In the ever-evolving world of on-demand delivery and online marketplaces, Instacart and UberEats stand as two giants—each representing distinct business strategies for fulfilling consumer needs in food and grocery delivery.

As we navigate 2025, this comparison is more relevant than ever. Startup founders and app entrepreneurs are seeking sustainable, scalable, and investor-attractive business models. With changing consumer behaviors, AI-driven logistics, and growing competition, understanding the nuances of these two models—product-first (Instacart) vs logistics-first (UberEats)—is crucial for building the next big success story.

If you’re building a food or grocery delivery app, choosing the right model early can define your customer experience, unit economics, and market positioning.

What is Instacart?

Instacart is an online grocery delivery and pick-up service that partners with national and local retailers across the United States and Canada. Users place orders via the app or website, and a personal shopper picks and delivers the groceries.

Founded in 2012, Instacart connects users with real-world grocery stores, allowing them to browse and shop from stores like Costco, Safeway, and Aldi. Rather than owning inventory or stores, Instacart acts as the technology and logistics bridge between consumers and grocers.

What is UberEats?

UberEats is an on-demand food delivery platform that allows users to order meals from nearby restaurants via an app. Launched in 2014 as a spinoff of Uber’s ride-hailing services, it uses Uber’s powerful logistics network to deliver food quickly and efficiently.

The platform serves as a marketplace, connecting three key stakeholders:

- Restaurants

- Delivery Partners (Drivers)

- End Customers

UberEats does not prepare food or own kitchens; it focuses on facilitating and optimizing the logistics of food delivery at scale.

Business Model of Instacart

1. Revenue Streams

- Delivery Fees: Charged per order or via a subscription model (Instacart+)

- Service Fees: Percentage of the order total

- Retailer Commissions: Retail partners pay Instacart a cut of every sale

- Advertising Revenue: Brands pay for placement and visibility

- Memberships: Instacart+ offers unlimited free delivery for a monthly/yearly fee

2. Cost Structure

- Shopper Payments: Compensation to freelance personal shoppers

- Technology Infrastructure: App development, backend, cloud services

- Customer Support & Operations

- Marketing & Advertising

- Insurance and Liability Coverage

3. Key Partnerships

- Retailers: Costco, Kroger, Safeway, etc.

- CPG Brands: Advertising partnerships with brands like PepsiCo, Nestlé

- Third-Party Logistics Providers

4. Growth Strategy

- White-label services: Instacart Platform for retailers (tech SaaS model)

- Expansion into health & wellness

- Focus on AI for personalization and fulfillment optimization

- Ads as a key revenue booster

Learn More: Instacart Business Model: How It Works & Why It’s Successful

Business Model of UberEats

1. Revenue Streams

- Delivery Fees: Paid by customers

- Service Fees: From restaurants and customers

- Commission Fees: 15–30% cut from each restaurant order

- Advertising Revenue: Restaurants pay for promotion

- Subscription Plans: Uber One subscription for perks like zero delivery fees

2. Cost Structure

- Driver Payments: Largest chunk of operational costs

- Platform Maintenance & Engineering

- Restaurant Onboarding and Support

- Customer Service

- Local & Global Marketing

3. Key Partnerships

- Restaurants: Local joints to global chains (e.g., McDonald’s, Starbucks)

- Logistics Partners: For last-mile innovation

- Corporate Clients: B2B food delivery for offices, events

4. Growth Strategy

- Vertical Expansion: Alcohol, groceries, pharmacy

- AI Route Optimization

- Super App Vision: Integrating rides, delivery, and other services

- Global Expansion: Focus on underpenetrated markets

Learn More: Master UberEats Business Model & Build a Profitable Food Delivery App

