In 2025, the global e-commerce landscape is witnessing massive shifts. With digital infrastructure maturing and customer expectations evolving, startup founders and app entrepreneurs are eager to learn from the giants who’ve shaped the space. Two standout models are those of Flipkart and Alibaba—pioneers in the Indian and Chinese markets respectively, but with fundamentally different strategies.

Understanding the Flipkart business model vs the Alibaba business model isn’t just academic. It’s a strategic necessity. Whether you’re building a multi-vendor marketplace, a logistics-driven e-commerce platform, or a B2B trade engine, this comparison helps define:

- Your platform architecture

- Monetization strategy

- Target audience and partners

- Long-term growth potential

This blog breaks down both models in detail—revenue, cost structure, partnerships, and growth—and concludes with practical recommendations for which model suits different startup types in 2025.

What is Flipkart?

Flipkart is one of India’s largest e-commerce platforms, founded in 2007 and acquired by Walmart in 2018. Initially started as an online bookstore, Flipkart has expanded into electronics, fashion, groceries, and more. It operates primarily in the B2C segment and mirrors the Amazon-like full-stack e-commerce model.

Core Focus:

- B2C retail

- Inventory + marketplace hybrid

- Indian consumer market

Notable Achievements:

- Acquired Myntra, Jabong, and PhonePe

- Dominant in fashion, electronics, and home products in India

- Backed by Walmart, expanding aggressively in Tier-2 and Tier-3 cities

What is Alibaba?

Alibaba Group, founded in 1999 by Jack Ma, is a Chinese conglomerate with diversified operations in e-commerce, cloud computing, fintech, and logistics. Its e-commerce operations include Alibaba.com (B2B), Taobao (C2C), and Tmall (B2C). The core Alibaba platform is a marketplace-first, asset-light business enabling manufacturers, traders, and retailers globally.

Core Focus:

- B2B + C2C + B2C marketplaces

- No inventory holding

- Global supplier network

Notable Achievements:

- Listed on NYSE and HKSE

- Over 1 billion annual active consumers globally

- Diversified revenue from logistics (Cainiao), cloud (Aliyun), and fintech (Ant Group)

Flipkart Business Model Breakdown

1. Revenue Streams

- Direct Sales (Inventory-led): Revenue from selling goods held in Flipkart’s warehouses

- Marketplace Commission: Commission from third-party sellers

- Advertising: Sponsored listings and product ads

- Logistics Services (Ekart): Delivery solutions for internal and third-party vendors

- Private Labels: Exclusive brands (e.g., MarQ, SmartBuy)

2. Cost Structure

- Warehouse and inventory management

- Technology and platform maintenance

- Customer acquisition (ads, cashback)

- Logistics and delivery operations

- Seller support services

3. Key Partners

- Sellers & brands

- Logistics providers (eKart, Shadowfax)

- Payment gateways & financial services

- Marketing affiliates

4. Growth Strategy

- Deep penetration into Tier-2 & 3 cities

- Buy-now-pay-later and UPI integration

- Omni-channel retail (Flipkart Quick)

- Video commerce and voice search integrations

Learn More: Business Model of Flipkart: How It Earns & Operates (2025)

Alibaba Business Model Breakdown

1. Revenue Streams

- Marketplace Commission (Tmall, Taobao): Transaction fees and commissions

- Membership Fees (Alibaba.com): B2B supplier access

- Marketing & Ads: Sponsored search, display ads, banners

- Cloud Services: Aliyun (Alibaba Cloud) revenues

- Logistics Platform: Cainiao fees from shipping and warehousing

- Fintech Services: Payments, lending via Alipay and Ant Group

2. Cost Structure

- Technology infrastructure (cloud, AI)

- Partner ecosystem management

- Marketing & brand campaigns

- R&D for innovation

- Minimal warehousing (logistics outsourced or platformized)

3. Key Partners

- Manufacturers, exporters, and wholesalers

- Logistics partners (Cainiao, SF Express)

- Payment ecosystem (Alipay, local wallets)

