LinkedIn has redefined professional networking since its launch in 2003. What started as a platform for uploading résumés and connecting with peers has evolved into a powerhouse of recruitment, B2B marketing, content publishing, and career development. With over 1 billion users in 200+ countries, LinkedIn is no longer just a social network — it’s a career ecosystem.

In 2025, LinkedIn is a revenue-generating machine under Microsoft’s ownership, with annual revenues exceeding $15 billion. But how exactly does LinkedIn make money from its free users, premium members, recruiters, and advertisers?

In this blog, we’ll break down the revenue model of LinkedIn, explain why it works in the current digital economy, and explore how startups can replicate a similar model using a LinkedIn clone solution by Miracuves.

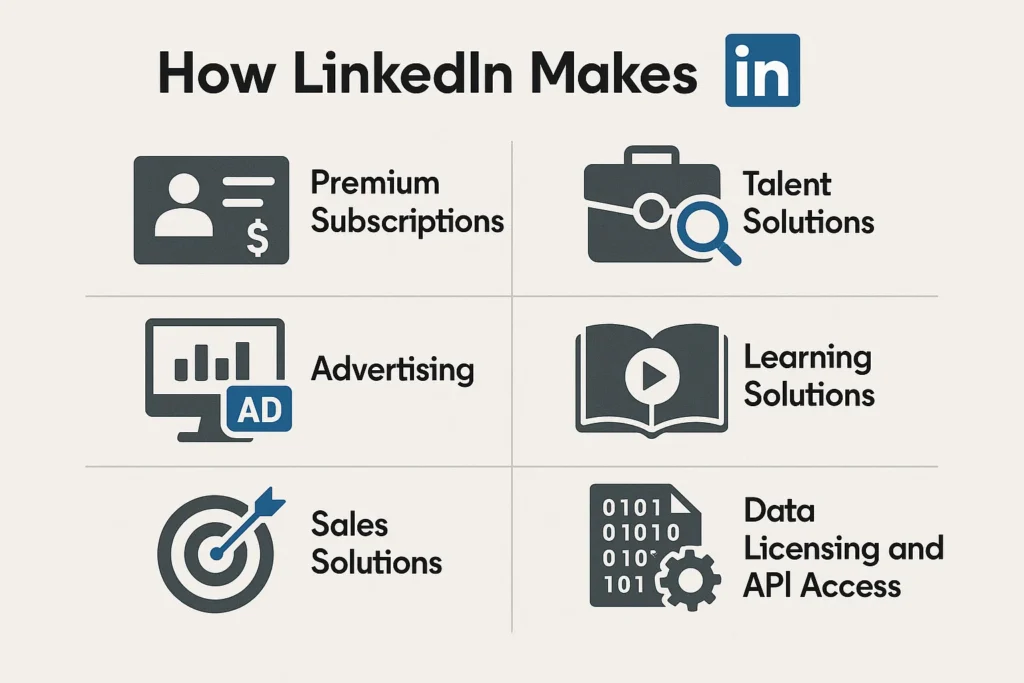

How LinkedIn Makes Money

LinkedIn’s monetization model is built on multiple high-margin, scalable revenue streams across B2B and B2C channels. Here’s how LinkedIn earns money in 2025:

- Premium Subscriptions – Paid tiers like Premium Career, Business, Sales Navigator, and Recruiter offer enhanced features.

- Talent Solutions (Recruiter Tools) – Companies pay to search, reach out, and manage candidates using LinkedIn’s hiring suite.

- Advertising (LinkedIn Marketing Solutions) – Brands run sponsored content, InMail, and display ads targeted at professionals.

- Learning Solutions (LinkedIn Learning) – Users and enterprises pay for access to professional development courses.

- Sales Solutions (Sales Navigator) – B2B sales professionals use this tool for lead generation, outreach, and CRM integration.

- Data Licensing and API Access – Some enterprise clients and tools pay for access to aggregated LinkedIn data or APIs.

Together, these revenue engines power LinkedIn’s continued growth as a business-first platform — all while remaining free for casual users.

LinkedIn turned networking into a billion-dollar ecosystem—explore the LinkedIn business model to see how features and revenue connect.

Detailed Breakdown of Revenue Channels

Premium Subscriptions

LinkedIn offers multiple paid tiers for individuals and businesses. These include:

- Premium Career – Helps job seekers stand out, message recruiters, and see profile views.

- Premium Business – Offers expanded search, business insights, and more InMail messages.

- Sales Navigator – Targeted at sales teams for lead generation and relationship management.

- LinkedIn Recruiter – For HR teams and agencies to access and contact passive talent.

Who Pays? Job seekers, professionals, recruiters, and sales teams.

Why It Scales? Subscription model with minimal delivery cost and strong retention.

Talent Solutions (Recruiter Tools)

This is LinkedIn’s biggest revenue driver. Companies subscribe to Recruiter seats, job posting credits, and employer branding packages. AI-based recommendations and integrations with applicant tracking systems increase hiring efficiency.

Who Pays? Enterprises, staffing firms, and HR teams.

Why It Scales? Recurring B2B revenue with high switching costs.

Advertising (LinkedIn Marketing Solutions)

LinkedIn runs native ad formats like Sponsored Content, Message Ads (InMail), and Dynamic Ads. Advertisers can target based on job title, industry, seniority, and even company size — making it highly effective for B2B campaigns.

Who Pays? B2B marketers, SaaS companies, universities, recruiters.

Why It Scales? Niche targeting with premium ad CPMs and ROI.

From professional profiles to content publishing, LinkedIn empowers growth—explore the LinkedIn features every entrepreneur and creator should use.

