The job portal ecosystem has become one of the strongest digital business models worldwide — not only because it connects employers and candidates, but because it monetizes data, urgency, visibility, and reputation. Platforms like LinkedIn, Indeed, Glassdoor, ZipRecruiter, and Naukri earn billions without managing recruitment teams or hiring processes themselves. Their strength lies in platform mechanics and monetization, not in traditional HR operations.

What makes this industry especially attractive is its scalability and high profit margins. Once the tech infrastructure is built, revenue grows exponentially through subscriptions, boosted listings, resume databases, employer branding packages, and AI-based hiring tools — all at nearly zero incremental cost per user. And with global remote work and digital hiring increasing every year, this model is primed for even faster adoption in 2025 and beyond.

Entrepreneurs who decode this revenue model can build profitable hiring platforms faster than traditional job agencies Like Job Portal Clone with Miracuves — and with niche targeting (e.g., nurses, chefs, pilots, remote workers, AI engineers), even small portals can dominate specific segments without competing against industry giants.

Job Portal Revenue Overview – The Big Picture

- Global Job Portal Market 2025: ~$15.7 Billion

- LinkedIn Estimated Revenue 2025: $16.5 Billion (projected)

- Indeed Estimated Revenue 2025: $7+ Billion

- YoY Industry Growth: 12–14%

- Avg. Profit Margin: 45–55%

- Top Regions: North America (38%), Europe (28%), APAC (22%), Others (12%)

- Primary Competitors: LinkedIn, Indeed, ZipRecruiter, Glassdoor, Monster, Naukri.com

Market Position Insights:

Paid digital hiring is replacing traditional HR recruitment, and AI-driven matching is creating premium pricing opportunities. Companies now spend 75% more per candidate than in 2019.

Read More: Everything You Need to Know About a Job Portal App

Primary Revenue Streams Deep Dive

1. Featured Job Listings (28% Share)

Companies pay to rank higher in search results.

Pricing ranges from $50 to $600 per listing depending on location & urgency.

2. Subscription Plans (23%)

Monthly recruiter access: resume views, job posting limits, AI matching tools.

Average pricing: $199–$499/month per recruiter.

3. Resume Database Access (15%)

Companies pay for bulk access to potential candidates.

Highly profitable due to zero incremental cost.

4. Sponsored Ads (14%)

Job portals offer on-site ad placements powered by CPM/CPC bidding models.

5. Commission on Successful Hiring (20%)

Some portals charge 5–12% of candidate’s first-year salary when placed successfully.

Read More: Business Model of Job Portal : Complete Strategy 2025

Revenue streams percentage breakdown

| Revenue Stream | Share (2025) |

|---|---|

| Featured Job Listings | 28% |

| Subscription Plans | 23% |

| Resume Access | 15% |

| Sponsored Ads | 14% |

| Hiring Commission | 20% |

The Fee Structure Explained

| User Type | Fees/Charges Applied | Example Pricing |

|---|---|---|

| Employer Posting Jobs | Per post / subscription / priority boost | $50–$600/job |

| Recruiter Hiring Candidates | Subscription / access pass | $199–$499/month |

| Candidates | Generally free – paid upgrade for priority visibility | $10–$25 |

| Agencies & HR Teams | API access, white label access | $399–$3,000/month |

Hidden Revenue Layers

- API access for HR software

- White-label hiring portals

- AI-based screening tools

- Employer branding pages

Regional Pricing Differences

North America = Premium, India = Volume based, Europe = Mid-tier, Middle East = Hybrid model

How Job Portals Maximize Revenue Per User

- Segmentation: Startups, SMEs, Enterprise – each charged differently

- Upselling: Extra credits, AI matching, candidate ranking

- Cross-selling: Resume templates, profile boosting

- Dynamic Pricing: Job sector-based surge pricing

- Retention Monetization: Annual recruiter plans = 40% more profit

- Psychological Pricing: $49 instead of $50 increases conversions by 8%

- LTV Optimization: Priority listings = 30% higher retention

Real Example (LinkedIn Talent Solutions 2025):

Avg. Recruiter Spend Per Year = $3,600–$9,000

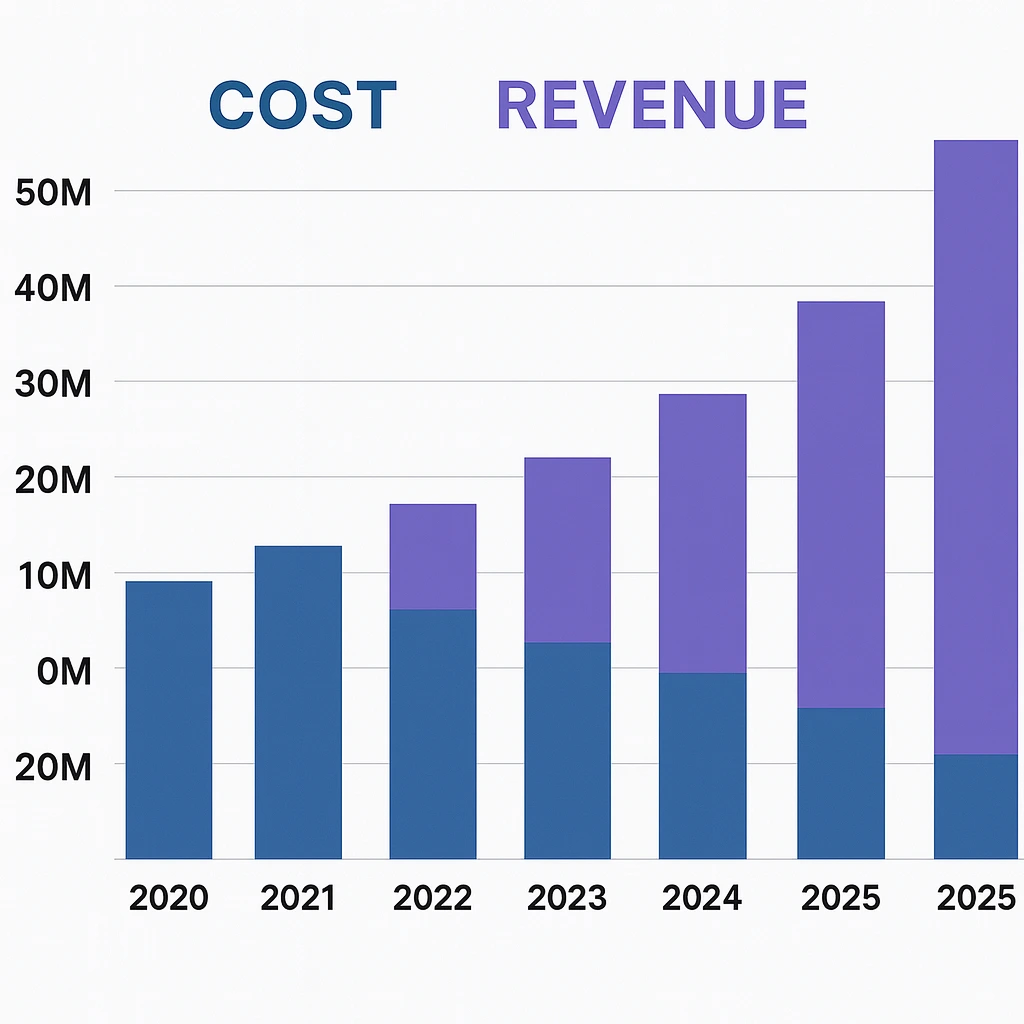

Cost Structure & Profit Margins

| Cost Component | % of Total Cost |

|---|---|

| Tech + Infrastructure | 30% |

| Marketing/CAC | 25% |

| Operations | 15% |

| HR & Admin | 10% |

| R&D & AI Tools | 20% |

Avg. Profit Margin 2025: 45–55%

Unit Economics Snapshot:

CAC: $58 | ARPU: $340 | LTV: $1,200

Read More: Best Job Portal Clone Scripts in 2025 | Features & Pricing Guide

Future Revenue Opportunities & Innovations

AI-Based Screening Tools – Auto resume scoring & interview prediction

Voice/Video Resume Features – Paid add-on

Recruitment SaaS Model – B2B recurring revenue

White-Label Hiring Portals – Employer branding

Global Expansion: LatAm & MENA – High growth regions

Risk: AI bias laws, compliance, fake profiles

2025–2027 Forecast:

Job portal revenue expected to cross $22B globally by 2027.

Lessons for Entrepreneurs & Your Opportunity

What Works: Subscription-first model, niche targeting, employer-focused

What to Replicate: Tiered pricing + paid visibility features

Market Gap: Industry-specific hiring platforms (nurses, chefs, pilots, tutors)

Startup Opportunity: AI-powered matching = highly valued by recruiters

Want to build a platform with proven job portal revenue model? Miracuves helps entrepreneurs launch revenue-generating hiring platforms with built-in monetization features. Our job portal clone scripts come with flexible revenue models you can customize. Some clients even start earning revenue within 30 days of launch, and Miracuves delivers ready-to-launch solutions in 3–9 days guaranteed. If you need it in an advanced language or customized tech stack, Miracuves will provide that also. Get a free consultation to map your revenue strategy today.

Final Thought

The future of recruitment won’t be owned by traditional HR agencies — it will be shaped by platforms that use data, sentiment insights, and personalization at scale. As workplaces become more transparent and employees choose culture over salary, digital hiring platforms will have the power to influence real business decisions. That makes this industry more than just a job-matching service — it’s becoming a decision engine for companies worldwide.

Entrepreneurs who act now can tap into this momentum and build specialized hiring ecosystems that deliver faster results, higher margins, and long-term recurring revenue.

FAQs

1. How much does a job portal make per listing?

$50–$600 depending on urgency & region.

2. What’s the most profitable revenue stream?

Subscription + recruiter access plans.

3. How does job portal pricing compare to competitors?

LinkedIn and Indeed typically use premium pricing, while many niche job portals rely on volume-based pricing — and with Miracuves, you can build a similar job portal platform starting at just $2899.

4. What percentage does a portal take from employers?

5–12% commission on successful hires.

5. How has the revenue model evolved?

Shifted toward AI-based subscription SaaS.

6. Can small platforms use this model?

Yes—niche hiring platforms are booming.

7. Minimum scale for profitability?

Around 900–1200 active recruiters per year.

8. How to implement this model?

Start with tiered hiring plans + resume access.

9. Alternatives to this model?

SaaS recruitment tools, freelance marketplaces.

10. How fast can you monetize?

With Miracuves, many platforms start monetizing in just 3–9 days with guaranteed delivery, thanks to built-in revenue logic and launch-ready features.