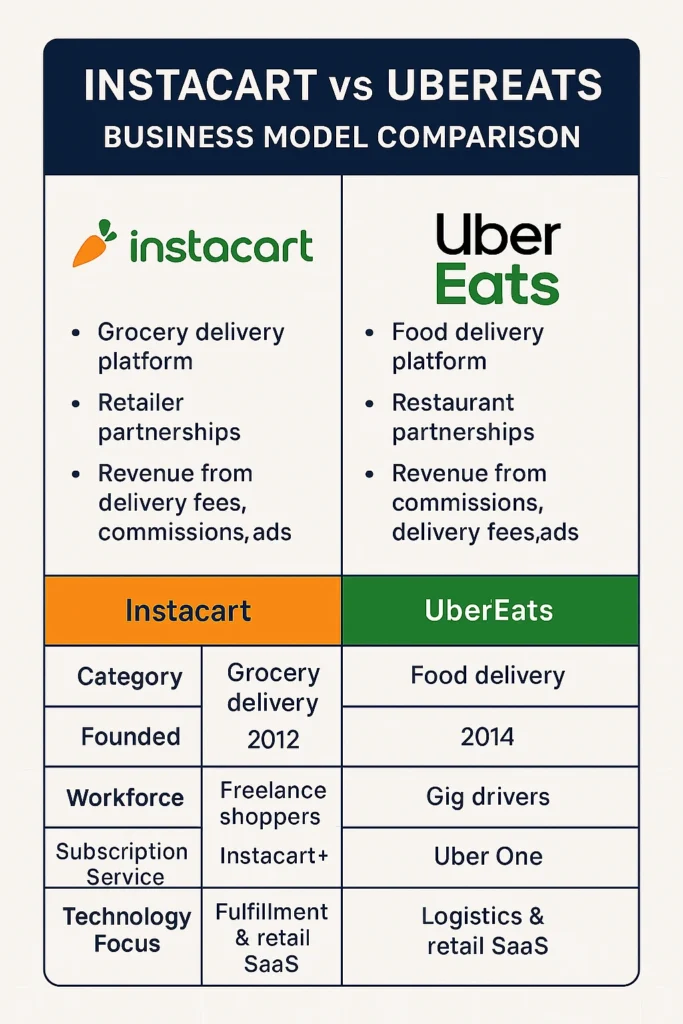

Instacart vs UberEats: Comparison Table

| Feature | Instacart | UberEats |

| Category | Grocery Delivery | Food Delivery |

| Founded | 2012 | 2014 |

| Business Model | Marketplace + Retail Partnership | Logistics Platform + Aggregator |

| Inventory Ownership | No | No |

| Workforce | Freelance Shoppers | Gig-based Drivers |

| Revenue Sources | Delivery, Service, Ads, Commissions | Commissions, Delivery, Ads |

| Subscription Service | Instacart+ | Uber One |

| Technology Focus | Fulfillment + Retail SaaS | Logistics + AI Matching |

| Global Reach | US, Canada | Global (40+ countries) |

| White-label Capabilities | Yes (Instacart Platform) | Limited |

Pros & Cons of Instacart’s Business Model

Pros

- Strong retailer partnerships

- Retail-as-a-service tech potential

- Efficient use of gig workforce

- Monetization via brand ads

Cons

- Thin margins

- High competition from Walmart, Amazon Fresh

- Dependency on retailer inventory data

- Shopper reliability varies

Pros & Cons of UberEats’ Business Model

Pros

- Global scale & brand recall

- Integrated into Uber ecosystem

- Multi-service expansion (groceries, meds, etc.)

- Dynamic pricing flexibility

Cons

- High driver churn rate

- Lower margins due to commission splits

- Restaurant dependency

- Complex logistics during peak hours

Market Data (2025 Outlook)

| Metric | Instacart | UberEats |

| Estimated Revenue | $3.2 Billion (2024 est.) | $12.2 Billion (Uber Delivery segment) |

| Market Share | 22% of US Online Grocery | 25% of US Food Delivery |

| Funding Raised | $2.7 Billion | $25B+ (via Uber Inc.) |

| Valuation (IPO plans) | $10 Billion (approx) | Public via Uber (NYSE: UBER) |

| Growth CAGR | 10.5% (grocery sector) | 13% (global food delivery) |

Which Model is Better for Startups in 2025?

It depends on your target geography, user behavior, and logistics capabilities. Instacart’s model favors deep local partnerships and operational excellence, while UberEats excels in scale and multi-category delivery.

If you want to:

- Build a retail-focused platform

- Offer white-label delivery tech

- Monetize brand & retail advertising

Go Instacart-style.

If your goal is:

- Hyperlocal food delivery

- Fleet optimization and super app functionality

- Monetizing high-frequency transactions

UberEats-style is ideal.

Choose Instacart-Style If…

- You’re entering the grocery delivery market

- You want to offer white-label tech to retailers

- Your focus is commission + ad revenue model

- You want to scale in mid-sized metro cities

Launch Your Own Instacart Clone with Miracuves

Choose UberEats-Style If…

- You’re targeting restaurant delivery aggregation

- You want to integrate into a super app ecosystem

- Your monetization relies on frequent orders

- You’re focused on urban delivery density

Build Your Own UberEats Clone App with Miracuves

Conclusion

Whether you’re drawn to Instacart’s tech-driven grocery fulfillment or UberEats’ global logistics edge, both models offer unique blueprints for success.

At Miracuves, we specialize in custom app development and clone app solutions that help founders replicate proven business models—while adding their own unique twist.

From MVP to full-scale launch, we’re your growth partner.

Let’s build your next big delivery startup today!

FAQs

1. What is the key difference between Instacart and UberEats business models?

Instacart focuses on grocery fulfillment via retail partnerships, while UberEats emphasizes logistics and restaurant delivery aggregation.

2. Which model is more scalable globally?

UberEats’ logistics-driven model is more scalable globally due to its focus on restaurant delivery and gig logistics.

3. Can I build an Instacart-style grocery app with Miracuves?

Absolutely. Miracuves offers fully customizable Instacart clone app solutions with full-stack support and retail integration — all starting at just $2899.

4. How do these platforms make money?

Both monetize through delivery fees, service charges, advertising, and subscriptions, but their revenue share models differ based on their partners.

5. Which model is better for small cities?

Instacart’s localized and retail-centric approach tends to work better in mid-sized to small cities with fewer restaurants but established grocery chains.