Picture this: You’re a founder with a killer idea for disrupting cross-border payments. You’re tired of seeing people pay steep fees just to send $100 overseas. You use Wise (formerly TransferWise) and think, “Why not build something like this — only better, smarter, faster?” That’s the moment your fintech journey begins.

But here’s the twist. You don’t want to build everything from scratch — the core tech, compliance, multi-currency support, user flow. You want a proven foundation to kickstart your app. That’s where the Wise clone comes in — a shortcut without the compromises, tailor-made for entrepreneurs who want to win big without wasting years in development purgatory.

This blog breaks down exactly what a Wise clone is, how it works, what makes it tick under the hood, and how Miracuves helps you launch your very own fintech super app — faster than you can say “SWIFT fee.”

What is a Wise App?

A Wise clone is a white-label, ready-to-launch fintech platform inspired by the architecture, design, and functionality of Wise — the international money transfer platform known for its transparency and real exchange rates.

But it’s not just a copy-paste job. It’s a customizable replica built with features like:

- Multi-currency wallets

- Real-time forex rates

- Peer-to-peer transfers

- Compliance modules (KYC/AML)

- Low-fee international transfers

How Does a Wise App Work?

Let’s peel the layers like a fintech onion. Here’s what happens under the hood:

1. User Onboarding with KYC/AML Checks

Every legit money transfer app starts with one thing: trust. The onboarding flow includes:

- Photo ID upload

- Facial recognition (selfie match)

- Address verification

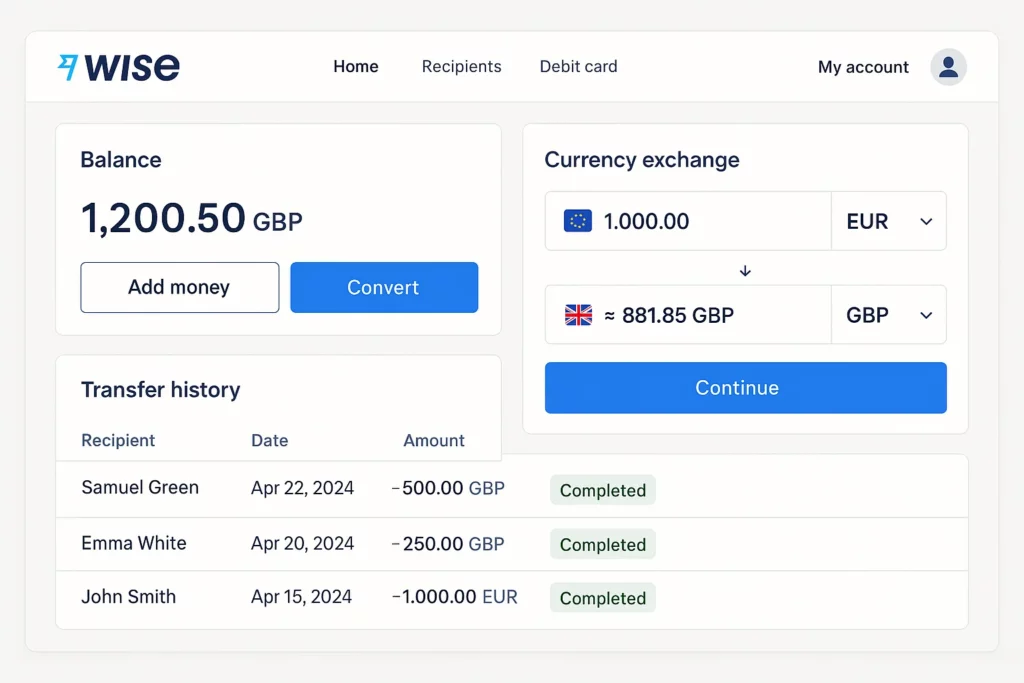

2. Multi-Currency Wallet System

Users get a digital wallet that can hold USD, EUR, GBP, INR, and more. The wallet behaves like a bank account — allowing deposits, transfers, and conversions.

A freelancer in India receives USD payments, converts to INR, and pays rent — all in-app.

3. Real-Time Currency Exchange Engine

No hidden markups, no guesswork. The app pulls live forex rates using third-party APIs and charges a transparent fee (or none, if you want a freemium model).

4. Cross-Border Transfers with Local Routing

Instead of wiring money internationally (slow + expensive), a Wise clone uses a “local payout” strategy:

- Senders pay locally in their country

- Receivers get paid from a local partner bank in theirs

It’s the fintech version of teleportation. Fast, cheap, and borderless.

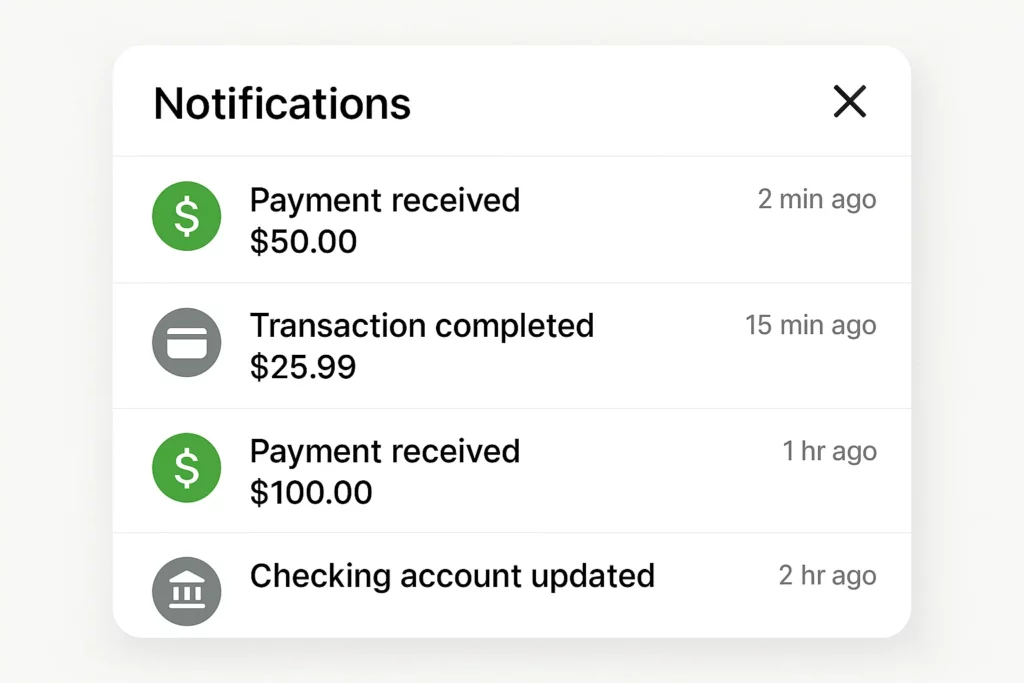

5. Transaction Tracking & Notifications

Like pizza delivery but for money. Users can:

- Track transfers in real-time

- Get alerts for status changes

- Receive monthly statements

Read More :-Best Wise Clone Scripts in 2025: Features & Pricing Compared

Core Features of a Wise App

Multi-Currency Wallet

Hold multiple currencies, convert on demand, and view balances instantly.

Transparent Fees

No guesswork. Users see fees and exchange rate upfront.

Local & Global Transfer Options

Transfer to banks, wallets, or other app users — domestically and internationally.

Secure Identity Verification

Built-in KYC tools and optional biometric login (Face ID, Fingerprint)

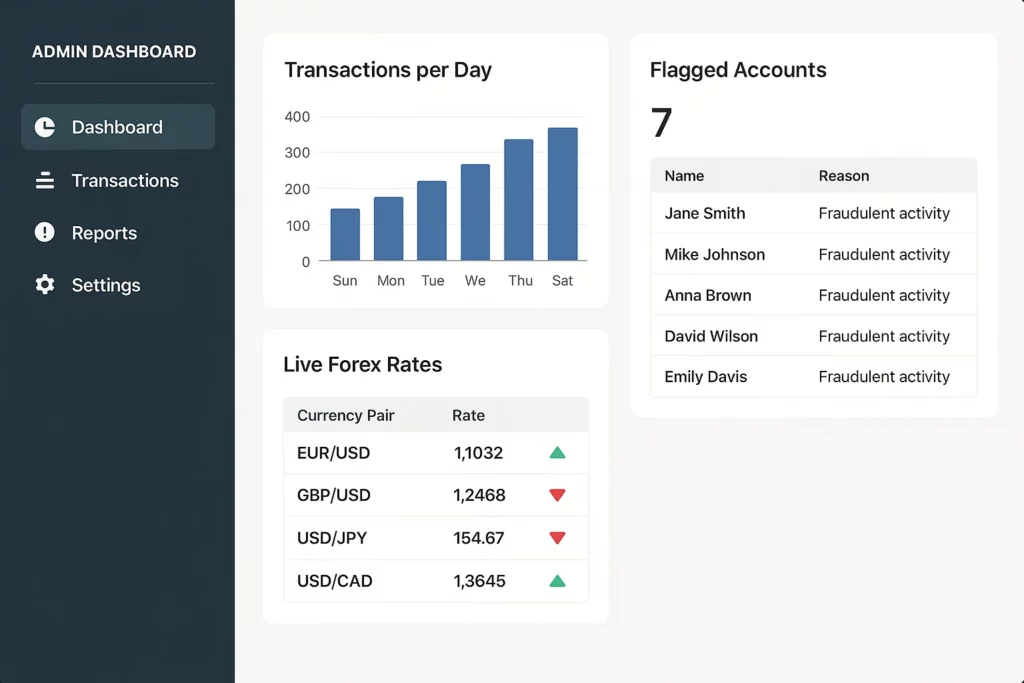

Admin Panel & Analytics

Admins can view user metrics, adjust fees, monitor fraud, and handle disputes.

Learn More :-Top 5 Mistakes Startups Make When Building a wise clone

Who Can Launch a Wise Clone?

This isn’t just for giant fintech unicorns. The Wise clone model fits:

- Fintech startups looking to disrupt banking in their country

- Remittance companies wanting a digital upgrade

- SaaS founders bundling money movement into their core offering

- Crypto entrepreneurs integrating fiat-to-crypto ramps

Want to launch in Latin America, Africa, or Southeast Asia? A Wise clone helps you localize faster than reinventing the wheel.

Why Choose a Wise Clone Over Building From Scratch?

- Speed: Go live in weeks, not years

- Cost: Avoid reinventing APIs and integrations

- Flexibility: Customize design, currencies, limits, and more

- Compliance: Use pre-built KYC/AML workflows

How Miracuves Helps You Launch a Fintech-Grade Wise Clone

At Miracuves, we’ve engineered our Wise clone to be developer-friendly, investor-ready, and future-proof. We handle:

- Frontend & backend setup

- Currency API integration

- KYC/AML systems

- Mobile app development

- Ongoing maintenance & scaling

Whether you’re targeting remote workers, international students, or diaspora communities — your money transfer app should feel seamless, secure, and stunning.

Also Read :-How Much Does It Really Cost to Build a Fintech App in 2025?

Conclusion

Cross-border money movement is broken — and users are sick of being robbed by hidden bank fees. A Wise clone helps you give them what they really want: speed, clarity, and control.

So whether you’re solving remittances in Nigeria or digital wallets in Brazil, the opportunity is massive.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Is a Wise clone legal to operate?

Yes, if you follow local financial regulations, integrate KYC/AML, and partner with licensed payment providers.

Can I customize the clone for my country or currency?

Absolutely. You can add/remove currencies, change UI languages, and localize for regulations.

How long does it take to launch a Wise clone?

With Miracuves, you can get your MVP up in 4–6 weeks depending on customization needs.

What’s the cost of building a Wise clone?

It depends on features, branding, and integrations — but it’s far cheaper than building from scratch.

Do I need a banking license to run a Wise clone?

You may need partnerships with licensed entities or apply for EMI licenses, depending on your region.

Can I integrate crypto features into the clone?

Yes! Many clients request fiat-to-crypto and stablecoin conversion modules.

Related Articles :-