In 2025, the online food delivery market in India and globally is undergoing a strategic evolution. With consumer expectations surging and hyper-local competition increasing, understanding the business models of leading players like Zomato and Swiggy has never been more critical—especially for startup founders and app entrepreneurs.

Both giants dominate the Indian food delivery ecosystem, yet they’ve taken distinct approaches to monetization, logistics, and growth strategies. As a founder looking to build a Zomato clone or Swiggy-style app, the choice of business model could make or break your venture.

In this deep-dive, we’ll break down:

- How each model works (revenue, cost, partners)

- Which suits modern startup dynamics

- Key market data

- Actionable insights on which path to choose

Let’s start by understanding what each platform represents in today’s food delivery economy.

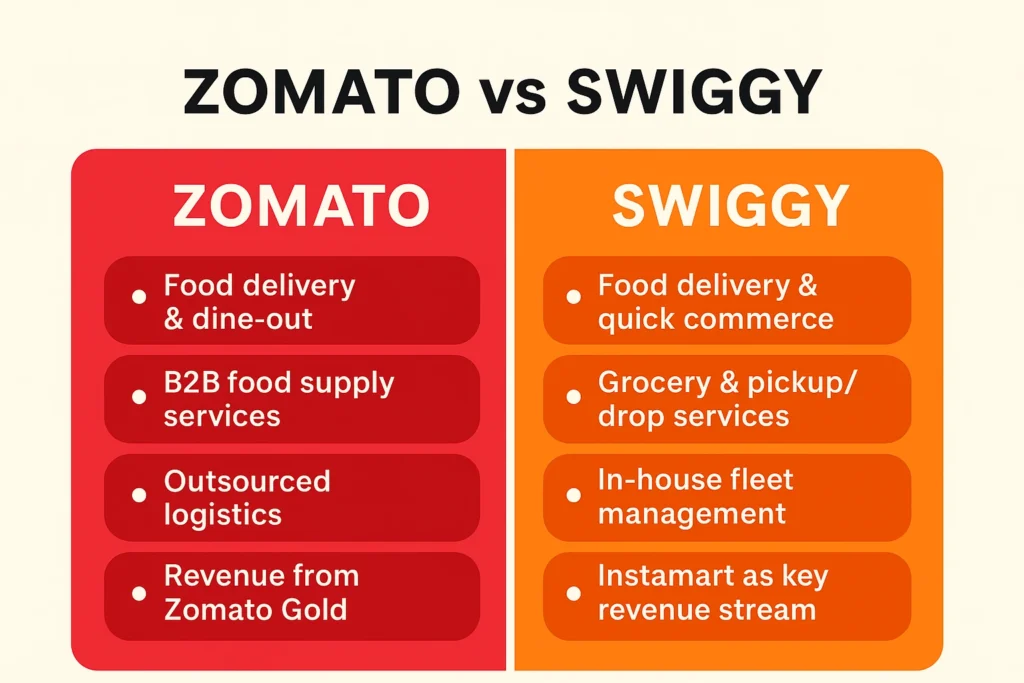

What is Zomato?

Zomato, founded in 2008, started as a restaurant discovery platform. Over time, it transformed into a multi-functional food tech ecosystem that includes:

- Food delivery

- Dine-out & table reservations

- Zomato Pro subscription

- Hyperpure (B2B supply for restaurants)

- Zomato Gold (Loyalty rewards)

By 2025, Zomato has matured into a full-stack food-tech and lifestyle platform, offering both consumers and restaurant partners a unified experience across ordering, discovery, and loyalty programs.

What is Swiggy?

Swiggy, launched in 2014, entered the market with a sharp focus on food delivery logistics. Known for its robust last-mile network, Swiggy’s model hinges on:

- On-demand food delivery

- Instamart (grocery delivery)

- Swiggy Genie (pickup & drop services)

- Dining & subscription (Swiggy One)

- Swiggy Dineout (post acquisition)

As of 2025, Swiggy is more of a hyperlocal delivery and convenience platform, expanding beyond food to cover everything that needs to move fast.

Business Model of Zomato

1. Revenue Streams

- Delivery Commission: 15–30% commission from restaurants per order.

- Advertisement & Listing Fees: Paid promotion by restaurants for visibility.

- Subscription Plans: Zomato Gold/Pro for users, offering discounts.

- Hyperpure: B2B food supply service to restaurants.

- Dining Revenue: Revenue from dine-in reservations and partner restaurants.

