So, I was at a weekend brunch with some startup buddies when someone joked, “I made more money flipping pancakes than launching my last SaaS product.” Naturally, we all laughed. But then he pulled out his phone and showed us PancakeSwap. Not a breakfast menu, but a decentralized exchange (DEX) app running on Binance Smart Chain. The kicker? It’s smooth, anonymous, and wildly profitable — when done right.

For creators and digital entrepreneurs, it’s not just a geeky crypto playground. PancakeSwap represents freedom — from middlemen, KYC forms, and trading delays. Whether you’re a DeFi degenerate, NFT collector, or startup dreamer hunting for passive income streams, this app flips the script on traditional finance — pun intended.

But what makes PancakeSwap click with millions? Why are founders building clones of it to enter the DeFi race faster? And how can you use this insight to launch a crypto app clone that’s actually viable? Let’s stir the syrupy details — and yes, Miracuves can help you cook up your own PancakeSwap-style platform with serious scalability.

What is PancakeSwap, Really?

At its heart, PancakeSwap is a decentralized exchange (DEX) — like Uniswap or SushiSwap — but built on the Binance Smart Chain (BSC) instead of Ethereum. It allows users to swap BEP-20 tokens, provide liquidity, earn yield, participate in lotteries, and even stake tokens for extra rewards.

In human terms? It’s a crypto market where you don’t need a bank, an identity, or a broker. Just your wallet (like MetaMask), a few tokens, and you’re in.

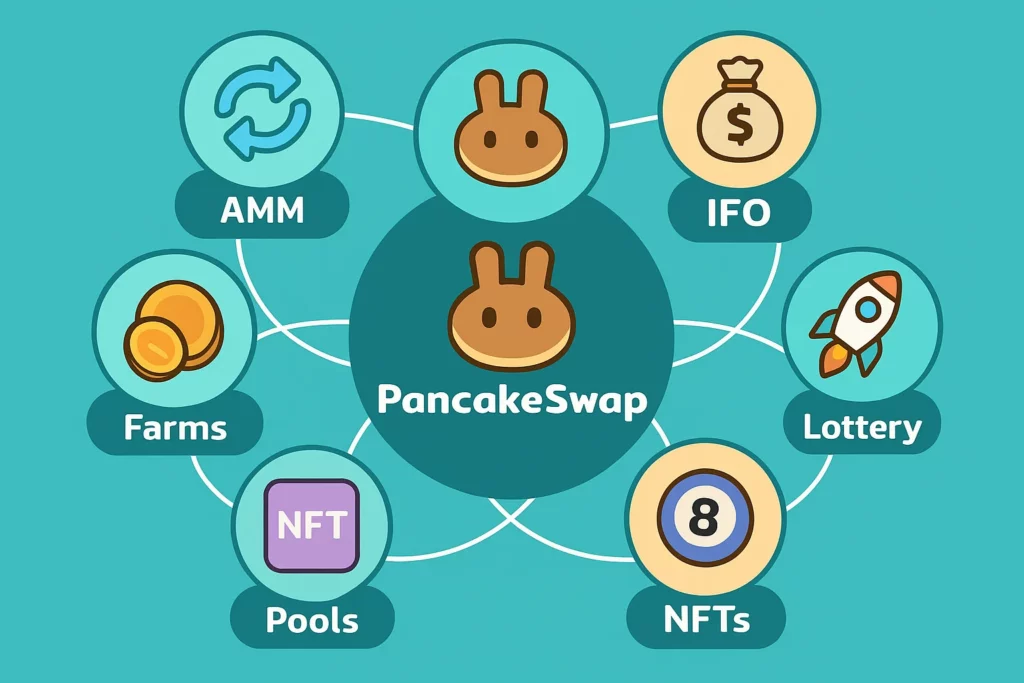

Key Features:

- Token Swaps (Instant trades via AMM)

- Liquidity Pools & Farming

- Staking via Syrup Pools

- Lottery & Prediction Markets

- NFT Marketplace

- IFO (Initial Farm Offering) Participation

How Does PancakeSwap Work?

Let’s skip the crypto-jargon for a second and break it down. PancakeSwap runs on an Automated Market Maker (AMM) model. That means:

- No Order Books: There are no buyers or sellers setting prices.

- Liquidity Providers (LPs) stake token pairs (like BNB/USDT) into pools.

- Traders swap tokens against these pools.

- LPs earn a cut of the trading fees — passive income, baby!

All of this happens without central control, powered by smart contracts.

