The world is more connected than ever—and so is our money. In 2025, international money transfer apps aren’t just a convenience; they’re a booming business opportunity. Whether you’re a startup founder, an entrepreneur, or a digital agency hunting for the next big app to build, international remittance platforms are shaping up to be a goldmine.

With rising global mobility, an influx of freelance and remote workers, and growing financial inclusion efforts in emerging economies, there’s never been a better time to build a global payments app. Add in real-time payment rails and regulatory tailwinds, and the case becomes even stronger.

Why International Money Transfer Apps Are a Hot Opportunity in 2025

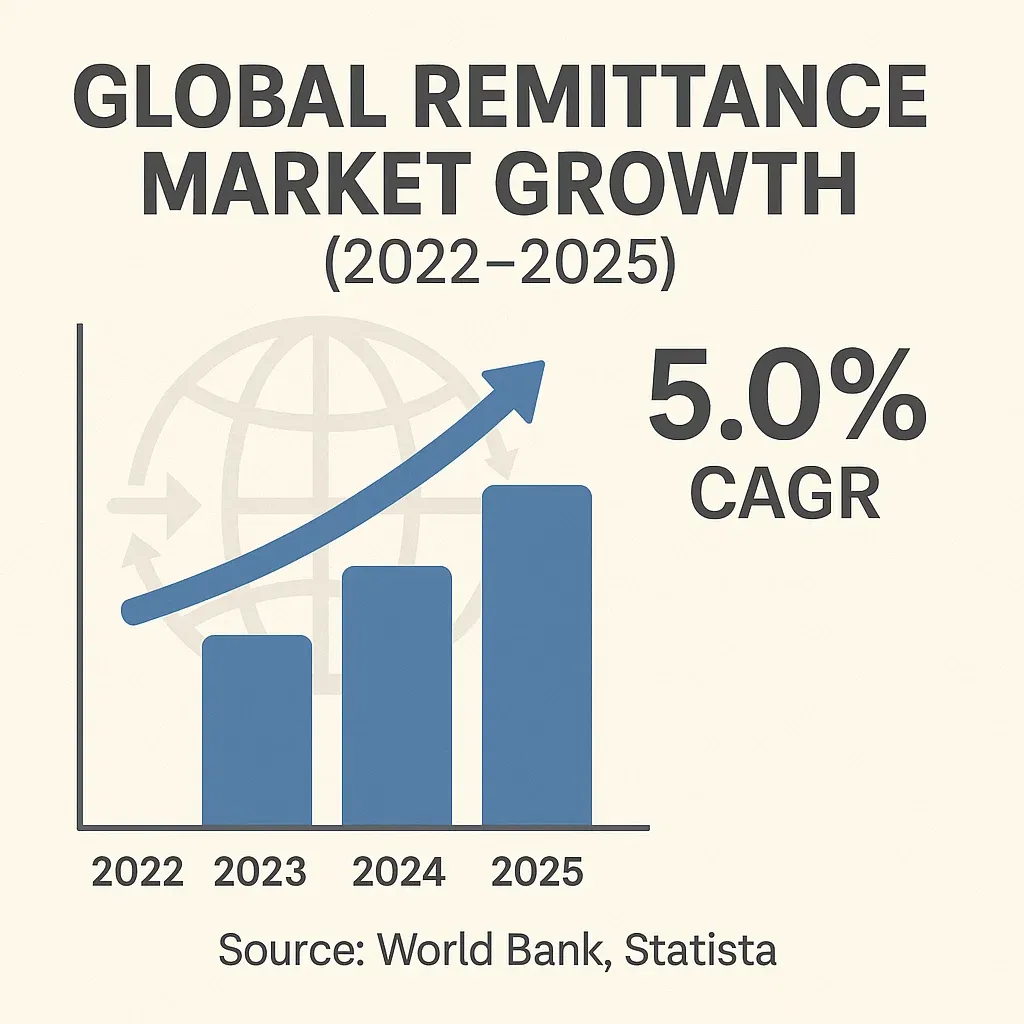

Global remittance flows are expected to exceed $850 billion in 2025, according to the World Bank. This is more than just a financial statistic—it’s a reflection of rising global migration, freelancing across borders, and small business exports booming across continents. From overseas workers sending money home to entrepreneurs paying remote teams, digital cross-border payments are now an everyday essential.

