Employer branding has evolved from a simple HR function into a data-rich, high-margin industry. With $3.2 billion in annual spending, companies are now investing heavily in reputation management, candidate perception, culture analytics, and workplace reviews. What makes this model fascinating is that platforms like Glassdoor do not hire employees or manage recruitment — they own only the platform that influences recruitment decisions.

Today, corporate reputation is treated as a strategic asset, and candidates research companies more than companies research candidates. This has created a new digital hiring economy, where trust, transparency, and data shape business decisions — and platforms that collect, organize, and monetize this data become incredibly valuable.

The biggest shift? Hiring is no longer just about job posts — it’s about workplace perception, culture insights, salary intelligence, and sentiment tracking. This is why the “Job Review Platform” model has become one of the most profitable digital ecosystems — and the opportunity for niche platforms is bigger than ever.

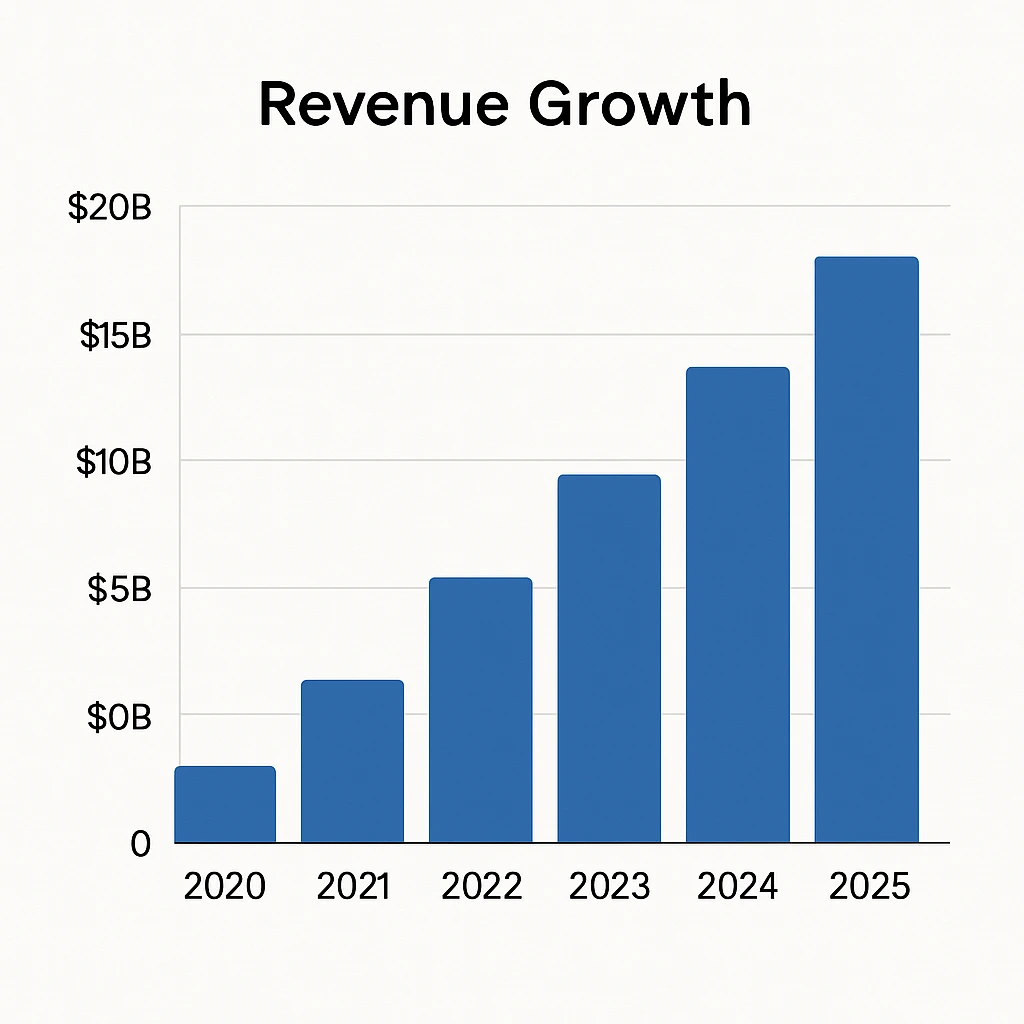

Glassdoor Revenue Overview – The Big Picture

| Financial Metric (2025 Estimates) | Value |

|---|---|

| Global Platform Valuation | ~$2.6 Billion |

| Annual Revenue (2025 Forecast) | ~$450 Million |

| YoY Growth | 13–15% |

| Avg. Profit Margin | 40–48% |

Revenue Breakdown by Region (2025):

- North America – 41%

- Europe – 27%

- APAC – 20%

- Others – 12%

Competitive Positioning

Glassdoor leads the employer reputation segment, while LinkedIn dominates recruitment. Paying companies treat reputation as currency, making this model highly scalable.

