Let’s rewind to a time when banking meant standing in queues, signing papers with pens chained to counters, and pleading with customer reps to fix a single transaction. Fast forward to today — Revolut has flipped the script. It’s no longer about visiting a branch; it’s about having one in your pocket.

As a startup founder or digital product enthusiast, you’ve likely seen Revolut pop up in discussions around neobanking, super apps, and fintech unicorns. The hype isn’t hollow — Revolut genuinely offers a bouquet of features that make traditional banking apps look like flip phones in the age of iPhones.

And here’s the kicker: These features aren’t just bells and whistles. They’re UX-designed power tools that make money movement feel like magic. So, if you’re eyeing the Revolut clone development space, or just want to get inspired for your next fintech idea, you’re in the right place. At Miracuves, we specialize in cloning brilliance — and Revolut is a blueprint worth breaking down.

Read more: What is a Revolut App and How Does It Work?

Core Banking Features That Got Revolut Noticed

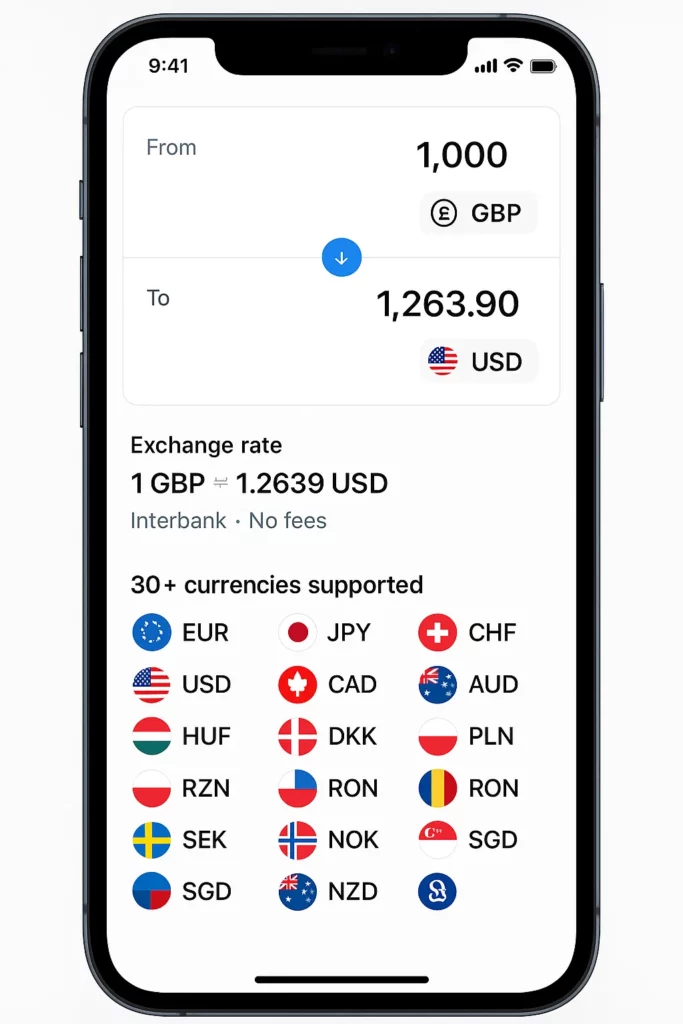

1. Multi-Currency Accounts

Revolut lets users hold, exchange, and send money in 30+ currencies. The real kicker? It uses interbank exchange rates — meaning you get the rate you’d see on Bloomberg, not the tourist trap rates banks often push.

Use case: A freelancer in Bali gets paid in USD, converts it to IDR, and spends locally — all within one app.

2. Instant Peer-to-Peer Transfers

P2P payments on Revolut are smoother than butter. No IBANs. No delays. Just phone contacts and a swipe.

Bonus: You can request money with a note or emoji. Try doing that with your traditional bank.

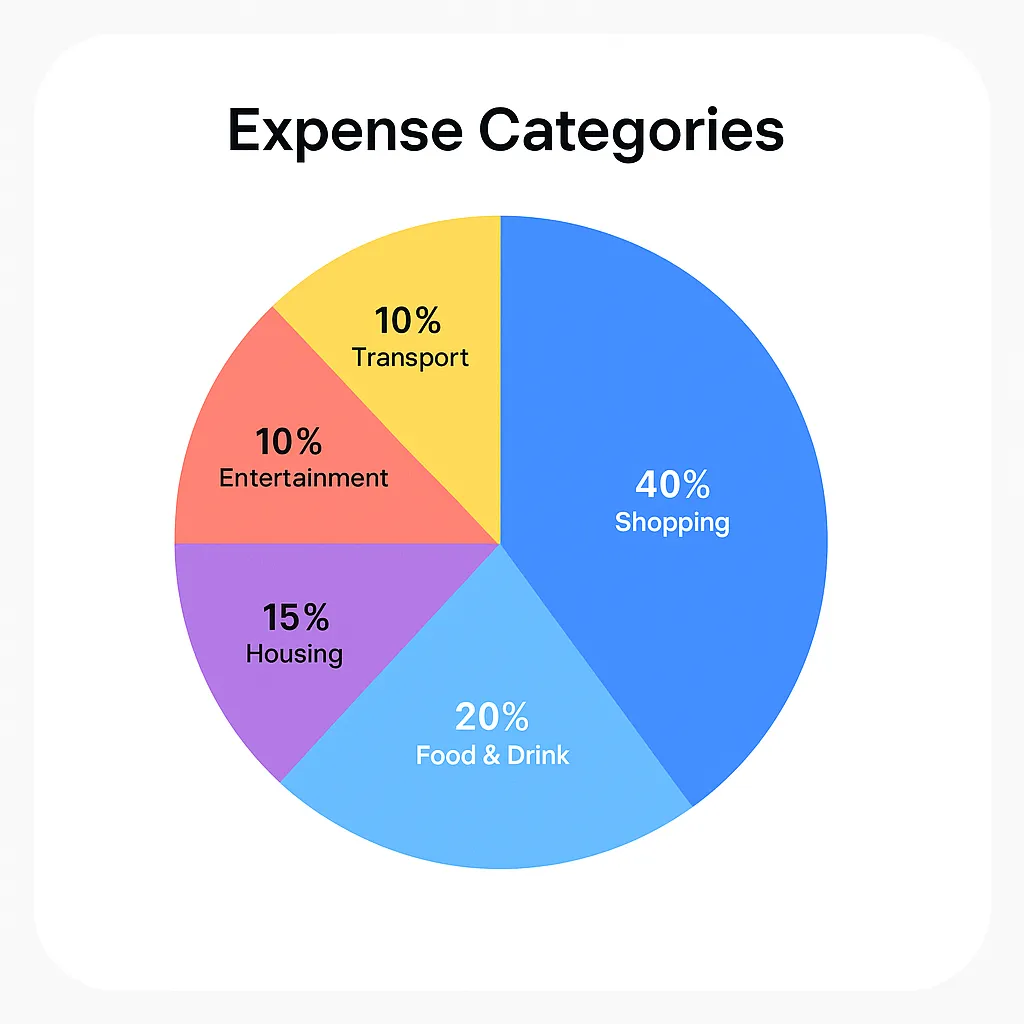

3. Budgeting & Analytics

This one’s for the spreadsheet haters. Revolut categorizes your spending in real time, sends alerts when you’re nearing limits, and even suggests where you’re overspending (yeah, coffee addicts, we see you).

Security That Doesn’t Sleep

4. Virtual Cards & Disposable Cards

Revolut offers single-use virtual cards for online purchases — a godsend for avoiding fraud and shady websites. The moment a transaction is done, the card details self-destruct like something out of Mission: Impossible.

5. Freeze/Unfreeze Cards Instantly

Lost your card? Don’t panic. Freeze it with one tap. Found it under the couch? Unfreeze. No phone calls. No anxiety.

6. Biometric & 2FA Login

Layered security ensures your data is safer than your Wi-Fi password (which, let’s admit, most of us never change).

Going Global, the Revolut Way

7. International Transfers with Low Fees

Think of Revolut as the Robinhood of remittances. It cuts out the middlemen and fees most traditional banks slap on international transfers.

Example: Sending €500 from Berlin to New York via Revolut might cost you €1. Traditional banks? Try €10–€50.

8. Global ATM Withdrawals

Up to a certain limit, users can withdraw cash from ATMs globally with no hidden charges. (Just don’t treat it like a daily piggy bank.)

Card Game Strong: Features You Didn’t Know You Needed

9. Metal Cards

Revolut’s premium users get access to sleek, heavy metal cards. It’s the kind of flex that makes baristas raise their eyebrows.

10. Round-Up Savings

Turn spare change into savings — every time you spend, Revolut rounds up the amount and drops the difference into a savings vault. It’s passive saving done right.

Features That Make It a Super App

11. Stock Trading & Crypto Integration

With a few taps, users can trade stocks, crypto, and commodities — no extra apps required. It’s Robinhood meets Binance wrapped in Revolut’s skin.

Supported assets: BTC, ETH, Gold, Silver, Apple, Tesla — the gang’s all here.

12. Travel Insurance On Tap

For the jet-setters, Revolut offers pay-per-day travel insurance based on your location. Yup, it uses GPS to detect if you’re abroad.

Connotation bonus: Peace of mind without the paperwork.

13. Lounge Pass & Perks

Premium users get access to airport lounges when flights are delayed. Add cashback offers and exclusive rewards, and suddenly, it’s not just a finance app — it’s a lifestyle assistant.

UX Features That Make Users Stick

14. Clean, Modular Interface

The design isn’t just minimalist — it’s intentional. No fluff. No friction. Just flow.

15. Personalization Galore

Users can customize their dashboards, change themes, set transaction limits, and even rename vaults like “Vacation ‘25” or “Don’t Touch This.”

16. Kids’ Accounts (Revolut <18)

Parents can set up accounts for their kids with spending controls and chore-based allowances. It’s like giving kids a financial playground with training wheels.

Read more: Top 5 Mistakes Startups Make When Building a Revolut Clone

Feature Table Comparison: Revolut vs. Traditional Banking

| Feature | Revolut | Traditional Bank |

| Multi-currency wallets | ✅ | ❌ |

| Virtual disposable cards | ✅ | ❌ |

| Real-time spend analytics | ✅ | ❌ |

| Crypto & stock trading | ✅ | ❌ |

| Peer-to-peer payments | ✅ | Limited |

| Travel perks | ✅ | ❌ |

Read more: Why Startups Choose Our Revolut Clone Over Custom Development

Why Revolut’s Features Inspire Clone App Development

Entrepreneurs aren’t just admiring Revolut — they’re cloning it (legally, of course). Whether it’s for a specific region, niche audience (like travelers or expats), or added features like BNPL (Buy Now, Pay Later), the demand for Revolut-style apps is booming.

If you’re thinking about tapping into the fintech revolution, building your own version of a digital banking super app is not just smart — it’s strategic.

Looking to build your own Revolut-style app? Check out our Fintech App Clone Solutions to get started.

Final Thoughts

Revolut isn’t just another finance app. It’s a tech-fueled, design-led, globally-minded tool that has redefined what we expect from our money apps. For startups and creators looking to ride the fintech wave, studying (or cloning) Revolut is a masterclass in modern UX and digital trust.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q:1 What makes Revolut different from traditional banks?

Revolut offers digital-first features like multi-currency wallets, instant transfers, and investing — all from your smartphone.

Q:2 Is Revolut safe for transactions and savings?

Yes. It uses top-tier security like 2FA, biometric login, and instant card freeze to protect your data and funds.

Q:3 Can I build an app like Revolut for a different region?

Absolutely. Many startups are creating localized Revolut-style apps tailored for niche audiences or regional markets.

Q:4 Does Revolut support cryptocurrencies?

Yes. Users can trade and hold crypto directly inside the app, including Bitcoin and Ethereum.

Q:5 Are all Revolut features free?

Some features are free, but premium features like metal cards and travel perks come with subscription plans.

Q:6 How can Miracuves help me build a Revolut-style app?

We offer fully customizable fintech clone solutions, built to scale and optimized for UX, security, and monetization.

Related Articles: