Remember the time you had to wait five business days just to transfer your own money? Yeah, not fun. Now imagine building an app that turns that nightmare into a fintech dream — fast transfers, sleek budgeting tools, crypto, and international payments all under one digital roof. That’s exactly what Revolut did — and why smart entrepreneurs are now eyeing the Revolut App route.

If you’re a startup founder or digital creator looking to break into fintech without reinventing the (banking) wheel, a Revolut-like app could be your golden ticket. It’s not just about being the “next big thing.” It’s about solving real money problems with tech that feels like magic — and works on any smartphone.

Curious how it all comes together? Buckle up. We’re about to explore how a Revolut Clone works and why companies like Miracuves are your best bet for launching one that’s slick, secure, and ready to shake up the market.

What is a Revolut App?

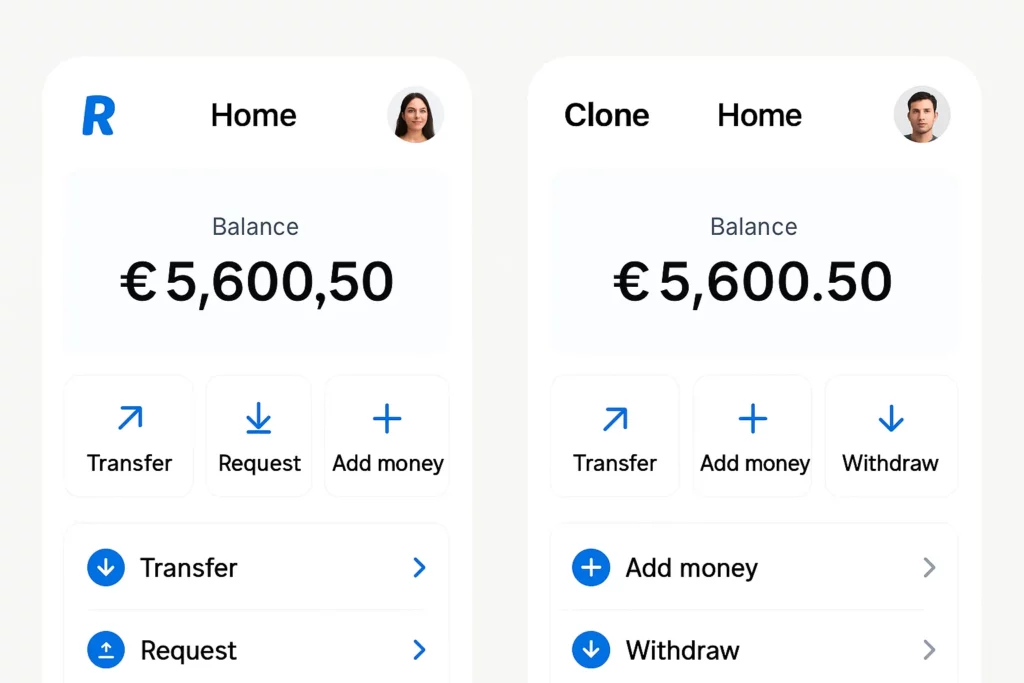

A Revolut App is a ready-made fintech app solution that mimics the features, design, and business logic of Revolut — a wildly successful UK-based digital banking platform. Think of it as your fast-pass to building a mobile banking app, without starting from scratch.

But it’s not just a copy-paste job. A true clone is customizable, scalable, and packed with the core elements needed to compete with the likes of N26, Monzo, or Cash App:

- Multi-currency accounts

- Budgeting tools

- Crypto trading

- P2P payments

- Instant money transfers

- Debit card integrations

Read Also :-Best Revolut Clone Scripts in 2025: Features & Pricing Compared

Why Revolut App Are Gaining Traction

Let’s face it — traditional banking is slow, stuffy, and stuck in the past. Fintech, on the other hand, is fast, flashy, and way more personal. Revolut kicked off a new generation of neobanks that offer real-time finance features with user-centric design.

That means opportunity for you. A Revolut app lets you ride the fintech wave with:

- Faster time to market

- Lower development costs

- Flexible monetization strategies

- Global scalability

Key Features of a Revolut App

1. Multi-Currency Wallets

Users can hold, send, and receive money in multiple currencies — ideal for freelancers, expats, and frequent travelers.

Real-time FX rate conversions make your app a go-to for global finance.

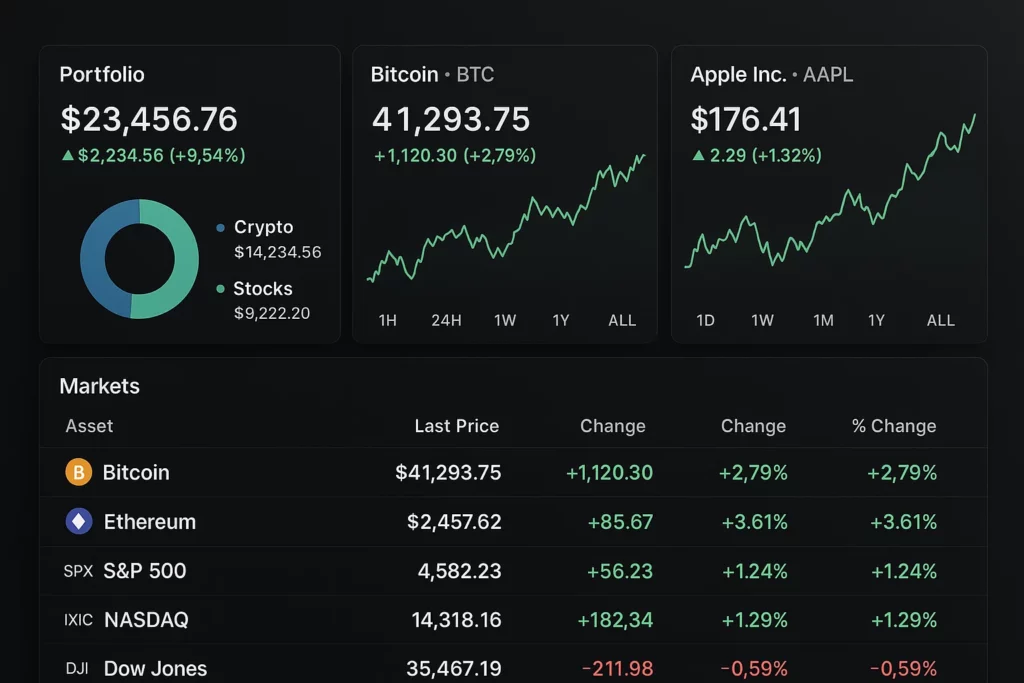

2. Crypto & Stock Trading

Allow users to dabble in Bitcoin, Ethereum, or fractional stock trading — all from their mobile app.

3. Instant P2P Transfers

Tap, type, and zap — money moves instantly between users, just like Venmo or Zelle, but smarter.

4. Virtual & Physical Debit Cards

Let users generate virtual cards for online purchases or order a sleek branded card in-app. Add budgeting limits and freeze options for safety.

5. Advanced Budgeting Tools

AI-powered spend tracking, savings goals, spending analytics, and alerts. Help users build better money habits.

6. Bill Splitting & Group Payments

Perfect for roommates, travel buddies, or startup teams splitting costs. Add reminders and auto-payments for a stress-free experience.

Learn More :-Why Startups Choose Our Revolut Clone Over Custom Development

How a Revolut Clone Works (Behind the Scenes)

User Registration & KYC

It starts with a simple onboarding process — sign up, ID verification, selfie check, and boom: your user is ready to roll. You can integrate providers like Jumio or Onfido for automated compliance.

Core Banking API Integrations

Connect with banking-as-a-service platforms like Solaris, Marqeta, or ClearBank to power the backend without owning a license.

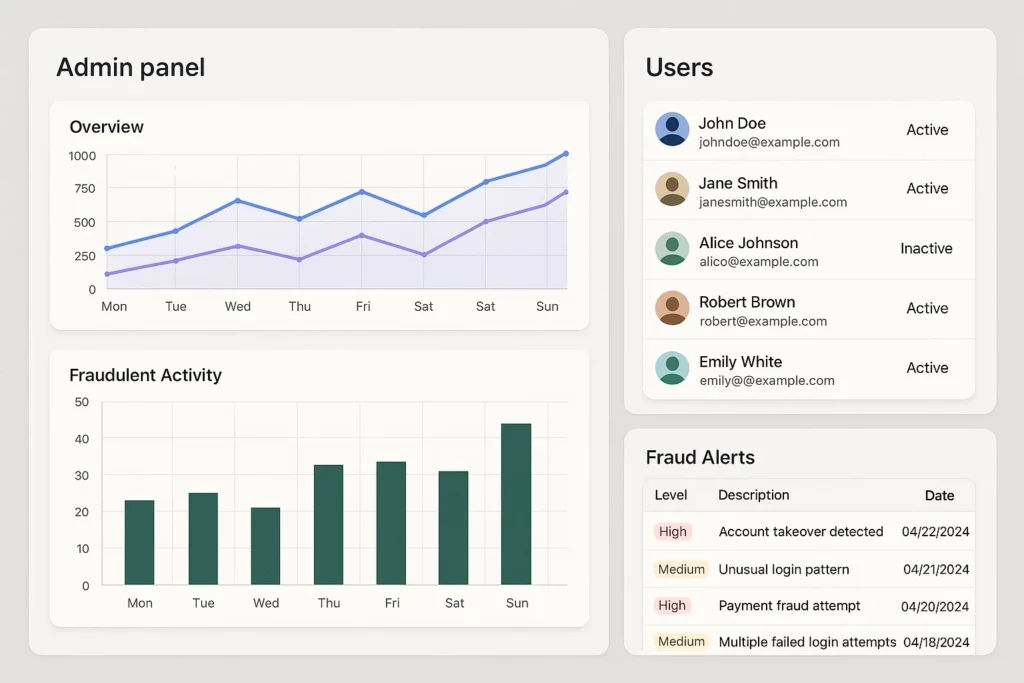

Security, Encryption, and Compliance

From end-to-end encryption to PCI DSS and GDPR compliance — a secure infrastructure is a non-negotiable. Miracuves bakes this into every deployment.

Admin Dashboard for Superpowers

Admins get tools to manage users, freeze accounts, analyze KPIs, and tweak app behavior without touching code.

Monetization Models for Your Revolut App

Launching a Revolut-style app isn’t just about UX — it’s about ROI. Here’s how you can make money:

- Subscription tiers (free, premium, metal)

- Card issuance & interchange fees

- Currency conversion markups

- Trading commissions

- Partnered services (insurance, loans)

- ATM withdrawal charges

Why Build a Revolut Clone with Miracuves?

Look, building a full-stack fintech app from scratch is like trying to bake a croissant blindfolded. There’s tech, compliance, integrations, and oh — the stress of scaling.

Miracuves gives you a ready-to-launch clone that’s not only beautiful but also:

- Secure

- Fully customizable

- API-integrated

- Compliant with major financial regulations

You get a launchpad, not a template. So whether you’re targeting your country’s unbanked users or launching a niche financial service — we help you get there, faster.

Read Also :-How to Market a Digital Banking App Successfully After Launch

Conclusion

The world doesn’t need another clunky bank. It needs smart, accessible, and mobile-first finance tools. A Revolut Clone helps you deliver that — while carving out a profitable spot in one of the hottest tech markets today.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

What exactly is a Revolut Clone?

It’s a pre-built app solution inspired by Revolut, designed to offer mobile banking features like currency exchange, P2P payments, and budgeting tools.

Is it legal to launch a Revolut Clone?

Absolutely — as long as you’re not copying branding or violating IP. Miracuves builds custom clones with unique design and full legal safety.

Do I need a banking license?

Not necessarily. With the right Banking-as-a-Service (BaaS) integrations, you can launch under a partner’s license.

How long does it take to launch?

Depending on features, your Revolut Clone could go live in as little as 6–8 weeks with Miracuves.

Can I offer crypto features?

Yes! Many clones include optional crypto wallets and trading features — though regional compliance may apply.

What if I want to target a specific niche?

Great idea! You can tailor your Revolut Clone for specific audiences like gig workers, students, or travelers.