Let’s face it: launching a money transfer app like Wise clone (formerly TransferWise) is like entering a fintech jungle—exciting, but full of hidden traps. You’ve probably seen the rise of digital banks, watched peer-to-peer transfer apps explode, and thought, “Hey, we could build something even better.” Spoiler alert: you absolutely can. But there are dragons to slay.

Maybe you’re a startup founder riding high on a recent funding round. Or maybe you’re bootstrapping this dream while juggling 18-hour days and instant ramen dinners. Either way, building a Wise clone isn’t just about copying UI screens or transaction workflows. It’s a test of precision, regulation, and customer trust. Miss the mark and your app might just become a money pit instead of a money mover.

At Miracuves, we’ve helped countless visionaries avoid the traps and bring bank-disrupting apps to life. So, let’s walk through the five most common (and costly) mistakes startups make when building a Wise clone.

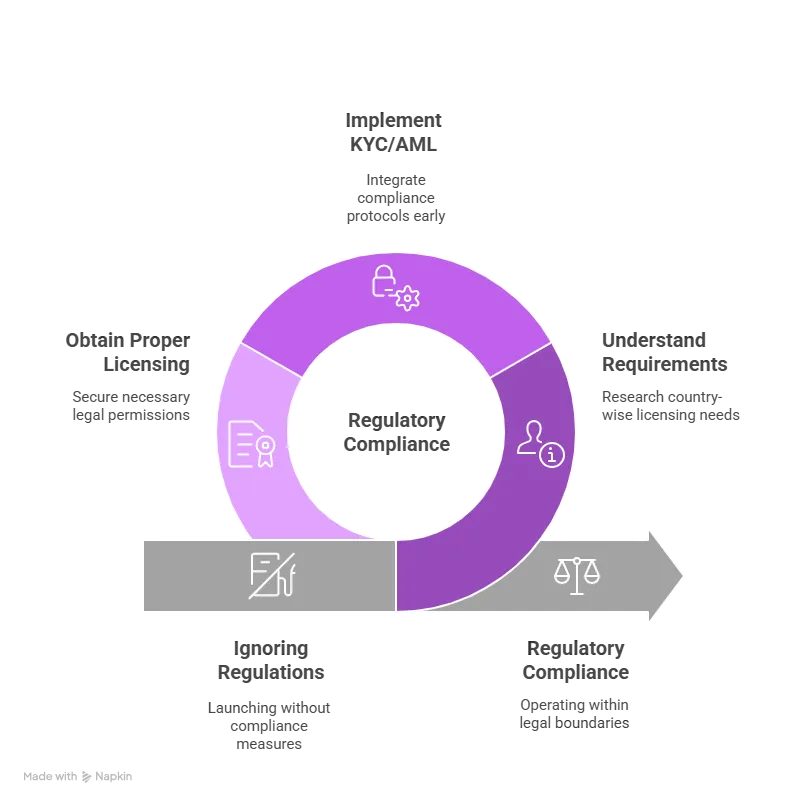

1. Ignoring Regulatory Compliance

Wise clone didn’t become a trusted global brand by winging it. Compliance is their bedrock. Yet so many startups jump into development with zero regard for KYC (Know Your Customer), AML (Anti-Money Laundering), and PSD2 directives. Why? Because regulations aren’t sexy.

But here’s the kicker: if your app lets users send money across borders, you’re playing in a legal minefield. One wrong move and you’re not just losing customers—you’re getting fined, blacklisted, or shut down entirely.

Real-World Example: A European fintech startup launched without proper licensing in the U.S. They got hit with a cease-and-desist within weeks, and the app died before version 2.0.

Read more : Wise Clone App Development: Step-by-Step Guide for Developers & Founders

2. Underestimating FX Engine Complexity

Wise clone crown jewel? Their real-time FX (foreign exchange) engine. It doesn’t just convert currency—it finds the best mid-market rate, adds a transparent fee, and executes the trade with lightning speed. Mimicking that isn’t a cakewalk.

Many startups use basic currency converters or rely entirely on third-party APIs like OpenExchange or XE. Sure, it’s fine at MVP stage. But as you scale, those systems buckle under real-time loads, leading to delays and loss of trust.

Read more : Pre-launch vs Post-launch Marketing for Wise Clone Startups

3. Cloning UI Instead of Solving UX Problems

Design envy is real. Wise clone has clean screens, calm tones, and delightful animations. But copying it pixel-for-pixel without understanding why those elements work is a classic rookie move.

UX isn’t just visual. It’s about how users feel when navigating, how error messages behave, how onboarding adapts to different users. Wise spends millions on usability testing. If you’re blindly replicating their front end without that context, you might be building confusion with a nice coat of paint.

Startup Tip: Test your onboarding on 5 real users. Record the friction points. Redesign based on that. Rinse and repeat.

According to Statista, global online travel revenue is soaring — so it’s important to set your revenue goals with real-world data in mind.

4. Neglecting Security and Fraud Prevention

This one’s a biggie. You’re handling people’s money. Not tweets. Not stories. Not cat memes. Actual. Hard-earned. Cash.

Wise clone uses two-factor authentication, device fingerprinting, anomaly detection, and machine learning to stop fraud. Startups often go live with the bare minimum: HTTPS and a login screen.

What happens next? Phishing attacks, account takeovers, and a flood of angry reviews. Word spreads fast. Especially when wallets go empty.

Must-Haves:

- 2FA (Two-Factor Authentication)

- End-to-end encryption

- Suspicious activity alerts

- PCI-DSS compliance

5. Forgetting the Power of Transparent Pricing

Wise clone won over millions by being brutally honest about fees. They show users exactly what they pay—no hidden charges, no “oops” moments at checkout.

Startups often try to outsmart the model by adding markup in the backend or hiding service charges. This might work short-term, but savvy users sniff out the gimmicks. You’ll lose their trust, and worse, your app might land on Reddit’s fintech hall of shame.

Alternative Approach: Use upfront pricing with a profit margin clearly explained. Transparency = trust = repeat business.

Conclusion

Building a Wise clone isn’t about slapping together screens or copying code. It’s about earning trust, ensuring safety, and solving real cross-border challenges. And let’s be honest, it’s not something you want to DIY in the dark. At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

How much does it cost to build a Wise clone?

It depends on features, tech stack, and compliance needs. But expect $50K to $150K for a full-fledged MVP.

Do I need a license to launch a money transfer app?

Absolutely. Licensing varies by country, but skipping it can land you in serious legal trouble.

Can I use third-party APIs for currency exchange?

Yes, at the MVP stage. But plan to build your own FX engine if you want long-term control and savings.

How long does development take?

Anywhere from 3 to 9 months depending on complexity and compliance integrations.

Is it safe to use open-source code?

Only if you audit it thoroughly and layer it with strong encryption and authentication systems.

What are alternatives to Wise I should study?

Check out Remitly, Revolut, WorldRemit, and PaySend for varied UX and feature sets.

Related Article :