Example:

If you want to trade CAKE (the native token) for BUSD, you do it right inside the app. Your transaction hits the smart contract, and the liquidity pool adjusts the ratio and price. Fast. Cheap. Transparent.

Revenue Streams: How PancakeSwap Makes Money (And So Can You)

Even in a “decentralized” world, somebody’s stacking the CAKE. Here’s how PancakeSwap makes bank:

Trading Fees

Every swap charges a 0.25% fee. A portion goes to liquidity providers, and the rest helps fund the platform and token burns.

Yield Farming

Liquidity providers get rewarded in CAKE tokens for “farming” — locking tokens in pools.

Staking in Syrup Pools

Users can stake CAKE and earn other tokens, or more CAKE — think of it as interest on your DeFi savings.

Lottery & NFT Marketplace

Small fees on NFT sales and lottery entries provide additional income.

Building a clone? These monetization streams are your blueprint. Need help? Miracuves does it all — from AMM mechanics to NFT integrations.

Also Read :-Proven Revenue Models for Your Decentralized Crypto Exchange

Why It’s Popular: PancakeSwap’s X-Factor

Let’s face it: Ethereum gas fees suck. PancakeSwap exploded because it runs on BSC, which is faster and cheaper. But that’s not all:

✅ Easy UX for Beginners

Even your crypto-curious cousin can use it.

✅ Token Variety

New tokens launch daily, giving early adopters tons of upside.

✅ Gamification

Lotteries, leaderboards, NFT collections — it’s like DeFi meets Candy Crush.

✅ Passive Income Options

Stake it, farm it, flip it — the app’s built for users to earn.

PancakeSwap Clone: Why Entrepreneurs Are Building Their Own

The demand for DeFi clones is skyrocketing. Why?

- You skip the learning curve of building from scratch

- Ready-to-go frameworks reduce time to market

- Custom branding + token integration lets you carve your niche

- Revenue models are already proven

Startups, DAOs, and even local crypto projects are cloning PancakeSwap to launch region-specific DEXs, NFT DeFi hybrids, or niche staking platforms.

At Miracuves, we offer PancakeSwap Clone Development — fully customizable, secure, and wallet-integrated. You focus on your token economy; we’ll handle the tech muscle.

Looking to build a decentralized exchange like PancakeSwap? Discover the top clone scripts of 2025 with complete features and cost breakdowns.

Real-World Use Cases of PancakeSwap-Style Apps

Local Crypto Hubs

Like India’s WazirX — imagine a DEX clone that serves local tokens and payments.

GameFi + NFTs

Gaming startups are embedding PancakeSwap’s AMM into their games for instant trading of weapons, skins, or coins.

DAO-Controlled DEXs

Communities launching tokens and using clones to trade, vote, and reward within a shared economy.

The Numbers Don’t Lie: PancakeSwap’s Market Impact

According to Statista, PancakeSwap once processed over $1B in daily trading volume, making it one of the most used DEXs globally.

With over 1.5M+ active users per month, it rivals major centralized exchanges in terms of liquidity and user activity — minus the red tape.

What’s Next for You?

The DeFi boom isn’t slowing down — but it’s evolving. Clones are becoming smarter, more feature-packed, and hyper-localized. Users want yield, speed, privacy — and gamification. PancakeSwap nailed the formula. Now it’s your turn.

Startups choose our PancakeSwap clone for its ready-to-launch DeFi features, saving months of development time and significant costs.

Conclusion

Building a crypto app shouldn’t feel like defusing a bomb. With the right team, tech, and monetization model, your DeFi dream is completely doable.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready.

Ready to turn your idea into reality? Let’s build together.

FAQs

Is PancakeSwap safe to use?

PancakeSwap is audited and considered relatively safe, but always DYOR and use trusted wallets.

Can I make money with PancakeSwap?

Yes — via yield farming, staking, and liquidity provision, though returns vary with market volatility.

Do I need to verify my identity?

Nope. It’s completely decentralized — just connect your crypto wallet and start trading.

What tokens can I trade on PancakeSwap?

Any BEP-20 token. New tokens are added frequently through IFOs and user liquidity pools.

How does a PancakeSwap clone differ from the original?

A clone replicates core features but can be customized in UI, tokens, staking logic, and user flows.

What tech stack is used to build a PancakeSwap clone?

Typically, Solidity (for smart contracts), React/Vue (for frontend), and BSC or Ethereum-compatible blockchain integrations.