In the ever-evolving world of finance, one thing is certain—digital banking and fintech apps are booming. With users increasingly relying on mobile-first experiences, 2025 presents a golden opportunity for entrepreneurs to carve a niche in this dynamic space. Whether you’re a startup founder, tech-savvy entrepreneur, or a digital agency eyeing high-margin projects, launching a fintech or digital banking app might be your most lucrative move yet.

So, what’s driving this wave? From the rise in mobile banking usage to the expansion of embedded finance and cryptocurrency adoption, the fintech revolution is real—and it’s just getting started. The best part? You don’t need to build from scratch. With clone app development from solution providers like Miracuves, you can leapfrog lengthy development timelines and launch faster with proven models.

Read more: How to Start a Digital Banking App Business in 2025

Why Digital Banking & Fintech Apps Are a Hot Opportunity in 2025

The digital finance space isn’t just expanding—it’s exploding. As more users shift from traditional banking to mobile-first alternatives, 2025 is shaping up to be a defining year for fintech startups and digital banking innovators.

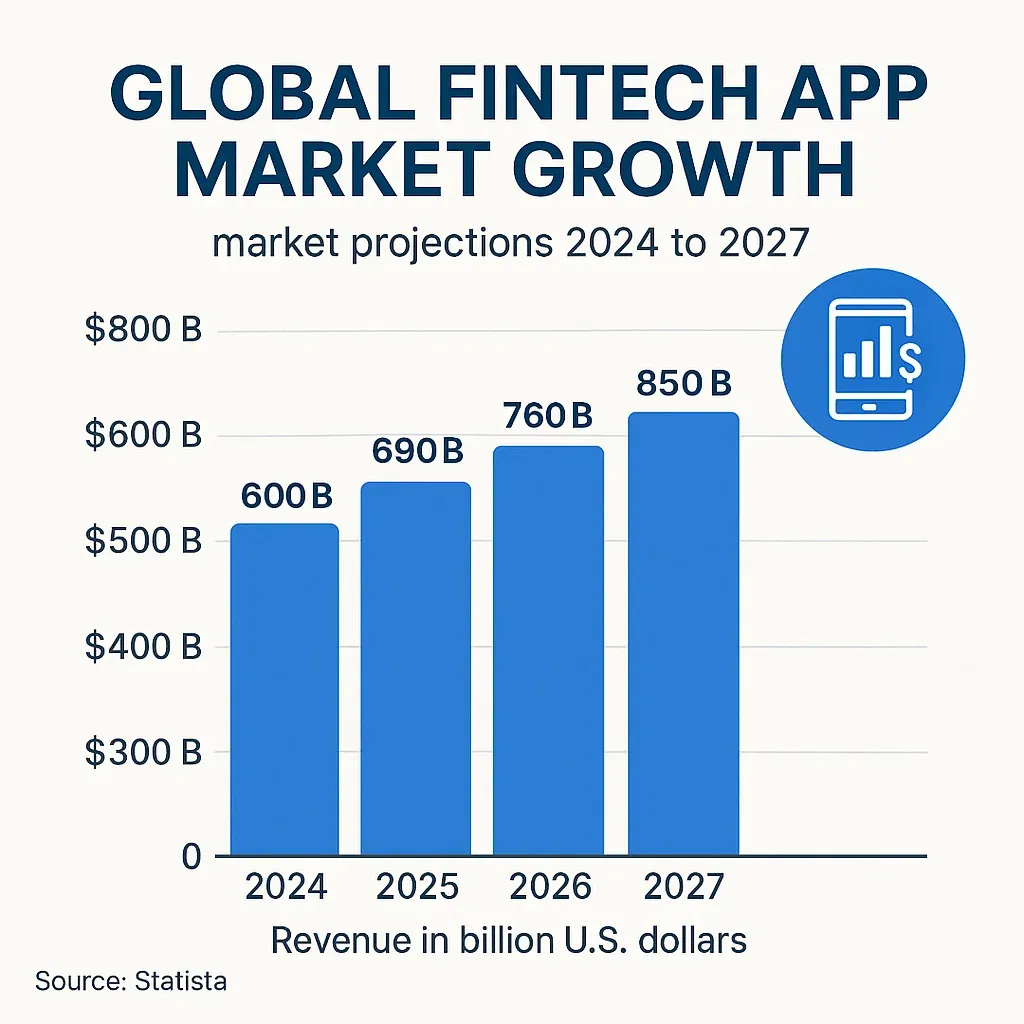

Global Market Momentum

According to Statista, the neobanking sector alone is projected to grow to over $4 trillion in transaction value by 2025, up from $2.6 trillion in 2022. Meanwhile, CB Insights reported that fintech funding hit $156 billion in 2023, with a renewed focus on embedded finance, AI-driven financial tools, and alternative lending models. This upward trend is expected to accelerate in 2025 as the global economy rebounds and digital finance becomes more mainstream.

Shifting Consumer Behavior

Consumers today crave financial autonomy, transparency, and personalization. Gen Z and Millennials especially are opting for mobile-first, low-fee, and instant service apps over traditional institutions. This shift has created massive demand for:

- Digital wallets

- Peer-to-peer payment apps

- Buy Now, Pay Later platforms

- Crypto trading tools

- AI-powered personal finance assistants

Tech Enablers Fueling the Boom

Advancements in blockchain, AI, cloud infrastructure, and APIs for open banking are making it easier than ever to launch feature-rich fintech apps. Even regulations are catching up, with regions like Europe and India supporting open financial ecosystems via frameworks like PSD2 and UPI, respectively.

Gaps in the Market

Despite the growth, there are underserved niches waiting to be tapped:

- Fintech solutions for freelancers and gig workers

- Cross-border micro-investment platforms

- Localized neobanks for underserved regions

- SME lending and credit scoring apps based on non-traditional data

With clone app development from a provider like Miracuves, you can tap into these gaps without reinventing the wheel—launching tested, scalable platforms tailored for specific user segments.

Read more: Top UI/UX Mistakes in Digital Banking & Fintech Apps

Top Profitable Digital Banking & Fintech App Ideas to Launch in 2025

Here’s a curated list of the most profitable digital banking and fintech app startup ideas for 2025, each backed by real demand, clear monetization paths, and scalability potential. These are perfect for entrepreneurs who want to capitalize on fintech momentum—especially when powered by clone app development from providers like Miracuves.

1. Neobank for Niche Audiences

A mobile-first bank with no physical branches, offering tailored financial services for specific groups—like freelancers, students, or SMEs.

Monetization Strategy:

Interchange fees, premium accounts, lending services, subscription-based tools for budgeting or invoicing.

Why It Works in 2025:

Neobanks are mainstream, but niche segments remain underserved. A focused offering builds strong community loyalty.

2. Peer-to-Peer Lending App

A platform where users can lend and borrow money without traditional banks, based on smart algorithms and risk ratings.

Monetization Strategy:

Commission on successful loans, borrower fees, credit scoring services, premium investor features.

Why It Works in 2025:

Traditional loans are hard to access for gig workers or small business owners. P2P fills that gap with flexible terms and high returns for lenders.

3. Crypto Wallet & Exchange App

A mobile app to buy, store, and trade cryptocurrencies, integrated with top blockchain networks and fiat on-ramps.

Monetization Strategy:

Trading fees, withdrawal charges, token listings, DeFi yield products.

Why It Works in 2025:

Despite market fluctuations, crypto adoption continues to grow. Users want easy, regulated access to tokens via mobile.

4. Buy Now, Pay Later (BNPL) App

A credit-based payment solution allowing users to split purchases into installments without traditional credit cards.

Monetization Strategy:

Merchant fees, late payment charges, premium user tiers, data analytics for partner stores.

Why It Works in 2025:

Consumers love flexibility. BNPL appeals to younger buyers and boosts merchant sales—win-win.

5. Robo-Advisory & Investment App

An AI-powered app that helps users automate savings, invest in portfolios, and set financial goals.

Assets under management (AUM) fees, robo-advisory subscription, premium financial planning tools.

Why It Works in 2025:

People want passive wealth building, especially Gen Z. Robo-advisors offer low-cost, low-hassle investing.

6. Expense Management & Budgeting App

A mobile tool that helps users track expenses, set saving goals, and automate payments and categorization.

Monetization Strategy:

Freemium model, affiliate commissions on bill payments or investments, in-app ads.

Why It Works in 2025:

Financial wellness is a top priority. Users crave simple tools to reduce spending and boost savings.

7. SME Digital Lending Platform

A fintech platform dedicated to offering fast credit, invoice financing, and working capital loans to small and mid-sized businesses.

Monetization Strategy:

Loan origination fees, interest margins, analytics dashboards for lenders and underwriters.

Why It Works in 2025:

SMEs remain underserved by big banks. AI-backed credit scoring gives your platform a competitive edge.

What Makes an App Profitable in the Digital Banking & Fintech Niche?

Not all apps are created equal—especially in fintech. The most profitable digital banking and fintech apps to launch in 2025 share certain core traits that drive recurring revenue, reduce churn, and scale efficiently.

1. Recurring Revenue Models

Subscription tiers, transaction fees, and embedded financial products provide a predictable cash flow. Profitable fintech apps typically layer multiple revenue streams, such as freemium + premium, B2B API access, or interchange fees.

2. High Retention Rates

Users rely on fintech apps for daily or monthly financial tasks—banking, budgeting, or payments. This frequency builds habit loops, increasing retention and lifetime value. Features like real-time alerts, savings nudges, and gamified goals reinforce daily engagement.

3. Low Overhead, High Automation

Thanks to API integrations, AI, and cloud infrastructure, fintech apps today can automate everything from KYC to loan underwriting. The result? Lean operations with fewer employees and faster time to revenue.

4. Strong User Acquisition Channels

Top fintech players leverage a mix of referral programs, influencer partnerships, SEO, and performance marketing. Community-focused niches like freelancers or crypto traders also enable strong word-of-mouth loops.

Why Clone App Development Gives You the Edge

Building from scratch takes time, money, and serious dev talent. Clone-based solutions from Miracuves offer:

- Reduced development time (launch in weeks, not months)

- Pre-tested UX flows that improve onboarding and retention

- Built-in features like wallets, authentication, and analytics

- Custom branding so you maintain a unique identity

- Lower upfront costs with scalable pricing models

In short: You get all the building blocks of a successful fintech app—without the usual startup headaches.

Cost to Build a Digital Banking or Fintech App in 2025

One of the first questions every founder asks is: “How much will it cost to launch my fintech app?” The answer depends on several factors—but here’s a realistic breakdown for 2025.

Estimated Development Costs

| App Type | Basic Version | Advanced Version |

| Expense Tracker App | $15,000 – $30,000 | $50,000 – $75,000 |

| P2P Lending Platform | $25,000 – $50,000 | $100,000 – $150,000 |

| Crypto Wallet & Exchange | $30,000 – $60,000 | $120,000 – $200,000+ |

| Neobank or Digital Bank App | $40,000 – $70,000 | $150,000 – $250,000+ |

| Robo-Advisory Investment App | $35,000 – $60,000 | $100,000 – $180,000 |

These are ballpark figures based on average pricing in the US, Europe, and Asia-Pacific. They vary based on region, complexity, and third-party integrations (like APIs for KYC, payment gateways, or blockchain).

Go Live in just 3 days with Miracuves! Get your fully functional, source-code-ready app starting from $4,000 to $5,000 — fast, reliable, and built to scale.

Key Cost Drivers

- Platform Choice: Web-only apps cost less than full-stack iOS + Android builds

- Tech Stack: Real-time data sync, machine learning, and blockchain integration increase cost

- Backend Logic: Features like automated risk scoring or wallet management add complexity

- UI/UX Design: Clean, conversion-optimized fintech design is crucial—and costs extra

- Compliance Requirements: Features like KYC/AML add development and legal overhead

Why Clone Apps Are a Smarter Investment

Rather than starting from scratch, many successful founders now opt for clone app development—especially in regulated, feature-heavy niches like fintech.

With a Miracuves clone, you get:

- Pre-built infrastructure that meets industry standards

- Customizable frontend to match your brand and UX goals

- Modular scalability as you grow

- Significant cost savings—up to 70% compared to scratch builds

- Faster time-to-market (go live in weeks)

That means more budget for marketing, compliance, and user acquisition—where it counts.

Tips for Founders to Launch a Successful Digital Banking & Fintech App

A great idea alone won’t cut it in 2025’s competitive fintech space. You’ll need strategic execution and a strong foundation to succeed. Here’s what founders should prioritize:

1. Start with an MVP-First Approach

Don’t aim for perfection in version 1. Instead, focus on core features that deliver value from day one—like seamless onboarding, essential transactions, and security. Build fast, validate early, then iterate based on real user data.

2. Prioritize Seamless UI/UX Design

Fintech users expect intuitive, friction-free interfaces. Clunky UX can kill trust—especially in finance apps. Prioritize simple flows, minimalist dashboards, and mobile responsiveness to ensure high engagement and retention.

3. Validate Your Market Before Scaling

Before investing in full-scale development, test your app concept through:

- Landing pages with early signups

- User surveys and focus groups

- Beta versions to gather feedback

This ensures you’re building something the market truly wants.

4. Invest in a Scalable Backend

Start lean, but don’t box yourself in. Choose a backend that can handle increased data, traffic, and transactions as you grow. APIs, cloud infrastructure, and microservices are smart bets.

5. Plan Post-Launch Marketing Early

Your app launch is just the beginning. Success depends on how well you:

- Create awareness through SEO, ads, and influencer outreach

- Retain users through push notifications and loyalty programs

- Collect and act on user feedback fast

Growth Tip: Partnering with a clone app provider like Miracuves gives you a proven framework and feature set to build from, freeing up resources for marketing and user acquisition.

Read more: How to Market a Digital Banking App Successfully After Launch

Conclusion:

As financial behaviors continue to shift toward mobile-first, AI-driven experiences, launching a digital banking or fintech app in 2025 is more than just a good idea—it’s a high-potential investment. The market is ripe with untapped opportunities, from neobanks for freelancers to AI-powered investment platforms. With the right product, founders can tap into recurring revenue, user loyalty, and rapid scale.

But success depends on execution. Rather than spending months (and a fortune) building from scratch, savvy entrepreneurs are turning to clone app development to bring their ideas to life faster and more efficiently. With pre-validated UX, scalable backend architecture, and customizable modules, Miracuves helps you hit the ground running—without sacrificing quality or innovation.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q:1 How much does it cost to build a digital banking or fintech app?

Building a digital banking or fintech app with Miracuves typically costs between $4,000 and $5,000, depending on your required features, integrations, and design complexity

Q:2 What features should a successful digital banking app include?

Core features include KYC onboarding, secure login, digital wallets, transaction history, real-time notifications, budgeting tools, and optional integrations like crypto or stock trading.

Q:3 Is it better to build from scratch or use a clone solution?

If speed, cost-efficiency, and proven functionality matter, clone app development is the smarter choice, especially when customized and scaled with a provider like Miracuves.

Q:4 How long does it take to launch a fintech app using a clone?

With a ready-made white-label solution, you can launch in 4 to 6 weeks, compared to several months for a ground-up build.

Q:5 Are clone fintech apps customizable?

Yes—modern clones are modular and fully brandable, allowing you to tailor UI, features, payment flows, and compliance elements.

6. Can I scale a clone app as my user base grows?

Absolutely. With a scalable backend and cloud-native architecture, clone apps from Miracuves can handle growth seamlessly.

Related Articles: