If you’ve ever moved abroad, freelanced across borders, or run a business that thinks globally but banks locally — you’ve probably tangled with the monster that is international money transfers. High fees, hidden markups, snail-speed delivery… yep, we’ve all been there. Enter Wise (formerly TransferWise) — a fintech unicorn that’s made sending, spending, and receiving money across countries feel like sending an email. Fast. Transparent. Slick.

It’s not just travelers or expats who swear by it. The Wise app has quietly become a go-to wallet for digital nomads, global freelancers, remote-first businesses, and even SaaS startups looking for borderless payments. What’s the secret sauce? It’s in the features — no fluff, all function.

And here’s the kicker: if you’re a startup founder or techpreneur dreaming of launching your own Wise-like app, this deep dive into Wise’s top features is more than just curiosity — it’s your product blueprint. Stick around, because we’ll also show how Miracuves helps you clone greatness without reinventing the wheel.

Read more: What is a Wise App and How Does It Work?

Borderless Banking: Wise App’s Core Features

1. Multi-Currency Accounts

Wise users can hold, convert, and manage 40+ currencies — all under one roof. Whether you’re juggling dollars, euros, or Japanese yen, Wise keeps your financial life tidy.

- Real-life scenario: A German freelancer billing a Canadian client can get paid in CAD and instantly convert it to EUR — at mid-market rates.

2. Local Bank Details in 10+ Countries

Users can receive money like a local — without needing a local bank account.

- Wise gives you local account numbers (like a UK sort code or US routing number).

- This is gold for freelancers, agencies, and SaaS founders who bill globally.

Think of it as having bank accounts in different countries… without the paperwork, rent, or awkward tax codes.

Money Transfers That Don’t Suck

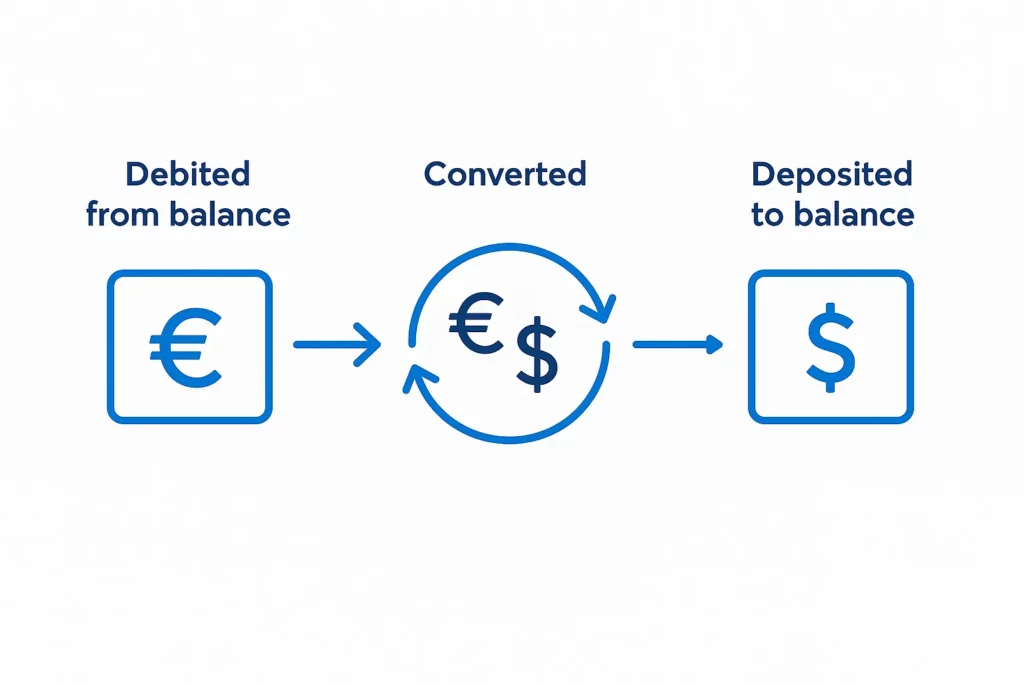

3. Low-Fee, Mid-Market Rate Transfers

Wise built its name on transparent international transfers. They don’t mark up the exchange rate and they always show you the fee upfront.

- Comparison: PayPal and most traditional banks can quietly take a 3–6% cut. Wise? Often under 1%.

- Tech Insight: Their backend uses a peer-to-peer model, matching transfers between countries to keep fees low.