2. Cost Structure

- Logistics & Delivery Partner Costs

- Marketing & Promotions

- Technology Infrastructure

- Customer Support & Operations

- Restaurant Partner Management

3. Key Partners

- Restaurants (Independent & Chains)

- Delivery Riders (Gig Workers)

- Cloud Kitchen Partners

- Advertising Agencies

- Hyperpure Vendors

4. Growth Channels

- Aggressive Acquisition (e.g., Uber Eats India)

- IPO Funding (2021) leveraged for tech and geographic expansion

- New verticals like Intercity Legends, Nutritional Meals, and Loyalty 2.0

Learn More: Business Model of Zomato | How It Makes Money in 2025

Business Model of Swiggy

1. Revenue Streams

- Commission on Orders: Similar to Zomato (15–30%)

- Swiggy One Subscriptions: Premium delivery & dining benefits

- Instamart: Margin on quick commerce grocery sales

- Advertising & Visibility Fees

- Swiggy Genie: Charges for on-demand errands

2. Cost Structure

- Fleet Management & Delivery Charges

- Inventory Costs (Instamart)

- Discounts & Cashbacks

- Tech R&D and Cloud Infrastructure

- Last-mile Logistics

3. Key Partners

- Restaurants & Cloud Kitchens

- Retail/Grocery Partners (Instamart)

- Gig Delivery Workforce

- Tech Vendors

- Local Shops (Swiggy Genie)

4. Growth Channels

- Focused expansion into Tier 2 & Tier 3 cities

- Diversification into quick commerce & same-day delivery

- Vertical integration with dark stores for better control

Learn More: Essential Swiggy Features for Delivery App Startups

Zomato vs Swiggy Business Model: Comparison Table

| Feature | Zomato | Swiggy |

| Core Focus | Food + Dining Ecosystem | Food + Hyperlocal Logistics |

| Revenue Streams | Commission, Ads, Subscription, B2B | Commission, Ads, Quick Commerce, Genie |

| Logistics Model | Outsourced + Aggregated Fleet | In-house Fleet + Dark Store Network |

| Quick Commerce | Limited (Hyperpure only) | Instamart – Major Focus |

| Diversification | B2B, Dining, Intercity Food | Grocery, Dineout, Pickup & Drop |

| User Subscription | Zomato Gold / Pro | Swiggy One |

| Partner Dependency | Heavily restaurant-centric | Includes retailers, grocers, vendors |

| Funding Style | IPO + Private | Private + Large Capital Injections |

Pros & Cons of Zomato’s Business Model

Pros:

- High brand equity in restaurant discovery

- Strong B2B vertical (Hyperpure)

- Superior dining loyalty programs

- More diversified for urban audiences

Cons:

- Logistics still not fully in-house

- B2B supply adds inventory complexity

- Higher dependency on restaurant ecosystem

Pros & Cons of Swiggy’s Business Model

Pros:

- Logistics excellence with in-house fleet

- Rapidly scalable via Instamart & Genie

- Dark store integration offers control

- Broader addressable market beyond food

Cons:

- Lower brand loyalty in dining

- High burn rate in quick commerce

- Capital-heavy last-mile operations

Market Data: Revenue, Funding, and Growth (2025)

Zomato (as of 2025):

- Revenue: $1.3 Billion (INR ~10,700 Cr)

- Net Loss: Reduced to ~$75 Million

- Funding: Public + Private Investors (Tiger Global, InfoEdge)

- Growth: CAGR ~22% YoY post IPO

Swiggy (as of 2025):

- Revenue: $1.1 Billion (INR ~9,000 Cr)

- Net Loss: ~$140 Million

- Funding: ~$3 Billion raised, incl. SoftBank, Prosus

- Growth: CAGR ~26%, led by Instamart

Which Business Model is Better for Startups in 2025?

Both Zomato and Swiggy showcase viable business models—but your startup goals, geography, and value proposition will determine which suits you.

- Want a leaner entry with restaurant-first focus? ➡ Zomato-style

- Prefer aggressive scale in logistics and quick commerce? ➡ Swiggy-style

Cost-wise, Swiggy requires higher logistics investment, while Zomato depends more on marketing and restaurant integration.

Choose Zomato-Style Model If…

- You’re building a food discovery + delivery ecosystem

- Targeting urban millennial diners

- Interested in B2B restaurant services (like supply chain)

Build Your Own Zomato Clone with Miracuves

Choose Swiggy-Style Model If…

- You want to lead with delivery efficiency

- Plan to expand into groceries, errands, or hyperlocal

- Are ready to invest in logistics control

Launch Your Own Swiggy Clone with Miracuves

Conclusion

At Miracuves, we specialize in crafting tailor-made clone solutions based on leading platforms like Zomato and Swiggy.

Whether you’re a first-time founder or an experienced entrepreneur, our end-to-end development, design, and deployment services ensure your business model aligns with 2025 market dynamics.

Ready to launch your next-gen food delivery app?

FAQs

1. Which is more profitable: Zomato or Swiggy?

As of 2025, Zomato is closer to profitability due to its diversified ecosystem and lower logistics burden.

2. Can I build a food app like Zomato with minimal investment?

Yes, with Miracuves’ white-label Zomato clone, you can launch a full-featured food delivery app quickly and cost-effectively — all starting at just $2899.

3. Is Swiggy’s quick commerce model sustainable in 2025?

Quick commerce is fast-growing but capital-intensive; startups should evaluate logistics capability before adopting it.

4. Which app model is better for Tier 2 cities?

Swiggy’s logistics-first model may be better suited for non-urban markets due to fleet control.

5. Do Miracuves clones support both business models?

Absolutely. Miracuves provides customizable solutions to match both Zomato and Swiggy-style architectures.