Imagine unlocking a trillion-dollar market where banks are optional and freedom is financial. That’s the wild, exciting world of DeFi—Decentralized Finance. If you’ve ever fumbled through clunky banking apps or watched crypto Twitter explode over the next yield farm, you already know the old rules are breaking down. Startups, creators, and even ex-Wall Street folks are jumping ship for something leaner, faster, and permissionless.

But here’s the kicker: DeFi isn’t just about trading tokens. It’s about building platforms that let anyone lend, borrow, swap, stake, and earn—without red tape. Whether it’s a protocol like Uniswap changing the way we exchange crypto, or GMX redefining perpetual trading, DeFi has turned into a creator’s playground. And yes, it’s risky. But so is staying behind.

So if you’re thinking, “Can I really launch my own DeFi platform?”—the short answer is heck yes. And with Miracuves, you don’t have to start from scratch. Let’s dive in.

Why DeFi is the Future of Finance

DeFi (short for Decentralized Finance) removes the middlemen from traditional financial systems by using blockchain technology—mostly Ethereum, but also Solana, Arbitrum, and others. It’s like taking the concept of a bank, shredding the paperwork, removing the gatekeepers, and replacing everything with transparent code.

From a business perspective, this means:

- Global access: No borders, no banks.

- Passive revenue: Think liquidity pools, staking fees, swap commissions.

- Community-led growth: Token holders govern the product roadmap.

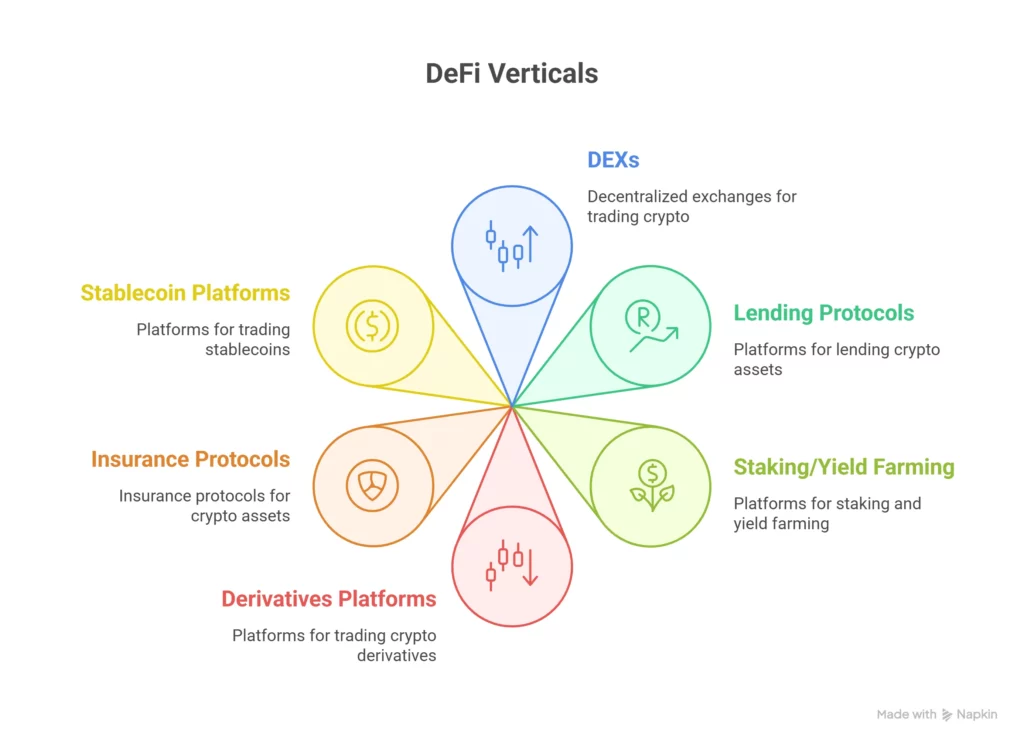

DeFi Business Models You Can Launch

1. Decentralized Exchanges (DEXs)

Think of Uniswap, SushiSwap, PancakeSwap. These let users trade tokens without centralized control. Revenue comes from swap fees, token listings, and liquidity farming.

