Airbnb has transformed the way people travel. By enabling homeowners to rent out their spaces — from cozy spare rooms to luxury villas — Airbnb created a global community-based marketplace that redefined the hospitality industry. Since its launch in 2008, the platform has hosted over a billion guest arrivals and operates in more than 220 countries and regions.

With millions of listings and a valuation that once surpassed $100 billion, Airbnb isn’t just a travel platform — it’s a tech-driven, two-sided marketplace that thrives on trust, user experience, and efficient monetization.

In this blog, we’ll break down how Airbnb earns money, why its business model remains powerful in 2025, and how startups can replicate its success with an Airbnb clone built by Miracuves.

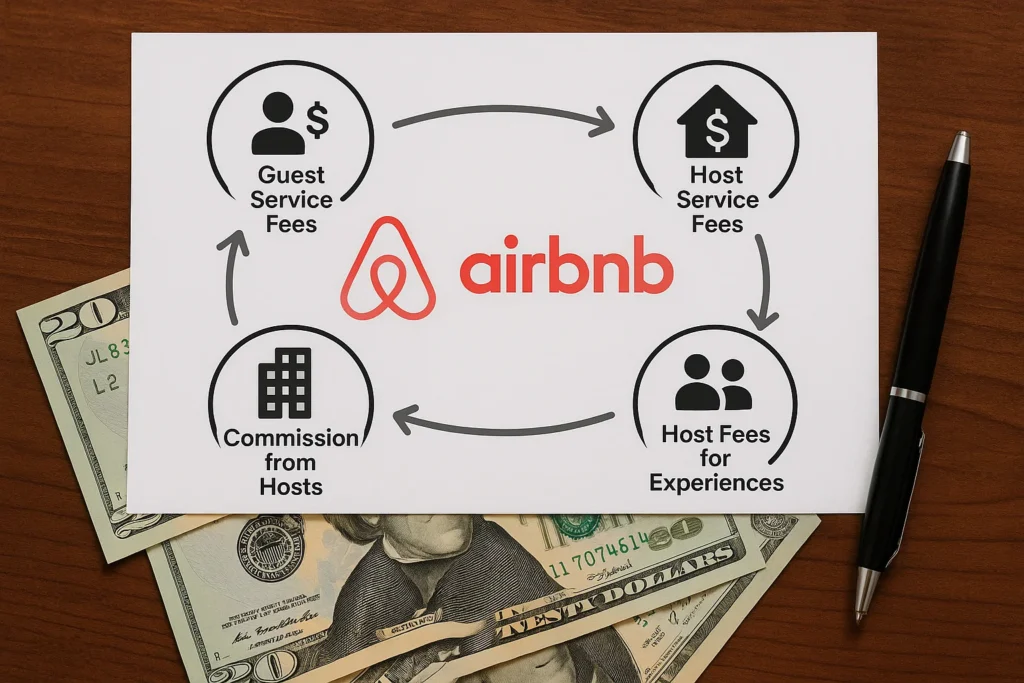

How Airbnb Makes Money

Airbnb’s revenue model is a classic example of marketplace monetization. It connects two sides — hosts and guests — and takes a cut from both. The platform also diversifies income with additional services and value-added offerings.

Here are the main ways Airbnb generates revenue:

- Guest Service Fees – Airbnb charges guests a percentage of the booking subtotal.

- Host Service Fees – A commission is deducted from each successful reservation made by hosts.

- Airbnb Luxe and Airbnb Experiences – Premium homes and curated activities generate high-margin revenue.

- Subscription Services – Airbnb has explored host-focused programs like Superhost tools and promoted listings.

- Interest and Currency Conversion Fees – Airbnb earns income through payment processing, especially in multi-currency bookings.

- Partnerships and Insurance Add-ons – Collaborations with insurance and third-party services enhance trust and generate affiliate revenue.

Airbnb’s model thrives on scale — more users and more bookings mean exponentially higher revenue without increasing platform complexity.

Read More :-What is Airbnb App and How Does It Work?

Detailed Breakdown of Revenue Channels

Guest Service Fees

Airbnb typically charges guests a service fee ranging from 5% to 15% of the booking subtotal (excluding taxes). This fee supports platform operations, 24/7 customer service, and the secure processing of payments.

- Who Pays? Guests making reservations

- Why It Scales? Fee is percentage-based, so as booking value increases, revenue rises

Host Service Fees

Most hosts pay a 3% commission on every booking. For Airbnb Plus and high-volume hosts, this may vary. Airbnb also offers an alternative host-only fee model (usually 14–16%) for properties listed via third-party software, especially in professional hosting scenarios.

- Who Pays? Hosts upon receiving a booking

- Why It Scales? Enables monetization on every supply-side interaction

Airbnb Luxe and Airbnb Experiences

Airbnb Luxe lists luxury properties with concierge support, while Experiences offer local tours, workshops, and cultural activities. These services often command higher fees and better margins.

- Who Pays? Guests booking premium stays or activities

- Why It Scales? Appeals to affluent travelers and supports upselling

Also Read :- Top Airbnb Features Every Vacation Rental App Needs

Subscription and Marketing Services

Airbnb has tested host subscriptions (for premium tools, visibility boosts, and analytics) and advertising features such as promoted listings to help hosts gain more visibility. These features provide recurring income.

