Returns & warranty protections

- Premium customer experience

- Faster deliveries

This attracts high-income buyers and global brands.

C. Full-Stack Logistics Power

Lazada has something most rivals lack: vertically integrated logistics.

Advantages:

- Faster delivery

- Better cost control

- Higher service reliability

- Ability to handle cross-border at scale

This is a critical differentiator vs. TikTok Shop and Shopee in 2025.

D. AI & Personalization (Powered by Alibaba Cloud)

Lazada leverages Alibaba’s:

- Search algorithms

- Recommendation engines

- Dynamic pricing

- Fraud detection

- Ad optimization

This creates a personalized shopping journey similar to Taobao/Tmall.

E. Payment & Fintech Stickiness

LazPay makes users return more frequently through:

- Wallet cashbacks

- Loyalty perks

- BNPL convenience

- Reduced COD friction

Fintech significantly increases retention and order frequency.

2. Market Defense Tactics

A. Strategic Feature Rollouts (Timing is Key)

Lazada carefully sequences feature launches like:

- Live commerce

- Ultra-fast delivery

- BNPL

- Gamified campaigns

- Brand festivals

These rollouts often pre-empt competitor actions

B. Exclusive Partnerships & Brand Lock-Ins

Lazada signs exclusive deals with:

- Global brands (electronics, beauty)

- Local champions

- KOLs for livestreaming

These deals create switching barriers for both sellers and buyers.

C. Pricing Strategy & Discount Control

While Shopee goes hyper-aggressive on price, Lazada focuses on:

- Voucher-backed discounts

- Card/bank partnership deals

- Category-specific promotions

- Strategic flash sales

This avoids bleeding cash while staying competitive.

Read more : Best Lazada Clone Scripts 2025: Build a Scalable E-Commerce Empire with Miracuves

Lessons for Entrepreneurs & Implementation

Lazada’s journey offers powerful, practical lessons for founders building marketplaces, multi-vendor stores, or regional super-apps. Whether you’re launching an e-commerce app, logistics platform, or vertical marketplace, Lazada’s strategy provides a blueprint for scale, monetization, and sustainability.

Let’s translate Lazada’s success into actionable insights.

1. Key Factors Behind Lazada’s Success

A. Build the Infrastructure First

Lazada invested early in:

- Logistics

- Data intelligence

- Payments

- Seller systems

Most founders make the mistake of prioritizing marketing before building a reliable backbone.

B. Combine Marketplace + Fintech + Logistics

This “triple stack” creates:

- High switching barriers

- Recurring revenue layers

- Long-term defensibility

Platforms that rely solely on commissions become fragile.

C. Local Execution Beats Global Playbooks

Southeast Asia is fragmented—localizing:

- Payment methods

- Language

- Logistics

- Promotions

is essential for growth.

D. Sellers Are the True Growth Engine

Lazada treats sellers as partners, not just inventory sources.

Investing in seller success equals:

- Higher SKU availability

- Better customer experience

- Stronger network effects

E. Mega Events Drive Massive Growth

Campaigns like 11.11 and 12.12 became cultural events—founders must create their own “seasonal moments” to drive demand spikes.

2. Replicable Principles for Startups

Entrepreneurs can apply Lazada’s playbook by:

- Starting with one core category and expanding later

- Building trust features early (reviews, ratings, secure payments)

- Offering sellers analytics and marketing tools

- Using AI for recommendations and pricing

- Designing retention loops (wallets, rewards, memberships)

3. Common Mistakes to Avoid

- Pure discount dependency (unsustainable)

- Ignoring logistics until it becomes a bottleneck

- Over-onboarding sellers without quality control

- No differentiation beyond “cheap products”

4. Adaptation Strategies for Local or Niche Markets

If you are targeting a niche (beauty, home services, electronics, grocery), apply these adjustments:

- Use micro-influencers for trust

- Build category-specific logistics or partnerships

- Create niche-based loyalty programs

- Drive community around your product categories

- Enable seller education and onboarding support

Ready to implement Lazada’s proven business model for your market?

Miracuves builds scalable, secure, ready-to-launch multi-vendor marketplace platforms with logistics, seller tools, and growth-ready architecture.

We’ve helped 200+ entrepreneurs launch successful apps across e-commerce, logistics, and marketplaces.

Get your free business model consultation today.

Conclusion :

Lazada’s journey shows that building a successful platform is never about one big idea—it’s about orchestrating technology, logistics, payments, sellers, and customers into a unified ecosystem. The company grew because it mastered both innovation and execution, turning a fragmented Southeast Asian market into one of the world’s most dynamic e-commerce landscapes.

For founders in 2025, Lazada proves an essential truth:Platforms that invest in infrastructure, trust, and user experience—rather than short-term discounts—build the strongest and most defensible business models.

As digital economies expand, the future belongs to ecosystem builders who can combine commerce, payments, logistics, and data into seamless user journeys. The next wave of billion-dollar marketplaces will emerge from those who design systems, not just apps.

FAQs :

1. What type of business model does Lazada use?

Lazada uses a hybrid marketplace model that combines third-party selling (3P), first-party retail (1P), cross-border commerce, logistics services, and fintech products. This creates multiple revenue layers and strong network effects.

2. How does Lazada’s model create value?

Lazada creates value by unifying products, payments, logistics, and seller tools into one trusted ecosystem. This reduces friction for shoppers and empowers sellers to scale effortlessly.

3. What are Lazada’s key success factors?

Its success comes from strong logistics, AI personalization, brand partnerships, and Alibaba’s backing. Mega-sale events like 11.11 further accelerate demand and platform growth.

4. How scalable is Lazada’s business model?

The model is highly scalable due to cloud tech, cross-border supply chains, and automated logistics. As more sellers and buyers join, margins improve through network effects.

5. What are the biggest challenges in Lazada’s model?

Challenges include fierce competition, COD dependency, logistics complexity, and counterfeit risks. Multi-country compliance also adds operational pressure.

6. How can entrepreneurs adapt Lazada’s model to their region?

Focus on a niche, build trust features, partner with local logistics, and offer wallet/BNPL benefits. Seasonal mega-sale events help drive rapid user adoption.

7. What resources and timeframe are needed to launch a marketplace like Lazada?

With Miracuves, you can launch in 30–90 days with full marketplace, payments, logistics, and seller tools. This avoids 12–18 months of expensive custom development.

8. What are alternatives to Lazada’s business model?

Alternatives include niche vertical marketplaces, social commerce, subscription commerce, hyperlocal apps, and B2B platforms. Each offers different unit economics and scaling patterns.

9. How has Lazada’s business model evolved over time?

Lazada moved from retail to marketplace, expanded logistics (LEL) and LazMall, and integrated AI, live commerce, and fintech. The 2023–2025 era added strong personalization and financial services.

Related Article :