Competitors: Glassdoor, Indeed, Blind, Kununu, Comparably, AmbitionBox (India)

Read More: Glassdoor App Explained – Features, Benefits & How It Works

Primary Revenue Streams Deep Dive

1. Premium Employer Branding Profiles – 32%

Companies pay to show a curated reputation, culture video, reviews management dashboard, job listing priority & branding assets.

Pricing: $249–$999/month (SMEs) | $2,500+ (Enterprise)

2. Data Analytics & Insights – 22%

Salary and workplace trend reports sold to HR teams & consulting firms.

3. Job Listings + Boosted Visibility – 18%

Premium placements & priority listing position with CPC/CPM bidding models.

4. Recruitment SaaS Plans – 14%

Subscription model for resume access, candidate filtering & AI screening tools.

5. Advertising & Sponsored Content – 14%

Sponsored hiring campaigns, SaaS HR tool integrations, podcast & media ad space.

Revenue Streams Percentage Breakdown

| Revenue Stream | Share (2025) |

|---|---|

| Premium Employer Profiles | 32% |

| Analytics & Salary Data Services | 22% |

| Paid Job Listings & Boosts | 18% |

| Hiring SaaS Subscriptions | 14% |

| Ads & Sponsored Content | 14% |

The Fee Structure Explained

| User Type | Paid Services & Fees | Avg. Pricing |

|---|---|---|

| Employers | Employer profile, branding, messaging tools | $249–$2,500/month |

| Recruiters | Resume access + insights | $199–$499/month |

| HR Teams | AI-powered talent analytics | $499–$1,500/month |

| Consulting Firms | Workplace trend reports & data | On-demand |

| Candidates | Generally free – optional resume boost | $15–$25 |

Hidden Revenue Layers

- API access to salary data

- Corporate review management & sentiment tracking

- Paid reputation recovery tools

- AI ranking of workplaces (2025 new trend)

Regional Pricing Variation

US & Europe – High-margin model

India & Asia – Volume-based pricing

Middle East – Hybrid plan based on employer reputation protection

How Glassdoor Maximizes Revenue Per User

| Strategy | Effect |

|---|---|

| AI-driven company review sentiment scoring | Drives premium upgrades |

| Tiered subscription plans | More predictable recurring revenue |

| Retention monetization | 1-year plans = 42% higher profit |

| Psychological pricing | $249 vs $250 = 7% more conversions |

| Cross-selling salary analytics | 2X revenue from same users |

| Employer reputation urgency | Rush-pricing for crisis reviews |

| Data-backed pricing | Industry-based variable subscription |

Real Example (2025):

Avg. Enterprise Employer Spend:

