In 2025, the on-demand food delivery landscape has transformed into a global battleground of innovation, customer expectations, and hyper-personalized experiences. Two prominent names in this arena—Postmates and Talabat—stand as distinctly successful models. As a startup founder or an app entrepreneur aiming to disrupt or localize the delivery game, the question isn’t which is better globally, but rather which business model is better suited for your market, tech stack, and growth strategy?

Understanding the Postmates business model and the Talabat revenue engine isn’t just about app features—it’s about knowing how they monetize, scale, partner, and sustain themselves in highly competitive regions.

This blog dissects both models deeply—covering cost structures, partnerships, market performance, pros and cons, and real-world applications. If you’re building a Postmates clone or considering a Talabat-style platform, this detailed comparison will help guide your blueprint in 2025.

What is Postmates?

Postmates is a U.S.-based logistics platform that enables customers to order food, groceries, alcohol, and essentials from local merchants through an app. Founded in 2011 and acquired by Uber in 2020, Postmates gained popularity for its “anything, anywhere” delivery promise. Unlike traditional food delivery apps, Postmates expanded its horizon to general retail and on-demand courier services.

Key Features:

- Delivery from restaurants, convenience stores, and retailers.

- 24/7 on-demand availability.

- Real-time GPS tracking.

- Postmates Unlimited (subscription model for free delivery).

What is Talabat?

Talabat is the leading food and grocery delivery app in the Middle East, operating across countries like the UAE, Kuwait, Qatar, Bahrain, Oman, Egypt, Jordan, and Iraq. Established in 2004 and acquired by Delivery Hero in 2015, Talabat operates in a multi-vendor marketplace model, serving customers through partnerships with restaurants, cloud kitchens, pharmacies, and supermarkets.

Key Features:

- Restaurant & grocery delivery.

- Scheduled and real-time orders.

- Wallet integration & promotions.

- Multi-language support for MENA users.

Business Model of Postmates

1. Revenue Streams

- Delivery Fees: Customers pay variable delivery charges.

- Merchant Commissions: 15%–30% of order value from partner restaurants.

- Surge Pricing: Higher delivery fees during peak times.

- Postmates Unlimited: Subscription model with a flat monthly fee.

- Advertising: Sponsored listings and promotions on the app.

2. Cost Structure

- Delivery partner payments (per task + bonuses).

- Customer service and support.

- Technology infrastructure and logistics backend.

- Marketing and customer acquisition.

3. Key Partners

- Restaurants, retailers, and stores.

- Third-party delivery agents (freelancers).

- Payment processors and logistics services.

- Tech partners for mapping, analytics, and ads.

4. Growth Strategy

- Expanded into non-food verticals.

- Loyalty through subscriptions.

- Hyper-local promotions and celebrity brand tie-ins.

- Merged logistics with Uber Eats for market share growth.

Learn More: Build an App Like Postmates: Step-by-Step Guide for Multi-Service Delivery

Business Model Canvas: Postmates

| Component | Details |

| Customer Segments | Urban consumers, retail buyers, subscribers |

| Value Proposition | On-demand delivery for anything, anytime |

| Channels | iOS, Android, Web |

| Customer Relations | App support, loyalty programs |

| Revenue Streams | Fees, commissions, subscriptions, ads |

| Key Activities | App ops, partner onboarding, courier mgmt |

| Key Resources | Tech stack, fleet, partnerships |

| Key Partners | Restaurants, retailers, couriers |

| Cost Structure | Courier pay, tech ops, marketing, compliance |

Business Model of Talabat

1. Revenue Streams

- Commission per order: 15–25% from restaurants.

- Delivery Charges: For logistics handled by Talabat itself.

- Advertising: Priority listing for restaurants.

- Subscription (Talabat Pro): Free delivery & exclusive offers.

- Service Charges: On selected order types (e.g., groceries).

2. Cost Structure

- Fleet operations and logistics expenses.

- Restaurant onboarding and tech integrations.

- In-app payment systems and fraud prevention.

- Localization, language support, and regional ads.

3. Key Partners

- Restaurants, cafes, grocery stores.

- Fleet and last-mile delivery services.

- Regional payment gateways and banks.

- Cloud kitchen aggregators (e.g., Kitopi, iKcon).

4. Growth Strategy

- Deep localization in MENA.

- Partnerships with smart cities and health platforms.

- Cloud kitchen infrastructure investments.

- AI-driven personalization and delivery optimization.

Learn More: How to Create an App Like Talabat: Complete Guide to Features and Cost

