A few years back, I watched a friend open a fully functional bank account — with a debit card and KYC verified — all within 10 minutes, while waiting for coffee. No branch, no paperwork, no grumpy banker. Just a few taps on her phone. that moment stuck with me. Because it wasn’t just convenient — it was the new normal. Digital banking once a novelty, has become the heartbeat of modern finance.

In a world where smartphones are more essential than wallets, digital banks (or neobanks, if you’re feeling fancy) are flipping traditional banking on its head. No monthly fees, slick apps, real-time alerts, and even rewards that don’t suck. But behind all that convenience lies a strategic, profit-driven engine humming with clever monetization tactics.

If you’re an entrepreneur eyeing the fintech wave or a creator dreaming of launching the next Revolut or Chime, stick around. We’re breaking down the business model behind digital banking — and how Miracuves helps build the engines that power them.

What Exactly Is a Digital Banking?

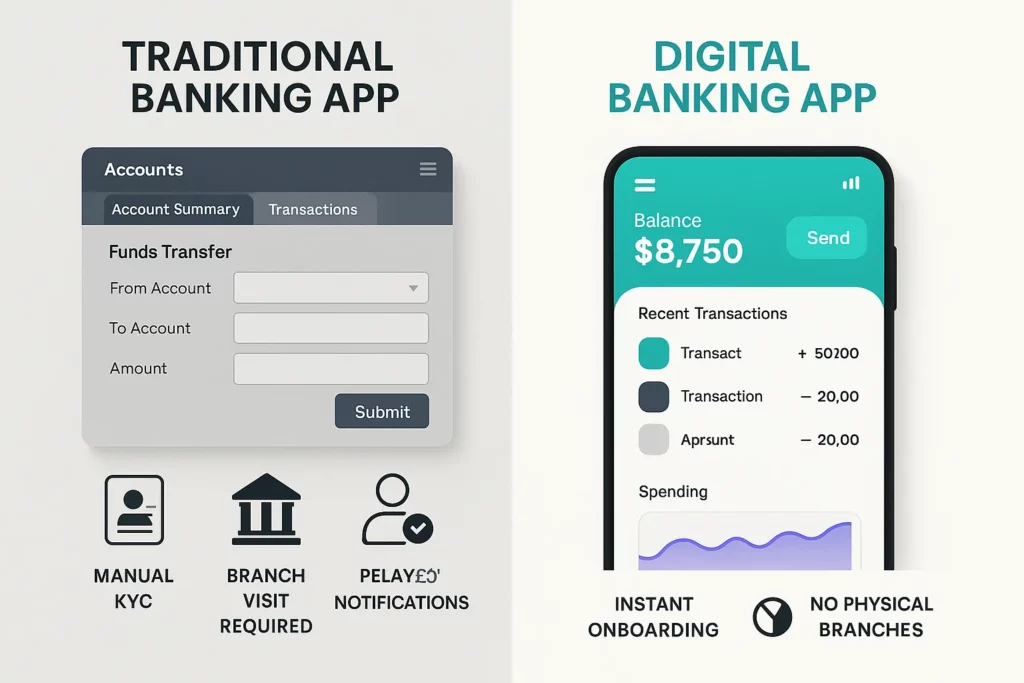

Digital banking are financial institutions that operate entirely online — no physical branches, just pure app-based banking. They serve the same purposes as traditional banks: deposits, payments, loans, cards — but reimagined for the app generation.

Key Characteristics:

- Mobile-first (or mobile-only)

- Hyper-personalized interfaces

- Low to zero physical infrastructure

- APIs and integrations galore

- Heavy use of automation, AI, and data analytics

Read more : How to Start a Digital Banking App Business in 2025

How Do Digital Banks Make Money?

This is where it gets juicy. Despite offering “free” accounts, Digital banking aren’t running a charity. Here’s how they actually profit:

1. Interchange Fees

Every time you swipe a debit card, the merchant pays a small fee. Digital banks get a cut — usually between 0.1% to 1%. Multiply that by millions of transactions? Ka-ching!