Read more: How to Develop an International Money Transfer App

Backed by Strong Market Data

- Statista projects that the total transaction value in the digital remittances segment will reach $207.70 billion in 2025, growing at a CAGR of over 7.6% through 2028.

- CB Insights reports over $3 billion in funding went into fintech startups focused on remittance and international payments in 2023–2024 alone.

- Consumers increasingly prefer digital-first, low-fee alternatives over traditional players like Western Union or MoneyGram.

What’s Driving the Growth?

- Mobile-first usage: In Africa and Southeast Asia, mobile money is the dominant mode of financial exchange.

- Rise of freelancers and remote workers: Cross-border salary disbursements and international gig economy payments are becoming normalized.

- Favorable regulations: Many countries are simplifying digital remittance licensing to encourage competition.

- Fintech stack maturity: With API-first banking, blockchain rails, and compliance-as-a-service providers, building such apps is technically more feasible than ever.

Market Gaps Still Exist

Despite the boom, many regions suffer from high fees, slow transaction speeds, and a lack of multilingual support—opening the door for new players. Successful apps like Wise (formerly TransferWise) and Remitly have proven that clear UX, transparent pricing, and fast payouts win trust—and market share.

If you’re looking to enter a profitable niche in 2025, international money transfer app startup ideas deserve your full attention.

Top Profitable International Money Transfer App Ideas to Launch in 2025

In the dynamic world of cross-border fintech, not all app models are created equal. Some cater to underserved regions, others simplify B2B flows, and some win with speed and low fees. Below are the most profitable international money transfer app ideas to launch in 2025, each offering a distinct value proposition and monetization model.

1. Real-Time Peer-to-Peer Remittance App

A mobile-first app allowing users to instantly send and receive money across borders with real-time currency conversion. Ideal for expats, migrant workers, or families supporting relatives abroad.

Monetization Strategy:

- Currency conversion margin

- Transfer fees (fixed or tiered)

- Premium subscriptions for faster payouts

Why It Works in 2025:

With real-time payment rails becoming globally adopted (e.g., UPI, FedNow, SEPA Instant), P2P apps with speed and transparency are in high demand.

2. Blockchain-Powered Remittance App

A decentralized money transfer app that leverages blockchain (e.g., Ripple, Stellar) to offer low-fee, near-instant transfers—especially to crypto-friendly markets.

Monetization Strategy:

- Transaction fee (lower than banks but enough to scale)

- Token swaps or withdrawal charges

- Partnerships with exchanges and wallets

Why It Works in 2025:

Blockchain-based transfers are up to 70% cheaper and are gaining regulatory traction. The Gen Z and Millennial user base also trusts crypto-based apps more than traditional banks.

3. SME B2B Cross-Border Payments App

A platform that allows small businesses to pay international vendors, freelancers, or suppliers in local currencies with automated invoicing and compliance tracking.

Monetization Strategy:

- SaaS pricing for business tiers

- Volume-based fees

- Invoice management add-ons

Why It Works in 2025:

Over 40% of SMEs face delays and high costs in cross-border payments. A streamlined, business-focused app can unlock a loyal, high-volume user base.

4. Multi-Currency Wallet App for Travelers & Expats

An e-wallet that holds, converts, and spends multiple currencies—ideal for digital nomads, international students, and expats.

Monetization Strategy:

- FX conversion fees

- Virtual/physical card partnerships

- Cross-sell travel insurance or services

Why It Works in 2025:

The travel resurgence post-COVID and rise of location-independent workers are fueling demand for borderless wallets.

5. Cash Pickup + Digital App Hybrid

Allows users to send money digitally while recipients can pick up physical cash from local partners or agents.

Monetization Strategy:

- Partner commissions

- Pickup convenience fees

- Ad placements in-app

Why It Works in 2025:

Many users in rural or unbanked areas still rely on cash. This hybrid model bridges digital and physical remittance needs.

6. Remittance App for Niche Communities (e.g., Students, Migrant Workers)

Tailored platforms catering to specific diaspora or migrant communities with localized UX, language options, and partner tie-ins (e.g., tuition payment support).

Monetization Strategy:

- Small transfer margins

- Niche services (education loans, cross-border health insurance)

- Partner promotions

Why It Works in 2025:

Trust and relatability are powerful in underserved markets. A “for us, by us” approach leads to high engagement and retention.

What Makes an App Profitable in the International Money Transfer Niche?

Not every app turns into a fintech unicorn, but the most profitable international money transfer apps to launch in 2025 share a few core characteristics. These traits drive revenue, encourage loyalty, and reduce operational burden—elements every startup founder should prioritize.

1. Recurring Revenue Streams

Whether through subscription tiers, transaction-based fees, or currency conversion margins, top-performing apps have built-in monetization models that generate consistent income. Offering premium services like instant transfers, VIP support, or multi-currency holding can also upsell users effectively.

2. High Retention & User Trust

Trust is everything in financial services. Profitable apps foster user loyalty by offering fast transactions, transparent fees, secure systems, and responsive support. Many also include features like real-time tracking, notifications, and user-friendly refund policies to increase stickiness.

3. Low Overhead with Automation

Using API integrations for KYC, currency exchange, fraud monitoring, and compliance reporting helps reduce manual effort and team size. Profitability increases when backend operations are automated and scalable.

4. Effective User Acquisition Channels

Growth-stage money transfer apps invest in referral programs, affiliate partnerships, community marketing, and targeted ads. Building viral loops—such as inviting recipients to become senders—helps keep CAC (Customer Acquisition Cost) low and LTV (Lifetime Value) high.

Clone Apps: A Smarter Path to Profitability

Building from scratch often delays your go-to-market timeline by 6–12 months and increases your upfront cost by tens of thousands of dollars. Instead, using a clone app development approach with a pre-built, customizable solution from Miracuves enables you to:

- Launch faster (as little as 3-6 days)

- Slash development costs by up to 60%

- Start testing monetization strategies earlier

- Get full control over branding and features

The clone model isn’t about shortcuts—it’s about strategic acceleration.

Cost to Build an International Money Transfer App in 2025

The development cost of an international money transfer app in 2025 varies greatly depending on complexity, compliance scope, and user experience goals. But here’s a realistic range to help you budget smartly.

Development Cost Breakdown

| Feature Set | Estimated Cost (USD) |

| Basic MVP App (P2P transfers, basic KYC, currency conversion) | $25,000 – $40,000 |

| Mid-Tier App (multi-currency wallet, compliance APIs, admin panel) | $45,000 – $80,000 |

| Advanced Platform (real-time payments, blockchain rails, B2B flows, agent systems) | $90,000 – $200,000+ |

Launch your International Money Transfer App with Miracuves — complete setup around $4000 – $5000 Go Live in 3 Days

Key Cost Factors

- Platform Choice

Native apps for iOS and Android increase development hours. A cross-platform build can reduce costs. - Backend Logic

Features like live exchange rates, real-time tracking, payout partner APIs, and fraud detection require complex backend workflows. - UI/UX Design

A high-converting app must be intuitive, multilingual, and mobile-optimized. Premium UI/UX increases upfront cost but boosts long-term retention. - Security & Compliance

Expect higher costs if you need to implement GDPR, AML/KYC integrations, and PCI DSS standards from the outset.

Why Clone App Solutions Are Smarter

Using a ready-made white-label solution from Miracuves significantly reduces both cost and time to market. Instead of building every module from zero, you get:

- Pre-built code base with battle-tested architecture

- Fully customizable branding, features, and workflows

- Optional modules (blockchain, agent network, multi-currency wallets)

With Miracuves, you could go live in under a month, spending only a fraction of what a custom build would cost.

Read more: Business Model For International Money Transfer

Tips for Founders to Launch a Successful International Money Transfer App

Breaking into the remittance space requires more than just a great idea—it demands smart execution. Here are the most crucial strategies for startup founders to increase their odds of success in 2025.

1. Start with an MVP First

Instead of building a full-featured app from the start, focus on launching with a Minimum Viable Product (MVP). Identify your core value proposition—such as faster payouts, lower fees, or community-based remittances—and build around that. Early traction validates your concept and helps attract investors or partners.

2. Prioritize UI/UX for Trust and Ease

Design matters. Users are dealing with their money, so your app must communicate security, reliability, and speed. Invest in professional design that offers:

- Clean, easy navigation

- Multilingual support

- Real-time notifications

- Simplified onboarding with guided KYC

Apps like Wise and Remitly have raised the bar—users expect polished, intuitive experiences.

3. Validate Your Market Before Scaling

Too many startups assume demand. Use surveys, beta testers, or community feedback to ensure your audience wants your solution. Focus on one user segment (e.g., Filipino expats, African freelancers) before expanding to new markets.

4. Build a Scalable Backend

Your app should be able to handle growth without major rewrites. Choose modern tech stacks (like Node.js, Firebase, PostgreSQL) and cloud infrastructure that can auto-scale as your user base grows.

5. Invest in Post-Launch Marketing

Launch day is just the beginning. A solid content strategy, influencer partnerships, referral programs, and paid ads are essential for acquiring and retaining users. Customer support, especially in multiple languages, also plays a key role in reducing churn.

Bonus Tip: Clone Before You Code

By starting with a customizable clone app solution from Miracuves, you reduce technical risk, speed up development, and focus more on market fit. With built-in compliance tools and global-ready infrastructure, you can skip months of backend setup.

Read more: How to Market a International Money Transfer App successfully After Launch

Conclusion

The international money transfer space is no longer a slow, bank-dominated monopoly. In 2025, it’s a fast-moving, tech-powered opportunity where nimble startups can disrupt entire regions—and profitably so. With rising digital adoption, underserved global markets, and improved infrastructure, launching a remittance app is one of the most strategic moves entrepreneurs can make this year.

The good news? You don’t need to start from scratch. Whether you’re aiming to serve expats, tap into B2B payments, or explore blockchain-powered transfers, Miracuves offers scalable, white-label clone solutions that help you go live faster, smarter, and with less risk.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q:1 How much does it cost to build an international money transfer app?

Costs can range from $25,000 for a basic MVP to over $200,000 for a fully featured platform. Clone solutions from Miracuves offer a faster and more affordable launch path.

Q:2 What features should a successful international money transfer app include?

Key features include multi-currency support, real-time exchange rates, instant transfers, KYC/AML compliance, and multilingual UX.

Q:3 Is it better to build from scratch or use a clone solution?

Using a clone solution like those from Miracuves dramatically reduces time-to-market and development costs while offering full customization.

Q:4 How do these apps make money?

Through transaction fees, foreign exchange margins, subscription plans, and sometimes partnerships or white-label integrations.

Q:5. Do I need licenses to launch a remittance app?

Yes, depending on the region. You may need money transmitter licenses, KYC/AML integrations, and to comply with regulations like GDPR or PCI DSS.

Q:6 Can I add blockchain or crypto payments later?

Absolutely. Many clone app solutions are modular, letting you add blockchain rails or crypto wallet integration when ready.

Related Articles:

- Wise Clone App Development: Step-by-Step Guide for Developers & Founders

- Cost to Build a Wise-Like Money Transfer Platform

- Top UI/UX Mistakes in International Money Transfer Apps

- Pre-launch vs Post-launch Marketing for Wise Clone Startups

- Breaking Down the Hidden Costs of Cross-Border Money Transfers