- Government trade initiatives

4. Growth Strategy

- Global expansion through Alibaba.com

- AI-driven product recommendations

- SME empowerment in APAC, Africa

- Cloud-first infrastructure scaling

Learn More: Business Model of Alibaba: How It Makes Money and Scales

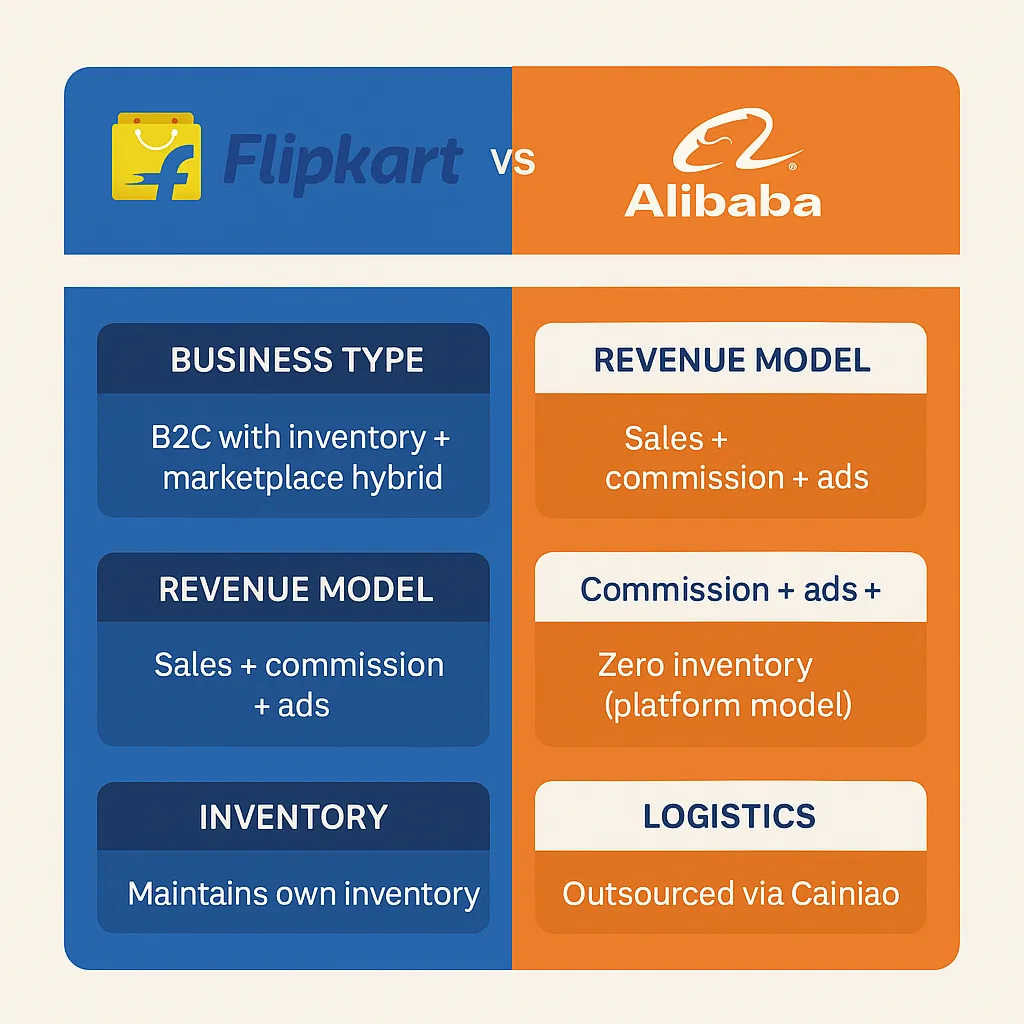

Comparison Table: Flipkart vs Alibaba

| Feature | Flipkart | Alibaba |

|---|---|---|

| Business Type | B2C with inventory + marketplace hybrid | B2B/B2C/C2C marketplace-only |

| Revenue Model | Sales + commission + ads | Commission + ads + cloud + fintech |

| Inventory | Maintains own inventory | Zero inventory (platform model) |

| Logistics | In-house (Ekart) | Outsourced via Cainiao |

| Geographic Focus | India | China + Global |

| Technology Stack | Traditional e-commerce platform | Advanced AI, Cloud, Big Data |

| Capital Investment | High (warehouses, logistics, customer care) | Low (platform + tech infrastructure) |

| Monetization Diversity | Moderate | High (e-comm, cloud, ads, fintech) |

| Startup Suitability | For product-based retail in one region | For platform-first global expansion |