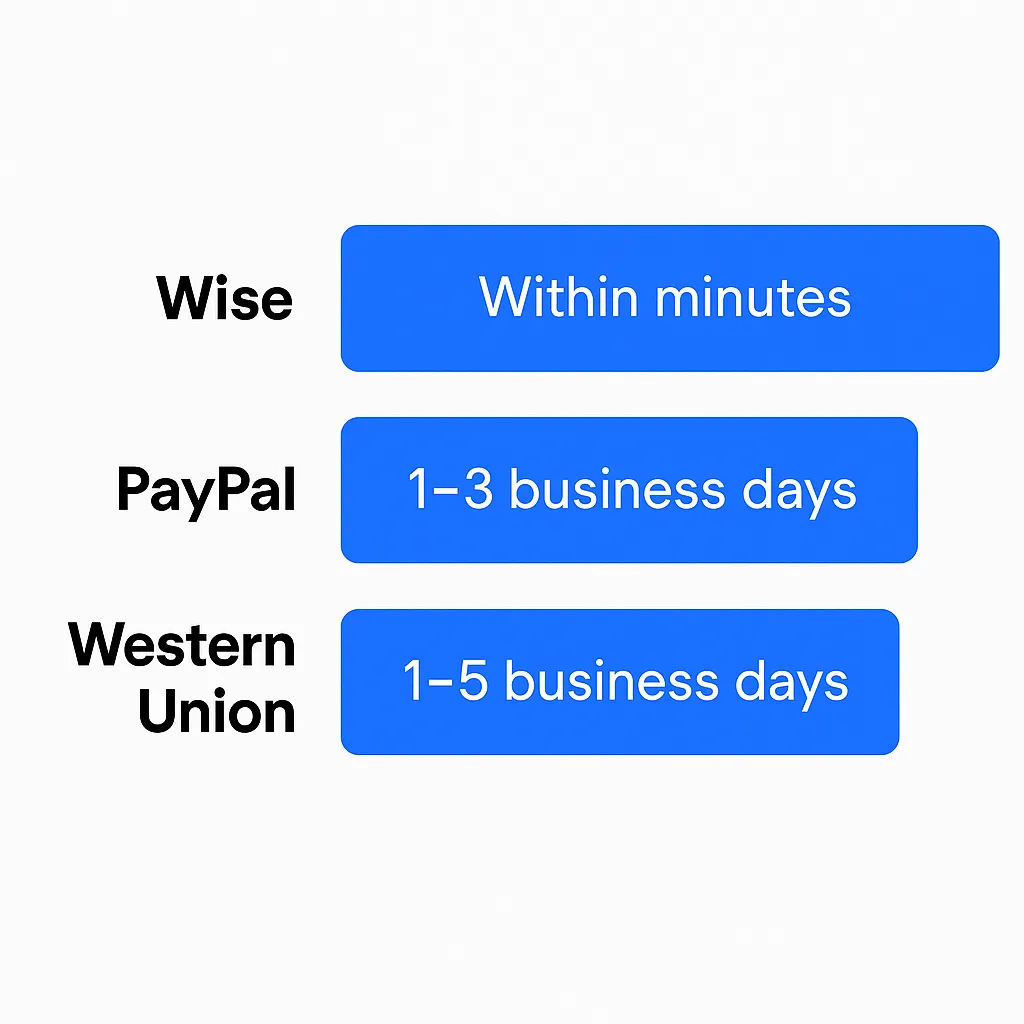

4. Fast Delivery

Over 50% of transfers arrive within minutes. Gone are the days of “3–5 business days.”

- Speed depends on currency route, payment method, and country.

- UX Bonus: The app provides estimated delivery times and real-time tracking.

Spend Smart with the Wise Card

5. Debit Card for Global Spending

Wise issues physical and virtual debit cards for both personal and business accounts.

- Works in 175+ countries

- Auto-converts to local currency at best rates

- Zero foreign transaction fees

6. Freeze/Unfreeze in One Tap

Lost your card at the beach in Bali? Just freeze it instantly from the app. No need to call a 1-800 number and press 5 for disappointment.

