Picture this. You’re a startup founder with wanderlust, sipping your third espresso in a co-working cafe in Bali. Suddenly, you wonder: “How do these travel apps rake in the big bucks?” You open your laptop and start digging. Turns out, it’s not just about pretty pictures of Paris or booking hotel rooms at 2 AM. There’s an entire money-making engine behind every online travel agency (OTA) — and understanding the revenue model for online travel agency platform success is where it all begins.

Now, if you’re thinking about launching the next big Expedia, Booking.com, or even a niche getaway finder for digital nomads, you need to understand how the cash flows. Spoiler alert: It’s not just commissions. We’re talking ads, data, partnerships, and a sprinkle of magic (okay, strategy).

At Miracuves, we build high-performing app clones that help travel tech entrepreneurs skip the guesswork and scale faster. Build your own OTA platform and discover the revenue models powering today’s top online travel agencies

Read more: How to Develop an Online Travel Agency Platform App

The OTA Revenue Model: It’s Not Just Book and Earn

Online Travel Agencies don’t just book tickets; they orchestrate a complex ecosystem. They bring together flights, hotels, car rentals, activities, and even insurance into one seamless app experience. And every interaction is an opportunity to earn.

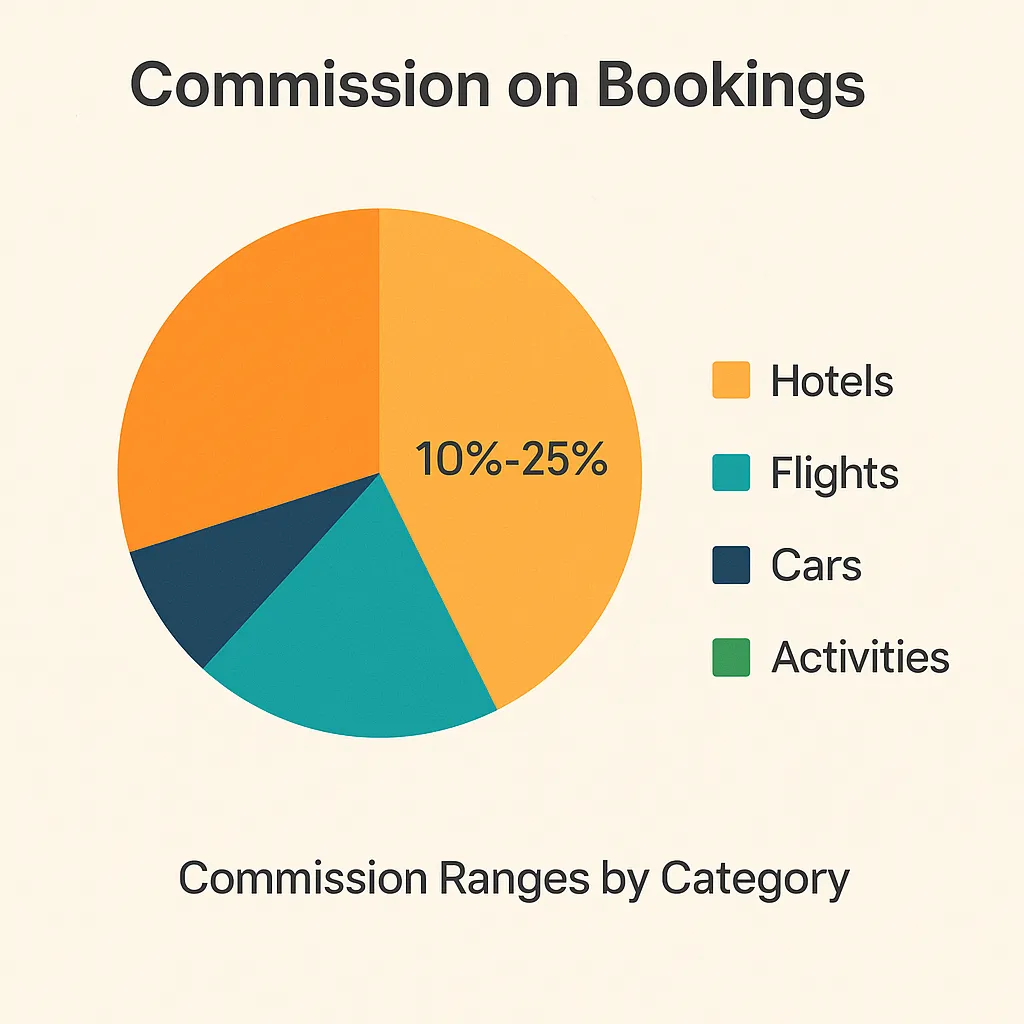

1. Commission on Bookings

This is the bread and butter. OTAs earn a percentage from hotels, airlines, or service providers for every completed booking.

- Hotels typically pay 10% to 25% commission.

- Airlines might offer less or none, pushing OTAs toward bundled packages.

2. Subscription & Membership Fees

Some OTAs (like Tripadvisor Plus) offer premium memberships. Users pay annually for perks like better rates, concierge services, or priority support.

Think Amazon Prime but for globetrotters.