Example: If a user spends $1,000/month, and the bank earns 0.5% per swipe, that’s $5/user/month.

2. Subscription-Based Premium Features

Many offer a free tier, but also push paid plans with perks:

- Airport lounge access

- Higher interest rates

- Crypto wallets

- Advanced analytics

3. Lending & Credit Services

Offering micro-loans, buy-now-pay-later, or overdraft protection gives Digital banking a legit reason to earn via interest and fees. This is where the big bucks roll in.

4. Partnered Offers & Marketplaces

From travel insurance to stock investing — digital banks plug into third-party services and earn affiliate or referral fees. It’s like being a fintech influencer.

According to Statista, digital banks raked in over $4.5 billion in global revenue in 2023 — and that number is expected to double by 2026.

Read more : Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Core Features Driving Engagement

Let’s break down the digital banking experience — the stuff users love and use daily.

Instant Account Setup

Onboarding is smoother than your espresso foam. Most banks verify identity in minutes with eKYC.

Budgeting & Spend Analytics

Pie charts for your paycheck! Users love tracking spending, setting goals, and getting alerts like .

Real-Time Notifications

Every transaction gets pinged — fraud becomes easier to detect and control.

Virtual & Physical Cards

Issue both instantly. And yes, the cards often look cooler than legacy banks’ 1998 designs.

Read more : How to Market a Digital Banking App Successfully After Launch

Regulatory Backbone & Trust Factors

No one’s handing over their cash without iron-clad trust.

- Licensing Models: Some Digital banking are fully licensed; others operate under a sponsor bank or banking-as-a-service model.

- Data Security: End-to-end encryption, biometric logins, multi-factor authentication

Regulatory Compliance: GDPR, PCI-DSS, PSD2 — sounds boring but is non-negotiable.

Read more : Best Banking Solution Clone Scripts in 2025: Features & Pricing Compared

Digital Bank Business Model Canvas (Quick Breakdown)

| Key Partners | Fintech APIs, Regulators, Sponsor Banks |

| Key Activities | App Dev, KYC, Transaction Monitoring |

| Value Propositions | Fast, Flexible, Fee-Free Banking |

| Revenue Streams | Interchange, Subscriptions, Lending |

| Cost Structure | Tech, Customer Support, Compliance |

Real-Life Case Studies

Revolut

Started as a currency exchange app. Now it’s a full-blown Digital banking with crypto trading, stock investments, and over 35 million users.

Chime

US-based, targets the unbanked. Revenue > $1B with clever fee strategies and early paycheck access. No branches, all vibes.

N26

European neobank, Digital banking with a flair. Transparent fees, minimalist UI, real-time control over transactions.

Why Launch a Digital Bank Now?

- Fintech funding is hot (even post-crash)

- Gen Z and Millennials prefer apps to branches

- Tech barriers are low thanks to platforms like Miracuves

The digital wallet revolution isn’t coming. It’s here. And the next big player could be you — if you build smart.

Conclusion

Digital banking is no longer just a trend — it’s a tectonic shift. From swipe fees to subscriptions, challenger banks are monetizing convenience like pros. And there’s plenty of room for more players with niche ideas and bold designs.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Do I need a license to start a digital bank?

Not always. You can partner with a sponsor bank or use a banking-as-a-service provider to legally operate without direct licensing.

How long does it take to build a digital bank app?

With the right team (like Miracuves), an MVP can be live in 3–5 months. Complex features might extend the timeline.

How do digital banks ensure security?

By using encryption, biometric logins, regular audits, and complying with data protection laws like GDPR and PCI-DSS.

Can I launch a crypto-friendly digital bank?

Absolutely. Many digital banks now include crypto wallets or trading. You’ll need added compliance steps, but it’s doable.

How much does it cost to build a digital bank?

Depends on scope, features, and region — but expect a ballpark of $50,000 to $200,000 for a solid launch-ready product.

Related Article :