Ever scrolled through Revolut or N26 and thought, “Why can’t I build this?” You’re not alone. In today’s swipe-savvy world, even your neighborhood chaiwala accepts UPI. Traditional banking? Meh. We’re living in the age of digital wallets, crypto cards, and virtual vaults. That’s why digital banking apps are no longer a trend — they’re the baseline for fintech innovation.

For bootstrappers, solopreneurs, and startup squads, the barriers to entry are lower than ever. With open banking APIs, white-label solutions, and on-demand dev teams, you don’t need a billion-dollar war chest to launch your own Neobank. You just need the right roadmap… and a touch of madness.

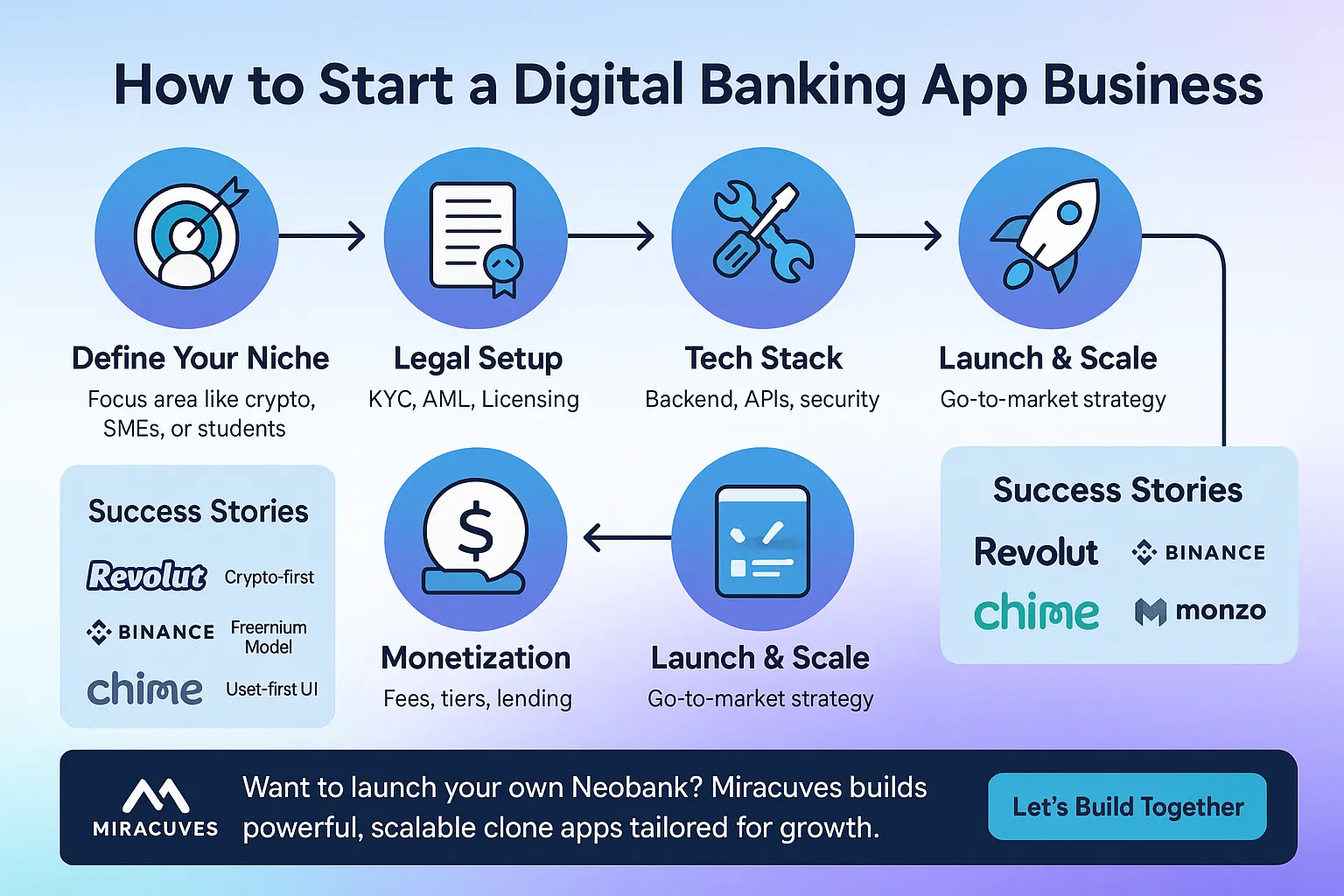

In this blog, we’ll walk you through everything you need to know about launching a digital banking app — from ideation and compliance to monetization and tech stacks. Plus, we’ll explore how pioneers like Revolut, Binance, and Chime cracked the code. Ready to build? Let’s dive in — and if you’re looking for a shortcut, Miracuves has your back.