- Who Pays? Hosts and property managers

- Why It Scales? Low-cost SaaS-style model on top of existing ecosystem

Payment Processing and Currency Conversion

Airbnb facilitates cross-border transactions in 60+ currencies. It earns money through exchange rate spreads, international transfer fees, and float interest on funds held temporarily before disbursing to hosts.

- Who Pays? Guests and hosts indirectly

- Why It Scales? Passive income stream tied to global operations

Insurance & Partnered Services

To build trust, Airbnb offers damage protection and liability insurance under AirCover for hosts. It also partners with third-party services (like cleaning providers or smart lock companies) — creating opportunities for affiliate commissions or bundled upsells.

- Who Pays? Hosts and guests opting into extras

- Why It Scales? Trust-enhancing and monetizable

Also Read :- Airbnb App Marketing Strategy: How to Make Your Rental App Unforgettable

Why This Revenue Model Works in 2025

Airbnb’s revenue model has not only stood the test of time — it has adapted and evolved with shifting travel behaviors, technology upgrades, and platform expectations. Here’s why it still thrives in 2025:

Rise of the Experience Economy

In 2025, travelers crave unique, local, and personalized experiences over generic hotels. Airbnb capitalizes on this trend with Experiences, Airbnb Luxe, and remote work-friendly stays. These offerings command higher prices and deliver greater margins.

Digital Nomadism and Work-from-Anywhere Culture

The post-pandemic shift to remote work led to longer stays, mid-term rentals, and increased cross-border bookings. Airbnb’s flexible model — with variable pricing, host controls, and multi-currency support — fits this lifestyle perfectly.

Trust and Safety as a Monetization Layer

With AirCover and host liability insurance bundled into listings, Airbnb reduces friction in the booking process. Enhanced safety builds confidence, which in turn increases conversion rates and boosts revenue.

Algorithmic Pricing and Smart Matching

AI-driven recommendations, pricing tools for hosts, and personalized suggestions help optimize occupancy rates and average daily rates (ADR). The smarter the tech, the more revenue the platform generates without increasing operating cost.

Asset-Light, Platform-Heavy

Unlike hotel chains, Airbnb doesn’t own real estate. This keeps overhead low while letting them monetize both sides of the marketplace (guests + hosts) — a perfect growth strategy in an era of cost-conscious scaling.

Learn More :-Best Airbnb Clone Scripts in 2025: Features & Pricing Compared

Can Startups Replicate Airbnb’s Revenue Model?

Yes — but only if they’re smart about how they build.

Airbnb’s success is powered by years of platform optimization, trust-building features, global payment systems, and community-led design. Trying to replicate this from scratch would require a massive investment in product development, compliance, AI, security, and infrastructure.

But with Miracuves, the story changes.

Our ready-made Airbnb Clone solution empowers startups, digital agencies, and entrepreneurs to launch their own property rental marketplace — complete with revenue-driving features — in a fraction of the time and cost.

Here’s what you get with Miracuves:

- Commission-based monetization on both host and guest sides

- Flexible convenience fees, subscription options, and promoted listing tools

- Real-time booking calendar, host dashboards, and review systems

- Integrated payment gateways and multi-currency support

- Admin panel for dynamic control over listings, fees, and trust policies

- Add-ons like AirCover, referral programs, and third-party API integrations

Whether you’re targeting a niche like pet-friendly stays, digital nomads, or regional tourism — our Airbnb Clone gives you the structure and scalability to grow fast, monetize effectively, and stand out in the rental ecosystem.

The Airbnb Clone by Miracuves is priced at $2,899, built for seamless property booking, management, and host-guest engagement.

Experience advanced features like real-time availability, secure payments, and verified listings.

Go live in just 3–9 days with complete source codes and full customization.

Read More :- Reasons startups choose our Airbnb clone over custom development

Conclusion

Airbnb’s revenue model is a benchmark for platform-based monetization — combining commissions, service fees, value-added experiences, and tech-enabled tools into a seamless ecosystem. In 2025, it remains one of the most profitable and scalable models in the travel and rental industry, thanks to its trust-driven design and two-sided marketplace dynamics.

For startups, replicating Airbnb’s revenue engine is no longer a dream. With Miracuves’ customizable Airbnb Clone, you can launch a feature-rich property rental platform with built-in monetization strategies — and get to market faster, smarter, and stronger.

FAQs

How does Airbnb generate revenue?

Airbnb earns money by charging service fees to both guests and hosts, offering premium stays through Airbnb Luxe, and monetizing experiences, subscriptions, and payment processing.

Is Airbnb profitable in 2025?

While profitability depends on operational scaling and market conditions, Airbnb continues to report strong revenues driven by increased bookings, mid-term stays, and premium offerings in 2025.

What are the main income sources for Airbnb?

Airbnb’s key income streams include guest and host service fees, Airbnb Luxe, Experiences, promoted listings, subscription tools for hosts, and payment conversion margins.

Can startups use the same revenue model as Airbnb?

Yes, startups can replicate Airbnb’s model using a well-built clone platform that includes commission logic, booking engines, trust systems, and monetization tools — like the one offered by Miracuves.

Does Miracuves offer an Airbnb clone with monetization features?

Absolutely. The Airbnb Clone by Miracuves comes with built-in commission setups, service fee engines, admin controls, loyalty features, and host monetization tools — ready to launch and scale.