If you’ve ever tried sending money across countries — say, wiring rent to your cousin in Canada or paying a freelancer in the Philippines — you’ve probably had one of those “Why is this so hard?” moments. Between the conversion rates, delays, and banking black holes, international money transfer can feel like 2005 with a dash of 90s bureaucracy.

For startups and digital entrepreneurs, this isn’t just a personal pain — it’s a business opportunity hiding in plain sight. With freelancers, remote teams, digital nomads, and e-commerce stores mushrooming across the globe, there’s massive demand for faster, cheaper, and smarter cross-border payments. Think less paperwork, more PayPal-meets-crypto vibes.

So, how do you tap into this lucrative fintech niche? That’s where a well-oiled business model for international money transfer comes in — and lucky for you, that’s our jam at Miracuves.

The Booming Landscape of Cross-Border Money Transfers

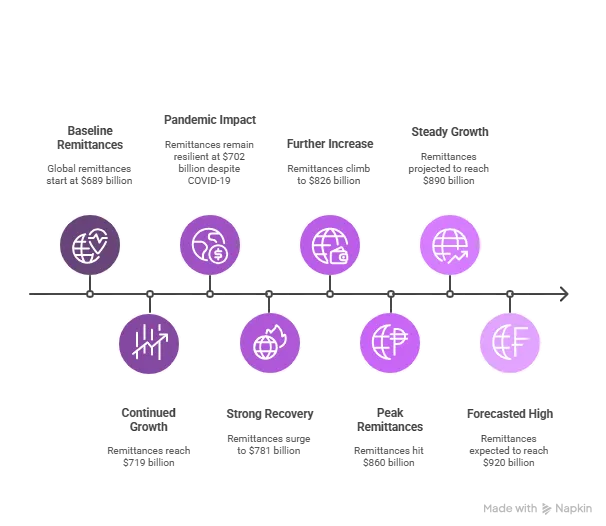

Global remittances aren’t slowing down. In fact, they’re skyrocketing. According to the World Bank, international money transfer remittances topped $860 billion in 2023 — and a solid chunk of that was through mobile and digital platforms.

From popular names like Wise (formerly TransferWise), Remitly, and Payoneer to mobile-first disruptors like WorldRemit and Revolut, fintech players are rewriting how money travels the world. And here’s the kicker: most traditional banks still charge 5–7% fees while these digital champs offer rates as low as 0.5–2%.

Core Components of a Successful International Money Transfer App

1. Multi-Currency Wallets

Users should be able to hold, convert, and send money in multiple currencies — think USD, INR, EUR, GBP, and more. Bonus if you integrate crypto like USDT or Bitcoin for borderless transactions.

2. Real-Time Exchange Rate Engine

No one wants to feel shortchanged. A real-time FX engine ensures users get the best bang for their buck. Pair this with a international money transfer

3. Compliance & KYC Layer

You’ll need airtight AML (Anti-Money Laundering) protocols and digital KYC onboarding to stay legit. APIs from tools like Jumio or Onfido make this seamless.

4. Payment Gateway Integrations

For funding transfers, tie-in with credit/debit cards, bank accounts, Apple Pay, and UPI (in India). Also, offer local cash-out methods like mobile money in Africa.

5. Transaction Tracking + Notifications

Just like Amazon lets you track your order, users should see every step — initiated, processing, in transit, completed. Add push/email updates for trust.

Read more : How to Market a International Money Transfer App successfully After Launch

Monetization Models That Actually Work

Let’s talk about how the money transfer apps make money — and how you should too.

1. Transfer Fees (Flat or Percentage-Based)

The classic model: charge a fixed fee or % based on the amount. Wise does this well with ultra-transparent sliders.

2. Exchange Rate Markup

Add a small margin on the mid-market rate. It’s subtle but scales beautifully with volume.

3. Premium Subscription Plans

Offer faster transfers, higher limits, or zero-fee options to paid users. Think of it as the Amazon Prime of fintech.

4. B2B White-Label Licensing

You can license your money transfer tech stack to banks or fintechs in emerging markets. Great recurring revenue model.

5. Cross-Selling Financial Products

Once you have a user’s trust, upsell insurance, loans, investment plans, or virtual cards.

Read more : Most Profitable International Money Transfer Apps to Launch in 2025

Tech Stack Essentials for Building a Transfer Platform

Here’s a peek under the hood of a modern money transfer app:

| Layer | Tools/Frameworks |

| Frontend | React Native, Flutter |

| Backend | Node.js, Laravel |

| Databases | PostgreSQL, MongoDB |

| Payment APIs | Stripe, Razorpay, PayPal |

| KYC/AML | Onfido, Trulioo, Jumio |

| FX Rates | OpenExchangeRates, CurrencyStack |

| Blockchain (Optional) | Solidity, USDC APIs, Chainlink |

Growth Levers: How to Attract & Retain Users

You’ve built the platform — now what?

1. Referral Bonuses & Affiliate Programs

Users love free money. Give them a slice of the transfer fees when they refer others.

2. Gamified Loyalty Programs

Reward points, badges, or cashback for frequent users — international money transfer create an experience, not just a transaction.

3. Local Language + UX

Hyperlocalize. Use Hindi in India, Tagalog in the Philippines, Swahili in Kenya — this builds instant trust.

4. Speed & Transparency

Market the “sent in seconds” feature. No one wants to wait three days for a critical payment.

You’ve built the platform — now what? Well, here’s some food for thought: digital payments worldwide are projected to hit $11 trillion by 2026, according to Statista — so yeah, the market’s not just hot, it’s on fire.

Read more : Revenue Model for International Money Transfer

Conclusion

International money transfer is no longer a luxury — it’s a necessity for a connected world. But building a scalable, compliant, and profitable platform? That takes strategy, tech, and vision.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

What licenses are required for launching a money transfer app?

You’ll need regional licenses like MSB (US), EMI (EU), or an RBI-compliant license in India. Partnering with legal experts or third-party compliance APIs can speed up the process.

Can I integrate crypto with my money transfer platform?

Yes, you can! Many platforms now support USDT, Bitcoin, or Ethereum for faster and borderless payments — just ensure local compliance.

How do I ensure low transfer fees and make money?

Offer mid-market exchange rates and keep fees transparent. Monetize through markup, subscriptions, or premium services for frequent users.

What’s the difference between peer-to-peer and bank-to-bank transfers?

P2P involves wallets and instant transfers (like Venmo or Paytm), while bank-to-bank typically takes longer and involves legacy infrastructure.

How long does it take to build an app like Wise or WorldRemit?

With a skilled team or a clone development partner like Miracuves, it can take as little as 6–10 weeks to get your MVP live.

Related Articles :