For Business & Freelancers: Wise Business Features

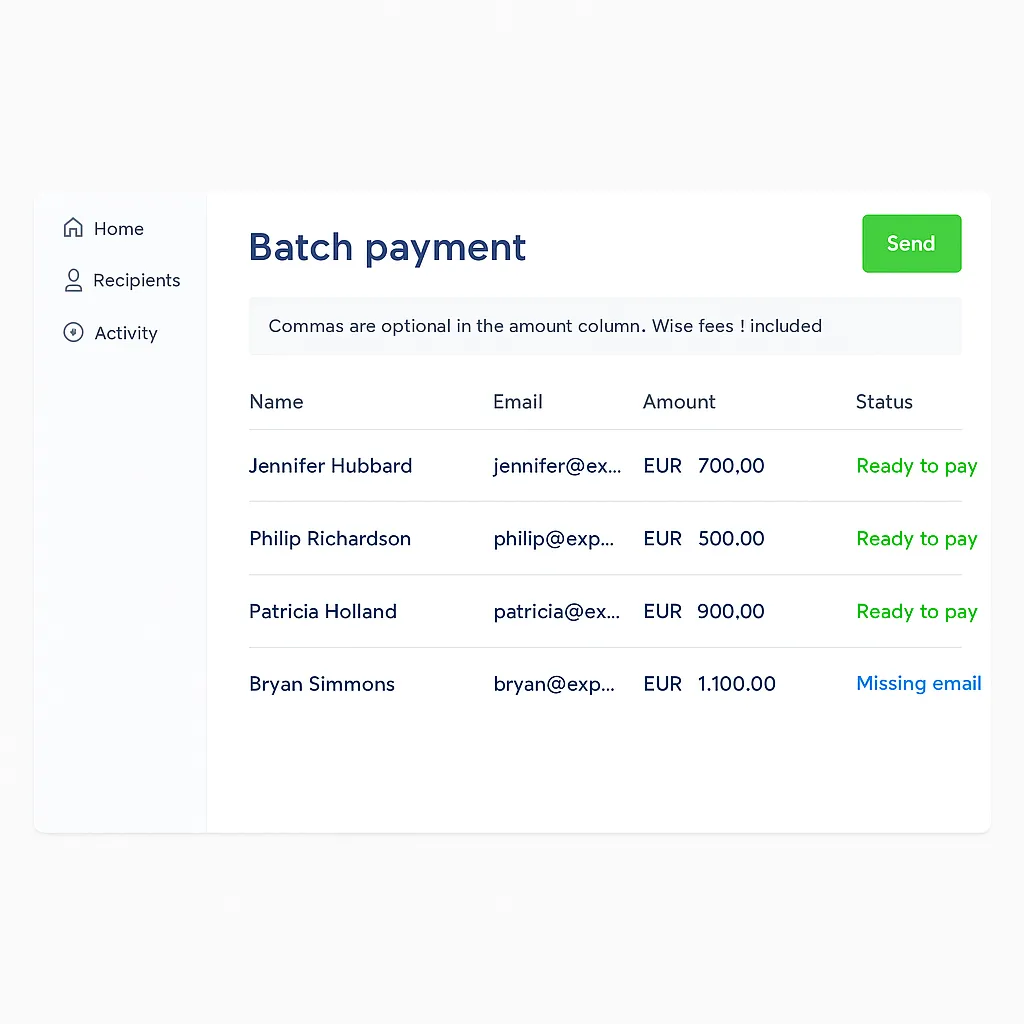

7. Batch Payments

Send up to 1,000 payments in one go via CSV — a lifesaver for agencies or SaaS businesses managing affiliate payouts, salaries, or vendor payments.

8. Xero & QuickBooks Integration

Sync Wise with accounting tools to auto-track expenses and reconcile like a pro.

- Time saved = money earned

- Great for SMEs, finance teams, and solopreneurs

9. Multi-User Access

Add team members with role-based permissions. Handy for co-founders, accountants, and operations heads.

Security & Trust: Not Just Another App

10. 2FA & Device Verification

Wise offers two-factor authentication, biometric login, and real-time login alerts.

- More secure than your average banking app

- Regular audits and compliance with global financial standards

11. Regulated Globally

Wise is authorized in the UK, EU, US, Australia, and beyond. It’s not just a flashy fintech — it’s a regulated money institution.

Under-the-Hood UX Brilliance

12. Real-Time Currency Alerts

Set alerts for when your desired currency hits your target exchange rate.

- Example: Planning to send INR to EUR? Get a ping when rates favor you.

13. Intuitive Onboarding

Wise’s onboarding feels more like signing up for Netflix than a financial service.

- Fast KYC checks, smooth UI

- Frictionless experience from download to first transaction

Read more: Pre-launch vs Post-launch Marketing for Wise Clone Startups

Why Entrepreneurs Are Eyeing Wise-Like Apps

Let’s be honest — Wise didn’t just create a money app; they pioneered a new UX category in fintech. It sits somewhere between a global bank, a digital wallet, and a B2B SaaS product. For startups looking to enter this space, Wise is both a benchmark and a source of inspiration.

And this is where Miracuves steps in. Whether you’re dreaming up a Wise clone, a fintech super app, or a crypto-integrated wallet, our team helps you build a scalable, secure, and ready-to-monetize solution that customers love from day one.

Conclusion

Wise made money movement feel local — no matter where you are. Its feature-rich, user-first approach didn’t just disrupt fintech; it rewrote the playbook.

Want to build your own money transfer app that’s fast, global, and user-loved?

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q:1 What currencies can I hold in Wise?

You can hold and manage 40+ currencies including USD, EUR, GBP, AUD, and more — all under one account.

Q:2 Is Wise good for business payments?

Absolutely. Wise for Business supports bulk payments, accounting integrations, and multi-user access — perfect for startups and SMBs.

Q:3 Does Wise offer a debit card for international travel?

Yes! Wise offers physical and virtual debit cards that work globally with zero foreign transaction fees.

Q:4 How fast are Wise transfers?

Over 50% of transfers arrive within minutes, and most are completed within a few hours depending on the route.

Q:5 Is it safe to use Wise for large amounts?

Yes. Wise is fully regulated in multiple jurisdictions and uses robust security protocols including 2FA and device verification.

Q:6 Can I build an app like Wise?

Totally. If you’re looking to build your own Wise-style app, Miracuves can help you get there faster with custom clone solutions.

Related Articles: