Twitter (rebranded as X) earned around $1.14 billion in the last reported quarter of 2024, reflecting a strong rebound in ad performance after earlier downturns. For entrepreneurs planning to build their own social media platform, understanding Twitter’s evolving monetization engine is key. The platform blends advertising, subscriptions, and data-driven models — a structure that inspires next-gen social apps. Let’s break down exactly how Twitter makes money and how you can apply the same blueprint to your own Twitter Clone with Miracuves.

Twitter Revenue Overview – The Big Picture

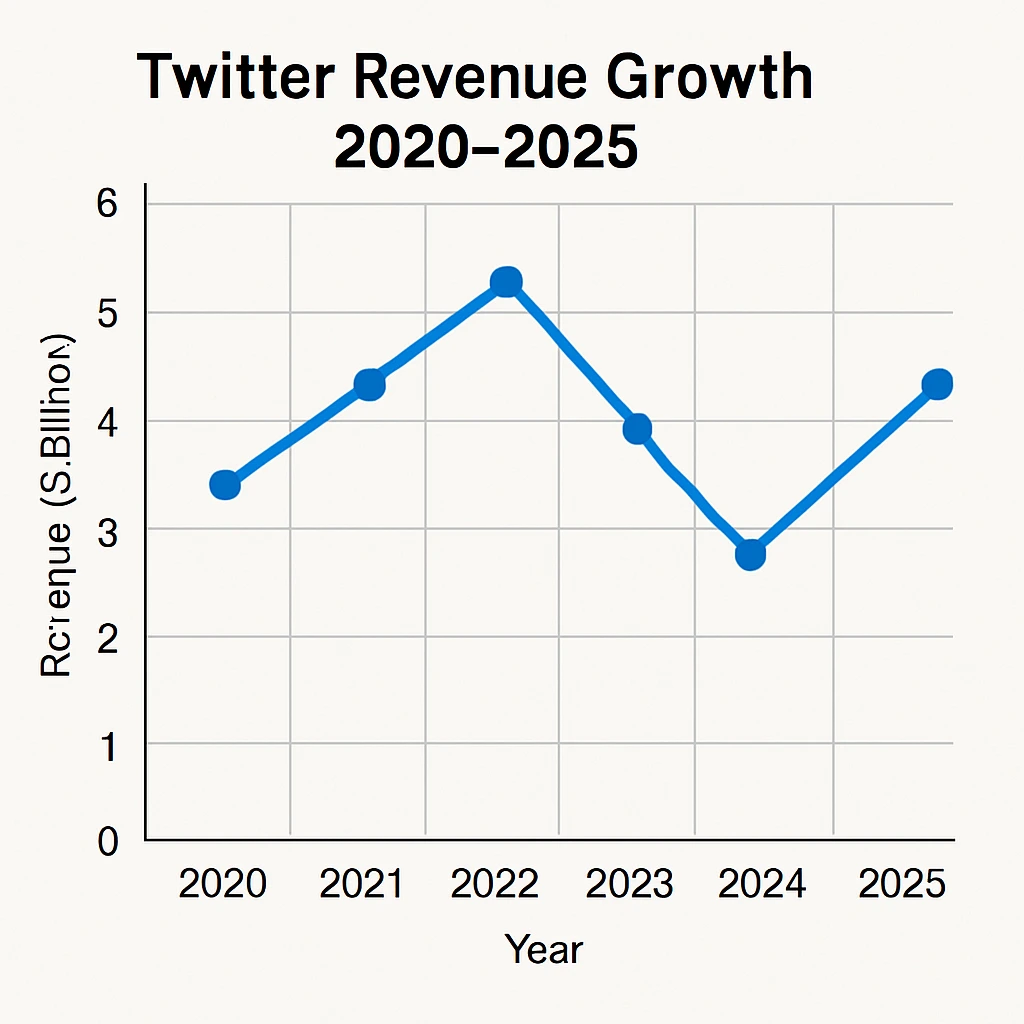

Current valuation & revenue: Twitter’s estimated 2024 revenue stood at roughly $2.5 billion, with projections showing a 16–18 % increase in 2025 as ad sales recover globally.

Year-over-year growth: Following a 13 % drop in 2023, growth in 2025 marks Twitter’s first revenue rise under its new ownership.

Regional revenue: The U.S. accounts for about 52 % of revenue (~$1.3 billion), with the rest of world generating ~$1.2 billion.

Profit margins: Net income improved to about $1.14 billion, largely due to cost restructuring and automation.

Market position: Despite competition from Threads, Mastodon, and Bluesky, Twitter still dominates real-time conversation niches.

Primary Revenue Streams Deep Dive

Revenue Stream #1: Advertising

Advertising remains Twitter’s core revenue engine. Brands pay for promoted posts, video ads, and trend sponsorships displayed across user timelines.

- Share of total revenue: ~68 %

- Pricing model: Cost-per-click (CPC) or cost-per-thousand-impressions (CPM)

- Average CPM: Around $6–$8 globally

- Growth trend: Ad revenue expected to grow 17 % YoY in 2025

Revenue Stream #2: Subscription Services (X Premium)

Users pay monthly or annual fees for perks like verification, post editing, fewer ads, and higher visibility.

- Share of total revenue: ~15 %

- Pricing: $8–$16 per month, depending on region

- Growth trend: Rising adoption among creators and professionals

Revenue Stream #3: Data Licensing & API Access

Twitter sells access to its massive data firehose for analytics, sentiment research, and AI training.

- Share of total revenue: ~10 %

- Pricing: From $100 per month (basic) to $5,000+ (enterprise)

- Growth trend: Expanding with the surge in AI applications

Revenue Stream #4: Creator Revenue Sharing

Introduced in 2023, Twitter shares ad revenue with verified creators posting high-engagement content.

- Share of total revenue: ~5 % (company outflow, not inflow)

- Impact: Drives platform engagement and content retention

Revenue Stream #5: Commerce and Payments (beta)

Pilot projects allow users to tip creators or pay via integrated wallets. Future versions may support in-app sales.

- Share of total revenue: <2 %, but potential high-growth frontier

Read More: Business Model of Twitter: Revenue, Costs & Key Insights

Revenue Streams Percentage Breakdown

| Revenue Source | Share of Total | Est. 2025 Value ($B) |

|---|---|---|

| Advertising | 68 % | 1.7 |

| Subscription (Premium) | 15 % | 0.38 |

| Data Licensing & API | 10 % | 0.25 |

| Creator Programs | 5 % | 0.12 |

| Commerce & Payments | 2 % | 0.05 |

| Total | 100 % | 2.5 |

The Fee Structure Explained

Twitter’s dual-sided ecosystem generates revenue from both users and advertisers.

User-side fees:

- Premium/X Blue: $8–$16 monthly

- API access: from $100 per month

- Tips/transactions: 3 %–5 % processing fee

Advertiser-side fees:

- Promoted Tweets CPC: $0.50–$3.00

- CPM rates: $6–$8 average

- Trend Sponsorship: $100 K+ daily package

Regional pricing:

Rates vary by engagement volume and GDP levels; U.S. and U.K. markets see up to 30 % higher ad rates.

Complete Fee Structure by User Type

| User Type | Product / Fee Type | Avg. Rate | Frequency |

|---|---|---|---|

| General User | Premium (X Blue) | $8 – $16 | Monthly |

| Developer | API Access | $100 – $5,000 | Monthly |

| Advertiser | Promoted Tweet | $0.50 – $3 CPC | Per Campaign |

| Advertiser | Trend Sponsorship | $100 K+ | Daily |

| Creator | Transaction Fee (Tips) | 3 – 5 % | Per Transaction |

How Twitter Maximizes Revenue Per User

- Segmentation: Users classified into free, premium, creator, and advertiser tiers.

- Upselling: Encourages free users to upgrade via visibility boosts.

- Cross-selling: Combines premium subscriptions with ad credits or data API access.

- Dynamic Pricing: Machine-learning adjusts ad rates based on engagement likelihood.

- Retention monetization: Features like long-form posts, analytics, and creator payments keep users active.

- Psychological pricing: $8 monthly fee chosen as “low-friction” below two-digit threshold.

Cost Structure & Profit Margins

Major Costs:

- Cloud infrastructure (AWS / data centers) – ≈ 25 % of expenses

- Staff salaries and R&D – ≈ 30 %

- Marketing and customer acquisition – ≈ 15 %

- Operations and compliance – ≈ 10 %

- Payment processing and creator payouts – ≈ 10 %

- Miscellaneous – ≈ 10 %

Unit Economics:

- Revenue per active user (ARPU): ≈ $5 – $6 monthly

- Operating margin: ~ 20–25 %

- Profit margin trend: Improving due to staff reductions and AI automation

Future Revenue Opportunities & Innovations

- AI and ML Monetization: Using AI for ad placement, content recommendation, and data API packages.

- Video & Streaming: Ad-supported live content and creator payout models.

- Payments and Crypto: Peer-to-peer transactions and micro-commerce integration.

- Super App Expansion: Combining messaging, banking, and shopping within one platform.

- New Ad Formats: Interactive polls, in-feed video, sponsored Spaces.

- Global Growth: Focus on India, Indonesia, and Brazil for next 100 M users.

- Threats: Regulatory risk, user fatigue, and ad trust issues remain key challenges.

Read More: Top Twitter Features You Should Know

Lessons for Entrepreneurs & Your Opportunity

Twitter’s revenue model proves that multiple monetization streams drive resilience.

Key takeaways:

- Diversify beyond ads early.

- Use subscriptions to stabilize cash flow.

- Sell data responsibly to create B2B revenue.

- Reward creators to retain content supply.

Your Opportunity with Miracuves:

Want to build a platform with Twitter’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization features. Our Twitter Clone scripts come with flexible revenue modules you can customize. In fact, some clients see revenue within 30 days of launch. Get a free consultation to map out your revenue strategy today.

Final Thought

In 2025, Twitter Clone Script monetization blueprint continues to evolve toward a multi-stream model balancing ads, subscriptions, and data. For startups and founders, the lesson is clear: create monetization layers early and design your platform for long-term value. With Miracuves’ ready-made Twitter Clone, you can skip the development hurdles and focus on revenue from day one.

When you use the Miracuves ready-made Twitter Clone, you start on the fast lane. No scaffolding. No months of trial and error. You jump straight into the business side: ads, premium tiers, creator payouts, brand dashboards, and AI-driven insights. The blueprint becomes actionable from day one, letting you scale faster, test smarter, and unlock long-term value without dragging through the usual development maze.

If your goal is to build a social platform that earns, grows, and adapts, this is the moment. With Miracuves powering the engine, your revenue story starts early, and your platform’s future feels a lot more in your control.

FAQs

1. How much does Twitter make per transaction?

Roughly 3–5 % on tips or in-app payments.

2. What’s Twitter’s most profitable revenue stream?

Advertising still accounts for around two-thirds of total revenue.

3. How does Twitter’s pricing compare to competitors?

Subscription rates ($8–$16) are lower than LinkedIn Premium and close to Reddit Gold, offering strong value — and with Miracuves, you can build a similar subscription-driven platform starting at just $2899.

4. What percentage does Twitter take from providers?

Typically 3–5 % on creator tips and ad revenue shares may range from 10–15 %.

5. How has Twitter’s revenue model evolved?

Shifted from 90 % ad-dependence to a mixed model including subscriptions and data.

6. Can small platforms use similar models?

Yes — by introducing ads and tiered subscriptions early.

7. What’s the minimum scale for profitability?

Around 5–10 million active users depending on ARPU and cost control.

8. How to implement similar revenue models?

Start with ad integration and offer premium features for power users.

9. What are alternatives to Twitter’s model?

Freemium content platforms like Reddit or Substack use community and creator monetization.

10. How quickly can similar platforms monetize?

With Miracuves’ Twitter Clone, entrepreneurs can start earning in just 3–6 days with guaranteed delivery, thanks to its launch-ready and monetization-focused design.