Why Digital Banking is Booming

It’s not just about cashless convenience anymore. Digital banking offers:

- Real-time financial access

- Lower operational costs than legacy banks

- Fintech partnerships through open APIs

- Gen Z and Millennials demanding seamless UI/UX

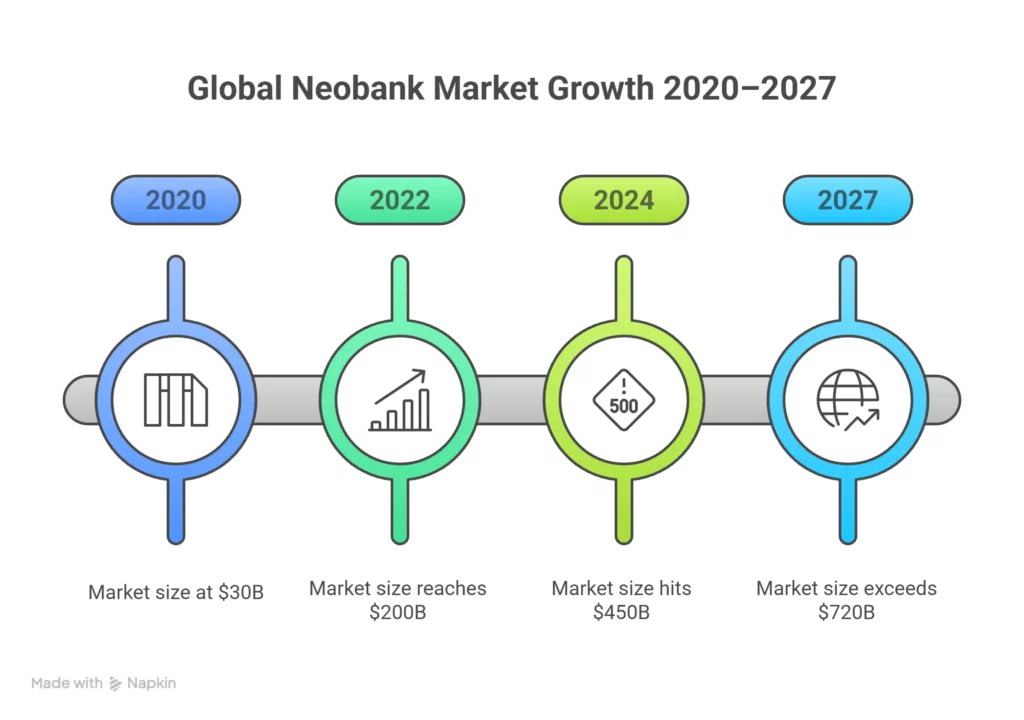

According to Statista, the neobank market is projected to reach $722.6 billion by 2028.

Step-by-Step: How to Launch Your Digital Banking App

1. Define Your Niche & Vision

Are you targeting freelancers? SMEs? Crypto traders? Students? Find your vertical and design your core offering accordingly.

Example Niches:

- Chime: Millennials with poor credit history

- Binance: Crypto-first banking

- Revolut: Global travelers & investors

- Monzo: UK-based budget-conscious users

2. Understand the Legal Maze

You’ll need:

- Banking licenses (direct or partner-backed)

- KYC/AML compliance

- PCI DSS for payment data

- GDPR or local data privacy laws

Pro Tip: Partner with licensed banks or fintech enablers to sidestep the slow licensing process in your MVP phase.

3. Choose Your Tech Stack Wisely

A killer app is only as strong as its backend. Key components:

- Frontend: React Native, Flutter

- Backend: Node.js, Python (Django)

- Security: AES-256 encryption, biometric login, 2FA

- APIs: Plaid, Yodlee, Galileo, Stripe, Currencylayer

4. Core Features Your App Must Have

| Must-Have Features | Why They Matter |

| User onboarding & KYC | Smooth entry = Higher retention |

| Multi-currency support | For travelers & global users |

| Budgeting & analytics | Keeps users coming back daily |

| Crypto wallets | Essential in the Binance-style ecosystem |

| Virtual + physical cards | Boosts user trust |

| Real-time push notifications | Keeps engagement up |

5. Monetization Models That Actually Work

- Interchange fees from card spending

- Subscription tiers for premium services

- Lending services (BNPL, microloans)

- Commission from partners (insurance, investments)

- Crypto exchange fee margins

Digital Banking App Giants: Bite-Size Inspiration

Let’s peek at a few disruptors:

- Revolut: Multi-currency, stocks, and crypto in one sleek package.

- Binance: From exchange to full-blown crypto bank — insane vertical growth.

- Chime: Zero fees + payday advances made it a darling of Gen Z.

- N26: German-engineered banking with a visual, mobile-first UI.

- Monzo: Known for transparency and viral word-of-mouth adoption.

- Cash App: Killer combination of P2P, Bitcoin, and stock trading.

Each of these started small but scaled with smart tech, killer UX, and sharp positioning.

Marketing Tips That Don’t Suck

- Gamify saving goals (e.g., “Money Pots” like Monzo)

- Collaborate with influencers in finance niche

- Offer referral bonuses that don’t feel stingy

- Create content engines (blogs, YouTube, podcasts)

- Invest in storytelling over product specs

Conclusion: What’s Next?

Digital banking isn’t just a business idea — it’s a financial revolution. Whether you’re aiming to create the next Revolut or just solve one community’s pain point, the opportunities are massive.

And if you want a faster route to launch, without compromising on quality or scalability?We help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q1. What’s the minimum investment required to start a digital bank app?

Starting a digital bank app with Miracuves requires an investment of around $2K–$5K. The ready-made clone model helps you launch a secure, fully functional platform within 3–6 days, reducing both cost and development time.

Q2. Do I need a banking license to start?

Not immediately. You can use Banking-as-a-Service (BaaS) providers to launch faster and stay compliant.

Q3. Can I offer crypto services in my app?

Yes, but it requires additional licenses and regulatory clearances depending on your region.

Q4. What’s the best region to launch a Neobank?

Europe (especially Lithuania), Singapore, and the US have mature BaaS infrastructures and clearer regulations.

Q5. How long does it take to launch?

With clone tech and agile development, 3–5 months is realistic for a solid MVP.

Q6. Can I monetize from Day 1?

Absolutely — start with interchange fees and gradually layer in premium offerings.