2. Lending & Borrowing Protocols

Platforms like Aave and Compound allow users to lend their crypto and earn interest or borrow against collateral. Monetization happens via interest spreads and token utility.

3. Derivatives & Perpetual Trading

GMX and dYdX let users trade perpetual futures without an expiry date. If you’re from a fintech background, this is like the Robinhood of Web3.

4. Yield Aggregators

Yearn Finance, Beefy Finance, and others help users auto-invest in the best DeFi strategies. It’s basically robo-advisors for crypto.

5. Stablecoins & Synthetic Assets

MakerDAO (DAI), Frax, and Synthetix offer assets pegged to real-world values. Ideal for founders who want to bridge TradFi and DeFi.

Micro Case Studies: Real DeFi Platforms to Learn From

GMX

Built on Arbitrum, GMX is a decentralized perpetual exchange with zero-slippage trading and low fees. Their revenue-sharing model with stakers is a masterclass in DeFi tokenomics.

Uniswap

The OG of automated market makers (AMMs). It sparked the entire DEX movement. Version 3 introduced concentrated liquidity, giving more power to LPs.

Aave

Not just a lending protocol but a DAO-run juggernaut with features like flash loans, rate switching, and collateral swaps.

Curve Finance

Built for stablecoins, Curve’s algorithm ensures ultra-low slippage trades. It’s like a savings account—but on steroids.

dYdX

Advanced derivatives platform with a clean UI. Offers margin trading, spot, and perpetuals. A gateway for pro traders into DeFi.

Step-by-Step: How to Launch a DeFi Platform

Step 1: Validate the Idea

Don’t build a clone blindly. Research pain points in existing platforms. Want better UX? Lower gas fees? Multi-chain support?

Step 2: Choose the Tech Stack

Ethereum for security? Arbitrum for speed? Or Solana for lower gas? Match your vision with the right chain.

Step 3: Decide Tokenomics

Will your token have governance rights, staking rewards, or a burn mechanism? Tokenomics = your growth engine.

Step 4: Build the MVP

Work with developers who get DeFi. Or better, launch faster with a DeFi clone app from Miracuves—fully customizable and secure.

Step 5: Security Audits & Launch

Never skip audits. Seriously. Partner with top security firms. Then do a soft launch, incentivize early users, and build your community.

How to Stand Out in a Crowded DeFi Space

- Focus on UX. Many DeFi apps look like they were built by devs for devs. Fix that.

- Gamify. Leaderboards, quests, badges = engagement gold.

- Partner smart. Cross-chain integrations and stablecoin incentives drive user stickiness.

Common Pitfalls to Avoid

- Skipping audits: A single bug can drain millions. Ask Poly Network.

- Overcomplicating tokenomics: Confuse users = lose users.

- Ignoring community: DeFi thrives on Discord, not investor decks.

Conclusion

Launching a DeFi platform is no longer reserved for elite coders in hoodies. With tools, clones, and communities available, you can step into this financial revolution without writing a single line of code (okay, maybe just one). What matters is your idea—and how quickly you bring it to life.We help innovators launch high-performance DeFi clones that are fast, scalable, and ready to monetize. Got a decentralized idea waiting to go live? Let’s bring it to life together.

FAQs

Q1. What is a DeFi platform?

A DeFi platform is a blockchain-based app that replaces traditional financial services like lending, borrowing, or trading—with no middlemen.

Q2. Is it profitable to launch a DeFi app?

Yes, with the right tokenomics and user base, DeFi apps can generate revenue via fees, staking, and governance participation.

Q3. How much does it cost to build a DeFi platform?

Creating a DeFi platform with Miracuves typically costs between $2K and $5K, depending on features and blockchain integrations. The platform can be deployed in just 3–6 days, minimizing both time and development expenses.

Q4. Can I clone platforms like Uniswap or GMX?

Absolutely. Many DeFi apps are open-source. With expert customization, you can build a unique version tailored to your audience.

Q5. Do I need to know coding to launch DeFi?

Not at all. Platforms like Miracuves offer DeFi clone apps that are ready to launch with zero-code involvement.

Q6. What’s the most secure DeFi protocol?

Aave and Uniswap are considered among the most battle-tested. But always check for third-party audits and community trust levels.