$6,200 – $14,000 / year

Read More: Business Model of Glassdoor : Complete Strategy 2025

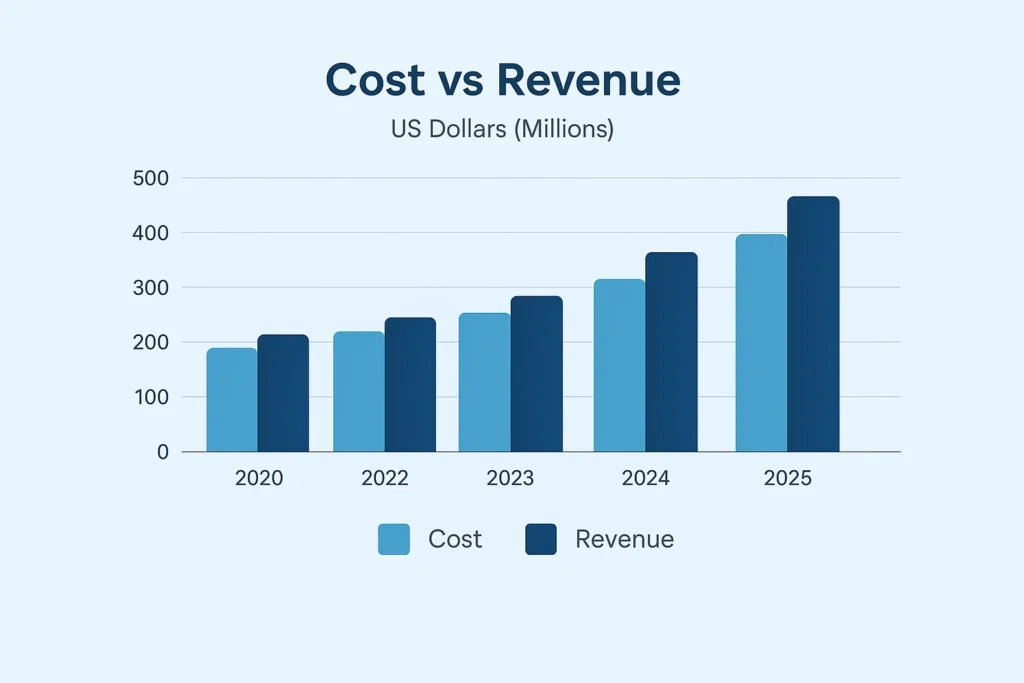

Cost Structure & Profit Margins

| Cost Component | % of Total Cost |

|---|---|

| Tech & Infrastructure | 28% |

| Data Handling & AI | 19% |

| Marketing & CAC | 26% |

| Operations & HR | 12% |

| R&D + Compliance | 15% |

Profit Margin (2025): 40–48%

Unit Economics:

CAC: $70 | ARPU: $340 | LTV: ~$1,600

Read More: Best Glassdoor Clone Script 2025 | Build a Job Review Platform

Future Revenue Opportunities (2025–2027)

AI-powered “Reputation Score” for companies

Video-based employee perception reports

Industry-specific review portals (Healthcare, Aviation, Logistics)

B2B Hiring SaaS for HR & Talent Agencies

Anonymous hiring + AI-based pre-interview screening

Salary Prediction Model – High Value Data Product

Risks: Regulation, Fake Reviews, AI Ethics Laws

Opportunity: Niche portals with curated review quality

Lessons for Entrepreneurs & Your Opportunity

What Works: Trust-centered platform + subscription model

What to Replicate: Reputation analytics + niche targeting

Market Gap: Industry-focused Glassdoor clones

Emerging Demand: Ethics-based hiring, DEI compliance, purpose-led workplaces

Want to build a transparent hiring platform like Glassdoor — with reputation management, analytics & earning potential from day one? Miracuves helps entrepreneurs launch revenue-ready Glassdoor Clone platforms with built-in monetization features. Some clients even start earning within 30 days of launch, and Miracuves delivers ready-to-launch solutions in 3–9 days guaranteed.

If you need advanced language scripts or AI sentiment analysis, Miracuves can provide that too — fully scalable and customizable.

Final Thought

Workplace transparency is no longer optional — it’s a competitive asset and a high-ROI digital model. As hiring becomes more data-driven, employers are willing to pay for reputation, analytics, and visibility. This gives entrepreneurs a major opportunity: niche Glassdoor-style platforms with built-in monetization from day one.

If you’re planning to build one, you don’t need to start from scratch.

Miracuves delivers fully customizable job review and employer branding platforms with AI-based sentiment tools, scalable revenue modules, and future-ready tech stacks — all ready to launch within just 3–9 days.

FAQs

1. How does Glassdoor make money?

Through employer branding, paid listings, analytics & advertising.

2. What is Glassdoor’s most profitable model?

Premium employer branding profiles.

3. Do companies pay for reviews removal?

They pay for reputation management tools — not removal.

4. Can startups build Glassdoor-like platforms?

Yes — niche segment platforms grow faster & cheaper. At Miracuves, you can build a similar job portal platform starting at just $2899.

5. What % does a portal take from employers?

Subscription models range from $249 to $2,500/month.

6. How fast can such platforms monetize?

With built-in features — within 30 days of launch.

7. What’s the minimum viable version?

Reviews + search + employer dashboards + AI scoring.

8. Can niche Glassdoor portals be profitable?

Yes — B2B niche targeting boosts ROI by 60%.

9. What is the future trend?

AI-powered workplace scoring & data-driven hiring.

10. Can Miracuves build this model?

Yes — with advanced monetization layers & ready in 3–9 days.