You’ve poured your heart, soul, and a fair chunk of your savings into building the next big thing in international money transfer. The app’s sleek, secure, and has that one feature your competitors totally missed. But here’s the kicker: if no one knows about it, it might as well be buried treasure in a digital desert.

If you’re a founder, creator, or startup warrior, you already know launching is just the first punch. The real match starts post-launch. Users need to trust you, download your app, and most importantly—keep using it. But how do you stand out in a crowded fintech arena where PayPal, Wise, and Remitly dominate?

At Miracuves, we’ve seen app clones and originals rise and fall—and we know what separates quiet launches from booming success stories. Let’s get into the gritty playbook that turns installs into income.

1. Positioning: Sell Trust Before Tech

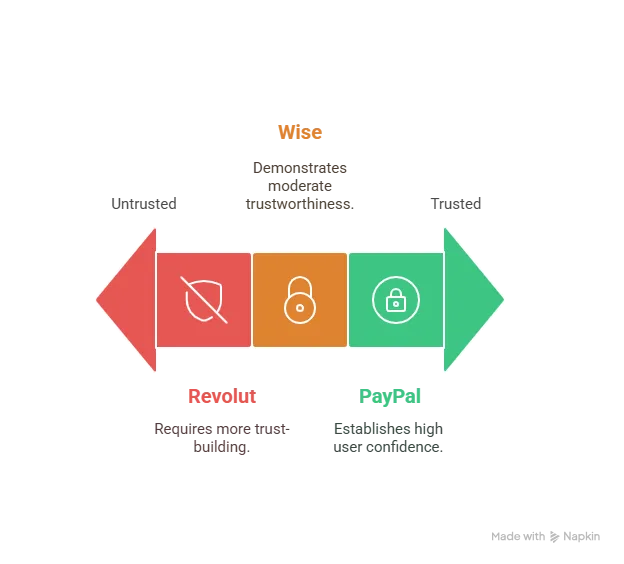

Marketing a international money transfer app is 80% trust, 20% tech. Think about it—users are literally handing over their hard-earned cash to your platform. Your first job? Position your app as secure, transparent, and regulated.

Key trust signals to highlight:

- End-to-end encryption & compliance with local/international money transfer regulations (KYC, AML, GDPR)

- Partnered banks or payment providers

- Transparent exchange rates & low fees

- Real-time transfer status updates

Read more : Business Model For International Money Transfer

2. Nail Down Your Niche & User Persona

Are you targeting:

- Migrant workers sending funds home?

- Freelancers receiving global payments?

- Travelers avoiding FX markups?

Don’t try to be everything to everyone. Build user journeys that speak directly to each group. Example: international money transfer Highlight savings on remittance fees for overseas workers with real-world use cases.

3. Mobile-First Marketing: Because That’s Where They Are

According to Statista, over 80% of digital remittances happen via smartphones. You need to win the mobile moment.

Must-haves:

- App Store Optimization (ASO): Keywords like “send money fast, ”international money transfer,” “zero fee transfers”

- App screenshots showing real-time exchange rates and UI ease

- Push notifications that nudge but don’t In fact,

- according to Statista, over 80% of digital remittance transactions now happen via mobile devices—making it absolutely crucial for your marketing to be mobile-first

Read more : Most Profitable International Money Transfer Apps to Launch in 2025

4. Influencer Collabs & Creator Marketing

Traditional ads are cool. But you know what really drives installs? international money transfer A real person explaining how they use your app to send money to their family in the Philippines or Kenya.

- Partner with micro-influencers in diaspora communities

- Sponsor YouTube or TikTok creators who share finance tips

- Give them early access + referral bonuses

5. Local SEO + Geo-Based Ads

Searches like “send money to Mexico fast” or “best app to transfer USD to INR” are hyper-commercial. international money transfer That’s gold for local SEO and Google Ads.

Tips:

- Create content targeting country pairs (e.g., “How to send money from UK to Nigeria safely”)

- Use geo-targeted Facebook and Instagram ads

- Translate onboarding + FAQs into top target languages

6. Referral Engines That Actually Work

Referral marketing can be your growth flywheel—but only if it’s exciting.

Examples:

- “Send $500, get $5” credit both ways

- Tiered rewards (refer 3 friends, earn $25)

- Track referrals in-app (transparency matters!)

Don’t be shy— international money transfer give users a reason to brag about your app at every WhatsApp family group reunion.

Read more : Revenue Model for International Money Transfer

7. Use Fintech PR and Product Hunt

A new app? Don’t wait for the press—go get it.

- Launch on Product Hunt with real user reviews

- Submit success stories to TechCrunch or Finextra

- Pitch community-specific media (e.g., immigrant newsletters or Facebook groups)

8. Retargeting: Don’t Let Them Slip Away

Got 10,000 installs but only 1,000 active users? Time to retarget.

- Facebook Custom Audiences: re-engage users who dropped off

- In-app popups for dormant users: “You’ve got $0 fees waiting”

- Email drips for identity verification drop-offs

Conclusion

The international money transfer space is crowded, no doubt. But the opportunity? Even bigger. A smart go-to-market strategy turns your app into a money-moving machine.

Trends like real-time payments, blockchain-based transfers, and decentralized finance are on the horizon—are you ready to ride the wave?

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

What are the best platforms to promote a money transfer app?

Start with Facebook, Instagram, and YouTube—especially for diaspora audiences. Use Google Ads for high-intent searches like “best app to send money to [country].”

Should I offer a referral program from day one?

Absolutely. Even a small referral bonus can kickstart organic growth. Just make sure it’s easy to understand and track.

How do I build trust with first-time users?

Highlight your security features, show real user testimonials, and make your support easily accessible. Transparency wins hearts.

What’s the role of influencers in this niche?

Huge. People trust people. Partner with creators who resonate with your target audience—especially those who send or receive money internationally.

How much should I spend on post-launch marketing?

There’s no one-size-fits-all, but plan to allocate at least 30–40% of your initial budget toward marketing in the first 6 months.

Related Articles :