You’ve got your Revolut clone almost ready. The app interface is sleek, your wallet integration works, your KYC flow’s airtight, and you’ve even got that modern “banking, but make it sexy” vibe going on. But here’s the million-dollar fintech question: will users trust you with their money from Day One?

Spoiler: they won’t—unless you market like your MRR depends on it (because it does). Fintech isn’t selling sneakers; it’s selling trust, utility, and habitual usage. Yet, so many digital banking startups forget that trust must be built before launch, and retained long after. For your reference consider Statista.

In this blog, we’re breaking down the critical differences between pre-launch and post-launch marketing for digital banking apps like Revolut clone. And yes, Miracuves can help you launch your app like a fintech pro—tech, traction, and trust included.

What is Revolut app and How does it Works?

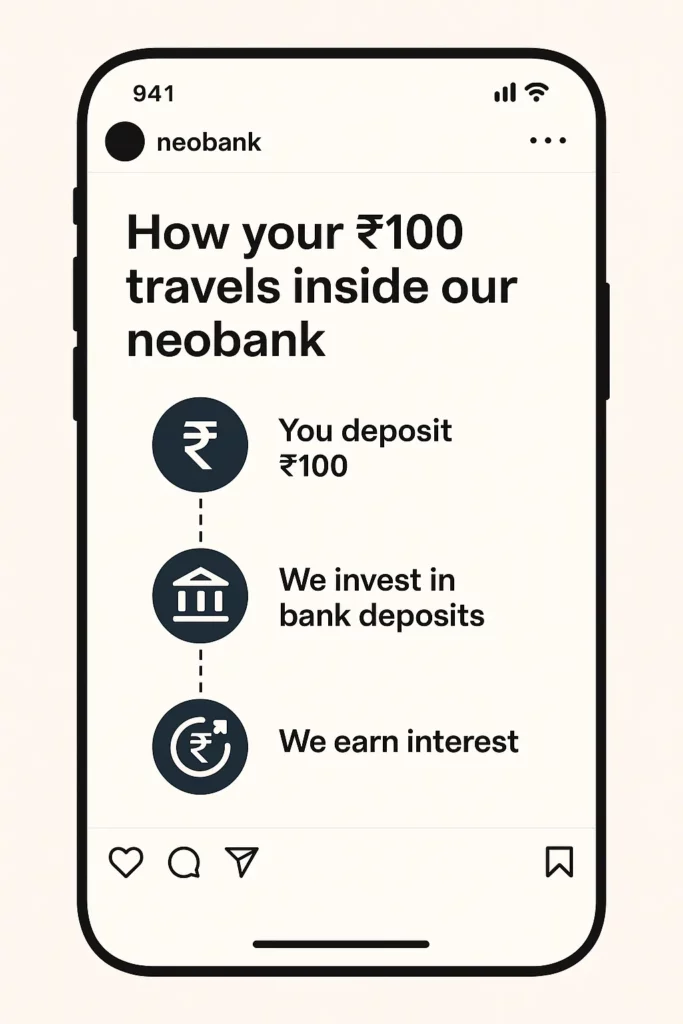

Revolut is a financial technology app that offers a wide range of digital banking services through a single, user-friendly platform. Designed to simplify money management, Revolut allows users to open multi-currency accounts, make global transfers at competitive exchange rates, spend with a prepaid debit card, and track their expenses in real time. It also supports cryptocurrency trading, stock investments, budgeting tools, and savings features like vaults. Available in numerous countries, Revolut aims to make financial services faster, more transparent, and accessible from your smartphone.

Learn More: Revolut App Explained: What It Is, How It Works, and Why You Need One

Why Pre-launch Marketing is a Non-Negotiable for Neobank Startups

You Can’t Launch a Wallet Without People to Fill It

Fintech apps face a unique problem: users don’t just try your product—they entrust it with their transactions, savings, even crypto. That means you’ve got to start building trust way before the download button even exists.

Pre-launch marketing is your foundation. It’s where you gather early signups, create community buzz, and start educating users about what sets your app apart—whether it’s multi-currency wallets, zero-fee exchange, or hyper-personalized analytics.

Pre-launch Marketing Strategies that Build Fintech FOMO

1. Waitlists with Perks That Matter

Nobody joins a waitlist just for fun. Offer tiered perks like:

- Top 100 signups get early beta access

- Invite 5 friends = earn ₹500 wallet credit

- Exclusive metal card access for early users

Use tools like KickoffLabs or ReferralHero to gamify it.

2. Partner with Niche Finance Influencers

Think beyond YouTubers. Go for personal finance coaches, Gen-Z savings TikTokers, and crypto Twitter educators. Let them trial your features and generate trust through reviews, reels, and AMAs.

3. Transparency = Trust

Use Twitter/X, LinkedIn, and your blog to show how you’re building your app. Share sneak peeks of fraud-detection workflows, customer support automation, or onboarding UI tests.

“People don’t trust what they don’t understand—so let them see how you’re building financial trust.”

4. Educational Content (Not Just Promo)

Drop reels and blogs explaining:

- How your wallet works

- What makes your fees lower

- What “banking alternative” really means

Post-launch Marketing: Time to Scale Trust, Users, and Revenue

1. Smooth Onboarding = Higher LTV

Every second counts. Break onboarding into visual steps. Auto-fill where possible. Show benefits (“Set up in 2 mins, no paperwork needed”) and remove friction.

Use in-app tooltips and gamified progress bars.

2. Use Transactional Nudges to Encourage Habit Loops

“Track your first expense → Unlock analytics”

“Top-up ₹1000 → Get cashback boost”

“Set your savings goal today → Watch it grow tomorrow”

Push notifications shouldn’t be spam—they should reward action.

3. Retarget Drop-offs Like a Pro

Someone downloaded your app but didn’t complete KYC? Set up a retargeting funnel:

- First reminder: “Finish KYC in 1 min—get ₹250 wallet credit.”

- Second: “Your account’s waiting! 95% complete…”

4. Promote Real Wins from Real Users

Nothing beats real screenshots and testimonials like:

“Switched from bank X to this—saved ₹1200 last month.”

“Used it abroad—best currency conversion ever.”

Use these in your retargeting ads and onboarding emails.

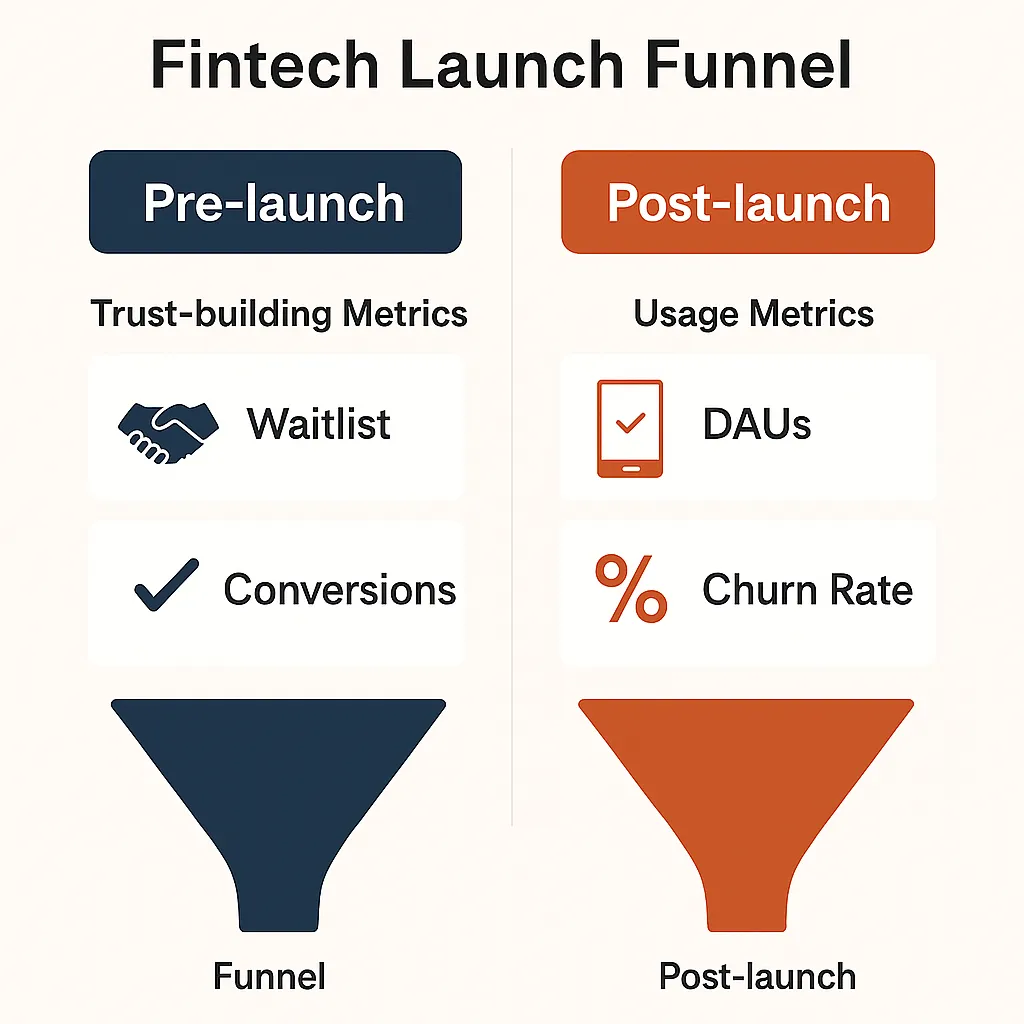

Pre-launch vs Post-launch: A Side-by-Side Fintech Breakdown

| Phase | Pre-launch | Post-launch |

|---|---|---|

| Objective | Build trust, generate signups | Drive installs, deepen engagement |

| Key Users | Early adopters, beta testers, finance-curious | Active savers, transactors, loyal customers |

| Channels | Influencer collabs, social proof, waitlists | Email flows, push notifications, referrals |

| Content | Teasers, trust-building blogs, product demos | User stories, feature promos, support content |

| Metrics | Signups, waitlist CTR, referral rates | DAU, retention rate, monthly load volume |

Why Revolut Clone Startups Need Both Phases

You can’t trust your growth to “launch and pray.” Financial apps are high-friction products—they need trust and habit to succeed. That means launching a Revolut alternative requires a solid pre-launch strategy, followed by data-driven post-launch marketing.

Learn More: Why Startups Prefer Revolut Clone Over Custom Development

Founders who ignore this? They burn through ad budgets and churn users faster than a weekend crypto pump.

Build Your Own Digital Banking App with Miracuves

Conclusion

Pre-launch builds trust. Post-launch builds stickiness. Together, they turn your fintech idea into a money-moving machine users love.

At Miracuves, we help innovators launch high-performance Revolut app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

1) How far ahead should I start pre-launch marketing?

Start immediately — with Miracuves delivering your solution in just 3–9 days with guaranteed delivery, you can begin gathering feedback, building anticipation, and refining your pitch right from day one.

2) What’s the biggest post-launch mistake fintech startups make?

They focus too much on downloads and not enough on onboarding completion and usage loops. DAU matters more than install count.

3) What are the best early user incentives?

Wallet credits, cashback boosts, lifetime access, or even physical debit cards for top referrers.

4) Is it safe to market a financial app before regulatory approvals?

You can market your mission and vision—just be transparent that you’re in the process of approvals and not taking user funds yet.

5) What tools help with post-launch re-engagement?

Firebase, Mixpanel, Braze, or CleverTap for triggers, analytics, and push notification campaigns.

6) How does Miracuves support the marketing side?

While we focus on development, we also provide launch roadmaps, retention best practices, and marketing enablement for fintech founders.