Learning Solutions (LinkedIn Learning)

Formerly Lynda.com, LinkedIn Learning provides video courses on soft skills, leadership, programming, design, and more. Available to individuals or bundled into enterprise training plans.

Who Pays? Individuals, universities, and enterprise L&D departments.

Why It Scales? Evergreen content and enterprise bulk licensing.

Sales Solutions (Sales Navigator)

This B2B product helps sales professionals find decision-makers, track lead activity, and integrate with tools like Salesforce and HubSpot. It’s a key upsell for any business using LinkedIn for outreach.

Who Pays? B2B sales teams and account executives.

Why It Scales? High-value tool with strong ROI and team adoption.

Data Licensing and API Access

LinkedIn monetizes some of its vast professional dataset via APIs and data partnerships. Aggregated insights help enterprises with analytics, HR planning, and competitive intelligence.

Who Pays? Analytics firms, HR tech platforms, enterprise tools.

Why It Scales? High-margin data licensing without additional user engagement.

LinkedIn turned networking into a growth engine for professionals worldwide—explore the LinkedIn app marketing strategy that made it possible.

Why This Revenue Model Works in 2025

LinkedIn’s multi-stream revenue model continues to perform exceptionally well in 2025 because it taps into several unstoppable trends shaping the global professional landscape.

Workforce Digitization and Remote Hiring

The shift to remote and hybrid work has made digital hiring platforms like LinkedIn essential for recruiters and job seekers alike. Companies now rely more on online tools to find talent — boosting demand for LinkedIn’s Recruiter products and job postings.

B2B Ad Growth with Hyper-Targeting

While traditional social media ad revenues slow down, B2B advertising is booming. LinkedIn’s ability to target decision-makers, professionals, and industry-specific audiences makes it the go-to platform for high-ROI campaigns.

Subscription Economy Acceptance

Users are now more comfortable paying for subscriptions if the perceived value is strong. LinkedIn’s premium plans cater to specific goals (e.g., career growth, sales, recruiting), making conversion easier and churn lower.

Upskilling and Learning Culture

The global push for upskilling has given platforms like LinkedIn Learning a major boost. Enterprises invest in team development, and individuals continuously seek to level up — fueling recurring learning revenues.

First-Party Data Advantage

LinkedIn owns its data — users voluntarily provide accurate information about their careers. This first-party data gives it an edge in targeting, recommendations, and enterprise solutions, unlike many competitors.

Can Startups Replicate LinkedIn’s Revenue Model?

Yes — but it requires more than just building a profile-based social network.

To replicate LinkedIn’s success, startups need a robust platform that serves multiple user personas: job seekers, recruiters, advertisers, learners, and business professionals. It also requires modular monetization features like subscriptions, ads, course delivery, and messaging — all wrapped in a scalable and secure ecosystem.

The LinkedIn Clone by Miracuves is a fully customizable white-label professional networking platform priced at $2,899.00 (originally $3,699.00).

It empowers users to connect, share, and grow professionally with modern features and seamless functionality.

Go live in just 3-9 days with complete source codes and full customization support.

That’s where Miracuves comes in.

With our powerful LinkedIn Clone solution, entrepreneurs can launch a professional networking platform with built-in monetization features, including:

- Premium membership tiers (Career, Business, Recruiter)

- Job posting and employer dashboards

- Learning/course modules with paywalls

- Ad placement, targeting, and analytics

- Messaging, InMail-style outreach, and CRM-like tools

- API-ready infrastructure for future SaaS integration

Our solution is customizable, scalable, and ready-to-monetize — allowing you to focus on community growth and niche targeting while we handle the tech stack.

Whether you’re targeting a specific industry, region, or business niche, the LinkedIn revenue model is not just replicable — it’s adaptable. And with Miracuves, you can do it faster, better, and profitably from day one.

See how LinkedIn works to power global networking, learn from our build guide to create your own platform, and kickstart faster with the best clone scripts in 2025.

Conclusion

LinkedIn’s revenue model is a blueprint for building a high-value, multi-sided platform. By monetizing subscriptions, recruitment tools, B2B advertising, professional learning, and data access — LinkedIn has turned networking into a billion-dollar business.

In 2025, the model thrives because it aligns with how professionals work, learn, hire, and connect in a digital-first world. It’s a future-proof monetization strategy — built on trust, data, and network value.

For startups, this model might seem complex to build from scratch — but with Miracuves, it’s not.

FAQs

How does LinkedIn generate revenue?

LinkedIn generates revenue from premium subscriptions, recruitment solutions, targeted B2B advertising, LinkedIn Learning, sales tools like Sales Navigator, and enterprise data licensing.

Is LinkedIn profitable in 2025?

Yes, LinkedIn continues to be highly profitable under Microsoft’s ownership, with annual revenue surpassing $15 billion in 2025. Its subscription-based and B2B monetization strategies deliver strong recurring income.

What are the main income sources for LinkedIn?

LinkedIn’s key income sources include Talent Solutions (recruiter tools), Premium Subscriptions, LinkedIn Marketing Solutions (ads), Learning Solutions, Sales Navigator, and enterprise data/API sales.

Can startups use the same revenue model as LinkedIn?

Yes, startups can replicate LinkedIn’s revenue model using a modular approach — offering subscription tiers, job tools, learning modules, and ad placements. A LinkedIn clone from Miracuves makes this process faster and scalable.

Does Miracuves offer a LinkedIn clone with monetization features?

Absolutely. Miracuves provides a customizable LinkedIn clone with built-in monetization options like subscriptions, recruiter dashboards, ad management, learning modules, and CRM tools — ready to launch and grow.