Business Model Canvas: Talabat

| Component | Details |

| Customer Segments | Middle East consumers, expats, families |

| Value Proposition | Fast, local, multi-language delivery platform |

| Channels | Mobile apps, smart kiosks, websites |

| Customer Relations | Arabic & English CS, live support, Pro loyalty |

| Revenue Streams | Commissions, fees, subscriptions, advertising |

| Key Activities | Vendor onboarding, delivery ops, customer care |

| Key Resources | Local market knowledge, fleet, partnerships |

| Key Partners | Restaurants, stores, couriers, cloud kitchens |

| Cost Structure | Fleet, tech, support, marketing |

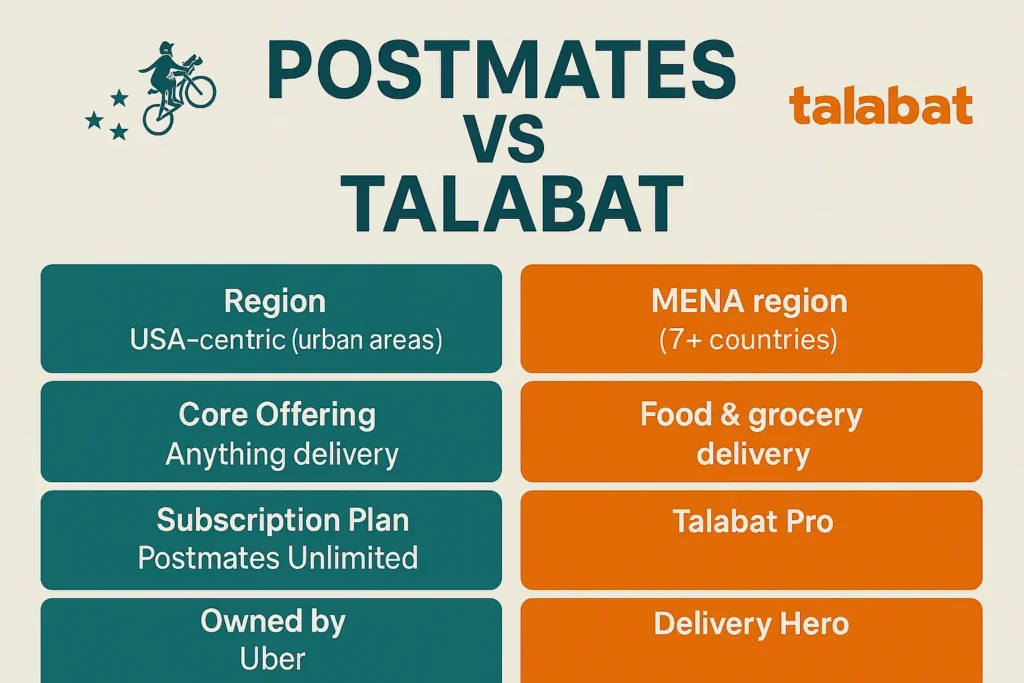

Postmates vs Talabat: Comparison Table

| Feature | Postmates | Talabat |

| Region | USA-centric (urban areas) | MENA region (7+ countries) |

| Core Offering | Anything delivery | Food & grocery delivery |

| Delivery Model | Freelance courier network | Mix of freelance & in-house fleet |

| Subscription Plan | Postmates Unlimited | Talabat Pro |

| Revenue Streams | Delivery fees, ads, subs, surge | Commissions, delivery, subs, ads |

| Owned by | Uber | Delivery Hero |

| Multi-language Support | English only | Arabic + English |

| Logistics Focus | General urban logistics | Hyperlocal food + grocery |

| Cloud Kitchen Integration | Limited | Deeply integrated |

| Tech Stack | Real-time routing, map-based UI | AI-personalized UI, region-specific |

Pros & Cons of Postmates Model

Pros:

- Flexible delivery beyond food.

- Subscription boosts retention.

- Works well in gig economies.

- Scalable to other sectors (retail, pharma).

Cons:

- High courier churn.

- Surge pricing may deter users.

- Regulatory hurdles for multi-category delivery.

- Less suited for lower-income markets.

Pros & Cons of Talabat Model

Pros:

- Deep market penetration in MENA.

- Strong multilingual and local brand.

- Efficient logistics for food/grocery.

- Cloud kitchen ecosystem adds value.

Cons:

- Limited to F&B and grocery verticals.

- Less flexibility beyond delivery.

- Regulatory dependencies in GCC nations.

- Narrower global appeal.

Market Data: Growth, Revenue & Funding

| Metric | Postmates | Talabat |

| Estimated Valuation | ~$2.65B (pre-Uber acquisition) | Part of Delivery Hero (€24B valuation) |

| Market Reach | 2,940+ US cities | 9 MENA countries |

| Monthly Users (2025) | ~8 million | ~10 million+ |

| Revenue Model Strength | Strong diversification | Strong regional specialization |

| Growth Focus | Multi-sector expansion | Hyperlocal scaling |

Which Model is Better for Startups in 2025?

In 2025, startups must decide based on market geography, cost of fleet operations, regulatory environment, and app focus.

- If you’re operating in North America, Latin America, or urban Europe, Postmates’ flexible, multi-category model offers faster scalability and broader revenue streams.

- If your startup targets Gulf countries, Egypt, or Jordan, Talabat’s localized, food-first approach with regional depth is more sustainable and competitive.

Choose Postmates-Style Model If…

- You’re targeting urban, on-demand economies.

- You want to include non-food verticals.

- Subscription-based loyalty is a key growth plan.

- You’re launching in competitive US/EU cities.

Launch Your Own Postmates clone with Miracuves

Choose Talabat-Style Model If…

- Your user base speaks Arabic or prefers local vendors.

- You’re focusing solely on food and groceries.

- Regional logistics and fleet control matter to your strategy.

- You want to integrate with cloud kitchens.

Get Your Own Talabat clone solution with Miracuves

Conclusion

Whether you align with Postmates’ versatility or Talabat’s hyperlocal mastery, Miracuves helps you custom-build delivery platforms with the right tech stack, clone scripts, and market-aligned features.

At Miracuves, we specialize in crafting robust, scalable, and tailored delivery app clones that bring your startup vision to life in 2025 and beyond.

FAQs

1. What is the main difference between Postmates and Talabat?

Postmates offers multi-category on-demand delivery in the US, while Talabat focuses on food and grocery delivery in the MENA region.

2. Which app is more scalable for global markets?

Postmates-style platforms are more flexible for global markets due to their general delivery model and diverse revenue streams.

3. Does Talabat own its delivery fleet?

Talabat uses both in-house fleet and third-party logistics partners, especially in key cities across MENA.

4. Can I build a hybrid model combining Postmates and Talabat?

Yes, a hybrid model is possible and can be tailored by Miracuves to fit your geography and audience.

5. How much does it cost to build a Postmates or Talabat clone?

With Miracuves, you can build a Postmates clone for just $3299 and a Talabat clone for $2899, both offering complete features and seamless delivery app functionality.