Pros & Cons of Flipkart Business Model

Pros

- Strong control over logistics = better delivery performance

- Brand loyalty via private labels

- Faster monetization from inventory

- Greater trust among Indian consumers

Cons

- High CAPEX in infrastructure

- Limited scalability outside India

- Risky if demand forecasting fails (unsold inventory)

- Slower innovation pace

Pros & Cons of Alibaba Business Model

Pros

- Highly scalable & low overhead

- Global marketplace potential

- Monetizes across industries (e.g., cloud, finance)

- Resilient during market downturns

Cons

- Less control over quality and delivery

- Heavy dependence on supplier performance

- Requires sophisticated tech stack

- Regulatory challenges in cross-border trade

Market Data: Growth, Revenue & Funding (as of 2025)

| Metric | Flipkart | Alibaba |

|---|---|---|

| 2025 Revenue Estimate | $25 Billion+ (India-focused) | $140 Billion+ (group-wide) |

| Funding Raised | $12 Billion (Backed by Walmart) | IPO + Retained earnings |

| User Base | 450 Million+ | 1 Billion+ Active Users |

| Market Expansion | India-centric | Global (Asia, US, Africa) |

| Profitability | Break-even targets by 2026 | Profitable segments: Cloud, Ads |

| Notable Acquisitions | Myntra, Jabong, PhonePe | Lazada, Trendyol, Daraz, Youku |

Which Model is Better for Startups in 2025?

If you’re an early-stage founder or app entrepreneur in 2025, the ideal model depends on:

- Your target market (local vs global)

- Your resource access (funding, logistics)

- Monetization horizon (short-term vs long-term)

- Tech readiness

Choose the Flipkart Model if:

- You’re building for a single country (like India or UAE)

- You want higher control over CX and delivery

- You’re ready to invest in inventory/logistics

- You have deep funding support

Build a Flipkart-style app with Miracuves

Choose the Alibaba Model if:

- You’re targeting cross-border commerce or B2B

- You prefer asset-light scaling with suppliers

- You want monetization through cloud or fintech

- You aim for global SaaS-style expansion

Launch an Alibaba-style marketplace app with Miracuves

Conclusion

At Miracuves, we help startups bring world-class platforms to life. Whether you aim to replicate Flipkart’s retail powerhouse or Alibaba’s marketplace marvel, we tailor scalable clone solutions designed for your region, niche, and user persona.

Both models work—but only when aligned with your vision, execution, and resources.

Want to launch your own Flipkart or Alibaba-style app?Reach out today and get a free roadmap consultation!

FAQs

1. What is the Flipkart business model?

Flipkart operates a hybrid B2C model combining direct inventory sales and third-party marketplace commissions. It also earns via ads, logistics (Ekart), and private labels.

2. How does Alibaba make money?

Alibaba earns via commissions, ads, membership fees, Alibaba, logistics (Cainiao), and fintech services through Alipay and Ant Group.

3. Which model is better for cross-border trade?

Alibaba’s marketplace and logistics-light model is more suited for cross-border and B2B commerce.

4. Is Flipkart profitable in 2025?

Flipkart is close to breakeven, focusing on scaling its logistics and ad tech revenue in Tier-2/3 Indian markets.

5. Can startups replicate Alibaba’s model easily?

Yes, but it requires strong tech infrastructure and global supplier onboarding. Miracuves offers white-label Alibaba clone solutions for faster launch.