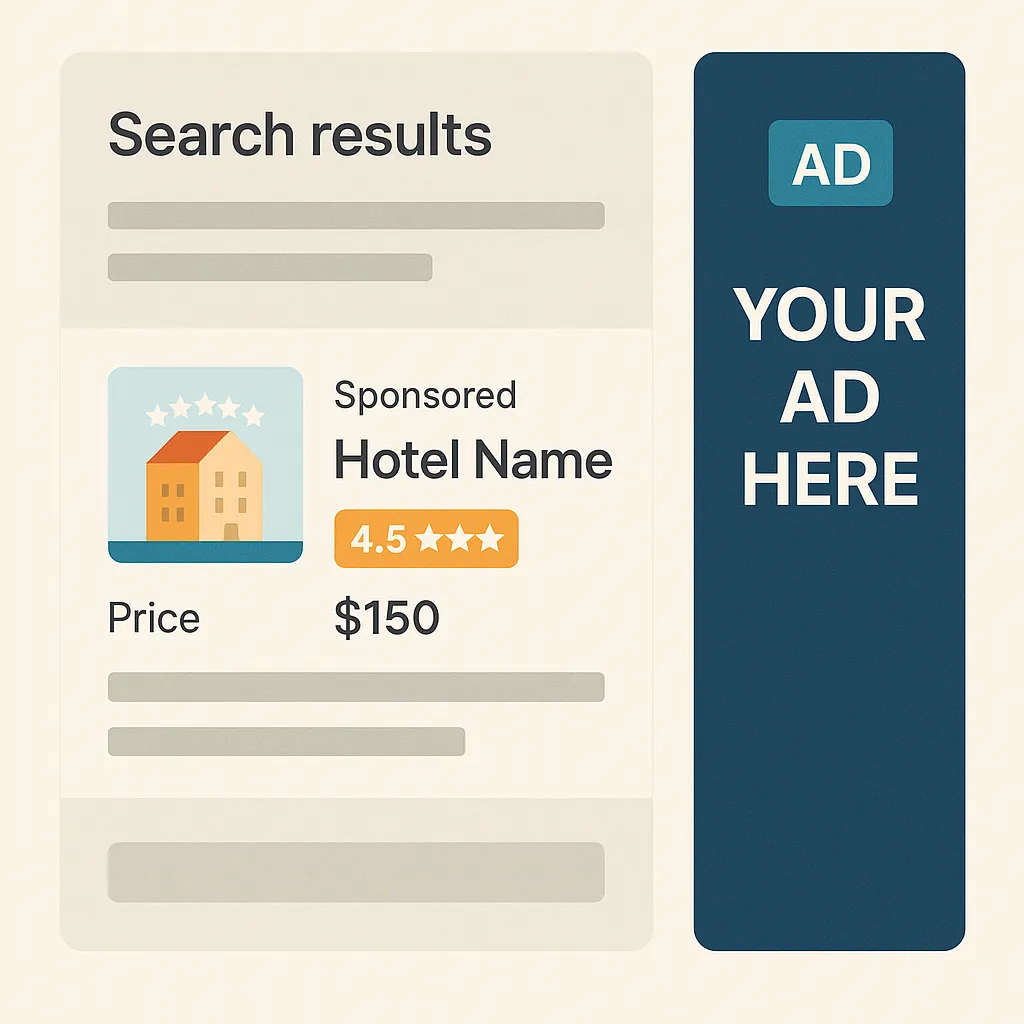

3. Pay-Per-Click Advertising (PPC)

Hotels and airlines bid for top spots in search results. It’s like Google Ads, but inside the app. More visibility = higher bookings = more revenue for the OTA.

4. Display Ads & Sponsored Listings

Beyond search rankings, some OTAs run banner ads and native placements. Travel insurance, luggage brands, credit cards — all want eyeballs.

5. Dynamic Packaging

Bundling a flight + hotel + car can unlock extra margins. OTAs negotiate exclusive rates and keep the markup.

6. Affiliate Partnerships

OTAs earn via referral links — e.g., booking protection insurance, travel gear stores, or guided tours on third-party platforms.

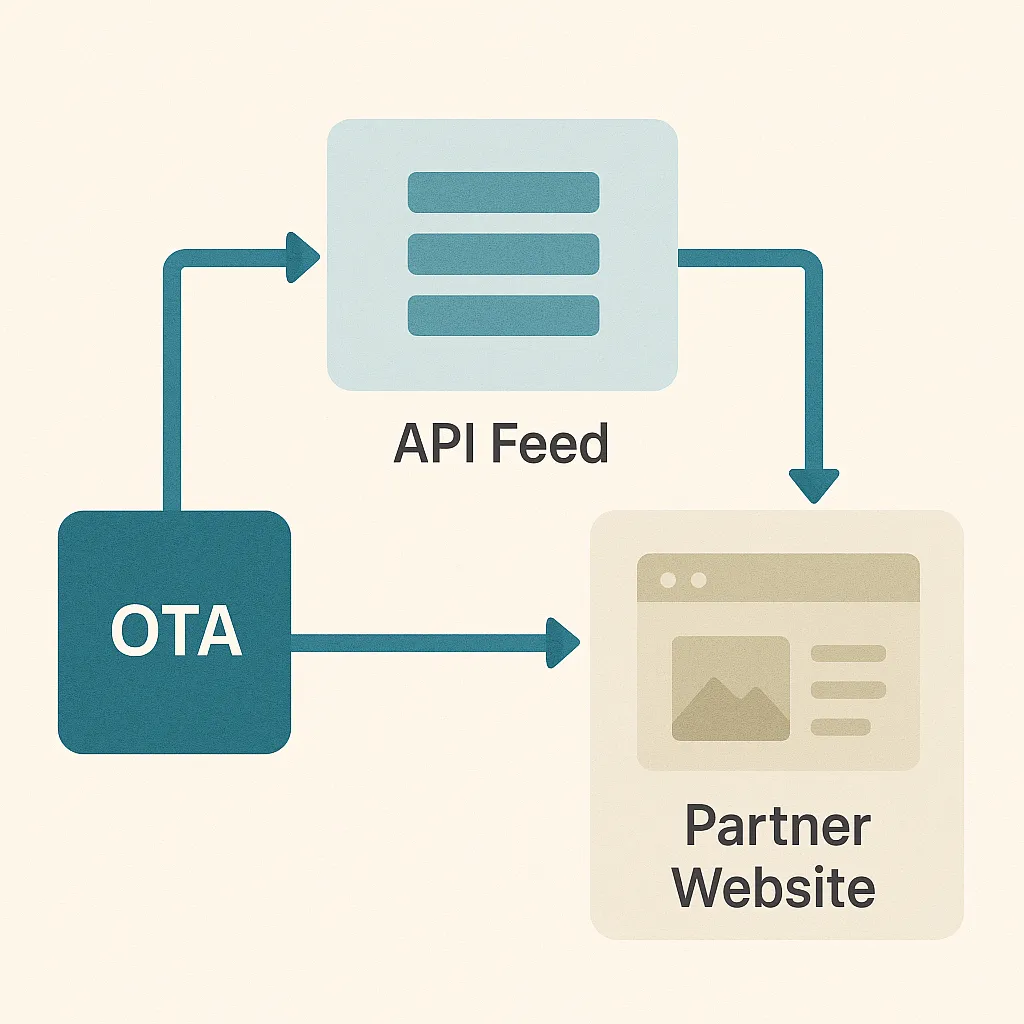

7. White Label & API Access

Smaller travel platforms or bloggers integrate OTA data through APIs or white-label portals, earning the OTA licensing fees.

Read more: Online Travel Marketplace Development: Full Cost Breakdown

Behind the Curtain: Tech That Powers Profit

Revenue doesn’t just appear. It’s coded into the infrastructure.

A. Personalization Engines

AI suggests hotels based on your previous trips, ratings, and budget. More relevancy = higher conversion = more commission.

B. Surge Pricing Algorithms

Like Uber, OTAs use demand-based pricing. They earn higher margins during peak seasons or local events.

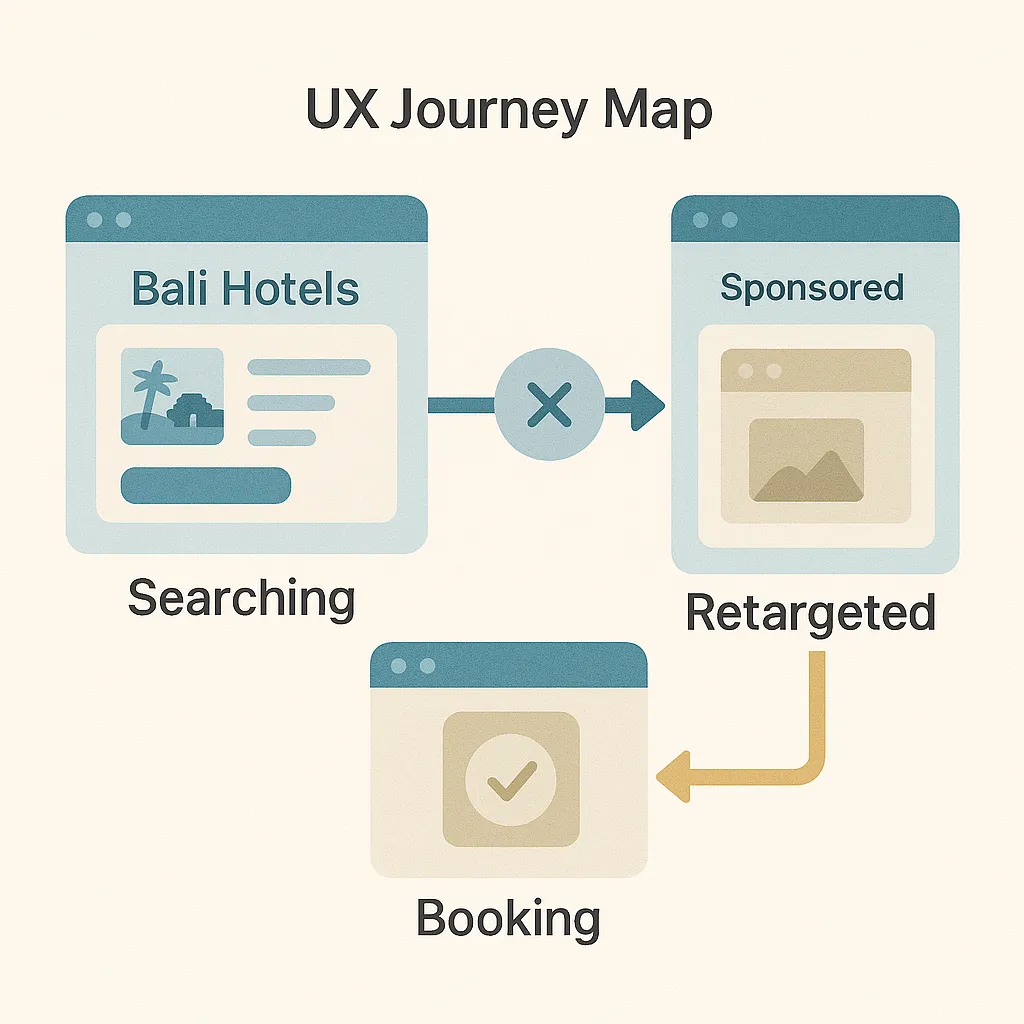

C. Retargeting Funnels

Ever seen that Bali hotel follow you across the internet? That’s OTA retargeting magic, funded by ad partnerships.

Read more: Essential Features of an OTA Platform and Their Development Costs

The Hidden Upsells That Print Profit

Many users miss these, but OTAs love them.

A. Travel Insurance Add-Ons

Partnered providers offer coverage during checkout. OTAs earn a commission per policy sold.

B. Seat Selection, Meals & Upgrades

Airlines let OTAs upsell add-ons with each ticket. Often, it’s more profitable than the ticket itself!

C. Priority Boarding & Fast Lane Passes

These convenience features are cash cows, especially for last-minute travelers.

Future-Proofing: Trends Shaping OTA Revenue

1. Voice Search Bookings

With Alexa and Google Assistant gaining ground, voice-first travel planning is emerging. Expect smart speakers to drive micro-monetization.

2. Super Apps & Cross-Selling

Apps like Grab and WeChat are merging travel, finance, and lifestyle. OTAs integrating multiple services may earn across categories.

3. Crypto & Alternative Payments

Accepting crypto isn’t just trendy — it taps into high-spending tech-savvy globetrotters.

Browse our complete range of travel booking platform solutions designed to launch your own OTA with ease and scalability.

Conclusion

Online Travel Agencies (OTAs) have evolved far beyond simple hotel booking platforms into sophisticated, multi-channel revenue engines that harness the power of technology, data, strategic partnerships, and user behavior to maximize profit. Their earnings are fueled not just by commissions from bookings, but through a web of monetization tactics like subscription memberships, PPC advertising, dynamic packaging, affiliate networks, and API licensing. Layered on top are smart upsells like travel insurance and priority services, as well as advanced technologies such as personalization engines and retargeting funnels that optimize every customer interaction. With the travel landscape constantly evolving, OTAs are also tapping into emerging trends—from voice-enabled bookings and super apps to crypto payments—ensuring they stay ahead of the curve and continue to scale effectively. In essence, an OTA is not just a service provider but a strategically engineered digital business model, turning every pixel and click into potential revenue.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q1: How much commission do OTAs usually charge?

It varies, but hotel commissions range from 10% to 25%, depending on location, season, and negotiation.

Q2: Can a small travel startup use these models too?

Absolutely. With white-label OTA platforms and API access, even solopreneurs can earn from bookings and add-ons.

Q3: Are ads inside travel apps really effective?

Yes, especially when targeted. Travel-related ads see higher engagement than general banners due to intent.

Q4: What if airlines don’t pay commissions?

OTAs bundle flights with hotels or sell seat upgrades and insurance to recover margins.

Q5: Is crypto acceptance just a gimmick?

Not anymore. Crypto travelers are growing, and OTAs tapping into this audience gain an edge.

Q6: How does Miracuves support OTA startups?

We build clone apps with integrated monetization models, ready to deploy and scale. Less dev time, more revenue time.

Realted Articles: