If you’ve ever tried building a finance app from scratch Revolut Clone, you already know the stress. The late nights, the blown-out budgets, the creeping deadlines… let’s not even talk about the regulatory headaches. Now imagine spending months pouring your soul into custom development—only to realize a Revolut clone could’ve done the same job in a fraction of the time, for a fraction of the cost. Ouch.

As founders, we all chase uniqueness. We want that “aha” moment to explode into a unicorn. But here’s the hard truth: speed and usability often trump originality. Today’s users don’t care if your fintech UI was handcrafted—they care if it works, fast, and gets the job done. With clone solutions getting smarter, sleeker, and savvier, the lines between “custom” and “clone” are blurring fast.

At Miracuves, we’ve seen dozens of startups jump ship from full-scale development to our Revolut clone—and come out stronger, faster, and way more budget-friendly. Let’s unpack why.

The Startup Struggle: Fast, Cheap, or Custom?

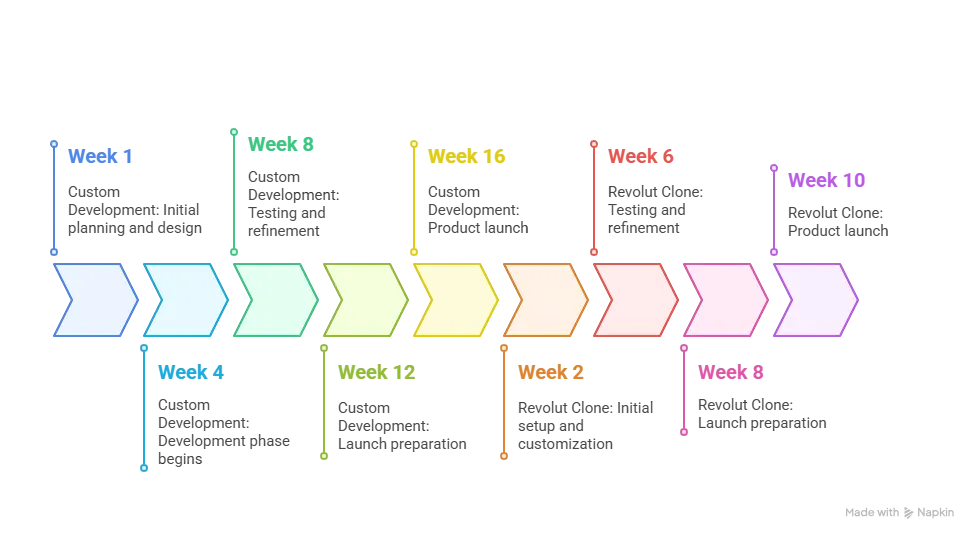

Every startup juggles the same triangle: cost, speed, and customization. Going custom sounds fancy until you hit the dev bills, QA setbacks, and three-month feature delays. A Revolut clone lets you cheat that triangle—delivering core functionality, slick design, and plug-and-play integrations without reinventing the neobank wheel.

Real-world example? One of our clients went from ideation to beta launch in just 42 days using our clone, while their competitor spent 9 months on custom development—and still hadn’t cracked KYC workflows.

Built-In Brilliance: Why Start With 80% Done?

Revolut’s success wasn’t just about tech—it was about trust, simplicity, and user flow. Our clone captures that essence. You’re not starting from zero; you’re starting from a proven UX model that millions already love.

What’s pre-baked in?

- KYC & AML compliance modules

- Multi-currency wallets

- IBAN/Swift support

- Virtual & physical card issuance

- Budget analytics dashboard

- Payment gateways

- Real-time FX rate conversions

These aren’t half-baked features. They’re plug-and-play systems optimized for scale.

Read more : Best Revolut Clone Scripts in 2025: Features & Pricing Compared

Smarter Scaling: Why Reinventing Is Riskier

Custom development often turns into a black hole—where scope creep, rewrites, and tech debt eat your budget alive. Clones aren’t “just MVPs” anymore—they’re strategic jump-starters. You get to launch lean, test fast, and scale with real user feedback.

And let’s talk security. Our Revolut clone is PCI DSS compliant, includes 2FA and biometric authentication, and is built on a modular backend that’s DevOps-friendly. You get flexibility without fragility.

Read more : Pre-launch vs Post-launch Marketing for Revolut Clone Startups

Budget-Smart, Not Budget-Cheap

Startups bleed money in the early stage. You’re burning cash for traction. A custom-built finance app can cost upwards of $300K before seeing a single user. With our Revolut clone, you’re investing less than 15% of that, with the freedom to customize and add features as you grow. This isn’t about “going cheap”—it’s about buying time. According to CB Insights, 38% of startups fail because they run out of cash. Don’t be that statistic.

Clones That Convert: UX that’s Already Been Battle-Tested

Users don’t need another experimental finance app—they want reliability. Our Revolut clone nails user flows that have already been market-validated. From intuitive onboarding to transaction tracking and card management, it’s built for trust.

It’s also mobile-optimized, gesture-ready, and frictionless across devices. You don’t just get an app—you get a user experience playbook that converts.

With digital banking adoption skyrocketing year after year, the demand for reliable, user-friendly fintech apps is only growing. In fact, according to Statista, millions of users are switching to neobanking platforms globally

Read more : Top 5 Mistakes Startups Make When Building a Revolut Clone

Customization Still Exists—Just Smarter

Choosing a clone doesn’t mean you’re locked in a template. Our clone is modular, meaning you can:

- Change branding/UI with drag-and-drop editors

- Integrate niche features like crypto wallets or carbon footprint trackers

- Connect APIs with fintech partners (Plaid, Yodlee, etc.)

Think of it like building with LEGO instead of carving from marble. Same end result—less mess.

Post-Launch Support (That Doesn’t Ghost You)

We don’t drop a zip file and disappear. Miracuves offers:

- Ongoing updates (think compliance patches, security upgrades)

- Dedicated dev support

- Cloud deployment guidance

- Monetization consulting

We’ve walked the founder journey ourselves. That’s why we stick around post-launch—because your real startup battle begins after you hit “go live.”

Conclusion:

Building a neobank doesn’t mean building from scratch. With our Revolut clone, startups get the best of both worlds—speed, flexibility, and a rock-solid foundation to grow on. You’re not compromising creativity—you’re accelerating it.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

What is a Revolut clone?

A Revolut clone is a ready-made neobank app solution that mimics Revolut’s core features like digital banking, currency exchange, and card management—designed for startups to launch quickly.

Can I still customize it to fit my brand?

Absolutely. Our clone is modular—meaning you can rebrand, redesign, and add custom features on top of the existing codebase.

How much does it cost compared to custom development?

On average, a full custom neobank app can cost over $300K. Our Revolut-like app starts at a fraction of that, often starting at $18999, depending on features.

Will I own the source code?

Yes! You get full access to the source code and IP rights. No lock-ins, no funny business.

Is it secure and compliant?

Yes. It includes pre-integrated modules for KYC, AML, and PCI DSS compliance. Plus, 2FA, biometric login, and encrypted databases.

Can I integrate third-party APIs or payment gateways?

Definitely. Our system is API-ready, so you can connect third-party services like Plaid, Yodlee, Stripe, or even crypto wallets.

Related Articles :